jonathan kitchen

Simulation Plus (Nasdaq:SLP) is a software and services provider benefiting from the increasing use of computational tools in drug discovery. Simulations Plus has a strong business, but the outlook for modest growth and We rely heavily on acquisitions and consulting income. However, the market generally places a large premium on high-margin simulation software companies, so we don’t expect a meaningful correction based on this. This calls into question the potential long-term benefits of investing in Simulations Plus, especially if the service accelerates growth in the future.

market

Drug discovery is hampered by the time and cost of bringing a drug to market, and a large part of the problem is caused by high failure rates during clinical trials. Biosimulation software can accelerate development and create safer, more effective medicines. solve some of these problems.

biosimulation market Achieved double-digit growth, Simulations Plus hopes to gain market share through a combination of research and development and acquisitions. This strategy is supported by the fact that the biosimulation market is highly fragmented, with only a few large players and low penetration.

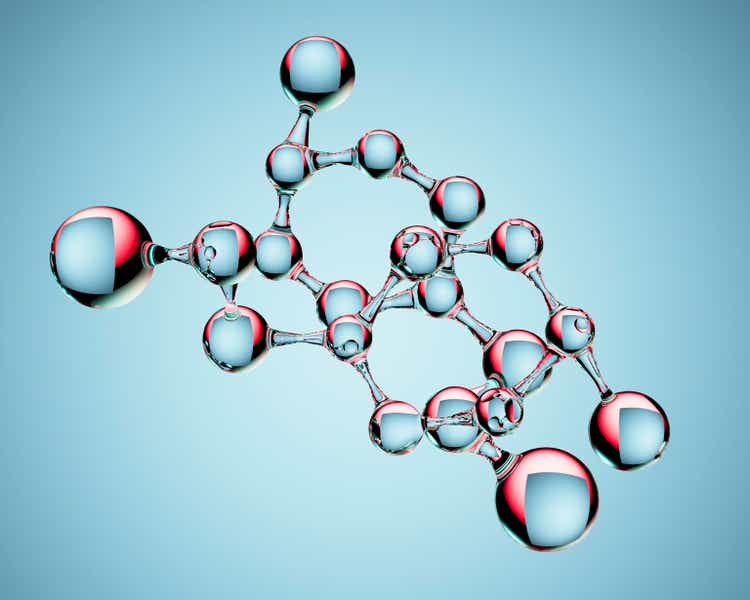

Table 1: Estimated TAM for Simulations Plus (Source: Created by author using data from Simulations Plus)

FDA Modernization Act 2.0 could be a tailwind for biosimulation in the coming years. The legislation would allow the FDA to consider data other than animal studies, such as computer-based modeling, when evaluating preclinical candidates. Quantitative clinical pharmacology and structure-based approaches can be used to assess the risks of new drugs and are likely to increase in demand as a result of this legislation.

While interest rates are hitting the pharmaceutical and biotech markets hard, Simulation Plus encourage signs of strength, especially from companies with candidates in clinical trials. Market conditions have reportedly improved over the past 12 months, and Simulation Plus expects conditions to continue to improve throughout 2024. However, customers remain cautious with their spending, particularly in China, where spending has retreated.

simulation plus

Simulations Plus is a developer of modeling and simulation software for drug discovery and development that increasingly incorporates machine learning. Simulations Plus’ software simulates drug and disease behavior in humans and other species, allowing customers to understand drug candidate properties, improve formulations, select doses, and optimize clinical trial designs. will help you. The company also provides consulting services ranging from drug discovery to clinical trials and regulatory filings.

Simulations Plus currently offers 12 software products.

- gastro plus

- DDD plus

- membrane plus

- ADMET Predictor

- medchem designer

- dilisim

- NAFLDsym

- ILDsym

- IPFsym

- Renasim

- mitoshimu

- monolix suite

Gastroplus is currently It is Simulations Plus’ largest source of software revenue, with over 200 companies licensing the software worldwide. Simulates the absorption and drug interactions of compounds administered to humans.

ADMET (Absorption, Distribution, Metabolism, Excretion, Toxicity) is used to predict properties of molecular structures. Over 80 companies have obtained licenses ADMET predictor in Simulations Plus. Going forward, the company hopes to use ML to improve model performance and help with data curation.

MonolixSuite provides drug efficacy modeling and supports nonparametric analysis, population analysis and modeling, and clinical trial simulation. Over 100 companies use his MonolixSuite. Simulations Plus also believes there are synergies between the software and consulting businesses.

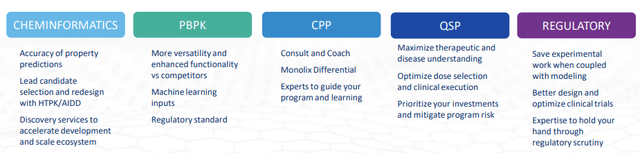

Consulting is a large part of Simulation Plus’ business, and demand is increasing. Simulations Plus offers a variety of consulting services, including:

- Population pharmacokinetic and pharmacodynamic modeling

- Exposure response analysis

- clinical trial simulation

- Clinical trial design

- Regulatory submission support

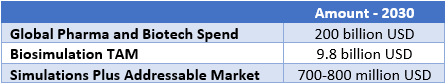

Simulations Plus also provides consulting services to support QSP modeling across a wide range of treatments. Simulations Plus hopes to expand QSP to more indications within oncology and is currently working on client-assisted development in the field of neurology.

QSP is a biomedical science aimed at modeling the mechanisms behind disease progression and quantifying the pharmacokinetics (movement of a drug through the body) and pharmacodynamics (the body’s biological response to a drug) of drugs. It is a rapidly growing field of research.

Figure 1: Library of existing QSP and QST models (Source: Simulations Plus)

Simulations Plus also provides in silico drug design and optimization services, including:

- Drug discovery and optimization using AI

- High-throughput screening library design and hit visualization and analysis

- QSAR/QSPR modeling and simulation

Simulations Plus’ products offer customers a variety of benefits based primarily on improved clinical outcomes and cost savings. The company believes it has a number of competitive advantages, including:

- Integration of portfolio and synergies of related solutions

- Access to data (provided by its size, breadth, and history)

- Key ML models (likely to be data dependent)

Figure 2: Benefits of Simulations Plus (Source: Simulations Plus)

acquisition

Simulations Plus is an active acquirer to support our growth and strengthen our technology capabilities.simulation plus Acquired Cognigen in 2014, provides population modeling and simulation research services. Clinical pharmacology consulting services include pharmacokinetic and pharmacodynamic modeling, clinical trial simulation, data programming, and technical writing services to support regulatory submissions.

simulation plus Acquired DILIsym in 2017provides drug-induced liver injury (DILI) simulation software and related consulting services to the company. DILIsym has also developed a simulation program to analyze non-alcoholic fatty liver disease.

simulation plus Acquired Rikusoft in 2020. Lixoft offers a wide range of software including Monolix, Simulx, and PKanalix.

Simulations Plus acquired Immunetrics in 2023, expanding the range of treatment areas covered by its QSP software by more than 50%. The acquisition expands Simulation Plus’ operations into underserved areas such as immunology and oncology.

While there is nothing inherently wrong with pursuing an acquisition, especially given the fragmented nature of the biosimulation market, this should be considered in light of the following: High-priced assessment of Simulation Plus. The company invests little in research and development and appears to be able to generate only fairly modest internal growth. This means that in order to generate a reasonable return for investors, Simulations Plus must have a suitable acquisition opportunity and be able to execute the transaction at a reasonable price.

A.I.

Simulations Plus has long leveraged machine learning in its products, but recent advances in generative AI have called into question the company’s competitive position. Simulations Plus considers ADMET Predictor to be a working example of his AI capabilities at the company, and the company suggests that it would be difficult for startups to replicate the capabilities of his ADMET Predictor tool.

Generative AI has threats, but it also offers opportunities, and Simulations Plus can leverage that data and existing solution portfolio. AI also has the potential to reduce the time and cost of drug development, potentially increasing the supply of drugs entering clinical trials in the coming years. If that happens, demand could increase further. Even with increased competition, Simulations Plus software and services remain available.

The company believes that access to accurate public and personal data is both a competitive advantage and a barrier to entry. Other companies have access to public data, but this data often requires extensive curation to provide value. Simulations Plus’ private data comes from a long history of collaboration with clients and regulators, giving you a stronger competitive advantage.

financial analysis

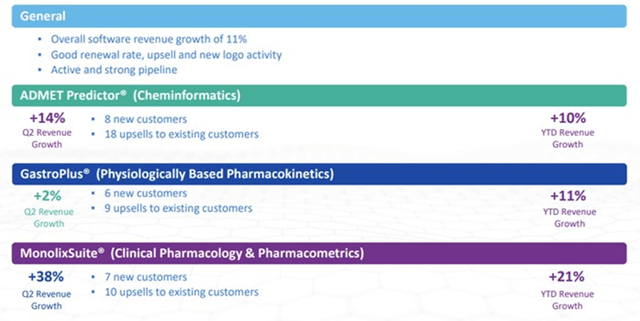

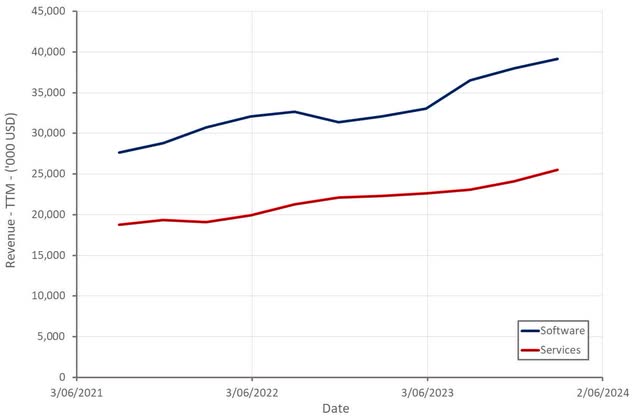

Simulations Plus revenue 16% increase compared to previous year In the second quarter, software revenue increased 11% and services revenue increased 27%. Software revenue increased 11% in the second quarter compared to the same period last year, with strong growth across regions excluding Asia. Clinical Pharmacology and Pharmacoanalytics revenue increased 38% year-over-year in the second quarter as Monolix continued to gain market share.What Simulation Plus sees Increase in average revenue per customer The software business is strong, along with fairly high renewal rates (in the mid-90s based on fees).

Figure 3: Q2 Software Highlights (Source: Simulations Plus)

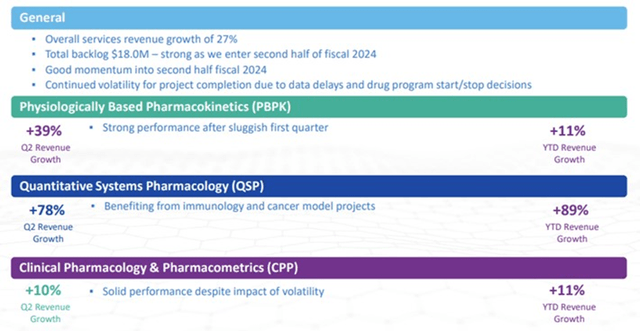

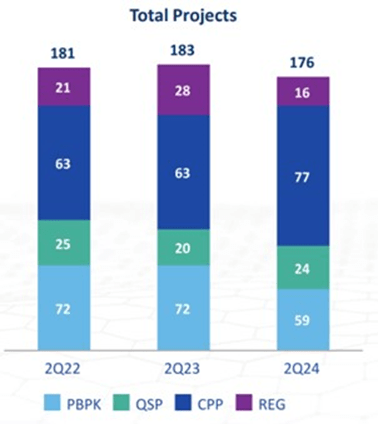

service revenue 27% increase compared to previous year during the second quarter, and Simulations Plus backlog continues to be strong. Services revenue growth is currently driven by Simulation Plus’ QSP business unit, benefiting from immunology and cancer model projects.

Figure 4: Second quarter service highlights (Source: Simulations Plus) Figure 5: Simulations Plus service project (Source: Simulations Plus)

Simulations Plus targets: Revenues between USD 66 million and USD 69 million This corresponds to a growth of 10-15% in FY24. This guidance could mean growth rates drop into his single-digit range towards the end of the fiscal year. Software configuration is expected to be in the 55-60% range. In the long term, Simulations Plus wants to grow at or above market growth rates while increasing profit margins.

Figure 6: Simulations Plus revenue (Source: Created by author using data from Simulations Plus)

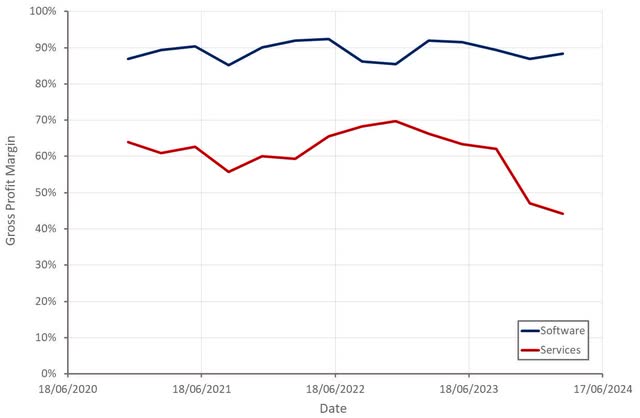

Simulations Plus is undergoing a business unit reorganization that will result in lower labor costs for all services (~1.3 million USD (transferred from general and administrative expenses) to cost of revenue. as a result, Simulations Plus’ gross margins for its services have declined significantly in recent quarters.

Figure 7: Simulations Plus Gross Margin (Source: Created by author using data from Simulations Plus)

meanwhile Although Simulations Plus has a small operating margin, it has a high EBITDA margin and generates strong cash flow. This difference was primarily due to stock-based compensation and amortization of intangible assets. The amortization reflects the real cost of doing business, given that the company relies on acquisitions to drive growth. However, if Simulations Plus chooses to back out of the deal, it could distribute significant cash to shareholders.

Figure 8: Simulations Plus Operating Margin (Source: Created by author using data from Simulations Plus)

conclusion

Although Simulations Plus has a relatively large market opportunity and can generate strong cash flows, the company’s Ratings will be high.

Simulations Plus is a good company with a positive outlook, but its stock price is likely to remain depressed in the short term. Analysts expect Simulation Plus to deliver mid-teens earnings growth over the next decade, but multiple compressions mean the stock’s return could still be low even if this growth occurs.

Moreover, short-term risks remain high. If inflation and interest rates remain high for an extended period of time, the recovery in biopharmaceutical activity will likely be delayed. In this scenario, valuations of tech companies are also likely to come under further pressure.

Figure 9: Simulation and EV/S multiple (Source: Seeking Alpha)