Mateo Colombo

introduction

If there’s one thing I’ve discussed in countless articles since last year, it’s my focus on value stocks as I predict a rotation from “growth” stocks to “value” stocks. .

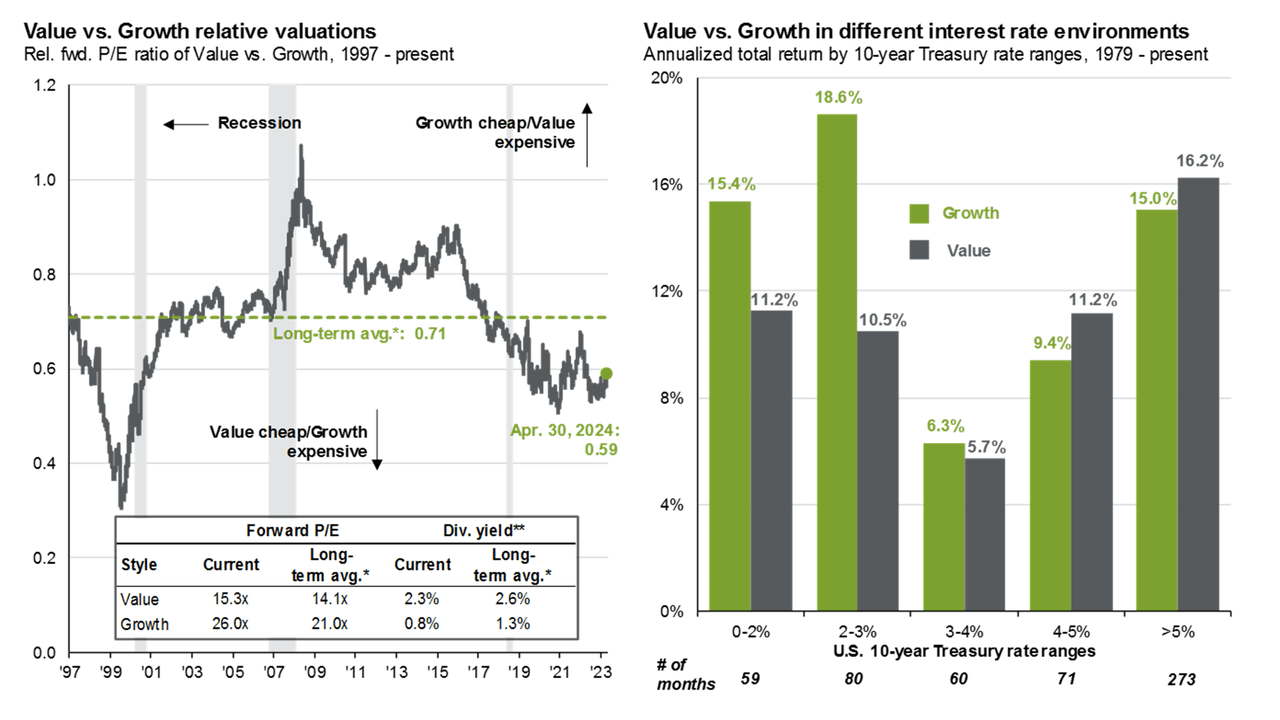

One of the charts I use often (and is updated frequently) is: From JP Morgan (J.P.M.) The following shows that value stocks are very attractive compared to growth stocks.

As you can see, value stocks have underperformed growth stocks since the end of the Great Financial Crisis, and even had periods of outperformance.

JP Morgan

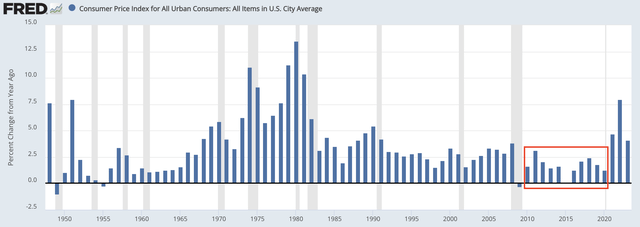

In fact, almost everyone in my generation (late millennials and younger generations) has never experienced a period of above-average inflation.

Federal Reserve Bank of St. Louis

That is wonderful. After all, the years between the Great Financial Crisis and 2021 have been great for investors. In general, yes.

The problem is that many people may have It has created a stigma, or at least an assumption, that what we have seen over the past 10-20 years is “normal.”

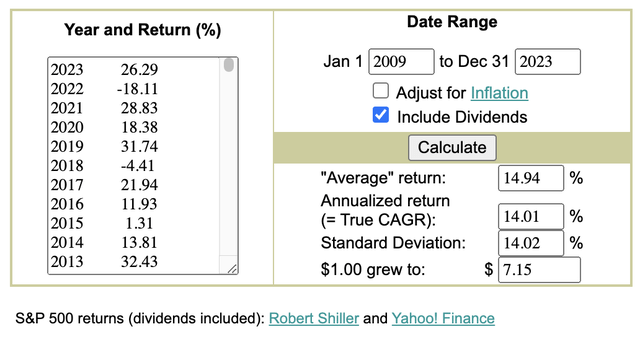

From January 1, 2009 to December 31, 2023, the S&P 500 returned 14.9% annually, converting $1.00 into $7.15, including dividends.

money chimpanzee

I’m not a bear by any means, but I’m not short-selling and have almost 100% of my net worth invested in long-term dividend investments. We believe investors should be aware of some very important trends that could have a significant impact on future returns and dividends. It offers great returns to investors with the right assets.

It may sound obvious, but choosing the right assets can be difficult.

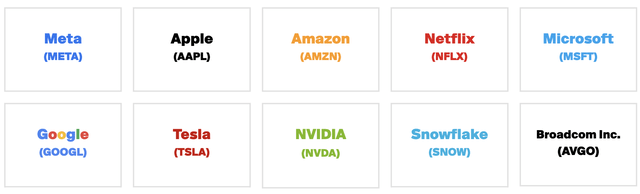

In this article, I’ll give my take on the FANG+/Magnificent 7 stocks, which could be the ultimate growth stocks in the market, and explain why I don’t believe this is the growth stock of the future.

So let’s get started!

FANG+ Basket Poor Risk and Reward

First, I used a graph that I often use in articles to show how low inflation was between the Great Financial Crisis and the pandemic. This was a truly incredible time to own growth stocks.

This has allowed countless people to retire early. I have no doubt that this is also true for many of you reading this.

The problem is that the tailwinds that led to low inflation have now turned into headwinds, increasing the likelihood of a prolonged period of above-average inflation.

The quotes below are recent article On a very similar topic (emphasis added):

- globalization It is under pressure from ongoing supply chain reshoring and new geopolitical tensions.

- of shale revolution finished. Growth in supplies of natural gas, oil, and coal has slowed significantly compared to before the pandemic.

- labor market dynamics It’s no longer very advantageous.

- Due to high inflation in 2021 and 2022; successfully navigated the economyleading to persistent wage inflation (supported by the labor market changes mentioned above).

That being said, this article is not about trolling FANG+ stocks or trying to get anyone to sell tech stocks.

After all, we may be dealing with some of the strongest stocks in modern history.

Even the latest forecasts of higher interest rates and inflation for an extended period of time had no negative impact on NVIDIA’s Mag 7 stocks (NVDA), Metaplatform (Meta), Tesla (TSLA),Amazon(AMZN), alphabet (Google), Microsoft (MSFT), Apple (AAPL).

These stocks collectively account for approximately 30% weight in the S&P 500.

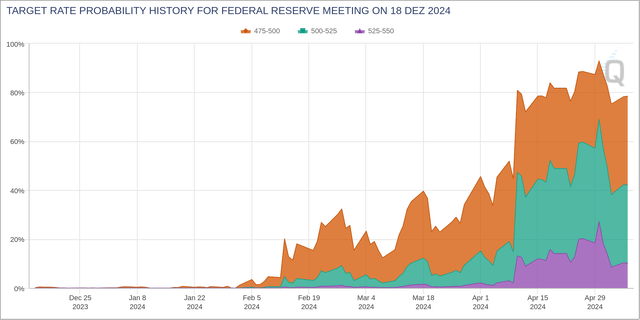

Returning to interest rates, the chart below shows the implied probability that the federal funds rate was above 4.75% on December 18th and that current rates are in the 5.25% to 5.50% range.

Until early February, the market had predicted a 0% chance that the federal funds rate would exceed 4.75% on December 18th. Currently, that percentage is 80%.

CME Group

All that was needed was that the previous report showed better-than-expected inflation for the fourth time in a row with upward momentum.

Expectations of higher interest rates are usually bearish for tech and growth stocks, but Mag 7 didn’t care.

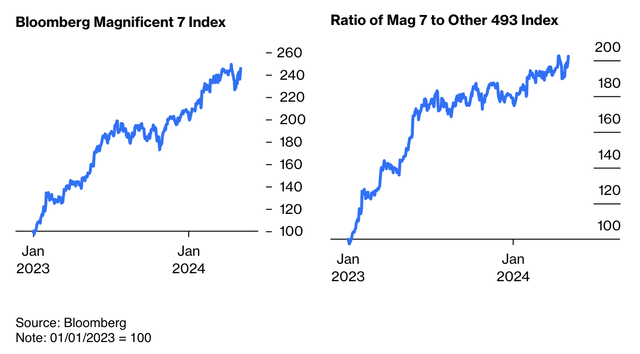

In fact, the Mag7 stocks have outperformed the other 493 stocks in the S&P 500 on a very consistent basis since the beginning of 2023, including the recent rise in inflation.

bloomberg

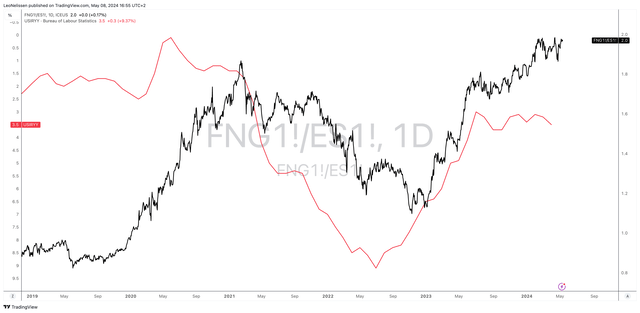

The TradingView chart below shows the ratio of FANG+ futures to the S&P 500. The future of FANG+ This is used as a proxy for Mag 7/Growth stocks because it is the largest basket of growth stocks that contains a Mag 7 component.

intercontinental exchange

A rising black line means FANG+ stocks are outperforming the S&P 500. We also added the average inflation rate for all items in the United States. This is an inverted (!) red line.

TradingView (FANG+/S&P 500 ratio, reversal inflation)

It’s highly unusual for growth stocks to outperform when inflation is bottoming out.

However, it’s not entirely unreasonable.

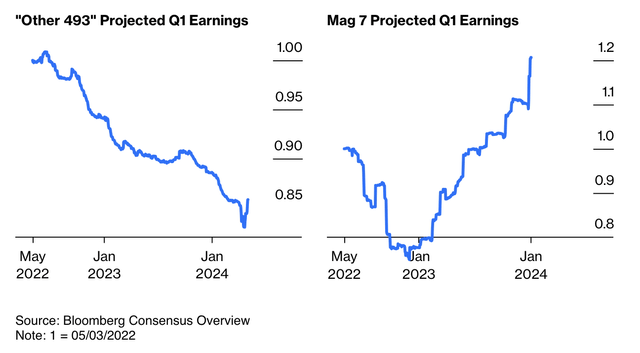

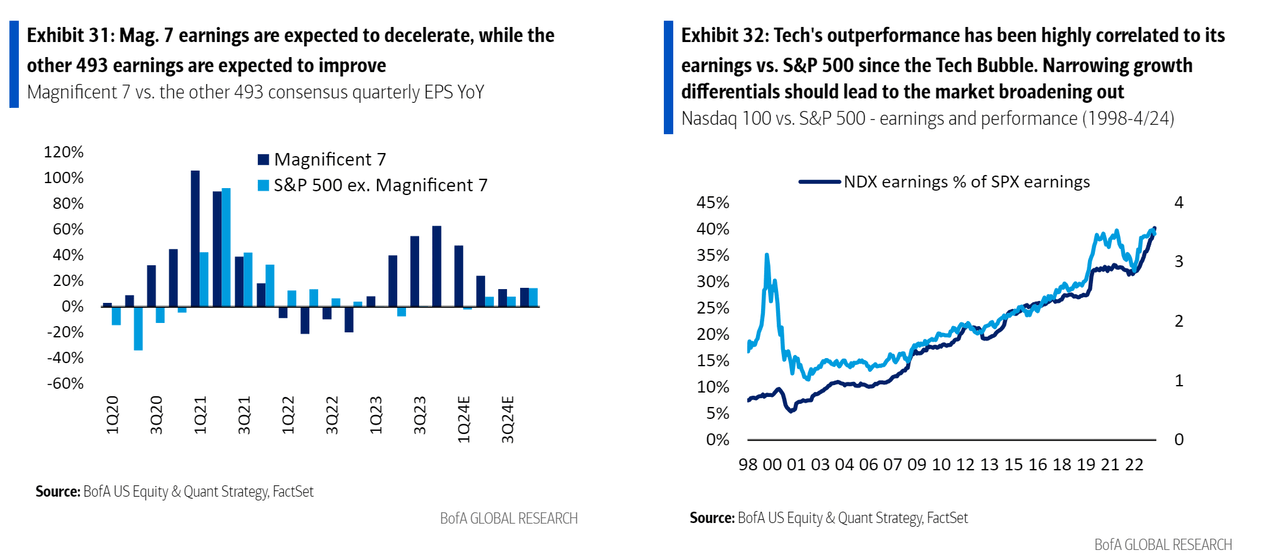

After all, the Mag 7 selection has become, in some ways, “the only game in town,” as the Q1 ’24 earnings forecast below shows.

That said, Non-Magnificent’s profits are still more than 15% below expectations from two years ago, while Seven’s profits are 20% above where they were then. – via bloomberg

bloomberg

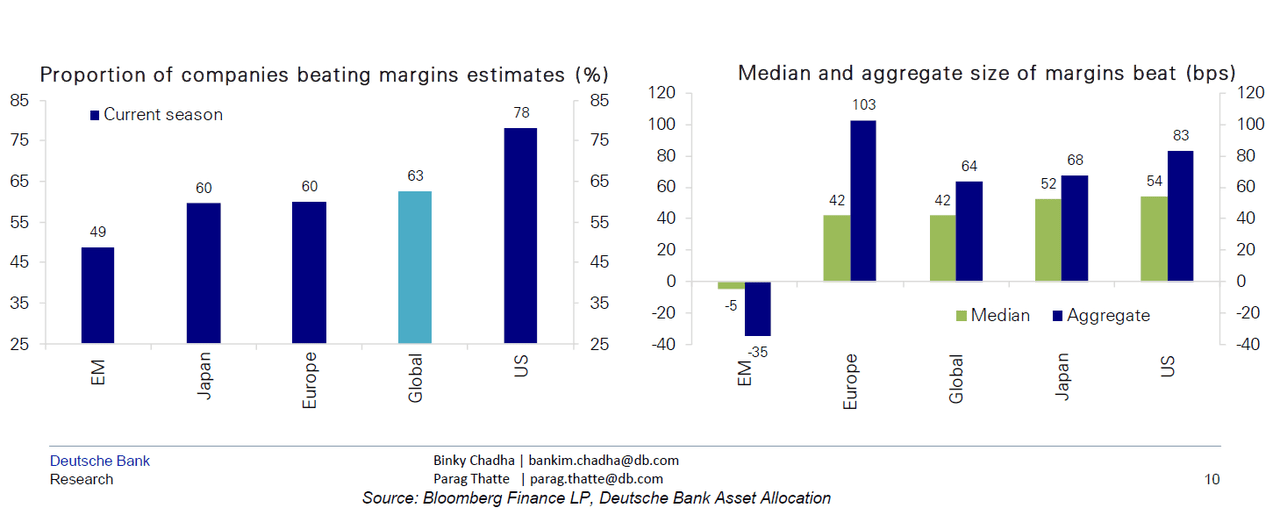

In general, companies with increasing profit margins (such as big tech companies) are doing very well, with U.S. companies outperforming profit margin expectations even more than their global peers.

deutsche bank

In other words, market participants are simply buying the best stocks in, frankly, the best countries.

There’s more evidence that the market is targeting certain growth stocks.

Remember 2020 and 2021?

At the time, inflation was extremely low due to the pandemic. Central banks engaged in aggressive quantitative easing, and most governments further accelerated economic expansion through fiscal stimulus.

That caused growth stocks to soar. But the rally was so broad-based that investors bought “everything” with a promising growth story.Investors also bought rock pictures Millions of dollars and all kinds of cryptocurrencies with funny names.

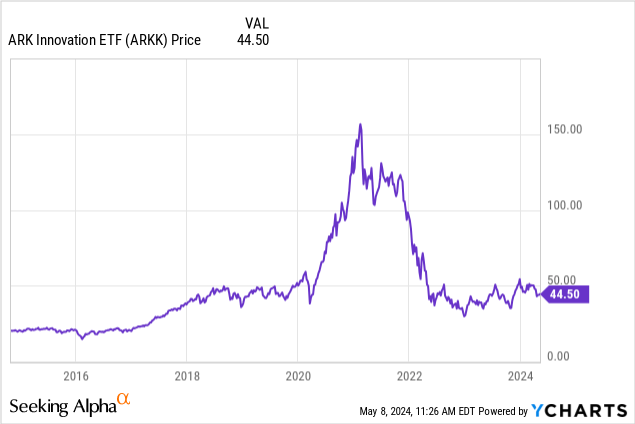

One of the biggest winners was Cathie Woods’ ARK Innovation ETF (Arkku), the stock price has risen from $50 pre-pandemic to more than $150.

However, unlike in 2020/2021, ARKK ETF performance has been abysmal, indicating that this is not a broad technology/growth rally, but a trend that relies primarily on Mag 7 with AI and similar benefits. clearly shows that. .

Therefore, I truly believe that the growth towards value rotation started in 2020/2021.

This is based on speculation, but I can only assume that the benefits of AI and the fact that the Mag7 stocks are so heavily weighted in the S&P 500 that growth will once again be outperformed.

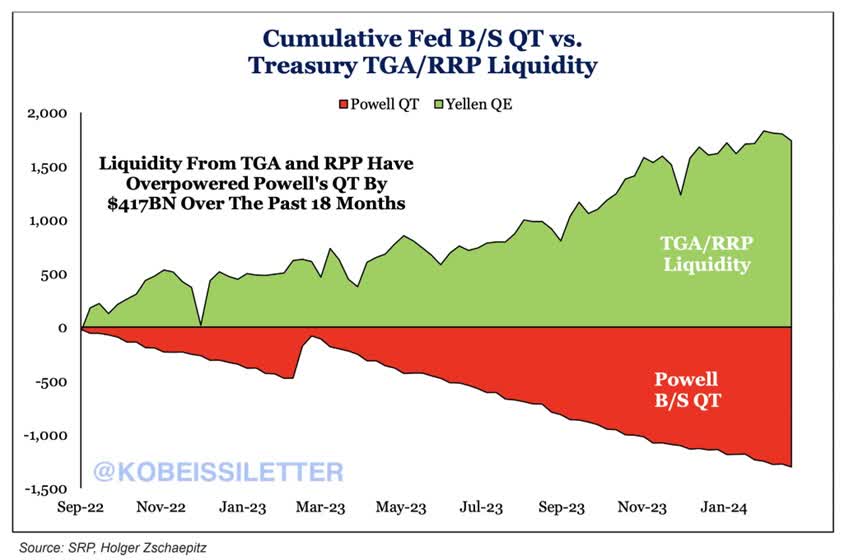

It should also be noted that despite the Fed’s monetary tightening, markets are enjoying greater liquidity.

As you can see in the chart below, increased liquidity from the Treasury General Account (“TGA”) and reverse repos has more than offset the Fed’s balance sheet reduction.

X/Twitter (@KobeissiLetter)

In other words, even as the Fed tries to tighten financial conditions, the Treasury has increased liquidity, greatly benefiting growth stocks backed by AI headlines and strong earnings results.

Going forward, TGA is likely to be a headwind for the market.

Like current accounts, the TGA can fluctuate widely and has been withdrawn twice in the past four years to give the government time to agree a debt ceiling with Congress (in the process liquidity has increased). After expanding in April, the plan is to expand by just another $100 billion by the end of September, more than offset by the Fed’s changes.. – via bloomberg (emphasis added)

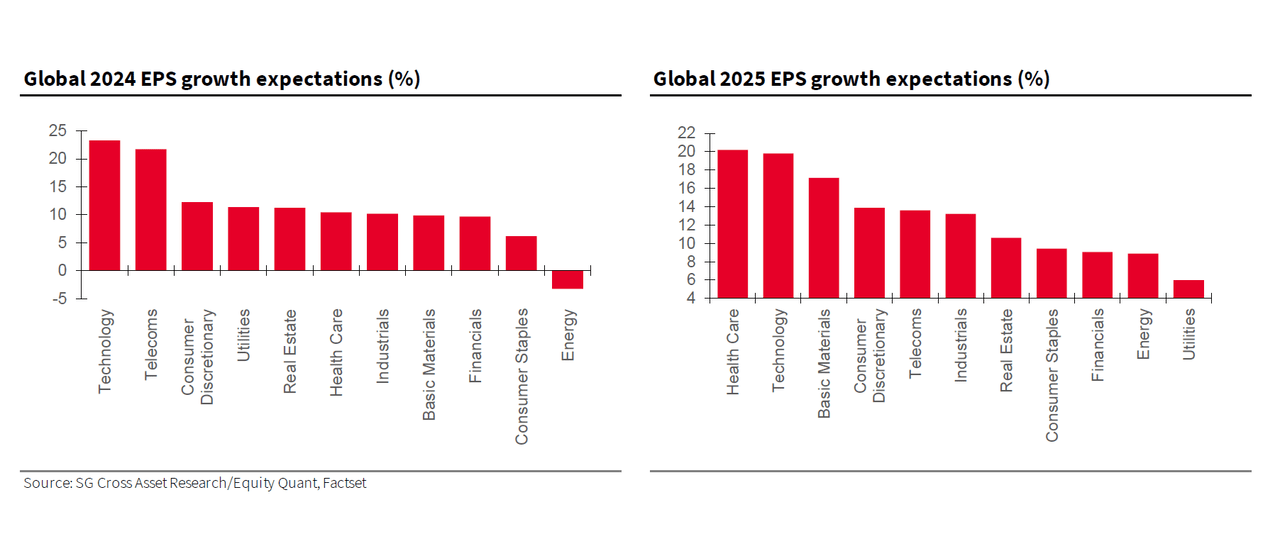

On top of that, there’s more data that could point to headwinds for big tech companies, at least in relative terms.

The tech and communications sector is expected to see higher EPS growth this year, but other sectors may catch up next year, as seen in the chart below.

sokgen

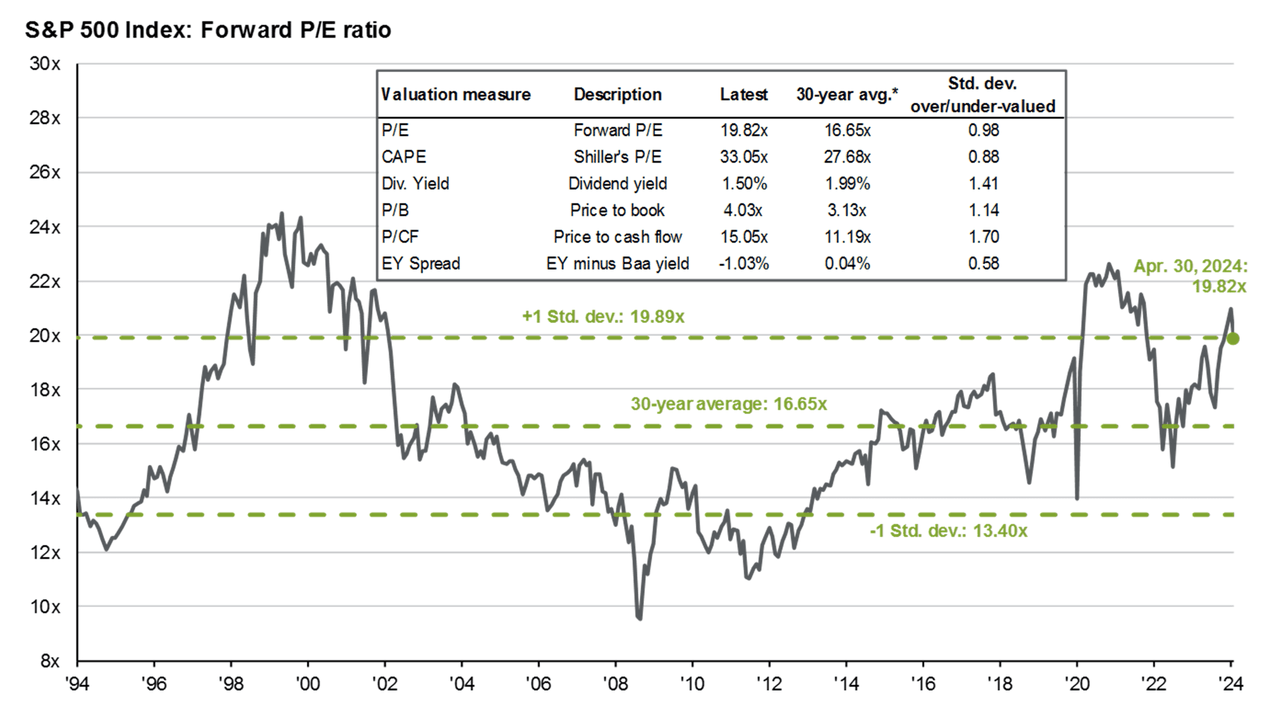

As a side note, note that while these EPS growth expectations are high, they would need to be high to justify the market’s valuation of 20x expected earnings (see summary below). ).

JP Morgan

When it comes to earnings, the huge advantage the Mag 7 enjoyed last year is gradually fading, with S&P 500 (formerly Mag 7) stocks expected to see similar earnings growth through the end of this year.

american bank

This is a big deal because it makes non-growth stocks even more attractive.

As the initial AI growth trend has faded, non-growth stocks with the same growth rate are now available at lower prices.

I’m obviously using a wider brush to paint here, but I think you get the idea.

what i am buying

Since I wrote this recently, I’ll keep this part a little short. article I’m buying six dividend stocks as having “generational change” potential.

That article focused on a wide range of commodity stocks, including energy.

In this space, I like distressed energy producers, midstream companies, and companies that make money on royalties.

My views on inflation and interest rates align with those of the “long-term high interest rate camp” driven by globalization, energy markets, and changes in the workforce.

This shift favors value stocks, which have the ability to protect investors from inflation and rising economic risks.

Given the uncertainty, I advocate long-term businesses like Texas Pacific Land Corporation, Deere & Company (D.E.), Intercontinental Exchange (ice), nutrien (NTR), Anteromidstream (morning), and Canada’s Natural Resources (CNQ).

When I invest in companies, I’m not necessarily looking for high-dividend-yield bangers, but I do look for companies that have some (and preferably all) of the following qualities:

- Fair valuation (considering the expensive market).

- A strong balance sheet (weak balance sheets are problematic for long periods of appreciation).

- Hirohori business. Generally speaking, it’s always good to look for companies with strong competitive advantages.

- Some kind of long-term growth.

For example, in the energy sector, long-term growth will be driven by lower supply growth (the end of the shale revolution) and strong long-term demand.

Still, we also include some high-yield investments because we believe dividends will play a bigger role in the coming years due to high market valuations.

If the market has a price-to-earnings ratio of 20 times or higher, it means that earnings over the next 5-10 years are likely to be subdued and a large portion of total returns are likely to come from dividends.

JP Morgan

Going forward, I will continue to focus on companies that I believe can outperform over the long term.

For now, my takeaway is that Mag 7/FANG+ stocks aren’t as big as you think.

While recent outperformance is well warranted, tailwinds are fading and favorable risk-reward shifts to value stocks.

I may be wrong, but I think most market participants are not prepared for a prolonged period of high inflation and poor performance from high-growth stocks.

remove

While the allure of tech giants like Mag 7/FANG+ stocks may be strong, changing market winds suggest a shift toward value stocks may be wise.

As inflationary pressures mount and the era of low inflation could end, the balance of risk and reward favors companies with strong balance sheets, broad businesses, and long-term growth potential. .

My investment strategy reflects this shift, focusing on value stocks that have the ability to deliver significant alpha when it matters most and can thrive in high inflation environments.