Sadeugura

Written by Nick Ackerman, co-produced with Stanford chemists.

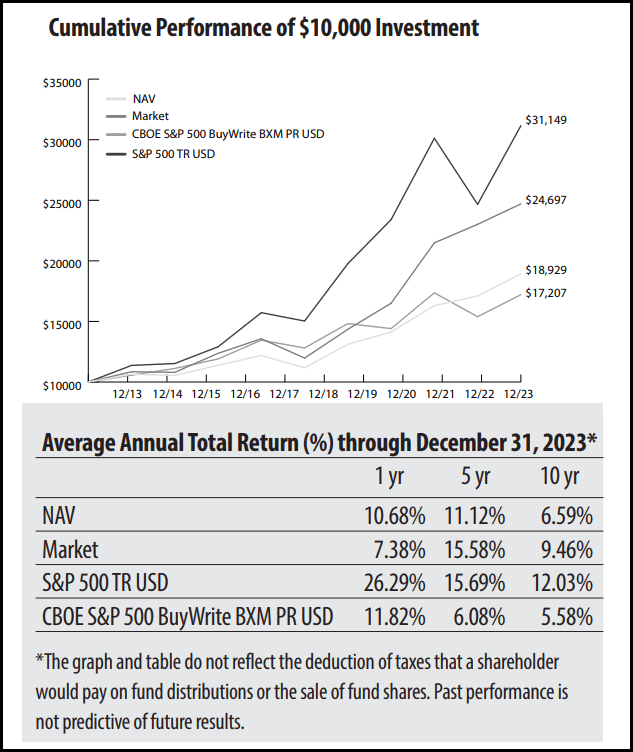

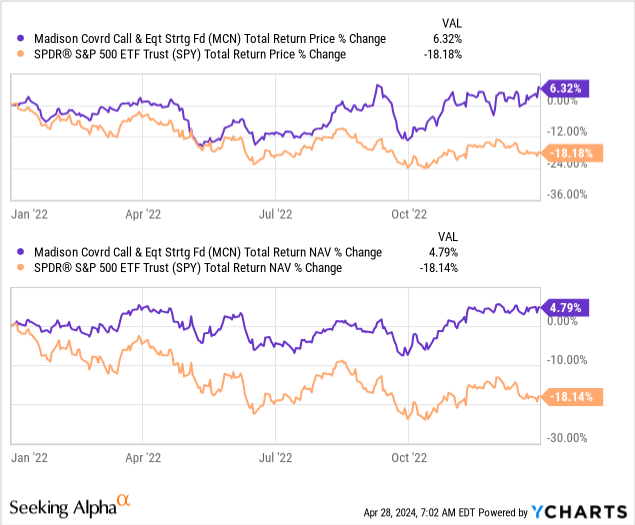

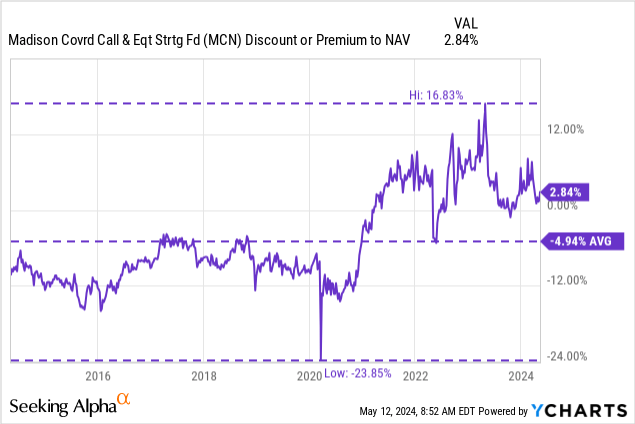

Madison Covered Call and Equity Strategy Fund (New York Stock Exchange:MCN), as its name suggests, offers a stock portfolio while employing a covered call strategy overlay.The fund was trading at a significantly high price. premium Last time I brought it upHowever, recently it has settled down to trading at roughly the same as the net asset value per share. This is partially due to the fund’s poor performance since the last update.

MCN performance since last update (In search of alpha)

From a total return perspective, investors actually lost money, but the S&P 500 index delivered returns of up to 28%. Today looks like a more interesting opportunity as entry valuations have improved.

However, the fund is still trading well above its long-term historical range. The premium is The current state of the fund over the past few years is truly abnormal. Stable quarterly dividends, unadjusted and dating back to the time of the global financial crisis, are likely a driving force for income-seeking investors.

MCN basics

- 1-year Z-score: -0.04

- Premium: 2.84%

- Dividend yield: 9.96%

- Expense ratio: 1.08%

- Leverage: Not applicable

- Assets under management: $146 million

- Structure: Permanent

MCN’s investment objective is “high level of ordinary income and profit.” They aim to accomplish this with an “actively managed stock portfolio of common stocks with a covered call option strategy.” Covered call strategies aim to “offer stable, low-volatility participation in the stock market while reducing risk and providing stable income returns from option premiums compared to simply owning stocks.” .

Since this fund is very small in terms of total assets under management, the daily trading volume is typically quite limited. Larger investors may find it difficult to rush in and out of this fund.

Performance – Interesting fund, but evaluation is not yet complete

As a covered call fund, it typically lags a straight equity benchmark because covered calls can limit return upside due to stocks being called away. It also means that a large portion of your portfolio will be overwritten, meaning that you may be largely restricted to strong upward movements. The most recent override was 88.2% of the portfolio.

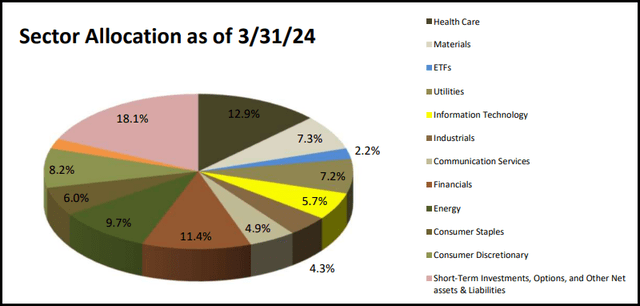

Additionally, the Fund does not currently have significant investments in the information technology sector. The last update had more significant funding allocations. Healthcare, finance, and energy now have the largest allocations, with a greater focus on value-oriented approaches. This means that it is the largest allocation of your overall funds in addition to your cash position. We pointed this out in our last update.

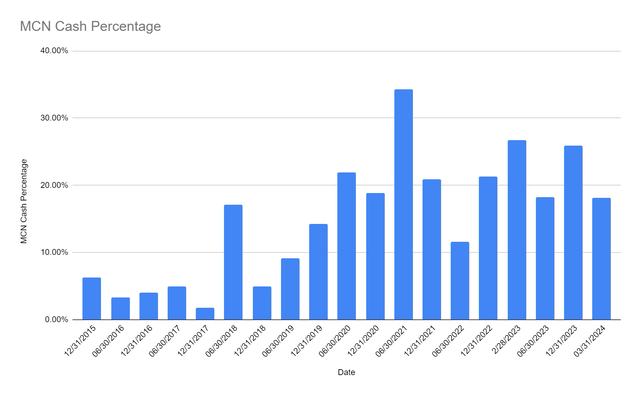

At the time, the company held 26.7% in cash, and its annual report at the end of 2023 showed it still held nearly 26% in cash. As of the latest fact sheet, that percentage has dropped to nearly 18% for him. But it’s still important.

Cash has been steadily making gains lately, with the fund posting a 5.32% yield on the money market funds in which they participate. Next, you also have to subtract his 1.08% operating expenses incurred by the fund, and his return on cash allocation is closer to 4.24%.

This isn’t terrible at risk-free rates, but we know how well the broader stock market has historically performed. Considering all these factors, with a value-oriented portfolio, large cash allocations, covered call writing, etc., it’s not really surprising that it underperforms when compared to, say, the S&P 500 Index. .

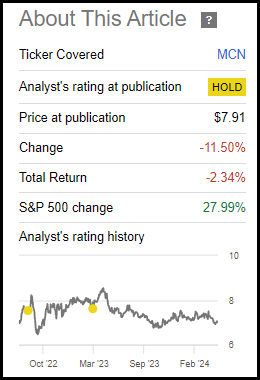

However, when compared to the CBOE S&P 500 Buy/Write Index, things are a little different. When comparing this fund with a benchmark that performs with a closer strategy, the results tilt in favor of his MCN.

MCN $10,000 graph and annual performance (Madison)

Additionally, with a value-oriented portfolio and covered call writing strategy, MCN delivers positive total returns, which is more It easily outperformed the broader market.

Y chart

That said, I don’t think this valuation makes MCN an overly attractive option in today’s market.

Yes, premiums have come down significantly since the last update, especially from their highs of about 15%. But it’s an odd move that the fund just started trading at a premium in 2021. Based on short-term average discount rates, this fund appears to have a relatively attractive valuation. In the long run, it still seems a little too rich for me.

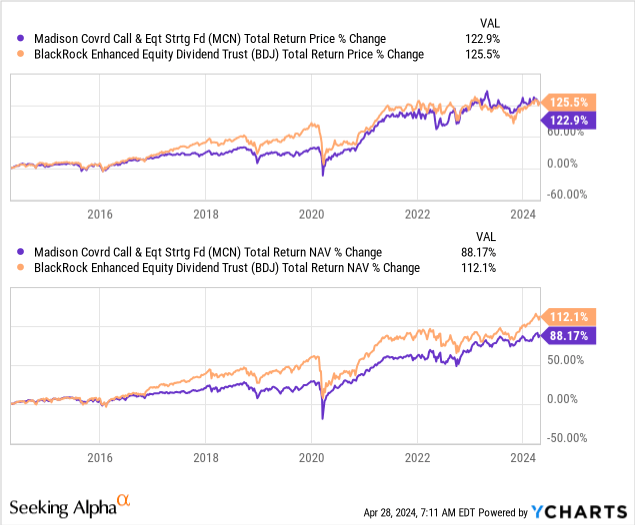

This may become the new normal, but we’re going to be a little more patient here. This is especially true when you find something like the BlackRock Enhanced Equity Dividend Fund (BDJ) with double-digit discounts. BDJ, like MCN, focuses on value-oriented portfolios and writes covered calls.

Y chart

BDJ even topped the list for total returns over the past 10 years. This does not mean that the fund will continue to outperform, but rather that it will undergo a fundamental shift as MCN moves from investing heavily in technology to now a more value-oriented approach. He actually showed that he was not against it.

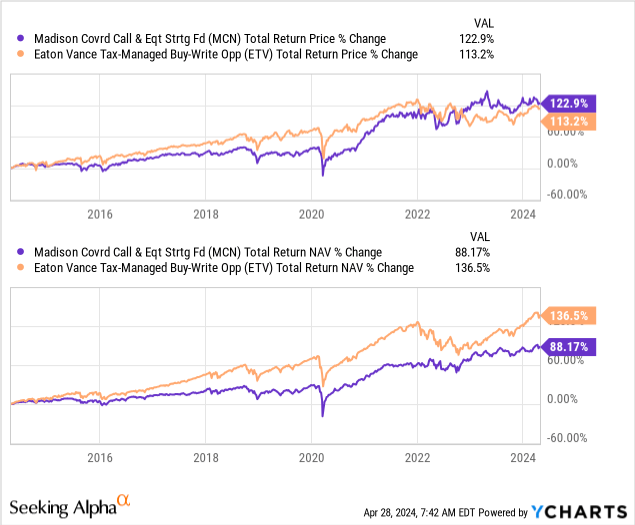

In that case, I would still invest in the Eaton Vance Tax-Managed Buy Right Opportunity Fund (ETV), which, like BDJ, is also trading at an attractive discount compared to historical levels. We know that ETV has invested heavily in technology, so on a historical basis for total NAV returns, it wasn’t even close to that.

However, on a total price/earnings ratio basis, MCN came out on top. ETV used to charge regular premium rates, but now they have reduced the price to a discount. So this is a bit of a reversal when compared to MCN, which previously traded at a discount forever but is now trading at a premium.

Y chart

Again, just because ETV’s portfolio has performed well in the past does not mean it will continue to do so in the future. Given that the valuations of funds like BDJ and ETV are much more attractive, he would have to say that there is more than a 50% chance that these two funds will outperform MCN in the future.

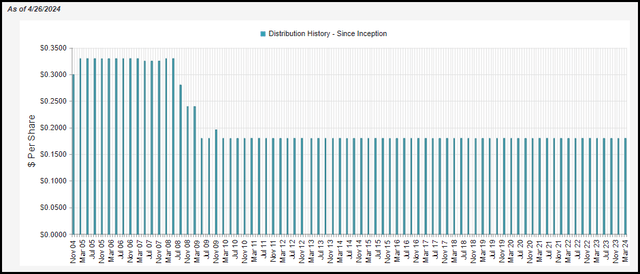

Stable distribution is attractive

Investors may prefer MCNs, which have been able to pay stable distributions since the global financial crisis. Investors looking for income tend to prefer those who can pay relatively high interest rates and hold for long periods of time. We’ve been driving the same quarterly distributions from this fund for about 15 years.

MCN distribution history (CEF Connect)

Also, the dividend yield is currently 9.96% and the NAV rate is 10.24%, which is similar due to the small premium. However, anything above 10% is a yellow flag for equity funds. That being said, given their long history of stability, I doubt management is going to make any adjustments anytime soon.

However, you should be aware that it can be difficult to earn that interest rate plus the fund’s expense ratio. One rough indicator to note is that the fund’s total NAV return over the past 10 years has been less than 7%. This suggests that this distribution has not been covered for most of the past decade. The total NAV return over the past five years was 9.94% per annum. This is still a shortfall, but not by much, and may be reflected by the fact that the erosion of his NAV over the past five years has been very slow.

Eventually, distribution will be reduced unless performance starts to improve. In this case, unless some kind of black swan event occurs, it will probably seem years away.

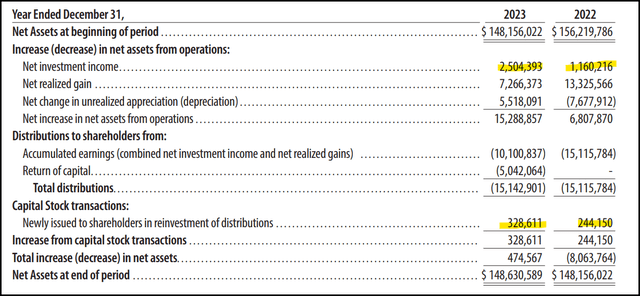

Speaking of coverage, you can check out the latest numbers provided by the fund below. annual report. To cover distributions, the fund requires capital gains, which is also not unusual for equity funds. However, the fund’s net investment income is double what it was last year, likely due to its heavy weight in cash. From 2022, when cash income was zero at the beginning of the year, a major change will occur if cash income increases by more than 5% by 2023.

MCN Annual Report (Madison (Author Highlights))

On a per share basis, NII rose from $0.06 to $0.12. This may be a better indicator than the absolute NII listed above. Because, as we also highlighted, the fund is issuing new shares through his DRIP. The fund trades at a premium, so there is an advantage to issuing new shares, and issuing at a premium means the NAV increases.

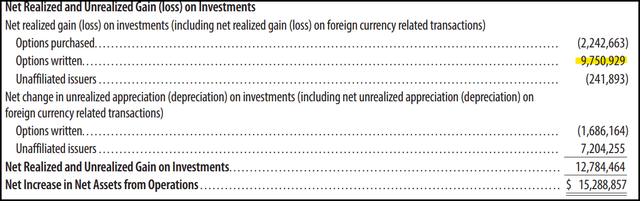

In addition to generating capital gains by realizing rising positions in the portfolio, this is where the fund’s option writing strategy comes into play. Last year, it was the largest contributor to the fund’s realized gains.

MCN Realized/Unrealized Gain/Loss (Madison (Author Highlights))

For tax purposes, the Fund lists the following breakdown:

For the years ended December 31, 2023 and 2022, the tax nature of distributions paid to stockholders was: ordinary income of $10,100,837 for 2023, return on equity of $5,042,064, and ordinary income for 2022. was $13,560,297 and long-term capital gain was $1,555,487.

MCN portfolio

As stated above, the Fund’s maximum allocation is cash, or what the Fund designates as “short-term investments, options, and other net assets and liabilities.” This is followed by healthcare at 12.9%, finance at 11.4%, and energy at 9.7%. This was a change from the last updated allocation, when information technology actually had an 18.6% weight.

MCN sector allocation (Madison)

I would say this was a big change in our weighting in this fund today. Last year’s portfolio turnover was 106%. Surprisingly, this was the second lowest sales in the last five years. The average attrition rate over the past five years has been 126%. So they’re a very active management team, so it’s not really surprising to see changes in their portfolio in terms of sector allocation.

But what has been consistent over the past few years is the largest cash allocation. This hasn’t changed much since the last update. The allocation has been increased since around 2019 and has remained at this high level for the past few years.

MCN cash allocation (Madison)

It’s great to have cash earning something these days, but when you’re looking to pay out more than 10%, earning up to 4% on such a large cash position means the rest of your portfolio is working even harder. means you have to work.

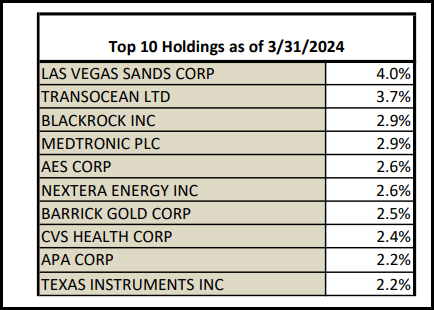

Despite the fund’s high turnover and changes in sector allocation, its two largest holdings, Las Vegas Sands (LVS) and Transocean Co., Ltd. (operation)—I’m in the same position I was in just over a year ago.

MCN Top Ten Holdings (Madison)

Other names that remained in the top 10 during this period include BlackRock (BLK), CVS Health Corp. (CVS) and APA Co., Ltd. (Apa) Position of.

conclusion

MCN provides investors with exposure to a portfolio of stocks while employing a covered call option strategy. This fund has provided stable distributions over the years, with a rate of over 10%, which is certainly attractive. Of course, the fund is also struggling to cover its 10% distribution. It’s also encouraging that the premium is down from the levels it has been trading at for most of the past few years. However, it is still trading well above its long-term average and will continue to give pause. I believe there are other funds that present more attractive opportunities from a valuation perspective at this time.