Thomas Berwick/Digital Vision via Getty Images

summary

Continue my coverage area Mohawk Industries (New York Stock Exchange:M.H.K.) In February 2024, we recommended a Hold rating as we wanted to see more signs of recovery before adjusting to a Buy recommendation.this post To update my thoughts on business and stocks. I am changing my rating from ‘hold’ to ‘buy’ as we see clear signs of an upcoming recovery and the market will start to raise MHK’s rating as it continues to record continuous improvement in sales. must.

investment thesis

just, a few weeks ago, MHK announced its financial results for the first quarter of 2024, and the adjustment amount decreased compared to the same period last year. EPS was $1.86, beating the consensus of $1.68. EPS beat consensus estimates, but revenue declined 5% due to weak demand and continued price/mix headwinds given the global macro environment and US housing environment. This beat was primarily driven by company-specific advantages. Restructuring, productivity and efficiency efforts. MHK’s Q1 2024 performance wasn’t the most ideal, but it was enough to convince us that a turnaround in demand is just around the corner. Compared to Q1 2023, year-over-year sales growth improved by 240 bps in Q1 2024, but could have been better had it not been for the bad weather in the US in January. In my opinion, this is a huge improvement. In terms of sales volumes, the improvement is more obvious, with sales volumes in Q1 2024 decreasing by 3.2%, while in Q1 2023 they decreased by about 11%. Adjusting for adverse weather conditions, the volume decline is very likely to be within 1-2 percentage points of 0%. Of note was Rest of the World (ROW) flooring, which saw a 7.5% volume increase. Although growth has come off a low base, I believe this is a very encouraging sign that trends are improving. Management also said that they are starting to see signs that volumes will increase. Below, we further elaborate on the Global Ceramic and Flooring ROW segment.

Global Ceramics’ first quarter 2024 sales decreased 1% on a reported basis and 5% on a constant currency basis. Sales were impacted by a 4.1% decrease in price/mix and a 0.8% decrease in volume. I think the bad weather in the US was a big drag on growth as many factories and service centers were closed in January, impacting both revenue and costs. In a normalized weather environment, I think this sector will be close to flat growth. This bodes well for the coming quarters. In Europe, we are seeing two indicators that demand is increasing. In Europe, porcelain panels showed solid growth following capacity expansion, and sales benefited from the launch of new premium products. Going forward, I believe there are several opportunities to bring growth in this sector back into positive territory. First, the US ceramic tile industry has filed, so pricing in the US should increase positively. petition The company filed a lawsuit against India in response to dumping of ceramic tiles in the U.S. market (dumping duties are expected to range from 400% to 800%, with additional tariffs on subsidies expected). Second, energy prices in Europe have fallen. We expect this to benefit consumers directly and MHK indirectly as they have more disposable income.

In the Flooring ROW segment, sales decreased 7% on a reported basis and 6% at constant currency, despite volume growth of 7.5%. A 13% decline in price/mix was the primary cause of the sales decline, primarily due to MHK’s ability to achieve cost savings in a highly competitive market. Management does not expect a repeat of the 13% price mix decline, as it has already announced price hikes in its panels and insulation business due to rising material costs. Additionally, MHK’s residential luxury vinyl tile (LVT) program has been restructured and is now experiencing significant growth in rigid LVT. This should help with both pricing and volume. Additionally, returning to my point above regarding European energy prices, rising disposable incomes should also continue to support volume growth.

The restructuring of the residential LVT program is complete and the anticipated savings are beginning to emerge. This change has resulted in significant growth in our residential rigid LVT, replacing discontinued flexible products. Financial results announcement for the first quarter of 2024

Finally, regarding the outlook for profit margins, the first quarter of 2024 showed that management efforts to improve profit margins were successful, so we believe that the company will continue to expand going forward. EBIT margin expanded by 30 bps despite the year-on-year decline in sales. In particular, productivity contributed $47 million to business expansion. MHK expects to save an additional $60 million in restructuring costs over the next few quarters ($90 million of the $150 million in annual cost savings expected from the restructuring has already been realized). MHK’s margin outlook is positive given its low cost structure and the potential for increased volumes in the coming quarters. MHK is currently operating at utilization rates in the 75-80% range, so no further capacity reinvestment is required. This means we have the ability to respond quickly to increasing demand. Management expects MHK to achieve an EBIT margin of approximately 10% over the next few years as demand improves due to operating leverage, the company’s recent cost reduction efforts, and productivity improvements.

evaluation

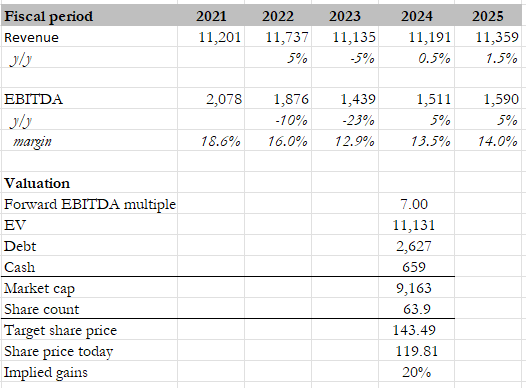

own calculations

The target price for MHK based on my model is ~$143.50, a 5% downward revision from the previous target price. I believe the outlook for MHK is clearer following the Q1 2024 results, but the results suggest that the strength of the recovery may not be as strong as previously thought. I was also convinced. Therefore, I have revised it downward. My model’s assumptions are that sales will grow by 0.5% in FY24 and in FY25 he is expected to grow by 1.5% (half the size of the previous assumption). We expect EBITDA margins to improve due to volume recovery and cost reductions, but at a smaller scale than our previous model due to lower growth rates. Although my latest view on MHK’s resilience has weakened, in my opinion it is far more important to have a clearer outlook for recovery, and MHK continues to see a recovery in volumes. I think the market will start to recognize this as it shows and that drives valuations. Upgrade. As expected, the growth rate is still below MHK’s long-term (from FY2001 to FY2023) growth rate of 6% (i.e., the growth rate has not yet reached normalized levels), and I still think that MHK is below the historical We believe it should be traded at a discount to the average 8x. Future EBITDA. Therefore, I value MHK at 7x future EBITDA (1x discount).

danger

The outcome of the US petition against India is variable. Market view on US ceramics growth prospects as study finds no ‘dumping’ practices by Indian competitors, meaning pricing may remain depressed in the short term may change. If the cost savings from restructuring are slower than expected, EBITDA margins may not expand as much as I expected.

conclusion

In conclusion, my rating for MHK is “buy.” Although the results for Q1 2024 were not perfect, they showed a clear trajectory towards recovery. Improved sales volumes and positive signs from Flooring ROW significantly narrowed the year-over-year decline in sales. Expanding profit margins shows the effectiveness of cost reduction measures. It is worth noting that despite the downward revision to my growth forecast, the path to recovery has become clearer. I believe that as MHK achieves sales volume growth, the market will likely raise its valuation.