Lori Patterson/E+ via Getty Images

Speaking of delicious food, comparatively For a healthy lunch, nothing beats CAVA (New York Stock Exchange:kava).

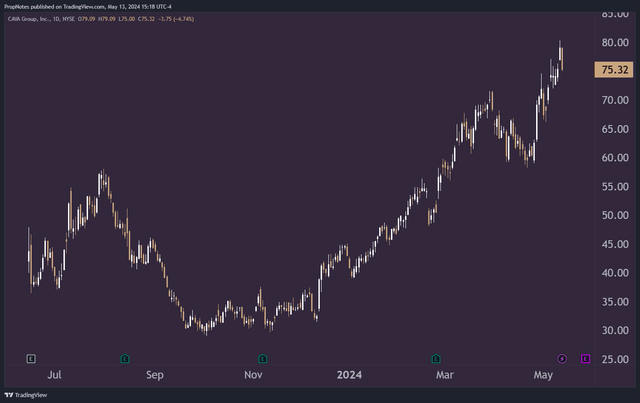

The fast-casual restaurant chain is beloved by many, but its stock has only recently begun to find its footing, rising more than 140% in the wake of a long recession. The price trough that occurred after last year’s IPO:

TradingView

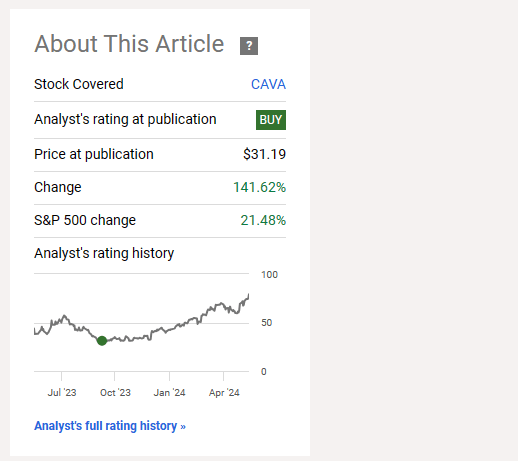

For reference, I issued my first “buy” rating in September last year. When the stock price just halved and the stock price was $31:

In search of alpha

Thankfully, stocks are no longer in the doldrums, but some are now concerned that the risks are piling up in the other direction, with multiples so high that new investors can’t get in.

We are not unaware of this. That’s why we’re following up on our initial coverage with today’s article. Focus on specific trade ideas that have potential. bring big profits to investors, reduce riskplot the stock entries. 23% discount Navigate to where stocks are currently trading.

With earnings approaching and price-to-sales ratios recently reaching all-time highs, an options trading strategy that utilizes a “short put” approach is an option for income-oriented investors and investors looking for future growth alike. We believe this is the best way to maximize risk-reward. In stock.

Let’s take a closer look at this.

Mr. CAVA finance

Before getting into options trading ideas, let’s first summarize CAVA’s financial situation and potential.

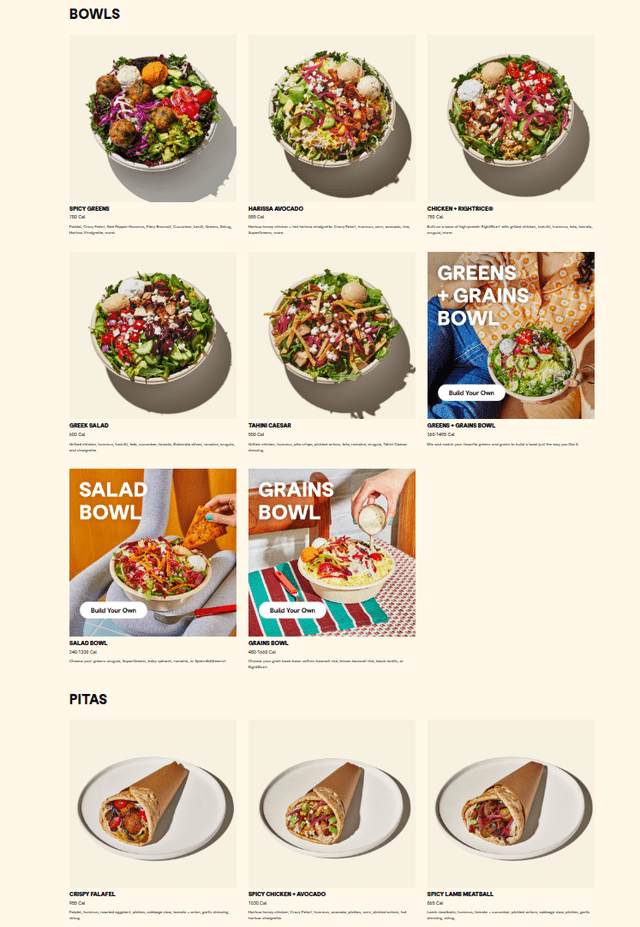

So, in case you haven’t read about the company yet or haven’t read our previous article, CAVA is a fast-casual restaurant that serves Mediterranean lunch and dinner in a highly customizable format. Think of Chipotle (CMG), for gyro bowls and chicken bowls:

kava

As a side note, anecdotally/in our opinion, the food is great, if a little pricey and high in salt.

But regardless of our preferences, this chain has become a favorite among diners in many of America’s largest cities. CAVA currently owns and operates his 309 restaurants in 24 states, which is in contrast to other companies in the field such as McDonald’s (M.C.D.), mainly operating franchises.

This gave us an interesting financial profile. Choosing to avoid an asset-light path, CAVA has lower margins than some of its competitors, but it has more vertical control over growth and quality.

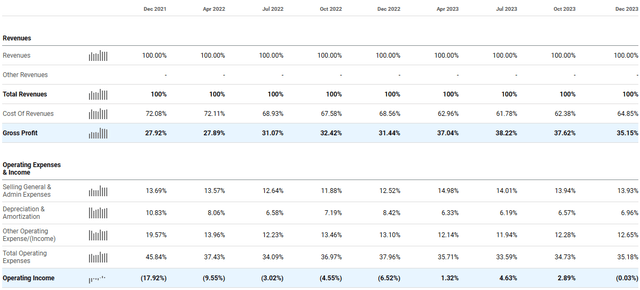

Looking specifically, the company has done a good job on the unit price front, maintaining gross profit margins in the mid-to-high 30% range. This is slightly behind more established companies like CMG, but well ahead of other owner-operated companies like Sweetgreen (Singapore):

In search of alpha

On the operating side, the company has just started achieving positive operating margins, which is primarily a result of increased spending on the company’s growth. CAVA’s restaurant-level profit margin is approximately 22.4%, which is encouraging.

Our performance in the fourth quarter of 2023 was outstanding with CAVA revenue increasing by over 52%. CAVA same store sales growth of 11.4%Includes a 6.2% increase in traffic. He had 19 net new restaurants, bringing the number of restaurants to 309 at the end of the quarter, an increase of 30% year over year. Adjusted EBITDA was $15.7 million, an increase of $12.2 million compared to the fourth quarter of 2022. And the net profit was $2 million.

…

CAVA restaurant-level profit for the fourth quarter was $39.3 million. 22.4% of revenue $23 million, representing 20% of year-over-year revenue 70.7% increase.

This means that once a company’s economic structure matures, expanding its footprint is a clear path to achieving high ROI for shareholders.

Additionally, the company’s brands are growing due to strong traffic and same-store sales growth. and Pricing power is both trending in the right direction.

In short, the company is doing well.

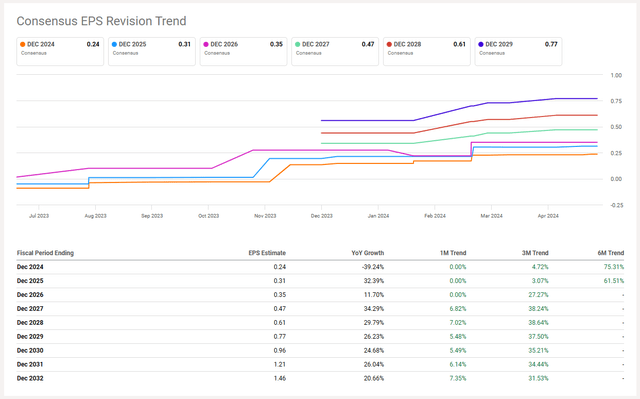

Looking ahead to first-quarter earnings, we have better-than-expected expectations, driven by CAVA’s simple business model, skilled cost management, and strong is supported by strong analyst momentum in EPS revisions.

In search of alpha

Overall, we’re bullish on CAVA’s business.

The value of CAVA

That said, from a value perspective, this stock just doesn’t seem worth trading at this point.

When we first listed it on CAVA last September, we noticed that this stock was trading at around 6x sales, making it look more expensive and somewhat richer than many other, more established brands. . This is undoubtedly due to CAVA’s strong growth profile and financially viable plan for him to reach 1,000 stores (three times his current store area) by 2032.

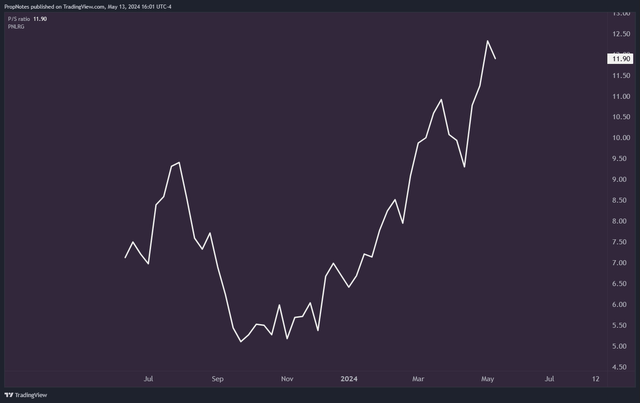

However, much of the recent 140% rise in stock price has been due to multiple business expansions rather than improved operating results.

Since September, TTM’s revenue has increased from $640 million to $730 million, an impressive 14% growth in just a few quarters.

However, the company’s top-line valuation has doubled to almost 12 times revenue, which accounts for the bulk of the stock’s return.

TradingView

At these prices, there is serious optimism embedded in the stock, and the risk of multiple mean-reverting declines is very real.

If growth slows or the company experiences pressure on its margins, the valuation could easily return to its original level, which is 50% lower than it is now.

Overall, we like the company, but are concerned about the potential for new investors to enter the stock at this high price. Even if the company is able to maintain growth, the high multiple will likely hinder future stock price returns.

trade ideas

Therefore, our trade idea is to sell a put option on CAVA stock.

If you’re new to options, selling a put is essentially like selling insurance. First, the option buyer pays a premium for assuming some of the risk.

You then maintain your cash premium even if the stock price rises, stays the same, or falls a little.

If the stock price falls significantly, the option buyer’s stock must be purchased at a predetermined price (strike price) by a predetermined date (expiration date).

So whenever you sell a put, one of two things happens. This means you should either hold cash or hold cash and buy the underlying stock.

If the underlying stock was okay to own anyway, it could be a very solid win-win.

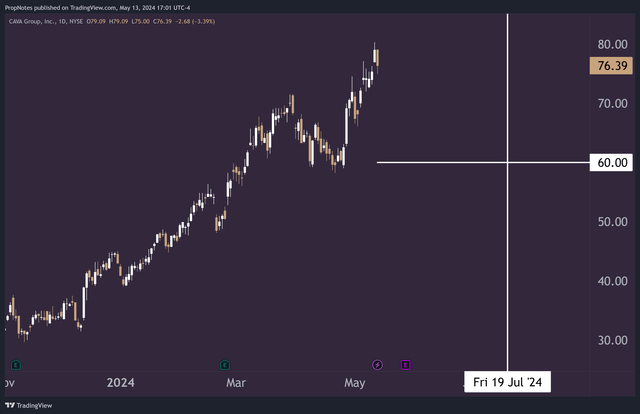

Right now, I like the July 19 $60 exercise put option.

Expiry and Strike (Trading View)

These contracts are currently trading at $1.50, which equates to a 2.56% cash return over the next 67 days. Converting this into an annual 14% back.

risk

There are three purposes for using puts in this situation. beginningThis allows investors who might otherwise sit on the sidelines waiting for a better price (due to valuation risk) to be rewarded for waiting, and 23% or less Where the stock is currently trading. Selling a put reduces this risk and allows you to enter at a better core price.

moreover, with earnings to be announced later this month, this deal provides investors with a cushion in the event of a downside. If the stock price drops significantly following this news, selling a put would be a far more optimal strategy for investors, and could significantly reduce losses. With optimism rising, even a strong beat like we’re expecting could see the stock fall significantly.

finally, since the strike price is a recent local low, we would expect the confluence level to be slightly higher if the strike price is challenged. The local low of $60 could provide support for the stock around expiration.

Specifically, there are some risks to this strategy, including the fact that if the stock price goes to zero overnight, you would have to buy the stock for $60. That said, it’s no riskier than buying and holding stocks outright.

summary

Overall, despite the inherent risks of selling puts, we think this trading idea works well to balance risk and reward for investors currently on the sidelines of CAVA . Although the company’s business is very attractive, valuation risk, earnings risk, and the potential for the stock to be overbought could lead to a retracement, which could be better managed with a short put position.

Given the strong cash-on-cash returns, we think this trading idea is nothing short of a solid win-win for investors.

We reiterate our rating on the stock as “buy.” That said, if you are already long, consider selling some calls on your position to generate income and lower your cost basis.

good luck!