Pocorex

This article is part of a series that continues our quarterly analysis of changes made to Tweedy Brown’s 13F portfolio. Based on Tweedy Browne regulations. 13F form Filed on May 6, 2024. Please take a look. Tweedy Brown Portfolio Tracking A series to learn about their investment philosophy and our investment philosophy last update Regarding fund movements in the fourth quarter of 2023.

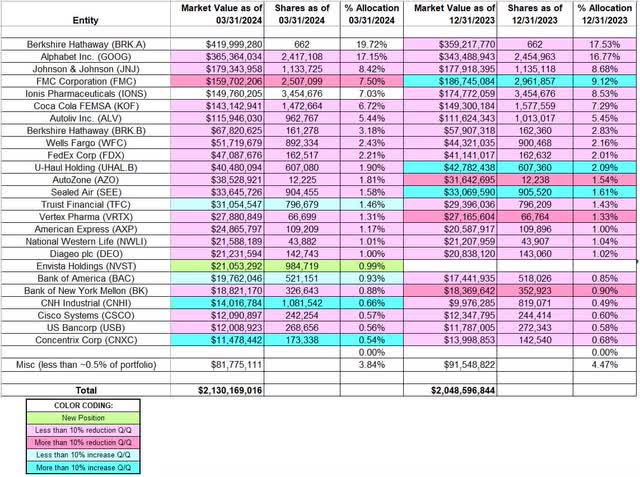

During the quarter, Tweedy Browne’s 13F portfolio value increased from $2.05 billion to $2.13 billion. The number of stocks he owns remains stable at 45 stocks. The largest position is in Berkshire Hathaway, accounting for about 23% of the portfolio. The top five companies with individual stock positions are Berkshire Hathaway, Alphabet, Johnson & Johnson, FMC Corporation, and Ionis Pharma. Together these add up to 63% of your portfolio. 25 of his 45 13F stakes are very large (approximately 0.5% or more of the 13F portfolio each), and these are the focus of this article.

Tweedy Brown has released many works so far. investment research paper This is a valuable resource for anyone who wants to learn from the philosophy of value investing. Also, Christopher Brown said,A little book on value investing” is a great introduction.

Note: Tweedy Brown’s flagship fund, the Tweedy Brown International Value Fund (MUTF:TBGVX) is globally oriented, with up to 85% of the portfolio allocated outside the US and up to 3% in cash. The top non-US holding not included in the 13F is TotalEnergies (Tete), Saffron SA (OTCPK: Safly), BAE Systems plc (OTCPK:BAESF), Nestle (OTCPK:NSRGY), Heineken (OTCQX:HKHHF), SOL Spa, United Overseas Bank (OTCPK:UOVEY), Diageo plc (D.E.O.), DBS Group Holdings (OTCPK:DBSDF), Trelleborg AB (OTCPK:TBABBF), DHL Group, Zurich Insurance (OTCQX:Zurvi), Roche (OTCQX:RHHBY). Since its inception (1993), the annualized return is 8.49% for him, while MSCI EAFE’s is 6.88%.

New stakes:

Envista Holdings (NVST): NVST is approximately 1% of the portfolio position purchased this quarter at prices between approximately $21 and approximately $26, and the stock is currently trading below that range at $19.17.

Increased stake:

American Bank (BAC), CNH Industries (CNHI), Concentrix Co., Ltd. (CNXC), and Truist Financial (TFC): These small positions (each less than approximately 1.5% of the portfolio) increased during the quarter.

Stake reduction:

Berkshire Hathaway (BRK.A) (BRK.B): Berkshire Hathaway is a very long-term stock that has been in my portfolio since before the financial crisis. Currently, the largest position in the portfolio is approximately 23%. Back in 2009, this was a minuscule 0.60% of his portfolio position. Most of the current stock was purchased in 2010 and 2012 at prices between $65 and $90. The third quarter of 2016 saw ~42% price declines with prices between $142 and $151, but the pattern reversed in the following quarter, with prices between $143 and $167. We saw an increase of up to 37%. In the five quarters ending in Q3 2021, about 15% sold at prices between about $200 and about $292. It was then followed by a ~20% price reduction during Q4 2022 with prices ranging from ~$264 to ~$319. The stock is currently trading at ~$410. There has been some reduction in the past five quarters.

Alphabet Co., Ltd. (google): GOOG currently holds the second largest 13F stock, representing about 17% of the portfolio. It was first purchased in 2012 for a much lower price than its current price of approximately $172. His two quarters through Q1 2023 saw a one-third price cut from about $83 to about $110. Then there were some adjustments in his last four quarters.

Johnson & Johnson (JNJ): JNJ occupies a large position (top 3) in the portfolio with 8.42%. It’s a long-term bet. This position was built from 400,000 shares to just over 4.3 million shares from 2009 to 2012 at prices between $48 and $72. Since then, the stock has seen some selling on most fronts. The fourth quarter of 2016 saw price reductions of up to 20% with prices between $111 and $120. This was followed by approximately 17% sales in Q4 2022 at prices between approximately $160 and approximately $180. The number of shares is currently around 1.13 million. The stock is currently trading at ~$151. Tweedy Browne is reaping long-term benefits from this position. There has been some reduction in the past five quarters.

FMC Co., Ltd. (FMC): FMC represents 7.5% of portfolio positions established in Q3 2021 at prices between ~$88 and ~$109. The next quarter saw an approximately 20% stock increase at prices from about $88 to about $110. Q4 2022 saw ~15% price reductions with prices ranging from ~$106 to ~$134. During the third quarter of 2023, there was a 43% stock increase at prices between approximately $65 and $105. Then, in the last quarter, stakes doubled at prices between about $50 and about $67. This quarter, stakes were down 15%, with prices ranging from $50.52 to $65.45. The stock is currently trading at $66.27.

Coca-Cola FEMSA (KOF): 7.29% KOF stock was built over three quarters through Q2 2020 at prices between $38 and $65. Since then, activity has become smaller. Q4 2022 saw a price reduction of about 18% with prices ranging from about $58 to about $70. This was followed by approximately 13% sales in Q3 2023 between approximately $74 and approximately $87. The stock is currently trading at around $101. There was a ~7% reduction this quarter.

Autoliv Co., Ltd. (ALV): The 5.44% ALV position was established in Q1 2020 at prices between ~$40 and ~$82, and the stock is currently trading at ~$122. There was a reduction of ~10% in Q4 2022, and an increase of ~7% in the following quarter. There was a ~5% reduction this quarter.

Uhaul Holdings (UHAL.B): U-Haul is approximately 2% of the portfolio position established during Q2 2023, with prices ranging from approximately $45 to approximately $59, with the stock currently trading at $66.17. Last quarter saw an approximately 45% stock increase at prices between approximately $47 and approximately $71. There was a slight adjustment this quarter.

Sealed air (look): 1.58% stake in SEE was purchased in Q2 2023 at prices between ~$38 and ~$48. The following quarter saw an approximately 50% stock increase at prices between approximately $31 and approximately $47. The current stock price is $38.62. In the last quarter, the stock also increased by ~11%. There was a slight adjustment this quarter.

Vertex Pharma (VRTX): 1.31% VRTX position was established in Q3 2023 at prices between ~$338 and ~$363. The stock is currently trading at ~$429. Last quarter, sales were up about 11%, and this quarter followed suit with a slight contraction.

American Express (AXP), AutoZone (Azo), Bank of New York Mellon (BK), Cisco Systems (CSCO), Diageo plc (DEO), FedEx Corporation (FDX), National Western Life (NWLI), US Bancorp (USB), Wells Fargo (W.F.C.): These positions (each representing less than approximately 2.5% of the portfolio) were reduced during the quarter.

Stay stable:

Ionis Pharmaceuticals (ion): IONS currently occupies ~7% position in the portfolio (top 5). It was purchased in the first quarter of 2022 at prices ranging from about $30 to about $37. During the fourth quarter of 2022, the stock increased approximately 30% at prices from approximately $37 to approximately $47. There was a slight adjustment in the last four quarters. The stock is currently trading at around $39.

The spreadsheet below shows the change in Tweedy Browne’s 13F stock holdings in Q1 2024.

Tweedy Browne Portfolio – Q1 2024 13F Report Q/Q Comparison (John Vincent (Author))

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.