A glass of cola with ice. Entleti / iStock (via Getty Images)

When it comes to investing, there is something to be said about investing in companies that most people would consider “boring.” As a dividend growth investor, consumer staples are some of my most stable businesses. portfolio.

One of the biggest characteristics of these companies is that they have little resistance to technological advances. Regardless of big technology innovations, consumers still want drinks and snacks. When combined with stronger consumer staples brand strength, sales, profits and dividends are guaranteed to increase.

One of the most consistently growing dividend companies in consumer staples is food and beverage giant PepsiCo (Nasdaq:pep). On April 10th, I increased my Dividend King status by 116.7%.

The last time I covered PepsiCo, Buy ratings in September, I was bullish for several reasons.First of all, the company 500+ brands Sold in over 200 countries and regions. This shows that the company’s brand is known and loved all over the world. The company’s financial health is also excellent, with an interest coverage ratio of 16 for the first half of 2023. Finally, the stock was undervalued by 4% at the time.

Today, I reiterate my buy rating on PepsiCo stock. As an example, in 18 of the past 20 quarters, the company has double beat For shareholders. Second, PepsiCo, which operates as a leader in the fragmented $1.2 trillion global beverage and convenience foods category, has several growth mechanisms. The company’s A+ credit rating by S&P is also stable. Finally, the stock rose 1%, similar to the S&P 500 (SP500) has risen 19% in the past eight months. Still, my fair value estimate for PepsiCo is even higher than it was in September. This could mean that the stock’s value is better than in our previous article on Seeking Alpha.

Starting 2024 with a new double beat

PepsiCo 2024 Q1 Financial Results Press Release

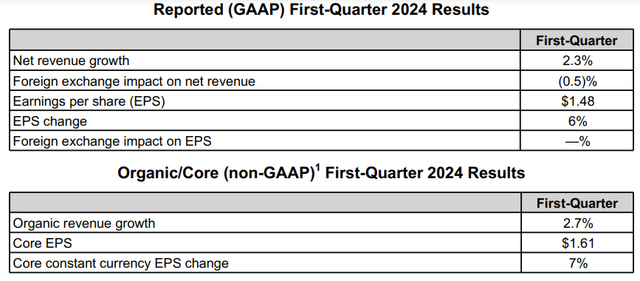

One thing great companies do regularly is exceed analyst expectations. PepsiCo built a reputation for doing so in the first quarter. This is the 18th time in the past five years that the company’s net revenue and core EPS have exceeded each other in the same period.

The other two quarters in the last 20 quarters weren’t too bad either. The fourth quarter of 2023 featured a decrease in net revenue of approximately $520 million and a decrease in core EPS of $0.06. In the fourth quarter of 2019, PepsiCo met EPS analyst core consensus and exceeded net revenue consensus by $404 million.

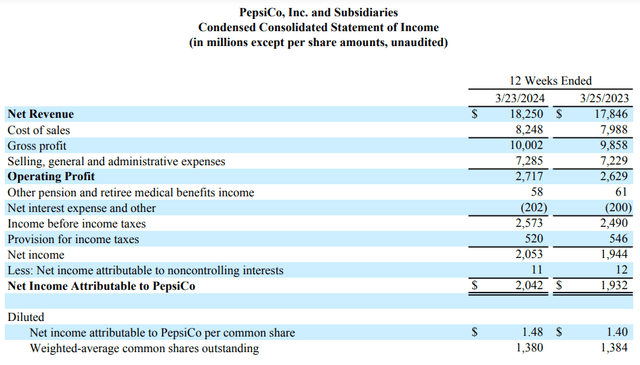

Turning our focus back to Q1 2024, the company’s net revenue for the quarter increased 2.3% year-over-year to $18.3 billion.This is included $140 million That’s better than analyst consensus, according to Seeking Alpha.

The factors behind this above-top-line performance are no different from past instances where PepsiCo beat analyst net revenue consensus. That is brand power and the pricing power that comes with it.

According to the “Who We Are” page referenced earlier, the company’s products are consumed by consumers more than 1 billion times a day. This means that PepsiCo’s delicious snacks and refreshing drinks are firmly in the daily lives of consumers around the world. Even in your house, you have a 1 oz bag of Lay’s Classic Potato Chips every day and sometimes Gatorade G2.

There are limits to how much price increases PepsiCo can avoid before people switch brands. However, I’m not going to bat an eyelash if a bag of chips goes from $0.49 to $0.53.

If most people are like me, they consider consuming PepsiCo products to be one of life’s simple pleasures. This appears to be happening as the company’s price hikes contributed to sales growth of up to 5% in the first quarter.

This was only partially offset by an approximately 2% decline in volume for the quarter, which suggests that consumers are still largely accepting these price increases for the reasons I have outlined. Suggests. Unfavorable currency translation of 0.5% also slightly hindered sales growth in the quarter.

PepsiCo continued to shine on the earnings front. The company’s core EPS increased 7.3% to $1.61 in the first quarter. This beat analyst core EPS consensus by $0.09 per Seeking Alpha.

Careful management of SG&A expenses (up just 0.8%) in the first quarter was the reason total expenses increased just 2.1% year-over-year to $15.5 billion. This widened PepsiCo’s non-GAAP net margin by nearly 60 basis points to 12.2% in the quarter. Coupled with a 0.3% decline in the company’s diluted share count, core EPS growth outpaced net revenue growth for the quarter.

PepsiCo CAGNY 2024 Investor Presentation

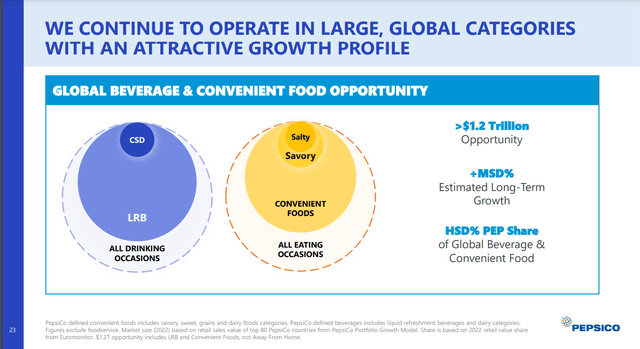

Looking ahead over the next few years, there are many opportunities for future growth for PepsiCo. The company leads the $1.2 trillion global home beverage and convenience food market. This is a market that is expected to grow by mid-single digits annually over the long term.

That means the company should have no problem achieving its long-term annual organic revenue growth target of 4% to 6%. By doing so, PepsiCo would only have to maintain its market share.

If anything, this is a rather conservative assumption. PepsiCo has gained market share in many major growth markets. Partnership with Celsius Holdings (cell) is helping keep the U.S. energy drink category’s growth strong.According to fellow integrator SA analysts, CELH’s market share is 11.5% in Q1 2024. This will remain behind Monster (MNST) and Red Bull, but PepsiCo is closing the gap due to its economies of scale.

Other key brands such as Mountain Dew and Gatorade continue to perform well. Ramon Laguarta, Chairman and CEO, said: Announcement of financial results for the first quarter of 2024 These brands grew share during the quarter, even though the weather impacted sales volumes.

Recent capital investments have also improved the company’s non-GAAP net margin from 10.7%. Q1 2019 In the most recent quarter, it was more than 12%. As PepsiCo continues to invest in capital expenditures to improve operating efficiency, this should contribute an additional 1% to 2% to annual core EPS growth over the long term.

The company’s modest share buyback program will also impact annual core EPS growth by less than 0.5%. Adding these three growth options together explains the promising FAST Graphs analyst consensus through 2026.

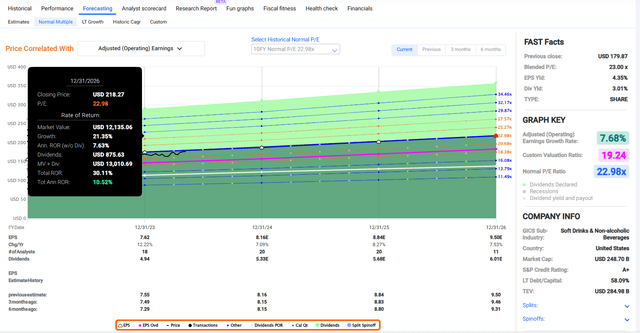

The consensus is for core EPS to rise 7.1% to $8.16 in 2024. The consensus is for core EPS to rise another 8.3% to $8.84 in 2025. Finally, the FAST Graphs analyst consensus is for core EPS to increase by 7.5% to $9.50 in 2026.

PepsiCo 2024 Q1 Financial Results Press Release

No discussion of PepsiCo would be complete without a quick summary of how financially healthy the company is. The interest coverage ratio for daily necessities in the first quarter was 13.7. This is close to the interest coverage ratio of 14.9 recorded in 2023.

This suggests that the company can still comfortably meet its financial obligations with profits. This is one of the reasons why S&P gives PepsiCo an A+ credit rating based on a stable outlook, according to Zen Research Terminal (All details in this subheading unless otherwise sourced or hyperlinked is as follows) PepsiCo’s 2024 Q1 Financial Results Press Release and PepsiCo’s CAGNY 2024 Investor Presentation and PepsiCo’s 2023 Q4 Financial Results Press Release).

Fair value is approaching $200 per share

PepsiCo isn’t a great bargain, but given its quality, it’s unreasonable to expect it to be such a bargain in most situations. Still, the current stock price of $180 (as of May 15, 2024) could make this stock a somewhat interesting value.

PepsiCo’s P/E ratio for the current year is 22x, slightly lower than its normal 10-year P/E ratio of 23x. I believe the 10-year regular P/E ratio will continue to be a reasonable fair value multiple for the next several years.

That’s because the analyst consensus of 7.7% annualized core EPS growth is higher than the 10-year typical 6.2% per FAST chart. This probably makes up for higher interest rates than in the past decade.

As of this week, 61.5% of the 2024 calendar year remains. This leaves 38.5% of 2025 remaining in the next 12 months. Here’s how to weigh the 2024 Core EPS estimate of $8.16 against the 2025 Core EPS estimate of $8.84. Therefore, the 12-month earnings input would be $8.42.

Using that 12-month earnings input and a 23x valuation, we get a fair value of $194 per share. This represents a 7% discount from fair value. If PepsiCo can match the growth consensus and return to my fair value multiple, it could have a cumulative total return of 30% by the end of 2026.

Dividend growth is unlikely to slow down anytime soon

Dividend King Zen Research Terminal

PepsiCo’s forward dividend yield of 3% is slightly higher than the consumer staples sector median of 2.7%. This is enough to earn a B- In search of alpha quantitative system As for future dividend yield.

PepsiCo’s 50+ years of consecutive dividend growth also explains the Quant System’s A+ grade for dividend consistency.If these numbers weren’t impressive enough, the company should be poised to continue to improve its performance going forward. Quarterly dividend per share At an annual rate in the low single digits.

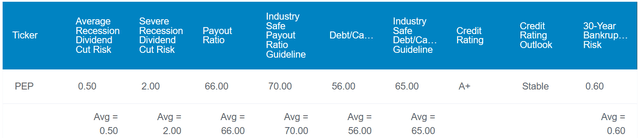

That’s because PepsiCo’s EPS payout ratio of 66% is slightly lower than the 70% EPS payout ratio that rating agencies prefer from the food and beverage industry. The company’s debt-to-equity ratio of 56% was also better than the 65% debt-to-equity ratio that rating agencies require from the industry.

PepsiCo’s core EPS payout ratio will further improve in 2024. The company plans to pay a dividend of $5.24 per share this year. This works out to be a core EPS payout ratio of 64.2%, contrary to the core EPS analyst consensus of $8.16. We believe this payout ratio is sufficiently sustainable, and that the dividend may increase in line with profits over the next few years.

Risks to consider

Although PepsiCo is a fundamentally sound company, there are still risks that need to be monitored.

First, the company is very consumer-oriented. PepsiCo’s sensitive corporate culture has contributed significantly to the company’s success over the decades. Over time, the company has adapted to changing consumer preferences to give consumers what they want.

PepsiCo’s success will depend on continued acceptance. If the company doesn’t regularly respond to consumers’ changing desires, it risks losing market share to competitors. That could negatively impact PepsiCo’s growth potential.

Additionally, a company’s success depends on maintaining a positive brand image. Any product recalls or product quality/safety concerns could harm PepsiCo’s position with consumers. This could also have a negative impact on the company’s growth prospects.

Summary: PepsiCo could be a blue-chip acquisition target

PepsiCo is one of the best stocks in the investment industry. The company stands out in a large and steadily growing industry. The dividend is well covered and has been growing for over half a century. The balance sheet is comfortable and he has an A rating.

However, the stock may be undervalued by 7%. These features give this high-quality dividend growth stock the potential to deliver a cumulative total return of 30% by the end of 2026, which is why I reaffirm my Buy rating.