Angel Di Billio/iStock Editorial via Getty Images

In December 2023, Allegiant Travel Company (Nasdaq:A.L.G.T.) opened the long-awaited Sunseeker Resort, diversifying Allegiant’s operations, which prior to its opening had focused primarily on passenger transportation and, to a lesser extent, resort-related revenues.

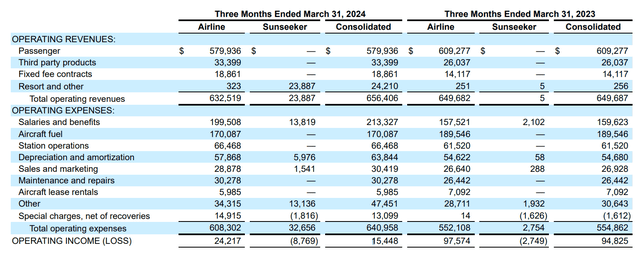

The Company announced its first quarter financial results on May 7, 2024, providing insight into Sunseeker Resort’s performance and expectations. The results beat analysts’ estimates for revenue by $11.18 million and beat EPS estimates by $0.12. Although the results exceeded analysts’ expectations, we felt that the earnings were a bit disappointing. In this report, I will explain why I was not satisfied with the results and update my price target for the stock.

Allegiant travel agency is in a cost trap

Total revenue increased 1% while the airline’s revenue decreased by $17.2 million. That’s more than offset by Sunseeker’s revenue growth. But the new resort is off to a rocky start, with a December opening far from ideal. Sunseeker Resorts has the potential of Allegiant Travel Company, but it clearly requires some learning curve to figure out the right way to market, price, and promote. For the full year, the company expects the resort to have an EBITDA loss of $15 million.

The reason why the results were unimpressive to me is mainly due to the performance of the aviation sector. Revenue decreased by $17.2 million, but costs increased by $56.2 million even though fuel costs decreased. This was primarily driven by a $42 million increase in salary. The increase in capacity is only 2%, indicating that a small increase in capacity cannot stabilize Allegiant Air’s costs and revenues. Total passenger revenue per available seat mile decreased by 4.8% and unit price excluding fuel increased by 18.5%. So what we’re seeing is that because of the layoffs, Allegiant Travel Company is not able to fully expand its production capacity, and while the company is currently increasing salaries, Allegiant is hurting unit revenue and unit prices. This means that they are increasing their cost base beyond what appears to be possible to expand production capacity. yield.

What is Allegiant stock price prediction?

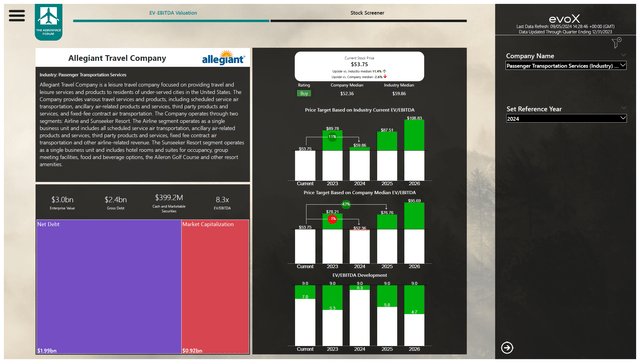

Allegiant will spend much of this year focused on lowering unit costs, which it hopes to achieve by the fourth quarter due to the gradual increase in production capacity and easier revenue generation. Sunseeker Resort will go into consolidation mode this year, and he expects it will take until 2025 to 2026 for pricing and occupancy to reach target levels. Based on my expectation that Allegiant will continue to add debt over the next few years to maintain at least $400 million in cash and cash equivalents and will have a wider than normal time period to evaluate its performance against its benchmarks. I rate this stock a buy. The price target is $76.76, indicating a 43% upside. However, given the cost challenges faced in operating a passenger airline and the learning curve and enhancements of Sunseeker Resorts, the risky nature of the investment opportunity should also be highlighted, making it a speculative purchase. .

Conclusion: A difficult year for Allegiant Travel Company, but the future is promising.

I think 2024 will be all about controlling the costs of our aviation business while aiming to improve the performance of Sunseeker Resorts. Sunseeker Resort has a lot of potential, but it will take some time to reach full occupancy. Considering all the risks, I think Allegiant Travel Company is a speculative buying opportunity with significant upside potential.

Want complete access to all reports, data and investment ideas? Join the Aerospace Forumis Seeking Alpha’s #1 aerospace, defense and airline investment research service. Gain access to evoX Data Analytics, our in-house developed data analytics platform.