Duke Energy Building and sunset sky in Charlotte, North Carolina Takako Hatayama-Philips

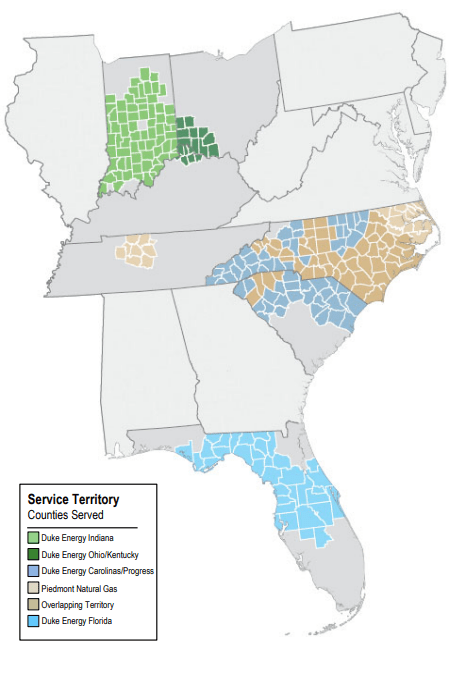

duke energy corporation (New York Stock Exchange:duck) operates not only gas and infrastructure businesses, but also energy and infrastructure businesses. This duo, which is primarily regulated, forms two major reportable segments: This company falls under the category of “Other,” which encompasses the balance of activities.

the Energy business and infrastructure management Includes electricity generation, transmission, distribution, and sales. The division serves more than 8 million retail customers in the Carolinas, Florida, Indiana, Ohio and Kentucky. Under this structure, Duke also serves the wholesale power needs of customers such as municipalities and cooperatives. The business primarily uses natural gas, heavy oil, nuclear power, and coal to generate electricity.dukes Gas business and infrastructure management It serves approximately 1.7 million customers, including residential, commercial, industrial and power generation natural gas customers and municipalities.Geographically, customers The operation is based in the Carolinas, Tennessee, Ohio, and northern Kentucky.

Q1 2024 Presentation

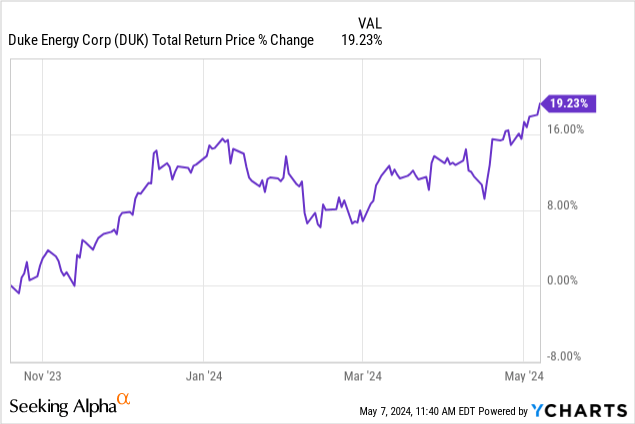

We covered this Fortune 150 company last October and gave it a Hold rating. In other words, I was watching from the sidelines. Since then, the company has grown by an impressive 19%, making a difference for investors.

We believed (and said as much in that article) that the utility company could earn 7-8% annually from that point on, but risk-free bonds and quality If you have a high bond, you can get it anyway. We outlined the risk factors of owning a utility when interest rates were high.

The days of zero percent are over, and utilities are becoming more vulnerable as they carry large amounts of debt. Another factor here is the popularity of closed-end funds, which have increased their influence on utilities. Maintaining the same level of leverage in a down market would require selling the underlying securities, which could continue to put pressure on these stocks.

sauce: Duke Energy: Solid utility company with a good growth profile

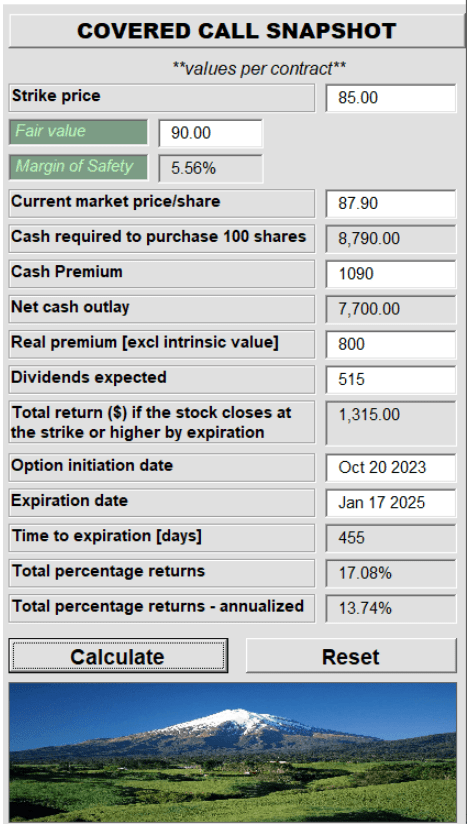

We proposed an in-the-money covered call play that locks in nearly 14% as an alternative for investors who want a piece of the action.

We are looking for alpha articles

We typically choose the path with the lowest investment volatility and prefer locking in annualized returns through options. In this case, the commons performed better than the option play, but in hindsight, we would choose the downside protection of the call in the current macro situation.

Duke’s first quarter results are fresh out of the oven, so we’ll take this opportunity to review the numbers and update our thesis.

Q1 2024 Results and Outlook

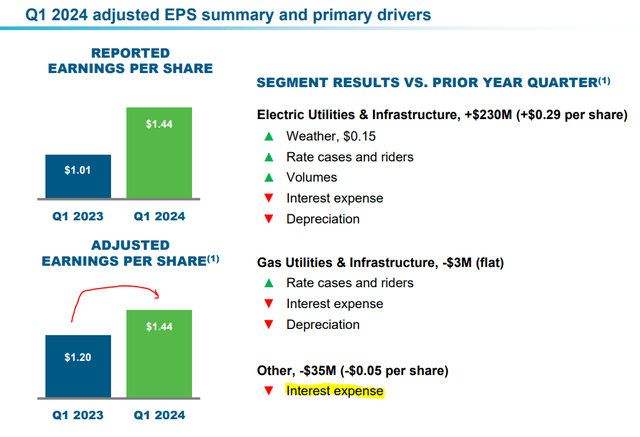

Duke delivered strong results in the first quarter of 2024, with adjusted earnings jumping from $1.20 to $1.44 per share. The main factor was due to the weather, which gave him a 15 cent increase, but the rest was due to the rate case and his ROE due to cost expansion. Although interest expense has been a slight point of criticism, Duke’s maturities are well spaced, minimizing financing needs when interest rates rise.

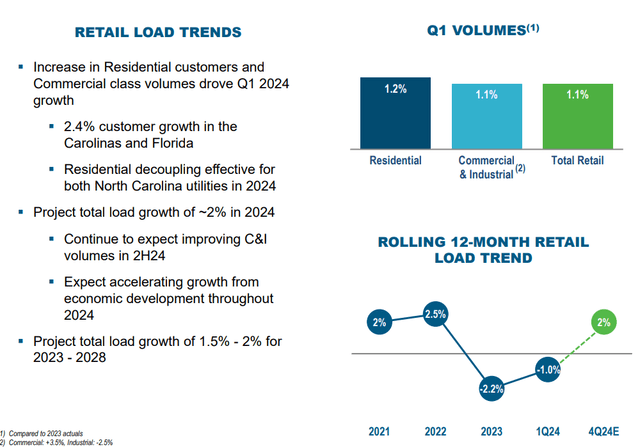

The main reason for owning a regulated utility is a focus on volume. Duke’s trading volume for his first quarter of 2024 was weak, but the utility expects an uptrend in the second half of the year.

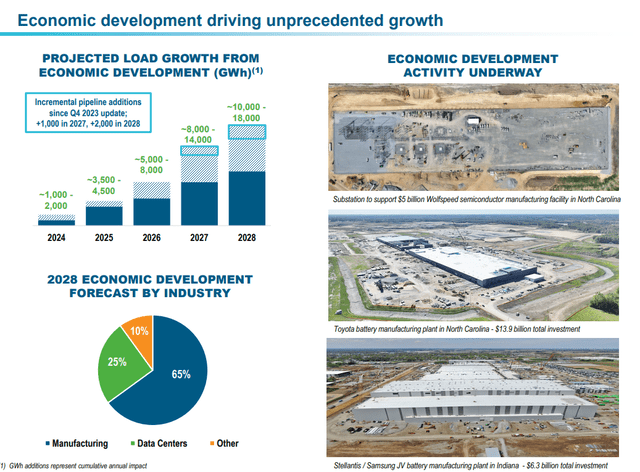

Broad developments due to onshoring trends are underway, and volume growth from both data centers and manufacturing could push Duke above the 2% level in late 2024 to 2025.

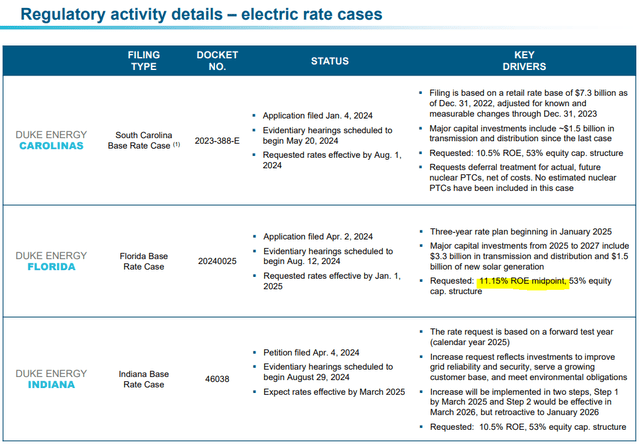

In terms of regulation, the company continues to have the most favorable environment. In one example highlighted here, Duke is asking for his ROE of 11.15%.

Obviously, just because they ask for it doesn’t mean they’ll get it. But power companies know how games are played and tend to ask ballparks what they expect. You can compare this number to what other power companies across the country are getting.

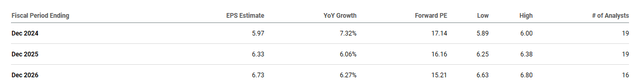

Management has been adamant that this year’s adjusted earnings are still heading for $5.85 to $6.10, and the stock has performed very well recently.

evaluation

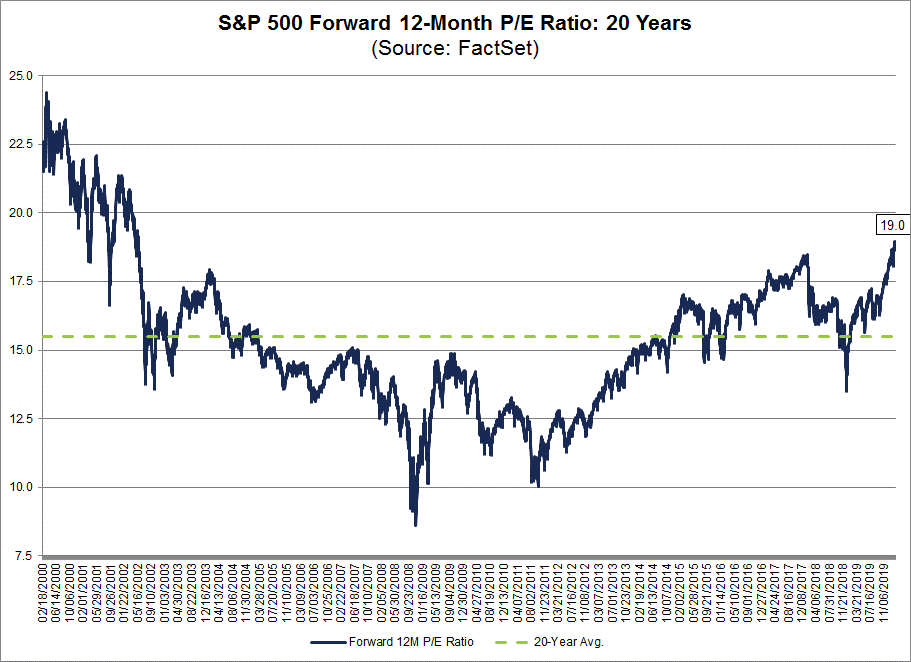

Duke’s 17 times earnings may not be too expensive for a power company with 6% growth.

Management believed that 6% growth plus a 4% yield yielded 10% with very low risk. This, of course, causes stock prices to rise, making stock issuance highly advantageous. So you have a kind of self-fulfilling prophecy. In general, there isn’t much that seems wrong with this idea, except that these 17x to 20x multiples are normal only from a zero interest rate policy (ZIRP) perspective. If you look at the non-ZIRP era of 2004-2008 (even before the crash), most utilities were trading well below that range.

fact set

This is still dangerous and can cause serious shock. Most investors tend to say they can ignore that as long as the dividends reach the bank on time. However, for chronic debt and equity issuers such as REITs and utilities, the cost of equity is not trivial. If the stock price falls significantly, all earnings forecasts will also fall. This may also affect credit ratings. So Duke here is a “hold/neutral” at best, and is rapidly converging to a point where it could even go to a “sell.”

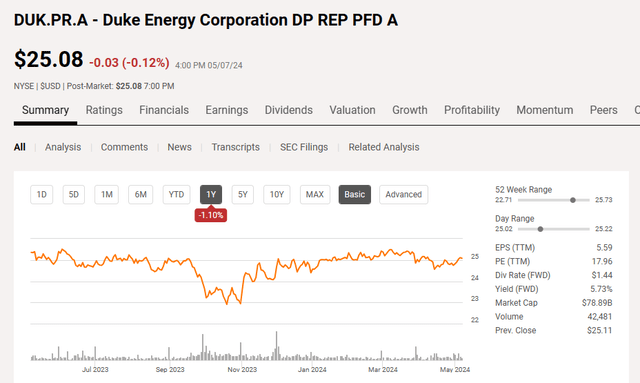

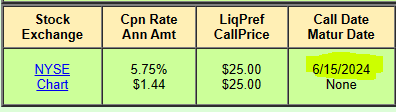

Duke Energy Corporation DP REP PFD A (New York Stock Exchange:DUK.PR.A)

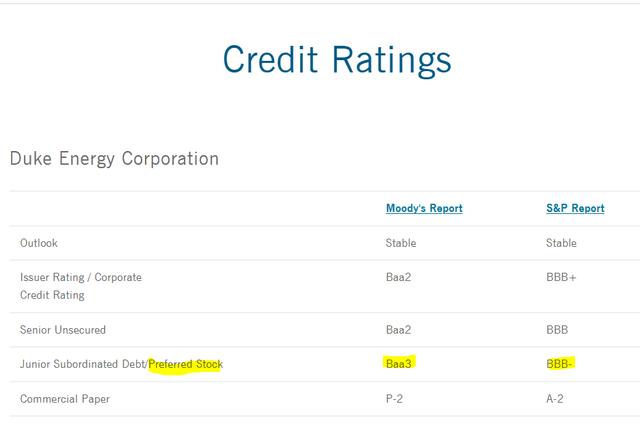

People who want a regular source of income from a top-quality power company often increase their capital. Duke does have preferred stock and remains on the last rung of the investment-grade ladder.

The stock is currently trading at near parity, with a stripped yield of 5.8% (next ex-dividend date is May 15, 2024).

This isn’t a particularly bad thing, but it’s also not something to get really excited about. Even if you believe that the interest rate will be near zero in the next two years, you should keep in mind that this means that he could be redeemed for $25.00 any time after June 15, 2024.

quantum online

There are much better prospects in the market today and this one will pass as well.