RomoloTavani

Investment Overview

Crispr Therapeutics AG (NASDAQ:CRSP), the first company to secure U.S. approval for a CRISPR (“clustered, regularly interspaced, short palindromic repeats”) based gene editing therapy, Casgevy, indicated for Sickle Cell Disease (“SCD”) and Transfusion Dependent Beta Thalassemia (“TDT”), reported its Q1 2024 earnings yesterday after the bell.

The reality is that Crispr Therapeutics will have much more significant earnings quarters in the years ahead, as Casgevy – which was only approved for SCD in December last year, and for TDT in mid-January this year – begins to make meaningful commercial sales, and the company secures further drug approvals, which is what I’d expect to happen within the next two to three years.

The headline numbers were that Crispr Therapeutics made a net loss of $116.6m, or $(1.43) per share, for the quarter, up from a net loss of $(53m), or $(0.67) per share in the prior year quarter. Last year, however, the company earned $100m of collaboration revenues from its partner Vertex Pharmaceuticals (VRTX), the Boston-based Pharma giant that is responsible for marketing and selling Casgevy, with Crispr Therapeutics earnings a 40% share of net profits.

Crispr Therapeutics was able to reduce its R&D spend and G&A spend year-on-year, from $99m and $22m, to $76.2m and $18m, and also report an improved cash position, of ~$2.1bn, up from ~$1.7bn one year ago.

With a market cap valuation of $4.5bn (before market open today), the company’s strong balance sheet is one of several reasons why I believe the stock price is undervalued – although investors will need to be patient as Casgevy matures as a commercial prospect, and the remainder of the pipeline works its way through early and late stage clinical studies.

Casgevy Launch – Early Days, Promising Signs

As a reminder, in its Q1 2024 earnings press release, Crispr Therapeutics discussed Casgevy as follows:

CASGEVY™ is a non-viral, ex vivo CRISPR/Cas9 gene-edited cell therapy for eligible patients with SCD or TDT, in which a patient’s own hematopoietic stem and progenitor cells are edited at the erythroid specific enhancer region of the BCL11A gene.

This edit results in the production of high levels of fetal hemoglobin (HbF; hemoglobin F) in red blood cells. HbF is the form of the oxygen-carrying hemoglobin that is naturally present during fetal development, which then switches to the adult form of hemoglobin after birth.

CASGEVY has been shown to reduce or eliminate VOCs for patients with SCD and transfusion requirements for patients with TDT.

In fact, Casgevy’s pivotal study results were compelling – in its pivotal CLIMB-121 study, data showed that 16 out of 17 patients with SCD, treated with the cell therapy, achieved the primary endpoint of freedom from vaso-occlusive crises (“VOCs”) for at least 12 consecutive months. 100% achieved the key secondary endpoint of being free from hospitalizations related to VOCs for at least 12 consecutive months.

In TDT, transfusion independence was achieved by 91.4% of patients (32/35), while the remaining three patients experienced reductions in annualized RBC transfusion volume requirements and annualized transfusion frequency.

As such, when Crispr Therapeutics and Vertex say that Casgevy has the ability to “functionally cure” patients and eliminate pain “crises” that dramatically affect quality of life, it is no idle boast. Besides the US, Casgevy has additionally secured approvals in the UK, European Union (“EU”), and the Kingdoms of Saudi Arabia and Bahrain, with decisions pending in Switzerland and Canada.

With that said, there are drawbacks to the therapy. Nobody can say for certain whether the treatment effect is permanent – Crispr Therapeutics and Vertex have agreed to follow patients treated with Casgevy for a period of fifteen years and share data – and before their cells can be extracted, patients must undergo a painful preconditioning regime – the entire treatment process requires a months-long stay in a treatment centre, and the therapy is expensive, too – costing ~$2.2m.

Vertex, who reported earnings on May 6th, had already shared some early launch details on its call with analysts and via press releases. 25 authorised treatment centres (“ATCs”) have been activated, where patients are eligible to receive treatment with Casgevy (Vertex’ target is to open 75 centres in total) and by mid-April, 5 patients had had their cells collected, ready to be edited with the CRISPR/Cas9 “molecular scissors” before reinfusion.

Vertex also updated on insurance coverage, telling analysts it is:

moving quickly to provide rapid and equitable access. In the U.S. commercial market, we have contracts and/or published policies in place for over 200 million lives or nearly 65% of total lives. In the government Medicaid sector, we have policies in place or active contract negotiations ongoing with 18 states.

The Vertex Chief Operating Officer (“COO”) also told analysts:

we are expecting the momentum to build based on all of the feedback that we’ve got and the trends that we’re seeing in activations and cell collections…we’re delighted to have had so collections already….we expect those trends to continue to ramp up during the course of 2024, which we’ve always said was going to be a foundational year for CASGEVY.

For its part, Crispr Therapeutics did not hold a call with analysts, but in a press release it echoed the Vertex statement that >25 ATC’s were now open, and confirmed that:

Vertex has signed multiple agreements with both commercial and government health insurance providers in the U.S. to provide access to CASGEVY. Vertex has also secured reimbursed access for eligible people with SCD or TDT in KSA and Bahrain, as well as for people with TDT in France through an early access program.

A ~$1bn Product May Become A $10bn Product If Preconditioning Regime Can Be Eased

Neither Vertex nor Crispr Therapeutics has reported any revenues from Casgevy, which is unsurprising as payments are received when cells are reinfused, not collected.

Crispr Therapeutics – in a recent investor presentation – states a market opportunity of ~5k patients in TDT, and 30k in SCD with the current approved product, which implies a total market opportunity of ~$77bn, or, if we multiply by the 40% of sales the company is entitled to, ~$31bn.

Naturally, that figure is nominal – my estimate would be that an ACT may be able to treat only 50 patients per annum, so at full capacity, 75 ACTs could treat a total of ~3.75k patients per annum, resulting in a peak annual revenue opportunity for Crispr Therapeutics of ~$3.3bn.

It will clearly take time for the two companies to open that number of ACTs, and it should also be noted that many patients may be unwilling to undergo treatment with Casgevy in its current form – the entire therapeutic process could take up to a year, it is believed. As such, I would mark down Casgevy – in its current form – as having a peak revenue opportunity of ~$1bn per annum, which may be achieved before the end of the decade.

Given the pace of growth, it is perhaps understandable that Wall Street – which valued Crispr Therapeutics at nearly $200 per share back in 2021, when Vertex paid the company nearly $1bn to increase its revenue share from Casgevy from 50%, to 60% – has been selling CRSP stock lately. Since reaching highs of ~$90 in late February, Crispr Therapeutics stock has drifted to a value of $53 (at the time of writing) down >40%.

Nevertheless, with a future “blockbuster” (>$1bn revenues per annum) product on its hands, >$2bn cash, and a large, diverse pipeline that addresses solid and heme cancers, liver disease, and diabetes, my contention is that Crispr Therapeutics remains a fundamentally undervalued company.

One of the most intriguing updates provided by management in its earnings press release – quoted below – relates to the company’s ability to ease the preconditioning burden associated with Casgevy, potentially extending its reach to a patient population of >150k patients:

CRISPR Therapeutics has two next-generation approaches with the potential to significantly expand the addressable population with SCD and TDT. CRISPR Therapeutics continues to advance its internally developed targeted conditioning program, an anti-CD117 (c-Kit) antibody-drug conjugate (ADC), through preclinical studies.

Additionally, the Company has ongoing research efforts to enable in vivo editing of hematopoietic stem cells. This work could obviate the need for conditioning altogether, expand geographic reach, and enable the treatment of multiple additional other diseases beyond SCD and TDT.

Admittedly, it is early days, and I would not anticipate a next-generation therapy to be approved for at least three years from today, but both the ADC approach – ADCs are increasingly being viewed as the future of cancer treatment, the combo of monoclonal antibody and chemical linker maximizing potency whilst minimizing “off-target” damage to healthy cells – and the in vivo approach would constitute major breakthroughs in the CRISPR therapy field and open up much larger market opportunities.

In short, Casgevy in its current form represents the beginning of a journey to being able to “functionally cure” all SCD and TDT patients, of which there are >100k in the U.S. alone – and given Crispr Therapeutics has made it to market with a CRISPR therapy likely years before any of its rivals – Editas Medicine (EDIT), Intellia Therapeutics (NTLA), Caribou Biosciences (CRBU) – the smart money would surely be on the company being the first to bring through an ADC based or an in vivo based CRISPR/Cas9 therapy, and reap the substantial rewards that that would entail.

It should also be noted that Vertex’s recent acquisition of Alpine Immune and its kidney disease franchise may help the company target easing of Casgevy preconditioning also, and that Vertex was successful in that regard, clearly, Crispr Therapeutics would reap a significant benefit.

Crispr Therapeutics Is Much More Than Casgevy – But Investors Will Need Patience

Crispr Therapeutics’ three areas of focus away from Casgevy, SCD and TDT are developing cell therapies to treat cancers and autoimmune diseases, leveraging the power of lipid nano particles (the type of delivery mechanism used successfully in messenger-RNA-based COVID vaccines), and edited beta cell therapies directed against Type 1 Diabetes.

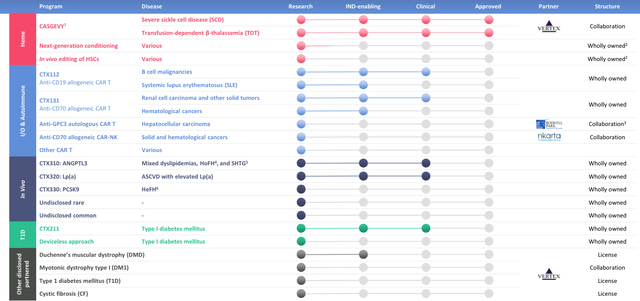

Crispr Therapeutics pipeline (investor presentation)

As we can see above, many programs are still at the preclinical / investigational new drug (“IND”) enabling stage (an “IND” application must be approved by the FDA before in-human clinical studies can be initiated), but clinical studies have been initiated in all three areas of focus.

No allogeneic – allogeneic means cells are derived from a donor as opposed to the patient themselves – cell therapy has been approved to date, due to safety issues related to a patients’ immune system rejecting donor cells – a condition known as graft vs host disease (“GvHD”), and concerns around patient’s durability of response.

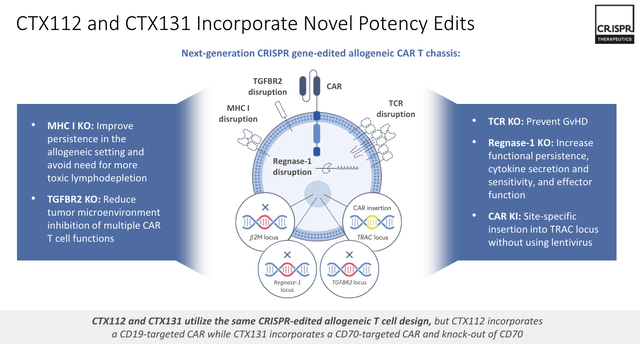

Crispr Therapeutics’ CTX112 and CTX131 are next-generation programs building on proof of concept (“PoC”) established by earlier projects. The latest iteration incorporates novel edits to Regnase-1 and TGFBR2, with the aim of making the therapies more palatable for patients, preventing GvHD, and increasing persistence, as shown below:

next generation allogeneic CAR-T (investor presentation)

Management believes its CAR-T candidates can eventually beat the durable complete rates set by approved therapies such as Novartis (NVS) Kymriah, Bristol-Myers Squibb’s (BMY) Breyanzi, and Genmab’s (GMAB) Epkinly when treating b-cell cancers, and these therapies earn combined revenues in the multi-billions each year.

Furthermore, Crispr Therapeutics has been quick to recognize that cell therapies may also help treat autoimmune conditions, and has rapidly pivoted into that space, with CTX112 – already in a Phase 1/2 study in refractory B-cell malignancies – expected to enter a study in systemic lupus erythematosus (“SLE”) later this year. Automimmune markets are as large as, if not larger than, many cancer markets.

Most exciting is arguably the company’s in vivo programs, given how much more effective it can be to treat a patient with an injection, as opposed to keeping them in the hospital for weeks at a time to undergo cell therapy.

This is uncharted territory, although the significance of an in vivo breakthrough is illustrated by the fact that Intellia Therapeutics’ (NTLA) share price nearly tripled in value, and the company’s market cap surged >$10bn, when the company successfully demonstrated gene editing in vivo using CRISPR, in 2021.

Where I put Crispr Therapeutics ahead of its competition is in its ability to execute, i.e., to progress therapies faster, and while there are multiple other companies targeting Artherosclerotic Cardiovascular Disease (“ASCVD”) with in vivo programs, including Intellia, and Verve Therapeutics (VERV), I would make the company a front-runner in the race to a first approval, which would be transformative for the entire Pharma industry.

Again, I believe the company is taking the right approach with the use of LNPs, and in yesterday’s earnings release the company “announced the addition of two additional preclinical programs, CTX340™ and CTX450™, utilizing this LNP delivery system, demonstrating the modularity and scalability of the platform.”

The former “is designed to inhibit production of hepatic angiotensinogen (AGT),” and the latter “designed to inhibit production of ALAS1 in the liver,” and both are expected to enter clinical studies next year, in the indications of Refractory hypertension, and Acute hepatic porphyria (“AHP”).

Finally, Crispr Therapeutics continues to partner with Vertex on a T1D program, with development milestones and royalties available, although it should be noted Vertex is also working with other companies in the same indication. The company is working on a method of treating diabetes using induced pluripotent stem cells (“IPS”), without requiring immunosuppression. Again, success in this field would represent a major breakthrough.

Concluding Thoughts – Uneventful Quarterly Update Won’t Move Share Price Near-Term, But Compelling Commercial / Developmental Is Being Made

I own Crispr Therapeutics stock and I continue to believe the company is deserving of a significantly higher share price and larger market cap valuation – in the double-digit billions, in fact, based on cash, commercial products, and pipeline, and I have discussed my reasons for believing this above.

In that respect, I am conservative in comparison with the company’s CEO, Sam Kulkarni, who has spoken about his desire to achieve a $25bn valuation in the past.

With that said, I can understand Wall Street’s position regarding the company at present. It is not the driving force behind the marketing and selling of Casgevy, with Vertex doing most of the heavy lifting. A second commercial approval for the company is still a couple of years away, at least, and it will take time for Casgevy to grow revenues, therefore, with few near term catalysts in play, why buy Crispr Therapeutics stock today?

Admittedly, in 2024 at least, the upside catalysts in play are limited – initial Casgevy revenue data, and rollout of the drug globally dominate the commercial agenda, while one data readout from CTX112 in B-cell malignancies aside, there are few major pipeline updates expected this year.

Nevertheless, I believe Wall Street is not full appreciating that Crispr Therapeutics earns a 40% share of Casgevy revenues, and that there is a good chance that patients will embrace the opportunity to functionally cure a lifelong, painful disease, when the therapy is better understood by the public.

From Crispr Therapeutics perspective, Casgevy in its current form is just the beginning, and while the company’s goals are ambitious, it has proven itself capable of bringing a CRISPR based therapy to market, an achievement that none of its rivals has come close to matching, and one that came ahead of most people’s expectations.

My belief is that there a great deal more to come from Crispr Therapeutics, which is a company unburdened by financial concerns, with a commercial product on the market that could help it drive blockbuster revenues, and self-sustainably fund research into CRISPR based therapies that leverage other cutting-edge drug development approaches, such as ADCs, LNPs, allogeneic, etc.

In summary, what’s not to like? Undervalued, successful, ambitious, well-funded CRISPR Therapeutics will eventually get the valuation upgrade it deserves, in my view.