Rasi Bhadramani

Dear Gator Financial Partners:

We are pleased to provide you with Gator Financial Partners, LLC’s (the “Fund” or “GFP”) 2024 1st Quarter investor letter. This letter reviews the Fund’s 2024 Q1 investment performance and shares our current views on the investment opportunity in regional banks.

Review of 2024 Q1 Performance

During the 1st quarter of 2024, the Fund had strong returns and performed in-line with the broader market but trailed the Financials sector benchmark. Our long positions in Robinhood Markets (HOOD), Jackson Financial (JXN), First Citizens Bancshares (FCNCA), Barclays PLC (BCS), and SLM Corp (SLM) were the top contributors to the Fund’s strong performance. The largest detractors were long positions in Genworth (GNW), Dime Community Bancshares (DCOM), and Old Second Bancorp (OSBC) and short positions in Bank of America (BAC) and Root Insurance.

|

2024 Q1 |

Total Return Since Inception1 |

Annualized Return Since Inception1 |

|

|

Gator Financial Partners, LLC2 |

10.72% |

1,869.38% |

20.83% |

|

S&P 500 Total Return Index3 |

10.56% |

462.06% |

11.58% |

|

S&P 1500 Financials Index3 |

11.68% |

264.61% |

8.56% |

|

Source: Gator Capital Management & Bloomberg 1The Fund’s inception date was July 1, 2008. 2Performance presented assumes reinvestment of dividends, is net of fees, brokerage and other commissions, and other expenses an investor in the Fund would have paid. Past performance is not indicative of future results. Please see General Disclaimer on page 7. 3Performance presented assumes reinvestment of dividends. No fees or other expenses have been deducted. |

Opportunity in Regional Banks

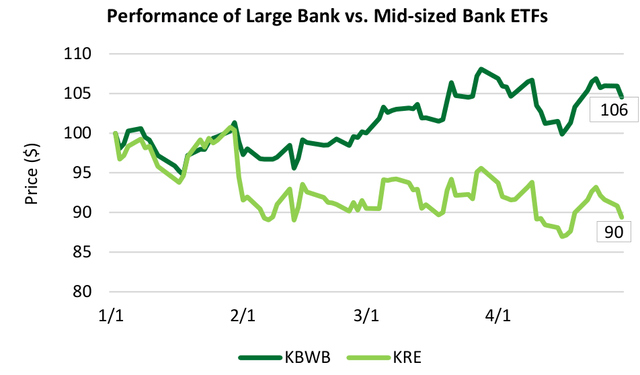

The recent turmoil at New York Community Bank (NYCB) has dragged down the stocks of small-tomid-sized banks again this year. The exchange traded fund for mid-sized banks, the SPDR S&P Regional Banking ETF (KRE), underperformed the ETF for large banks, which is the Invesco KBW Bank ETF (KBWB) in the 1st quarter. The KRE was down 3.33% while the KBWB was up 10.01%. The underperformance of the mid-sized banks versus the large banks continued in April. Large banks are perceived by investors as having less credit risk, more robust credit reserves, and more liquid balance sheets.

Performance of Large Bank vs. Mid-sized Bank ETFs

There are obvious headwinds that the banks are facing: tepid loan growth, competitive deposit environment, and an uncertain credit environment; however, we see opportunity in selected small-to-mid-sized regional banks (“SMID banks”). We think stock investors are overly pessimistic in their assessment of SMID bank credit concerns. We believe the larger issues for SMID banks are interest rate risk and loan volume growth. Regarding interest rates, we see banks having a wide disparity of performance based on the positioning of their securities portfolios, their percentage of fixed rate loans, and how they manage their deposit franchise. Many banks have navigated the move in higher rates well and remain well-positioned for the current environment. We also see differences in how banks manage their loan growth. Some banks continue to grow loans and deposits and accept that margins in the near term are narrower due to the inverted yield curve and competitive deposit environment. We think these banks will be rewarded when the yield curve normalizes, and they realize wider net interest margins on a larger book of business.

Within SMID banks we group our favorites into three buckets: Puerto Rican banks, growth banks, and small banks with unique stories.

Credit Risk

Credit risk is perilous for banks. The current environment poses four areas where banks may experience heightened credit losses. The first area is office buildings. The second area is rent-regulated apartment buildings in New York City. The third is commercial estate properties (‘CRE’) where the rapid rise in interest rates has caused the value of CRE to decline. The fourth is rapidly rising debt costs for borrowers with floating rate debt.

So far in the Q1 bank earnings season, banks have reported better than expected credit metrics. The increases in non-performing assets and criticized loans are not alarming given that bank credit metrics were at record lows in 2022 and 2023. We’ll have to remain vigilant about credit risk to see if metrics deteriorate in the coming quarters. In the meantime, we will stay focused on banks with historically strong credit cultures. As we meet with bank management teams, we remain alert for any changes in risk appetites. Many market participants have a negative view of bank managements’ ability to see pending problems in their loan portfolios. We note that risk management and monitoring of loan portfolios has improved from when we started investing in bank stocks. We realize that bank stock investors may need to see the other side of the credit cycle before putting higher multiples on bank stocks and this contributes to the current opportunity we see.

Interest Rate Risk

Market participants are divided on the outlook for banks. Some investors see an opportunity because banks are cheap and poised to benefit from interest rate cuts. Others are concerned about potential credit losses or rising interest rates. We believe selective opportunities exist, with certain banks offering attractive valuations and potential for earnings growth, while others are at risk as they have significant holdings of fixed-rate loans and securities on their books.

Banks benefit from higher reinvestment yields, but some banks have more near-term opportunity. If a bank has a lot of loans and securities maturing in the next year at low yields, they can take the proceeds from the loan payoff to make a new loan at today’s higher yield. Unfortunately, many banks made a lot of 5-year and 7-year fixed-rate loans in 2021 and 2022 that won’t mature until 2026 or as late as 2029. In a more robust deposit environment, banks would generate loan growth which would allow new production to be put on the books at normalized spreads.

In 2022 and very early 2023, almost all banks paid aggressively low deposit rates even as the Federal Reserve raised the Federal Funds rate. Most bank customers had become accustomed to the zero interest rate environment and were not in the habit of managing their excess cash for higher yields. The media focus on Silicon Valley Bank’s (OTC:SIVBQ) failure in March 2023 caused many bank customers to change how they managed their excess cash. This change in customer behavior forced banks with weaker deposit franchises to raise deposit rates to retain customers and deposits.

Banks have deposit franchises with varying degrees of strength. Many different factors can create a strong deposit franchise such as a long history in a marketplace, a strong branch and ATM network, a strong sales culture within the bank of asking for additional deposits from customers, and the size of the bank. Banks with weak deposit franchises use higher rates to attract price sensitive customers.

When Silicon Valley bank failed, the banks with weak deposit franchises had to raise their deposit rates more aggressively to retain their deposits. During Q2 and Q3 of 2023, these banks raised deposit rates to a level that stabilized their customer bases. We estimate this level is about 3.75% to 4.00%. Although these banks have weak deposit franchises, their net interest margins (‘NIM’) have already compressed. In a stable rate environment, they should have loans and securities repricing to higher rates as they mature and their NIMs should gradually widen. In a declining rate scenario, they should be able to reprice their deposit rates lower. This will lead to wider NIMs. There is also the possibility that they will strengthen their deposit franchises and attract less rate sensitive deposits. We think this scenario is less likely, but there are a few banks where this is a possibility.

Banks with stronger deposit franchises are experiencing continued deposit cost pressures. They have not had to raise deposit rates as aggressively because their customers are not as price sensitive, however, with money market rates above 5%, even customers of these banks with strong deposit franchises are looking to better manage their excess cash. This has put continued pressure on these banks to retain deposits. Even JP Morgan Chase (JPM) has not been immune. On its most recent earnings conference call, the CFO said that the bank expects to see continued movements by customers to seek higher deposit rates.

We believe the current high level of interest rate risk will dissipate with time. We believe the inverted yield curve and the significant rate increases by the Federal Reserve is causing the small-to-regional banks to under-earn compared to our estimate of their normalized earnings power. Despite this underearning, we observe that the small-to-mid-sized regional banks trade at the low end of both absolute and relative valuations. It is a classic value situation of the market assigning a low multiple on stocks with depressed earnings.

New York Community Bank (NYCB)

At the end of January, New York Community Bank reported Q4 earnings. The surprisingly bad earnings report caused the stock to decline 37% in one day. The stock has continued to slide despite a $1 billion recapitalization led by former Secretary of Treasury Steven Mnuchin.

NYCB’s poor earnings report and stock price decline in January was a catalyst for the entire regional bank sector underperforming so far in 2024. Through March 31st, the SPDR S&P Regional Bank ETF (KRE) was down 3.33% versus the S&P 1500 Financials Sector Index which rose 11.67%. The January earnings season was constructive, but NYCB’s report changed investor sentiment on the regional banks. The question presented to us as bank investors is “Are NYCB’s problems idiosyncratic or systemic to all banks?”

We believe NYCB’s issues are idiosyncratic to NYCB. NYCB has long been a New York City apartment lender. Their track record over many decades has been spectacular with near zero losses. But, in 2019, NYC passed a law that limited how much landlords could raise rents. In the current inflationary environment, landlords’ costs are rising, but they can’t raise rents, so investors are concerned that landlords will get squeezed so much that they will default on their loans.

The NYCB acquisition of Signature Bank highlighted a potential regulatory oversight. NYCB crossed the $100 billion asset threshold, placing it in a new regulatory category with stricter capital requirements. Regulators should have recognized this deficiency in capital and forced NYCB to raise its loan loss reserves and raise additional capital instead of reporting a bargain purchase gain. If regulators were more proactive, the issues with NYCB purchasing Signature could have been avoidable.

We think the regulator’s treatment of NYCB was idiosyncratic because of NYCB’s concentration in NYC apartment loans and its crossing $100 billion in assets with the Signature Bank purchase. We think SMID banks underperformed their large bank peers starting on January 31st because of NYCB’s unique issues.

Best Opportunities in Regional Banks

Within SMID banks we group our favorites into three buckets: Puerto Rican banks, growth banks, and small banks with unique stories.

Puerto Rican Banks

Banking in Puerto Rico is an oligopoly. In 2006, there were 11 banks in Puerto Rico and the economy had just entered a recession that would last 15 years. Through bank failures and consolidation, there are just three commercial banks operating in Puerto Rico. We have seen the Puerto Rican banks expand their margins and improve their returns. We also see early signs that bank stock investors are taking note by placing higher valuations on the Puerto Rican banks. We’ve owned First Bancorp (FBP) and OFG Group (OFG) for several years and continue to think they have attractive upside.

Growth Banks

We have written about Growth Banks in the past. We continue to like this group of banks. They have cultures that foster organic growth. For banks to grow, they must generate capital through retained earnings. So, many of these growth banks also have high returns on capital. One way to identify these banks is to screen for banks with the highest tangible book value per share growth over a 10-year or 20-year timeframe.

The banks we hold that fall into this category are First Citizens, Western Alliance (WAL), Pinnacle, United Missouri, Esquire (ESQ), Axos (AX), Customers (CUBI), and Webster (WBS).

Small Banks with Unique Stories

We also own smaller banks that have unique stories: NYCB collateral damage (DCOM & CNOB), small cap M&A banks (OSBC, BANC, & BFST), ultra cheap but solid banks (FBIZ, OPBK, & UNTY), and a purchaser of loans from other banks (NBN). While each of these positions is small due to liquidity considerations, we think each will generate attractive returns.

Portfolio Analysis

Largest Positions

Below are the Fund’s five largest common equity long positions. All data is as of March 31, 2024.

Long

First Citizens Bancshares

Robinhood Markets Inc.

SLM Corp.

UMB Financial Corp.

Jackson Financial Inc.

Sub-sector Weightings

Below is a table showing the Fund’s positioning within the Financials sector5 as of March 31, 2024.

|

Long |

Short |

Net |

|

|

Alt Asset Managers |

5.35% |

0.00% |

5.35% |

|

Capital Markets |

19.71% |

-4.81% |

16.91% |

|

Banks (large) |

12.70% |

-4.91% |

7.79% |

|

Banks (MID) |

44.30% |

-19.94% |

24.36% |

|

Banks (small) |

22.21% |

-5.38% |

16.84% |

|

P&C Insurance |

2.65% |

-1.95% |

0.70% |

|

Life Insurance |

5.93% |

0.00% |

5.93% |

|

Non-bank lenders |

9.57% |

0.00% |

9.57% |

|

Processors |

0.00% |

0.00% |

0.00% |

|

Real Estate |

5.09% |

-11.67% |

-6.58% |

|

Exchanges |

0.00% |

0.00% |

0.00% |

|

Index Hedges |

0.00% |

0.00% |

0.00% |

|

Non-Financials |

0.00% |

0.00% |

0.00% |

|

Total |

127.51% |

-48.65% |

78.86% |

The Fund’s gross exposure is 176.16%, and its net exposure is 78.86%. From this table, we exclude fixed income instruments such as preferred stock. Preferred stock positions account for an additional 16.43% of the portfolio.

New Office

We’ve moved our office. After 14 years in our original office in the Wells Fargo Center in Downtown Tampa, we’ve moved to a great office on the water close to Tampa International Airport.

Our new address is:

2502 N. Rocky Point Drive, Suite 665, Tampa, FL 33607

We loved our old office. It was home. It is where we built the firm. But, we decided to move because our view of the Hillsborough River will be blocked by a new condo tower under construction. We didn’t want to look across the street into the condo tower’s parking garage for the term of our next lease.

Our new office looks south over Tampa Bay. Our view will never get blocked by new development. Plus, we will have shorter, less stressful commutes. Please visit us in our new office. We’d love to host you and talk about stocks.

Conclusion

Thank you for entrusting us with a portion of your wealth. We are grateful for you, our investors, who believe and trust in our strategy. On a personal level, Derek Pilecki, the Fund’s Portfolio Manager, continues to have more than 80% of his liquid net worth invested in the Fund.

As always, we welcome the opportunity to speak with you and discuss the Fund.

Sincerely,

Gator Capital Management, LLC

|

Gator Capital Management, LLC prepared this letter. Ultimus LeverPoint Fund Solutions, LLC, our administrator, is responsible for the distribution of this information and not its content. General Disclaimer By accepting this investment letter, you agree that you will not divulge any information contained herein to any other party. This letter and its contents are confidential and proprietary information of the Fund, and any reproduction of this information, in whole or in part, without the prior written consent of the Fund is prohibited. The information contained in this letter reflects the opinions and projections of Gator Capital Management, LLC (the “General Partner) and its affiliates as of the date of publication, which are subject to change without notice at any time subsequent to the date of issue. All information provided is for informational purposes only and should not be deemed as investment advice or a recommendation to purchase or sell any specific security. All performance results are based on the net asset value of the Fund. Net performance results are presented net of management fees, brokerage commissions, administrative expenses, and accrued performance allocation, as indicated, and include the reinvestment of all dividends, interest, and capital gains. The performance results represent Fund-level returns and are not an estimate of any specific investor’s actual performance, which may be materially different from such performance depending on numerous factors. The market indices appearing in this letter have been selected for the purpose of comparing the performance of an investment in the Fund with certain well-known equity benchmarks. The statistical data regarding the indices has been obtained from Bloomberg and the returns are calculated assuming all dividends are reinvested. The indices are not subject to any of the fees or expenses to which the funds are subject and may involve significantly less risk than the Fund. The Fund is not restricted to investing in those securities which comprise these indices, its performance may or may not correlate to these indices, and it should not be considered a proxy for these indices. The S&P 500 Total Return Index is a market cap weighted index of 500 widely held stocks often used as a proxy for the overall U.S. equity market. The S&P 1500 Financials Index is a market cap weighted index of financial stocks within the S&P 1500 Super Composite Index we used as a proxy for the Financials sector of the U.S. equity market. An investment cannot be made directly in either index. The Fund consists of securities which vary significantly from those in the benchmark indices listed above. Accordingly, comparing results shown to those of such indices may be of limited use. Statements herein that reflect projections or expectations of future financial or economic performance of the Fund are forward-looking statements. Such “forward-looking” statements are based on various assumptions, which assumptions may not prove to be correct. Accordingly, there can be no assurance that such assumptions and statements will accurately predict future events or the Fund’s actual performance. No representation or warranty can be given that the estimates, opinions, or assumptions made herein will prove to be accurate. Any projections and forward-looking statements included herein should be considered speculative and are qualified in their entirety by the information and risks disclosed in the Fund’s Private Placement Memorandum. Actual results for any period may or may not approximate such forward-looking statements. You are advised to consult with your own independent tax and business advisors concerning the validity and reasonableness of any factual, accounting and tax assumptions. No representations or warranties whatsoever are made by the Fund, the General Partner, or any other person or entity as to the future profitability of the Fund or the results of making an investment in the Fund. Past performance is not a guarantee of future results. The funds described herein are unregistered private investment funds commonly called “hedge funds” (each, a “Private Fund). Private Funds, depending upon their investment objectives and strategies, may invest and trade in a variety of different markets, strategies and instruments (including securities, nonsecurities and derivatives) and are NOT subject to the same regulatory requirements as mutual funds, including requirements to provide certain periodic and standardized pricing and valuation information to investors. There are substantial risks in investing in a Private Fund (which also are applicable to the underlying Private Funds, if any, in which a Private Fund may invest). Prospective investors should note that: ◉ A Private Fund represents a speculative investment and involves a high degree of risk. Investors must have the financial ability, sophistication/experience, and willingness to bear the risks of an investment in a Private Fund. An investor could lose all or a substantial portion of his/her/its investment. ◉ An investment in a Private Fund is not suitable for all investors and should be discretionary capital set aside strictly for speculative purposes. Only qualified eligible investors may invest in a Private Fund. ◉ A Private Fund’s prospectus or offering documents are not reviewed or approved by federal or state regulators and its privately placed interests are not federally, or state registered. ◉ An investment in a Private Fund may be illiquid and there are significant restrictions on transferring or redeeming interests in a Private Fund. There is no recognized secondary market for an investor’s interest in a Private Fund and none is expected to develop. Substantial redemptions within a limited period of time could adversely affect the Private Fund. ◉ Certain portfolio assets of a Private Fund may be illiquid and without a readily ascertainable market value. The manager’s/advisor’s involvement in the valuation process creates a potential conflict of interest. Instances of mispriced portfolios, due to fraud or negligence, have occurred in the industry. ◉ A Private Fund may have little or no operating history or performance and may use performance information which may not reflect actual trading of the Private Fund and should be reviewed carefully. Investors should not place undue reliance on hypothetical, pro forma or predecessor performance. ◉ A Private Fund may trade in commodity interests, derivatives, and futures, both for hedging and speculative purposes, and may execute a substantial portion of trades on foreign exchanges, all of which could result in a substantial risk of loss. Commodities, derivatives, and futures prices may be highly volatile, may be difficult to accurately predict, carry specialized risks and can increase the risk of loss. ◉ A Private Fund’s manager/advisor has total trading authority over a Private Fund. The death or disability of a key person, or their departure, may have a material adverse effect on a Private Fund. ◉ A Private Fund may use a single manager/advisor or employ a single strategy, which could mean a lack of diversification and higher risk. Alternatively, a Private Fund and its managers/advisors may rely on the trading expertise and experience of third-party managers or advisors, the identity of which may not be disclosed to investors, which may trade in a variety of different instruments and markets. ◉ A Private Fund may involve a complex tax structure, which should be reviewed carefully, and may involve structures or strategies that may cause delays in important financial and tax information being sent to investors. ◉ A Private Fund’s fees and expenses, which may be substantial regardless of any positive return, will offset such Private Fund’s trading profits. If a Private Fund’s investments are not successful or are not sufficiently successful, these payments and expenses may, over a period of time, significantly reduce or deplete the net asset value of the Private Fund. ◉ A Private Fund and its managers/advisors and their affiliates may be subject to various potential and actual conflicts of interest. ◉ A Private Fund may employ investment techniques or measures aimed to reduce the risk of loss which may not be successful or fully successful. ◉ A Private Fund may employ leverage, including involving derivatives. Leverage presents specialized risks. The more leverage used, the more likely a substantial change in value may occur, either up or down. The above summary is not a complete list of the risks, tax considerations and other important disclosures involved in investing in a Private Fund and is subject to the more complete disclosures in such Private Fund’s offering documents, which must be reviewed carefully prior to making an investment. Footnotes 4The chart assumes $100 invested in KBWB and KRE ETFs from year-to-date through 4/30/24. 5‘Financials sector’ is defined as companies included in the Global Industry Classification System (“GICS”) sectors 40 and 60, which contains financial and real estate companies. |

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.