Beasley Broadcast Group, Inc. (NASDAQ:BBGI) Q1 2024 Earnings Conference Call May 8, 2024 11:00 AM ET

Company Participants

Caroline Beasley – CEO

Marie Tedesco – CFO

Conference Call Participants

Operator

Good morning, and welcome to Beasley Broadcast Group First Quarter 2024 Earnings Call. Before proceeding, I would like to emphasize that today’s conference call and webcast will contain forward-looking statements about our future performance and results of operations that involve risks and uncertainties described in the Risk Factors section of our most recent annual report on Form 10-K as supplemented by our quarterly reports on Form 10-Q.

Today’s webcast will also contain a discussion of certain non-GAAP financial measures within the meaning of Item 10 on Regulation S-K. A reconciliation of these non-GAAP measures with their most directly comparable financial measures calculated and presented in accordance with GAAP can be found in this morning’s news announcement and on the company’s website.

I would also like to remind listeners that following its completion, a replay of today’s call can be accessed for five days on the company’s website, www.bbgi.com. You can also find a copy of today’s press release on the Investors or Press Room sections of the site.

At this time, I would like to turn the conference over to your host, Beasley Broadcast Group CEO, Caroline Beasley. Please go ahead.

Caroline Beasley

Thank you, Melissa, and good morning, everyone. Thank you for joining us to review our first quarter results. Marie Tedesco, our CFO, is with me this morning.

Industry-wide ad softness led to a first quarter revenue decrease of 5.9%, which is slightly below the pacings we previewed at the time Q4 was reported. Perhaps more importantly, on a same-station basis, meaning excluding revenue from WJBR, the Outlaws and the March 23 home show in the year-ago period, first quarter revenue declined 3.1% or $1.7 million.

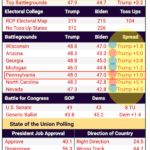

During the quarter, we generated $548,000 of net political revenue, and that compares to $19,000 in Q1 ’23. This exceeds our first quarter budget for political, and we continue to look forward to robust ’24 political spend as several of our markets are located in swing states.

Operating expenses declined 2.8% or $1.4 million, reflecting the divestiture of WJBR and our esports team. Same-station expenses declined $23,000, which includes a headcount reduction from last year, offset by increased third-party digital cost related to the increase in digital PPP revenue. As a result, our first quarter adjusted EBITDA was $731,000 compared to $2.6 million last year.

Breaking down our first quarter revenue performance. Over-the-air local spot was down 12.8% or $4.4 million, and same-station local was down 12% or $4.1 million. This was driven by a decline in agency business as local direct was flat.

We remain highly focused on developing new local direct business, and our efforts paid off as our new business increased 53% or $2.9 million to $8.4 million for the first quarter. Local direct accounts for 57% of our total local business as we continue to shift from agency to direct.

Now showing signs of stabilizing, during the quarter, national increased $100,000 or 1.1% year-over-year, and it declined just 4.9% excluding political. Our digital build continues as we delivered year-over-year 20% digital revenue growth in the quarter, and this is on a same-station basis.

Digital revenue accounted for 20.1% of first quarter total revenue, again, outbilling national revenue, which was at 12.7% of total. And this is ex political as we’ve been successful in offsetting the national declines with growing digital revenue. We expect digital to account for between 20% and 25% of total revenue in 2024 driven by our content creation and the continued success and growth of digital services.

Now quickly touching on the sports betting category. We recorded $4.9 million in Q1, marking a 17% year-over-year increase with sports betting revenue now accounting for 9% of total revenue in the quarter. And this was driven by both our Boston and our Charlotte cluster following the recent approval of sports betting in North Carolina.

So now I’m going to turn it over to Marie, and she’s going to provide you a deeper dive into the quarter. Marie?

Marie Tedesco

Thanks, Caroline, and good morning, everyone.

As Caroline mentioned, first quarter net revenues decreased 5.9% or $3.4 million to $54.4 million. Augusta, Charlotte, Fayetteville and our in-house agency, Digital Direct, recorded positive revenue growth year-over-year. The main driver of the revenue decline was related to the divested Wilmington station, one less Tampa home show in the quarter and a decline in local agency spot business, which was somewhat offset by continued growth in digital revenue, up 10% year-over-year and 20% on a same-station basis.

Looking closer at the quarter, January increased 1.7%, February declined 2.1% and March dropped 9.5%. However, on a same-station basis, excluding the divested Wilmington station, esports and the non-return of the March home show, January was up 3.4%, February down 0.4% and March declined 6.1% year-over-year. And same-station revenue for the quarter declined 3.1%.

Operating expenses for the quarter decreased 2.8% year-over-year or by $1.4 million. And SOI declined $2 million to $5.1 million compared to first quarter 2023 primarily due to the divested Wilmington station and esports team. Same-station expenses dropped $23,000 driven by our previous 2023 headcount reduction and overall expense management, which was somewhat offset by increased cost of sales from third-party expenses related to the shift in digital revenue. Same-station SOI declined $1.7 million for the quarter to $5.4 million.

Now looking at our revenue categories for the quarter. Consumer services remained our largest revenue category at 31.9% of total revenue with an increase of 5.3% year-over-year, including increased spend in legal and home improvement. Our second largest category was entertainment, which was up 1.8% in the quarter, accounting for 17% of total revenue.

The largest entertainment spend increase came from Charlotte, where we are benefiting from a surge of sports betting ad revenue. We also had increases year-over-year in Boston, Detroit, Tampa, Fort Myers, Fayetteville and Augusta. We continue to see declines in the Philadelphia market due to some sports betting dollars moving to new markets such as Charlotte.

Retail landed in third place, representing 14.3% of the quarter, falling 8.4% year-over-year, mostly from Tampa and Detroit. The other category saw revenues down 10.6% or $560,000 year-over-year, and the category accounted for 8.8% of our total first quarter revenue.

However, three of our markets exceeded prior year in revenue growth, including Tampa, Charlotte and Las Vegas. And on a positive note, we grew our share of auto dollars in Philadelphia, Charlotte, Detroit and Las Vegas as the market spend decreased year-over-year.

Consumer products came in fifth place at 6% of total first quarter revenue, up 20.7%. And telecom landed in sixth place with 4.2% of total revenue.

Corporate G&A expenses for the quarter decreased 1.7% or $75,000 compared to the same quarter a year ago to $4.4 million. The year-over-year decrease in corporate G&A is mostly related to a reduction in wages and legal fees. Noncash stock-based compensation increased $21,000 to $131,000 in the quarter, and we paid $84,000 in income taxes for the quarter.

First quarter 2024 operating income decreased $1.4 million to a negative $1.1 million compared to $413,000 in the year-ago quarter, reflecting the year-over-year decline in revenue. Interest expense in first quarter decreased $1 million year-over-year to $5.6 million, reflecting debt reduction throughout 2023.

We ended the quarter with a total debt of $267 million, and we made our semi-annual interest payment on February 1, 2024. Adjusted EBITDA for fourth quarter was $731,000 compared to prior year adjusted EBITDA of $2.6 million. I will note that the cyclical pattern shows first quarter consistently being the lowest in profitability throughout the year.

We ended the quarter with cash on hand of $27.8 million, up from $26.7 million at year-end 2023. Our capital expenses for the quarter were $948,000 compared to prior year first quarter of $1.2 million. And looking into 2024, we expect our annual CapEx spend in the range of $4 million to $5 million.

And with that, I will turn it back to Caroline.

Caroline Beasley

Thank you, Marie.

Digital revenue growth has been a significant focus for Beasley. A variety of factors will continue to contribute to this growth, including: number one, the expansion of our digital sales force; number two, the successful implementation of digital marketing strategies that continue to leverage our strong local relationships and offer a breadth of omnichannel solutions to advertisers; and finally, number three, impressive CPM growth, particularly after transitioning a higher percentage of sales to private marketplaces.

We can see that Beasley’s multi-platform local content strategy has been yielding dominant share results with strong digital impressions and top-rated clusters in the majority of our markets. The local audience appeal of our over-the-air talent and strong brand recognition have been pivotal with a growing following on platforms like Instagram, Twitter and TikTok.

Across all of our brands, we have combined social media audiences of about 7 million. And despite a year-over-year digital audience decrease as we mentioned in last quarter’s call, there is an expectation for normalization in the second half of the year as we adapt to the Google algorithm changes and some of our newer initiatives bear fruit.

We’re particularly excited about an initiative to redesign all of our websites, which will enhance user experience and increase site traffic. Part of the redesign, the transition to a new back-end platform will allow for SEO and security upgrades, contributing to further traffic growth.

Now caring for our local communities is at the heart of who we are, and we’d like to take the opportunity to underscore our continued commitment to our communities. This past April, our Southwest Florida cluster joined forces with Children’s Miracle Network to host the first Cares 4 Kids Radiothon, in which we raised over $50,000 for Golisano Children’s Hospital.

Now looking at second quarter revenue as of today, we are pacing down in the low single digits, with April ending up and May and June pacing down. We remain mindful of the current economic environment. And based on such, we’ve kicked off process- and technology-based initiatives designed to streamline our business operations, resulting in the recent elimination of approximately $6.8 million in expenses through the end of this year, including a 7% reduction in workforce.

This strategic realignment will enable us to improve our operating efficiency while also reducing our leverage as we continue to best serve the needs of our valued audiences, advertisers and shareholders. Beyond next quarter, we expect the asset sales we made in late ’23 to impact our year-over-year comps through third quarter. However, we remain optimistic about our growth prospects in ’24, given our anticipated strong political spend in the back half of the year and expectations for continued growth in digital.

We’re also seeing some positive signs that the national advertising market is beginning to stabilize. But we remain mindful of the current economic environment and are taking actions to further reduce our cost structure.

Finally, we received $6 million for our BMI shares in the first quarter. And we intend to use this cash to reduce debt, in line with our continuing effort to right-size our capital structure, reduce leverage and bring more dollars to the free cash flow line.

So in closing, I’d like to thank our team members across the company for everything that they’ve done and they are doing to focus forward. And I thank you all for attending today.

And Marie, I think we have a few questions.

Question-and-Answer Session

A – Marie Tedesco

Thanks, Caroline. Yes, we received a few questions that were not particularly addressed in our prepared remarks, and here comes the first one. Could you give an update on the bond maturity in February of 2026?

Caroline Beasley

Yes. So what I can say is that we are highly focused on addressing the maturity of our bonds. And our goal is to have this resolved as soon as possible as this is a top priority for the company.

Marie Tedesco

The next question is, is there anything left of esports at this point?

Caroline Beasley

So we no longer have any teams in esports at this point.

Marie Tedesco

Great. And the last question. How much of the $6.8 million have been implemented? And when should we see this flow through? So out of the $6.8 million, $3.8 million is related to the headcount reduction that we just completed, including wages and benefits, and these have been implemented. The remainder is related to reductions in cost of goods sold, research and marketing and other operating expenses. But keep in mind that the $6.8 million relates to the current month through the end of the year, and this will be higher on an annual basis. And that’s all the questions.

Caroline Beasley

All right. Great. Well, thank you again for attending today’s call. And feel free, as always, to reach out to Marie or myself with any follow-up questions. Thank you.

Operator

Thank you. This concludes today’s conference call. You may disconnect your lines at this time. Thank you for your participation.