Artificial intelligence has been around since the 1950s, but the business potential of AI has expanded dramatically in recent years. We now live in a world where AI thrives on big data and powerful computing power. Businesses, including insurance companies, are investing in establishing data lakes. Optimized for cloud-based operations and enable AI for targeted analysis.

Insurers are seeing tangible results from their current AI efforts. According to our AI Maturity Survey: Telcos’ share of cost savings from AI more than doubled between 2018 and 2021. We predict that its share will triple by 2024. Additionally, insurance companies are quite happy with the return on their AI investment. 52% of insurers said the revenue from their AI initiatives exceeded their expectations, while only 3% said the revenue was lower than expected.

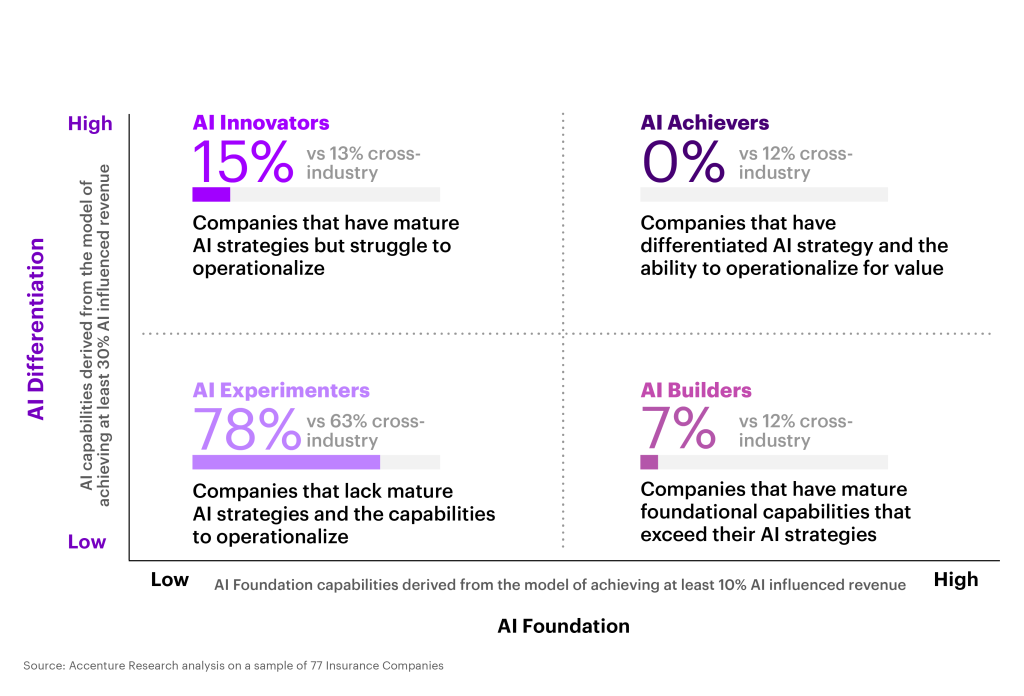

But insurance companies are withholding value. An analysis of 77 insurance companies found that AI achievers are defined as those with a differentiated AI strategy and operationalizing AI to execute that strategy. In fact, most insurance companies are in the AI experimenter category, representing those with the least mature AI strategies and the ability to operationalize AI.

Insurers can move into the “achiever” category to realize greater value by leveraging AI to drive reinvention across the enterprise. This includes adopting AI for decision-making across the organization and integrating it into every part of the business, from optimizing business processes to delivering reimagined products, services, and experiences to customers. included.

Operators looking to gain momentum with their AI investments can find opportunities in the front office to build their next stage of growth. Our research looked at three key front office use cases that we’ll explore in detail in this post: customer experience, product and service development, and sales and marketing.

Customer experience intelligence and journey automation

While insurance companies are starting to make more progress than other industries when it comes to optimizing the customer experience, they are still in the early stages of leveraging AI.

Many insurance companies have invested in developing a single view of their customers, including what products they own, whether they have recently made a claim, or received a quote for another product. Now you can understand what’s going on.

While some insurers are beginning to better understand their specific customer interactions, most struggle to connect the customer journey across multiple channels and touchpoints. Far fewer people are able to use these insights to understand and systematically address the breaking points in their experience.

Many insurance companies have invested in customer relationship management (CRM) platforms to share customer insights across the enterprise, but they can also layer AI and use those insights to improve marketing, sales, service, Few insurance companies are orchestrating a highly personalized customer experience across claims. Leading CRM vendors are integrating AI capabilities into their platforms, making it easy to incorporate ready-to-use AI models into any workflow. Choosing such technology presents a huge opportunity to create an omnichannel experience and build a truly holistic view of each customer.

Conversational AI remains a largely untapped opportunity for the insurance industry as a whole when it comes to automating parts of the customer journey. Companies that create self-contained conversational experiences that meet customer needs, rather than simply answering frequently asked questions or directing customers to where they can get support, can significantly reduce customer service costs. and reduce dependence on a tight labor market, resulting in higher levels of satisfaction. .

Development of new products and services

Recently, Accenture discovered that: 88% of executives We believe that customer needs are changing faster than companies can keep up. Factors such as climate change and economic uncertainty are forcing customers to adapt to circumstances beyond their control and moving through the realm, trying to make decisions that are best for them. Our research reveals that companies need to move from a focus on customers as consumers to a nuanced understanding of customers as multifaceted human beings with complex and often contradictory desires. became.

Moving from customer-centricity to an approach we devised “life-centeredness” This is especially important when carriers develop products. AI helps carriers expand their understanding of customer behavior and move beyond cookie-cutter customer profiles with data insights. This helps customers build products tailored to their needs and habits as they go through life, and to respond to events such as buying a new home or providing coverage as the natural environment changes due to climate change. , you can seamlessly recommend or upgrade your personal products. Disaster risk.

Insurers have many opportunities to use AI to create new products and services that deliver more value and provide enhanced experiences. We are already seeing many airlines implement AI into their auto insurance products to assess driver behavior and offer pay-as-you-go insurance.

As IoT and wearable technology improves, carriers will be able to use AI to better understand customer behavior, meet customer needs, and predict future needs. A deeper understanding of their customers will enable carriers to build products with higher levels of personalization at scale.

my colleague Jim Bramblett I considered several methods AI can provide a new layer of protection For our customers while collecting data on their risk profiles and needs. One of the examples he describes is a factory floor connected to IoT. There, he will be able to use AI to stop and start machines as employees pass by, notify team members about parts that need maintenance, and see potential hazards via AR glasses.

Sales and marketing intelligence, recommendations, and process automation

Finally, carriers can leverage AI to improve sales and marketing performance. Across the marketing and sales funnel, carriers can implement AI to present customers with the most relevant recommendations and address customer questions in the moment.For example, British business insurance company Tapori leverages AI at every customer touchpoint to deliver customized commercial insurance products to its target market of MSMEs and freelancers. It also leverages AI to optimize pricing and risk assessment based on customer data.

When customers want to speak directly to a real person, AI can streamline the process. humans and human experience And you’re more likely to achieve the results your customers are looking for. Agents have more data and insights at their fingertips, allowing them to instantly seize up-sell and cross-sell opportunities. Agents can use her AI assistant to display the most relevant information and make recommendations in real-time as they speak with prospects.

SOMPO We’ve also partnered with AI CRM company Vymo to build proactive, AI-powered sales coaching technology to improve the service our teams deliver.peace has developed similar solution Provide relevant customer data and real-time coaching assistance to improve agent performance.

How insurance companies can become AI achievers

In a recent report, The art of AI maturityWe’ve identified five key areas where businesses need to invest if they want to realize the full potential of AI and capture the value at stake.

- Ensure leadership champions AI as a strategic priority across the organization. When it comes to change, everyone is a stakeholder. Leaders must ensure their teams understand the value that AI brings to daily operations and overarching business objectives.

- Invest more in your people to get more return on your AI investments. Innovation comes from hiring a diverse group of people to solve problems in unique and meaningful ways.

- Industrialize your AI tools and teams to create an “AI core.” To scale AI, carriers must create repeatable processes that build a strong foundation for increased innovation over time.

- Use AI responsibly from the beginning. AI ethics and governance As carriers scale, they need to be at the center of any AI initiative. Currently, only 35% of consumers trust the way their organization implements AI. To retain customers, carriers must demonstrate transparency and minimize bias.

- Plan long-term and short-term investments. When it comes to AI strategy and innovation, there is no end goal. Customer needs will continue to evolve, as will AI capabilities. Those who plan ahead will stay ahead of the curve as the need to adapt increases.

Although the potential of AI in insurance has not been fully realized, insurers that take the initiative to build strong AI programs today will see significant returns on their investments. We’d love to talk to you about how you can make AI more effective in your front office. please contact me.

Transforming claims and underwriting with AI: Applied in conjunction with humans, AI has emerged as a key differentiator in the insurance industry.

Get the latest insurance industry insights, news and research delivered straight to your inbox.