Vitoria Holdings LLC

Gold has been one of the best-performing assets in 2024, with year-to-date returns of up to 16%. Both gold miners and gold miners ETF (GDX) is rising as well. As detailed recently, Newmont (Nemu) and that big Minor ETF GDX,I(GLD) in minor. The number of gold miners will likely increase, but its production costs have risen too quickly relative to gold, and many miners have not seen comparable profit growth.

My neutral view of miners is that they operate on a large scale in developing countries, particularly Africa and South America, and face increasing labor unrest, political and economic instability. Mainly focused. Year after year, companies operating in these regions face employee strikes, business closures, and other problems that increase operating costs. If these regional currencies continue to fall at their current pace, or if energy commodities rise, I expect to gain all or more from the appreciation. Gold and silver prices lead to increased costs and operational issues.

However, Agnico Eagle Mines (New York Stock Exchange:AEM) is primarily focused on Canada, but also has some operations in Mexico, Finland, and Australia, where they appear to be doing better. AEM is up ~26% year-to-date, with peers Newmont (4%) and Barrick (Money) (-Four%). Please refer to the following:

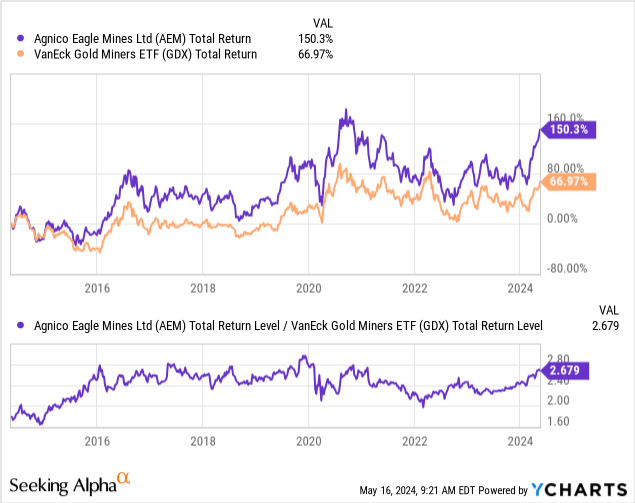

Agnico has a very strong relative performance trend compared to the industry. Although it underperformed the gold mining index from 2020 to 2022, it has since recovered and has managed to keep production costs from rising as quickly as its peers, resulting in much better returns.

Basically, I would invest in gold miners rather than GLD. Because they have physical assets, which usually provide some price leverage in gold. But there is a problem for gold miners, where production is erratic and costs are rising. Because their mines are not necessarily secured from the whims of a growing number of volatile gold miners. Governments in some regions. Therefore, I believe Agnico deserves further investigation to assess its potential value.

Production costs are rising, but not as rapidly

A major problem for Newmont and Barrick is the rapid increase in their full maintenance costs (AISC). Newmont reported that its 2019 AISC was in the mid-$900s per ounce and expects it to remain at that level through 2023. AISC did not go as planned. It was $1485/oz. Most of the gains from higher gold prices will be offset during the fourth quarter of 2023.

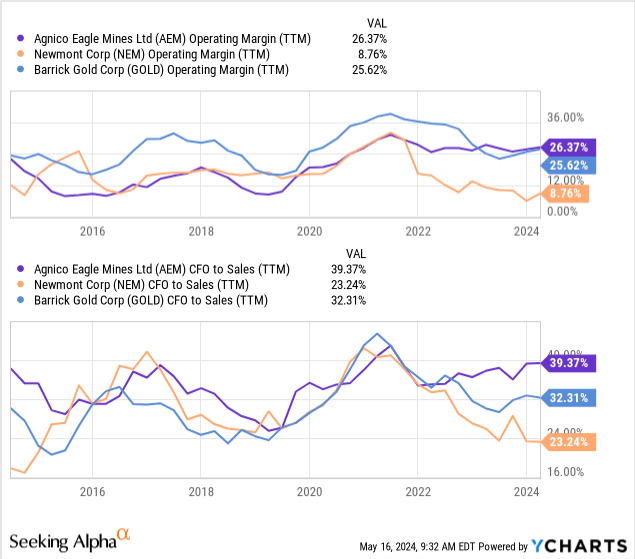

Agnico was also in the middle. $900/oz range Although it is 2019, It was just The outlook for 2023 is $1,117/oz and 2024 is $1,225/oz. Therefore, the company has a much more stable production cost growth, leading to greater profit margins and, more importantly, more stability than its peers. Please refer to the following:

Previously, AEM had focused on developed markets, particularly Quebec and Ontario, resulting in high labor costs and low profit margins. However, today the opposite is true, with a more centralized footprint and more economically stable regions resulting in more stable and higher margins. In general, AEM is likely to benefit more from rising gold prices than its peers, and it’s reasonable to expect this trend to continue.

A rise in the price of gold usually means that the value of fiat currencies around the world is falling. This is the case today, especially in developing markets, but also in other important markets. markets like japan. If we do see a wave of currency instability, as many gold bulls predict, we will also see a wave of social and economic instability that will inevitably result from a sustained rise in inflation. . We find that gold mine operators often underestimate jurisdictional risk, primarily when gold bullish narratives imply increased political risk. However, I think AEM’s track record of AISC stability will greatly alleviate this problem.

What is Agnico Eagle’s fair value today?

Determining the fair value of a gold miner can be difficult because it depends on the expected price and profitability of mining the precious metal, including discounts to account for leverage and operational risk factors. Agnico’s lower jurisdictional risk makes it worth some premium over its peers. Additionally, the company’s net debt is approximately 21% of its enterprise value, compared to 34% for Barrick and 36% for Newmont. There are similar differences in other leverage metrics, showing that AEM shareholders have a bigger slice of the pie than the other two companies.

Agnico’s 2024 guidance indicates a gold production outlook of 3.45 Moz at an AISC of $1,225/oz. Today’s gold price of $2,375/oz means a significant margin of ~$1,150/oz. Assuming this level holds, it would result in a pre-interest and tax profit of approximately $3.97 billion. Importantly, this metric is based on sustaining capital expenditures rather than valuations, so although it is non-GAAP, it is more likely to reflect actual expected sustained profit levels.

Subtracting $101 million from net non-operating interest and assuming an effective tax rate of 30% results in expected non-GAAP income of approximately $2.71 billion. The company generated an additional approximately $80 million in revenue from silver, zinc, and copper byproduct sales. You can add some of that to your income, but the net effect is probably not significant, and if anything it will offset the possibility that your AISC will be higher than expected (which is often the case). Become. Therefore, at current gold prices, he values AEM based on expected forward revenue of $2.71 billion.

With a market capitalization of $34 billion, AEM has a low P/E ratio of 12.5x. Technically, the company’s forward “P/E” is 22.6x based on consensus earnings estimates. the market expects Earnings gains will be smaller and disappear by 2027. These predictions were likely made earlier this year, when the price of gold was about $400 lower than it is today. Rising gold prices have significantly improved AEM’s profit outlook.

conclusion

I like AEM and have a bullish outlook on AEM given its lower leverage and much lower jurisdictional risk. To me this is a much better risk reward opportunity than Newmont or Barrick. Mainly because AISC is more stable. I believe AISC is a significant risk factor as fiat currencies struggle relative to gold.

This is not to say that AEM is necessarily low risk. One is, as we discussed with respect to GDX, gold is trading at a very high premium compared to implicit trading. real interest price, about $1,200 per ounce. Typically, higher real interest rates, the net returns on long-term government bonds after inflation, are associated with lower gold prices. In fact, if investing in fiat currencies provides superior returns after inflation, then gold should be worthless as it does not promise to outperform inflation.

There are various reasons why this anomaly may occur.First, China and other central banks stockpiling gold Extremely. China and other central banks, as well as many wealthy people, think it’s a good idea to buy gold now to protect against the possibility of a future rise in global inflation. Yes, inflation is slowing, but I would argue that the U.S.’s debt is so high and its infrastructure is aging that it needs to remain persistently high. Therefore, assuming inflation spikes again over the next decade, the actual interest rate numbers could be inaccurate. Still, I remain bullish on gold, but prefer silver (SLV) and platinum (PPLT) because this premium is missing.

Apart from falling gold prices, Agnico is not immune to operational risks. Although the company’s operating risk is lower than its peers, rising energy and labor costs could still impact profitability. This is something to consider, but I’m not too concerned unless oil prices spike sharply. I’m bullish on his AEM and believe its fair value is around $42 per share, equating to a forward “P/E” of 15-16x based on my earnings projections. Additionally, we think the benefits from rising gold prices are greater than for other peers, making it a good long-term bullish trade for gold.