Esch collection

paper

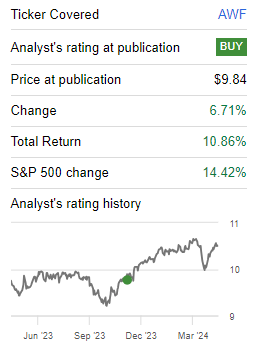

Six months ago we started Covering Alliance Bernstein Global High Income Fund (New York Stock Exchange:AWF), assigned a Buy rating at the time due to its attractive discount to NAV profile and high corporate spread. The fund is It performed well and achieved a total return of over 10%.

original rating (In search of alpha)

I’m going to reconsider this name today given the incredibly tight credit spreads currently in the market and the significant increase in this product’s discount to NAV.

analysis

- Assets under management: $900 million.

- Sharpe ratio: -0.08 (3Y).

- Standard deviation value: 9.4 (3Y).

- Yield: 7.5%.

- Premium/discount to NAV: -5%.

- Z-Stat: 1.75.

- Leverage ratio: 1.3%.

- Validity: 3.4 years

- Composition: Multi-sector bonds

Holdings – Focus on global junk bonds

The fund focuses on global non-investment grade stocks, which represent more than 70% of the fund’s holdings.

| Corporate – Non-Investment Grade | 72.89 |

| Corporate – Investment grade | 19.00 |

| Emerging Markets – Corporate Bonds | 5.58 |

| loan collateral debt | 3.81 |

| bank loan | 3.19 |

| Mortgage collateralized debt | 3.19 |

| Emerging Markets – Sovereign | 2.62 |

| Commercial mortgage-backed securities | 1.70 |

| US Government Securities | 1.63 |

The second highest exposure is to investment grade companies, followed by emerging market debt and CLOs. The remaining asset class allocations are very small.

Although the portfolio is global, the current allocation is US-centric.

| holding | % of portfolio |

|---|---|

| America | 68.36 |

| England | 4.17 |

| France | 2.46 |

| Germany | 1.85 |

| Spain | 1.78 |

| Canada | 1.72 |

| Brazil | 1.38 |

| Mexico | 1.30 |

| Columbia | 1.29 |

| other | 15.69 |

US credits account for more than 68% of the portfolio, followed by the UK and France. Please note that CEF has worldwide authority. This can be a great feature if a portfolio manager can identify undervalued global bonds. Think of this name as a CEF that can harvest global alpha when the opportunity arises. However, the focus is not necessarily on foreign jurisdictions.

Due to their composition, CEFs are very sensitive to credit spreads, followed by interest rates. Since credit spreads are a major risk factor, we will take a closer look at how credit spreads stack up from a macro perspective.

Credit spreads are at historic lows

Given that CEFs are sensitive to credit spreads, let’s take a look at how they fare in historical context.

Single B credit spreads, as measured by the ICE BofA Single B U.S. High Yield Index, are at a 10-year low, below 300 bps (or 3%). Here’s what Morningstar analysts have to say about current spread levels in historical context.

However, even in a soft landing scenario, we believe corporate credit spreads have become too tight and should be underweight. Over the past 24 years, only 2% of the time the Morningstar U.S. Corporate Bond Index spread was below the current spread of +86 basis points, and only 3% of the time was the Morningstar U.S. High spread was. The Yield Bond Index is below its current spread of +302 basis points. For comparison, the narrowest investment-grade and high-yield credit spreads ever traded were +80 basis points and +241 basis points, respectively, in 2007.

So, historically, spreads on HY bonds have only been 3% tighter than they are today, and let’s look at the most recent example from 2007. I’m not going to speculate on soft or hard landings here, but you have to realize that historically, spreads have been very tight. If the spread is tight, don’t buy. You may even consider selling.

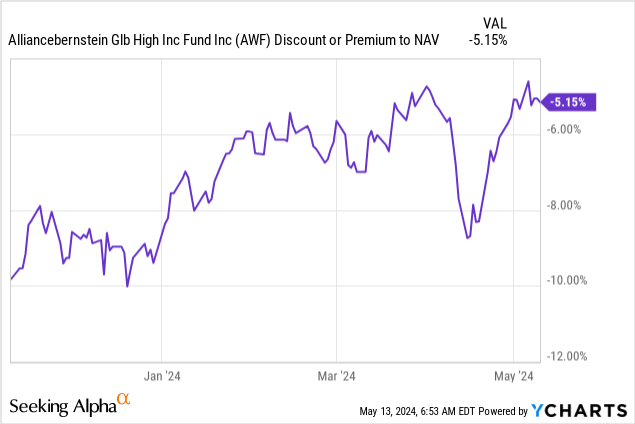

Discount amount reduced

The structural feature I liked when assigning a Buy rating to CEF was the large discount to NAV. We said in our initial coverage that we believe the discount rate will narrow as the value of CEFs rises. This assessment is correct, and the discount has narrowed significantly since the original article.

When we wrote the original article, the discount rate was -9%; now it is -5%, increasing the fund’s market value by 4%. Historically, we are currently on the tough side, with the Z-statistic showing a high ratio of 1.75. This statistic simply means that discounts have historically been on the narrow side of the distribution.

We do not expect further gains from this structural feature and, in fact, expect discounts to widen again on the back of a risk-off event.

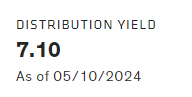

Yields are not attractive to buy here

Note that this CEF has very little leverage, so by not utilizing ROC (which is a good thing), the fund’s dividend yield is quite low.

yield (Fund homepage)

The above indicators and others can be found on the fund’s main page. page. Many short-term bond funds yield above 6% without duration risk, which makes the CEF’s 7.1% figure unconvincing. It’s not a good idea to buy this yield here, as all risk factors are biased to the downside.

There are many other opportunities in the market today where there is no credit spread risk, only duration risk, such as those identified in .GDV.PR.K: A rates play and repeats Buy rating‘ article. Eaton Vance’s CEF with barbell was also appealing. This was discussed in “.EVG: This 9% CEF yield is finally attractive‘ article. Barbel CEFs tend to have higher allocations to AAA assets such as agency MBS bonds that appreciate in traditional risk-off environments, providing a built-in hedge.

conclusion

We began covering the bond AWF CEF with a Buy rating last year. This fund has a track record of achieving total returns of over 10% since our rating. The primary drivers of our initial rating were wide credit spreads and significant discounts to NAV. Both of these factors have now returned to historically challenging levels. At this point, AWF’s pricing is no longer an attractive entry point, so we need to downgrade our rating from ‘buy’ to ‘hold’.