Sitthipong Pengjan/iStock Editorial via Getty Images

Kering (OTCPK:PPRUF), Gucci, Balenciaga, Bottega Venetta, and other famous luxury brands, he has struggled to keep up with the industry.

Mixed with poor marketing and relatively high dependence Wholesaling, lackluster design and complacent management have left Kering behind the luxury brand leaders and continuing to lose market share.

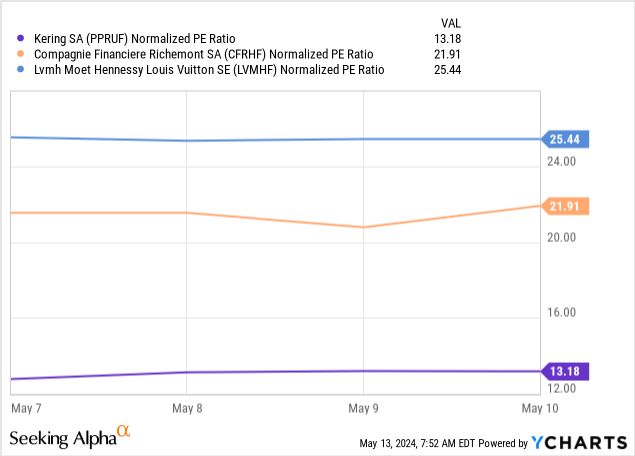

This is reflected in the company’s valuation, which is heavily discounted relative to the sector.

A question arises here. If a turnaround occurs, how can we identify it early?

Let’s dive in.

Introduction – Kering’s Ugly Duckling Story

I’ve been covering Kering for Seeking Alpha since July last year. I maintained a bearish stance throughout the period, rating the stock as a hold, although I probably should have opted for a sell.

of Story of Kering is the ugly duckling of the luxury goods industry. He had players who did worse, but I would argue that no one was in a better position to succeed than Kelling.

Headed by the Pinault family, the company’s luxury brand history began in 1999 when it purchased a controlling stake in Gucci.

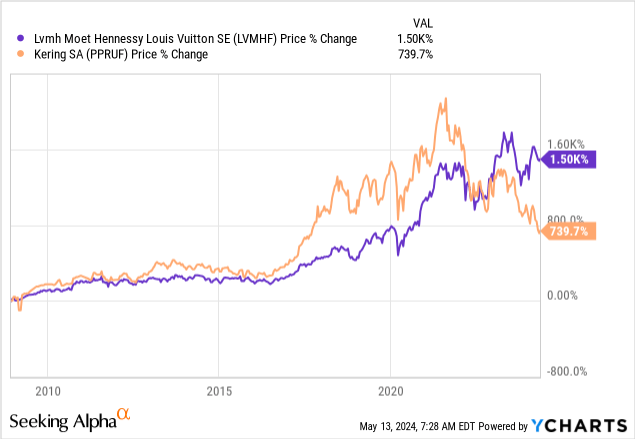

The conglomerate has been in business for roughly the same period as its arch-rival LVMH. But LVMH’s story has been far more successful, especially since the pandemic.

LVMH’s market capitalization is now nearly 10 times Kering’s, with a 10-year return of 420% compared to Kering’s 119%.

This is well justified by the respective performance of both companies over this period, as LVMH grew revenue and EPS at a CAGR of 11.5% and 16%, compared to Kering’s 7.3% and 10.4%. Masu.

There is no sign that this difference in performance will stop. In fact, it has become even more important.

Further quarterly market share loss

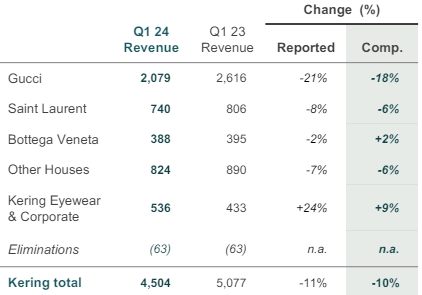

In the first quarter of 2024, Kering’s revenue decreased by 11% (10% year-on-year) to €4.5 billion. According to the company, the reasons for this decline include a difficult macro environment, sluggish customer traffic at directly managed stores, and a slump in the wholesale business.

In conclusion, everything was bad.

Kering Q1 2024 Presentation

Looking at sales by segment, Gucci, the company’s most important brand, declined 21% on a reported basis and 18% on an organic basis. Bottega Venetta and Eyewear were the only two segments to experience positive growth, with the latter benefiting from the Creed acquisition.

Kering Q1 2024 Presentation

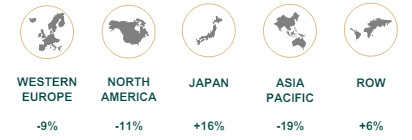

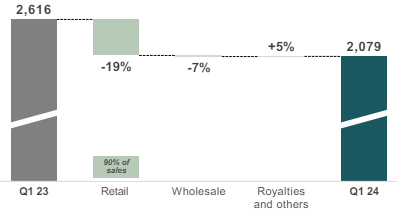

On the distribution side, retail sales declined by 11%, led by declines in Asia Pacific, North America, and Europe. Although Kering benefited from the Creed acquisition, as luxury brand wholesale sales fell 20%, the decline was only 7%, driven by wholesale sales, which typically underperform luxury goods companies.

Kering Q1 2024 Presentation

For Gucci in particular, wholesale sales outperformed, reflecting a larger problem for the company. Simply put, it means that the wholesaler sells the brand better than the brand owner himself. This means Gucci is not popular enough to draw traffic to its stores, so either it would benefit from wholesale exposure, or worse, wholesalers would provide a better customer experience for Gucci customers.

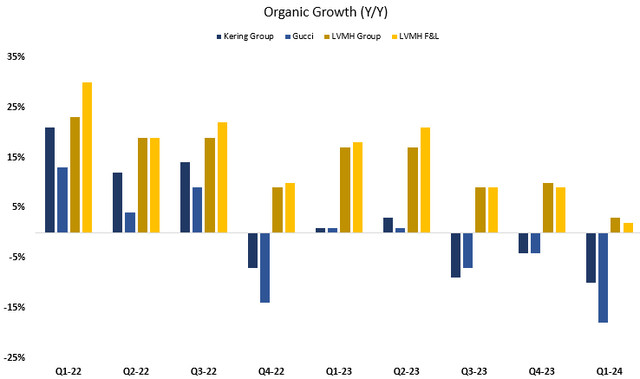

The bottom line is that this was another significantly underperforming quarter for Kering, with LVMH outperforming Gucci’s owner by 13% on a consolidated organic basis.

Regionally, LVMH grew 13% in the US, 16% in Japan, 13% in Asia Pacific and 13% in Europe. From a business unit perspective, LVMH’s Fashion & Leather division, which largely overlaps with Kering, grew 2% organically, while its Perfume & Cosmetics division grew 7%.

Valuation – Huge discount compared to the sector

Kering’s 2023 EPS is 13x, LVMH’s 25x and Richemont’s EPS (OTCPK:CFRHF) 22x.

On a forward-looking basis, Kering is expected to generate EPS of €17.2 in 2024, reflecting a 30% decline and a P/E of 19.3x. Meanwhile, LVMH’s EPS forecast is €32.16, reflecting a 6% increase, for a multiple of 24.5x, while Richemont’s forecast is €6.1, for a multiple of 22.7x.

On a trailing basis, Kering looks much cheaper than on a forward basis, which is one of the reasons for the discount.

If Kering had a Richemont multiple to 2023 earnings, it would be up 70%.

Given that the company has an earnings power of 13x, which is very cheap compared to its peers, we have to ask ourselves if and when Kering can recover.

How to identify an upturn?

I’ve been on a wait-and-see approach to Kering for quite some time. As indicated above, I believe there is plenty of upside in the event of a turnaround and am willing to sit on the sidelines and miss out on the first rally to reduce risk.

It’s been almost a year since I first started hearing, “It’s so cheap, just buy it and wait for it to recover. This strategy will result in a 50% loss.”

That being said, I think it’s important to spell out what the signs are that it’s time to pull the trigger.

First, let’s talk about management and leadership changes. In August, Kering announced a major change in management, which some investors saw as the first step in improving the company. At that time, I Said This seemed more like a cosmetic modification than a physical modification. As long as the Pinault family owns control of the group (which they probably will in our lifetimes), management changes will not truly change the company’s culture, so for me it’s an improvement. This cannot be recognized as a sign.

Incidentally, since that reorganization, Kering has spent billions on real estate, entered new categories through acquisitions, and its underperformance has only accelerated.

Second, Gucci’s new creative director, Sabato de Sarno, who will take over in early 2023, will revive the brand. For now, I don’t know if he can do it. He is not very famous in the fashion industry and left his job as fashion director at Valentino to come to Gucci. Gucci shows no signs of improving, at least in the first quarter of 2024. It’s important to remember that design is only part of the equation, and when it comes to marketing, Gucci appears to be far behind (just look at Gucci’s social media compared to the LVMH brand) ).

Finally, and this is where things get interesting and quantifiable, I expect Kering to close the gap with LVMH in terms of organic growth by at least one quarter.

Created by the author using data from LVMH and Kering financial reports

Since the pandemic, Kering has consistently trailed LVMH, and the gap has only grown wider. In Q1-22, Kering was only two points behind (although it benefited from a much easier comp). Since then, the gap has widened into his mid-teens and remained stable at this level.

Even if the macro environment becomes more favorable and motivated customers return to stores, I would not declare the beginning of a turnaround as long as Kering’s performance continues to significantly underperform LVMH.

Importantly, a common theme throughout my articles and my overall strategy is that you don’t want to own an inferior company just because it’s cheap. Bad companies show time and time again that there are new pitfalls. For luxury goods, this is even more important. Investors are willing to pay top dollar for successful brands and ignore other brands, regardless of price. Therefore, I have little interest in Kering’s evaluation.

We do not recommend investing until we see that the situation is improving.

conclusion

Kering owns several world-famous brands with decades of heritage. Unfortunately, the company has not been able to elevate these brands to the same extent as its peers, especially LVMH.

The result was a decade of significant underperformance in both the company’s growth and stock price, which accelerated after the pandemic.

Nothing the company has achieved so far gives us confidence in a short-term turnaround. Waiting for the macro environment to improve is not a strategy, nor is it a path to outperforming the market.

Investors are advised to remain on the sidelines until Kering shows signs of improvement. This will take shape in the form of closing the growth gap with LVMH.

Therefore, I would like to reiterate my rating on the stock as Hold.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.