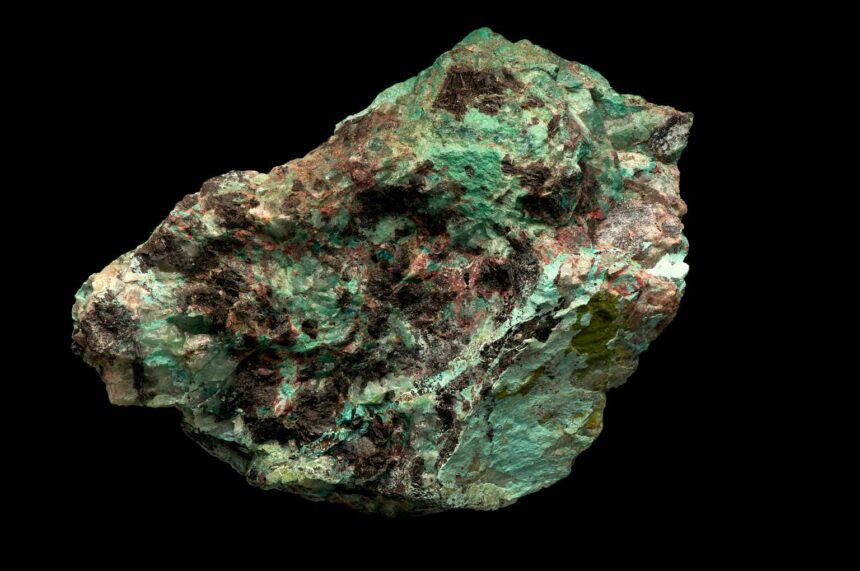

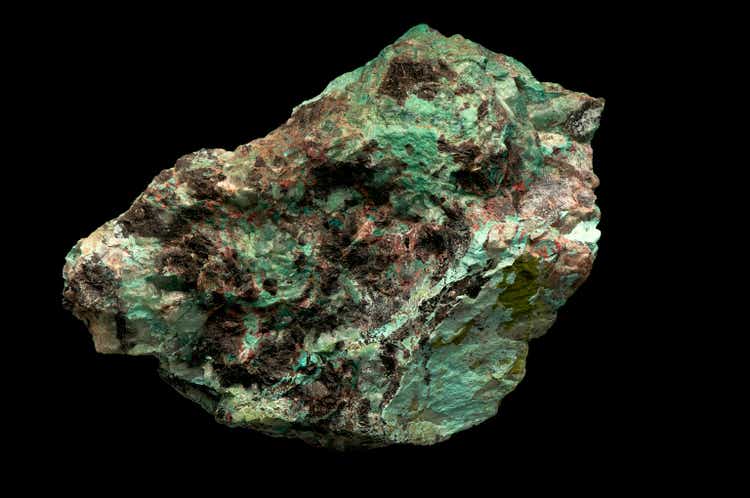

ElementalImaging/E+ (via Getty Images)

Ferro Globe PLC (Nasdaq:GSM) report 2024 Q1 Results this week. EBITDA was $25.8 million, down from $60.3 million in the fourth quarter of last year and $44.8 million in the first quarter. The drop in profitability isn’t all that surprising. Q1 is usually This was the season’s lowest volume quarter, and pricing was generally weak. The prices of silicon metal and silicon alloys both fell by more than 20% compared to the previous year, and the price of manganese alloys fell by less than 20%.

Management appears to believe that demand is improving, at least in the U.S., and that most pricing has bottomed out. The lower end of the full-year EBITDA outlook has been raised from $100 million to $130 million, and the interim outlook has been raised from $135 million to $150 million. There’s nothing to be excited about yet, and it’s well below the 2024 EBITDA threshold the company was guiding for when new management announced the reorganization in February 2021.

On the bright side, the company ended up with $79 million in net cash. The last of the 9.625% bonds have been called and will contribute to earnings and cash flow.

I think the company wants to get to about $100 million to $200 million in net cash. Dividends (only $0.01 per quarter) announced March. The board also approved a $200 million share buyback over five years, which will be put to a shareholder vote in June. It’s almost certain that it will pass. Aggressive share buybacks cannot be expected until net cash reaches target levels.

The future of EVs and solar panels:

Management continues to believe that demand for high-quality silicon in the solar panel and EV battery industries remains strong. So they are applying for brownfield permits to expand silicon metal production in the United States. The facility is intended to supply core-shell technology for metallurgical silicon batteries for EVs. In it, the company states: earnings release:

“Using silicon in EV batteries has significant advantages over graphite, including lower cost, up to 40% increased range, and significantly faster charging times.”

This application could be interesting, or it could be a total cakewalk. Over the past 25 years, I’ve heard many promises about efficient batteries. I would be excited too if Elon Musk started talking about this application.

evaluation:

The company is valued at approximately $1 billion. Multiples declined as EBITDA targets declined. The other major change is the presence of net cash.

| Market capitalization (@ $6) | $1.128 billion |

| debt | $80.8 million |

| cash | $159.8 million |

| Corporate value | $1.049 billion |

| Enterprise value/EBITDA (midpoint $135) | 7.77 times |

If we’re at the low end of the profitability spectrum, 7.7x is cheap for a highly cyclical commodity company. The big question is: What is mid-cycle profitability? At more than $350 million, as the company guided it to three years ago, you could argue that the stock is very cheap here. I’m not going to jump into buying here right away until we see a more sustained demand picture. Another thing that would make things a little easier for me would be leaving Europe. I think it’s a garbage manufacturing market and trying to supply those customers is a fool’s errand in the long run.

danger:

The main risk here is the commodity price. Quantitative demand, which makes up the bulk of that demand, is also at risk, particularly in Europe, where energy costs have long hampered factory operations.

I take the Balance sheet Increasing net cash de-risks the business considerably. Sure, you’ll be protected in case the price drops again and your margin disappears.

Conclusion:

I think Ferroglobe PLC’s management is decent at best. In the past, we’ve announced cost reductions that would make us profitable with our current pricing, but none of that materialized. Balance sheets have been incredibly slow to shrink, especially as demand dries up in Europe. That being said, they ended up taking on high debt and coming out with net cash. The current stock price is favorable in terms of the business cycle, and there is a lot of room for it to rise if silicon metal EV batteries take off.