The insurance industry understands that to remain relevant and maintain market share, it must be agile, innovative, and embrace new technologies. From a technology perspective, this means that insurers need to be able to quickly and sustainably adapt their enterprise architecture in order to reinvent themselves and grow. However, in an industry rife with legacy architectures, system modernization is a pressing issue. How can insurance companies design future systems that protect their heritage while integrating into the modern world?

Accenture is working with our insurance clients to address this challenge. The result is a new frontier in how technology infrastructure is built.

Insurance architecture design is changing

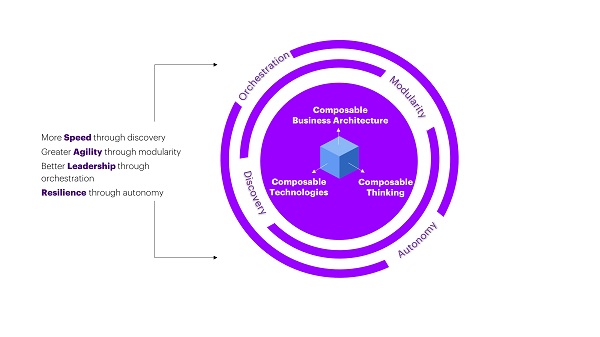

To increase agility and growth, we need to change the way we design insurance architectures. This isn’t just limited to our industry. Every industry is experiencing a dramatic shift from inflexible monolithic architectures to modular apps that can be assembled, reassembled, and expanded to adapt to business changes. This allows organizations to respond to changes in customer demand, disruptions in supply chains, economic uncertainty, and rapid technological advances.

Insurance is a data-rich industry, but it is often hampered by legacy technology. New adaptive solutions will set leading insurance companies apart. According to Gartner, by 2023, organizations that adopt an intelligent composable approach will Outperform competitors by 80% In terms of speed of implementation of new features.

Composable companies in insurance – Latest information

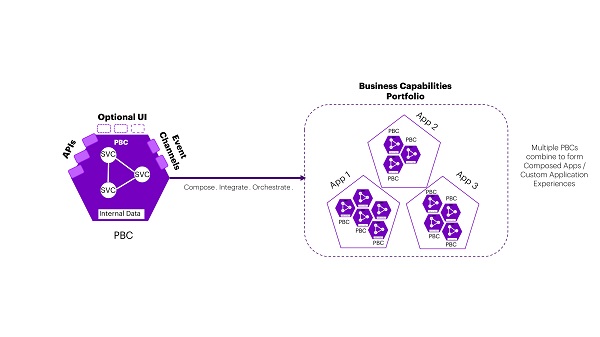

A composable enterprise can be defined as an organization that effectively delivers business outcomes and adapts to the pace of business change. The digital architecture that enables the composable enterprise is built on a powerful application program interface (API)-centric mindset, where business functionality is encapsulated in interchangeable components. In a composable architecture, APIs help increase flexibility and ecosystem monitoring. This enables organizations to democratize business processes and become scalable digital businesses. For insurance companies, this approach has a lot of potential to simplify and scale their digital operations. Packaged business functions (PBCs) are encapsulated software components that represent well-defined business functions and can be created to be easily recognized by business users. The concept of composable architecture has been around for several years, but we are now harnessing the power of PBC to create infrastructure solutions that are truly replicable and scalable.

How insurance companies can profit

By leveraging the potential of composable enterprises and PBC, insurance companies can scale with speed and agility. To build a strong foundation for your composable enterprise:

- Build modular business capabilities: When insurance companies want to build scalable and composable architectures, they need a set of autonomous business functions that can be interconnected to execute unique business processes that provide competitive advantage. These modular business capabilities require the ability to be independently managed and improved while participating in the larger business model.

- Create modular technology capabilities. To support modular business capabilities, insurers must build modular technology capabilities that can be easily integrated to enable smarter business models. They must be autonomous, managed, and modular to connect through standard interfaces to support required business needs.

In summary, taking a composable approach to technology architecture in the insurance industry has the potential to be game-changing. This allows insurers to future-proof their strategies through design, focus on proactive creation, and increase the speed of feature implementation. In the next blog post in this series, we will present a practical example of his composable architecture in the context of insurance claims.

Get the latest insurance industry insights, news and research delivered straight to your inbox.