Susquehanna International Group LLP (SIG), a global trading, technology, and investment company, has invested more than $1.8 billion in Bitcoin exchange-traded funds (ETFs) through its 13F-HR filings with the Securities and Exchange Commission (SEC). revealed that it is in possession. ), provides a detailed breakdown of SIG’s investment portfolio.

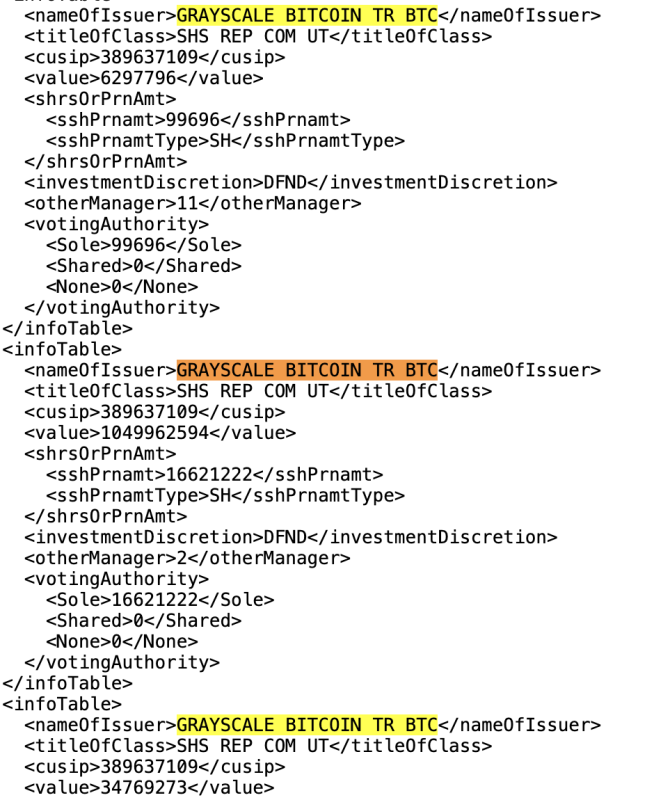

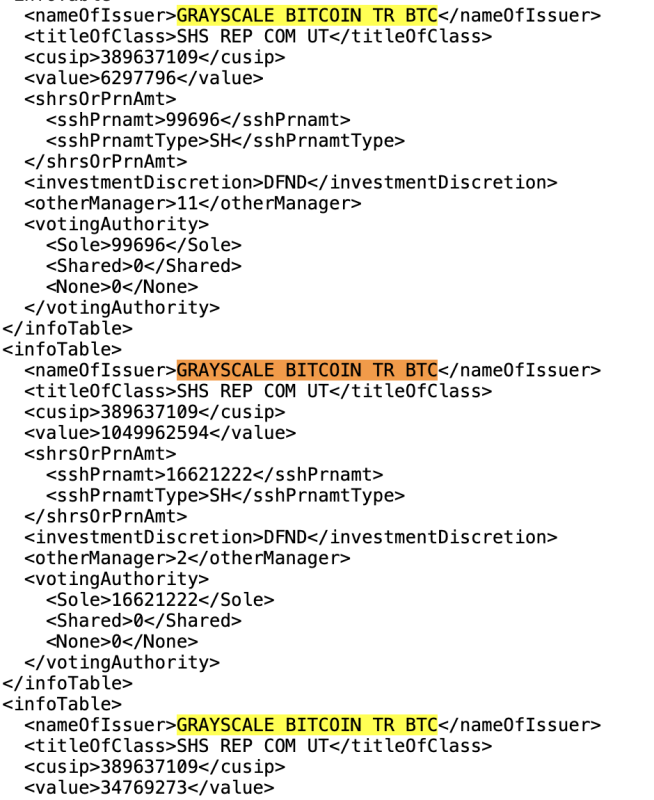

filing reveal The investment firm’s largest position was in the Grayscale Bitcoin ETF GBTC with a total value of $1,091,029,663.

The document also lists SIG’s ARK 21 Share Bitcoin ETF, Bitwise Bitcoin ETF TR, Bitwise Fund Trust (Bitcoin and Ether), Fidelitywise Origin Bitcoin, Franklin Templeton Digital Bitcoin, Global X Bitcoin Trends, Invesco Galaxy Bitcoin ETF, Ishares Bitcoin TR, ProShares TR Short Bitcoin, ProShares TR Bitcoin Straight, ProShares TR Bitcoin & Ether, Valkyrie Bitcoin FD, Valkyrie ETF Trust II Bitcoin and Ether, Valkyrie ETF Trust II Bit Coin Miners, Valkyrie ETF Trust II Bitcoin FUTR LEV, Vanek Bitcoin TR, Volatility SHS TR 2X BITCOIN STRAT, and WISDOMTREE BITCOIN FD.

All these ETFs have total assets of over $1.8 billion at the time of writing.

Interestingly, it is worth noting that this investment firm holds $4,037,637 worth of ProShares Short Bitcoin ETF, which aims to offer investors the potential to profit on days when BTC prices fall. It is said that In addition to this, SIG also owns the Valkyrie Bitcoin Futures Levered Strategy ETF worth $1,004,552 and the Volatility Shares 2x Bitcoin ETF worth $97,856,513, which could make it even more profitable on days when BTC prices are rising. Masu.

Bitcoin ETFs provide financial institutions with a regulated and accessible way to gain exposure to Bitcoin price movements, but relinquish the ability for investors to directly hold Bitcoin themselves.

SIG’s disclosure that it holds over $1.8 billion in Bitcoin ETFs reflects the growing trend of institutional investment and adoption of Bitcoin as part of diversified investment strategies. Market researchers and analysts believe that more financial institutions will file these 13F-HR documents with the SEC in the coming months, and that more and more financial institutions will be filing these 13F-HR documents with the SEC in the coming months, and that more and more financial institutions will be filing these 13F-HR documents with the SEC in the coming months. We expect them to reveal whether they are buying Bitcoin ETFs.