Ratana21/iStock (via Getty Images)

investment thesis

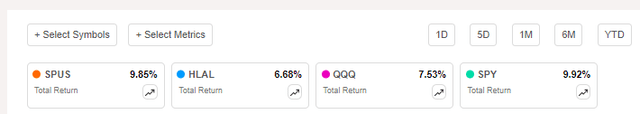

This article Continue my coverage SP Fund S&P 500 Sharia Industry Excluded ETF (Knee search:SPUS) is a top-performing ESG fund that meets the investment requirements of Islamic religious law. In January I rated SPUS a Although we expressed concerns about the management company’s own debt review process, we felt reassured by the high quality of the overall portfolio and maintained a firm ‘hold’ rating. Nevertheless, SPUS continues to perform well, delivering a total return of 9.85% since my review, outperforming the tech-heavy Invesco QQQ ETF (QQQ) and its main competitor Wahed FTSE USA Sharia ETF (HLAL). As shown below, the SPDR S&P 500 ETF (spy), a benchmark representing that selection.

One downside to SPUS is its expense ratio of 0.45%, but as a non-religious investor, I feel this is too much considering there are many low-fee options with similar structures.However, I We believe this is the best Islamic ESG ETF available as it has a competitive combination of growth and value while maintaining superior quality. We look forward to discussing these basics in more detail below and then answering any questions you may have in the comments section.

Overview of SPUS

strategy discussion

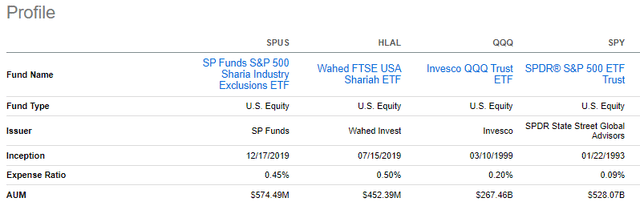

SPUS tracks the S&P 500 Sharia Industry Exclusion Index, a relatively new index launched in October 2019. SPUS was launched two months later, on December 17, 2019, and has since amassed his $575 million in assets under management. I think this is great for an ETF with a relatively narrow target market. In comparison, HLAL has $452 million in assets under management and was founded on July 15, 2019, five months before he did so.

by index fact sheet, S&P Dow Jones Indices has partnered with an independent consulting firm specializing in global Islamic investment market solutions. The index follows an industry exclusion methodology. That is, we start with the entire S&P 500 index as our selection and then exclude companies that engage in specific business activities, such as:

1. Advertisements related to pork, alcohol, gambling, and tobacco.

2. Media and entertainment related to music, television programs, music ratio shows, and cinema operators (news channels, newspapers, sports channels, children’s channels, and educational channels are permitted activities).

3. Financial services (other than Islamic banks, financial institutions, insurance companies, or others that pass Islamic and accounting-based examinations).

4. Other activities such as pornography, recreational marijuana, and trading gold and silver as cash on a deferred basis.

These exclusions only apply if the company derives at least 5% of its revenue from these activities. Additionally, the index excludes companies with a 36-month average debt-to-equity ratio of more than 33%. Finally, the index is float-adjusted market capitalization weighted and rebalanced monthly.

performance analysis

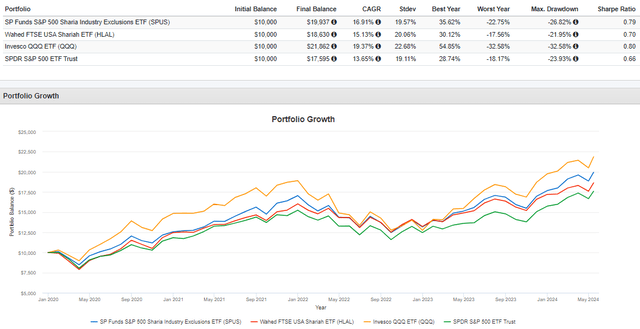

Since January 2020, SPUS is up 99.37%, while HLAL, QQQ, and SPY are up 86.30%, 118.62%, and 75.95%, respectively. SPUS also had a fairly high Sharpe ratio, a standard measure of risk-adjusted return.

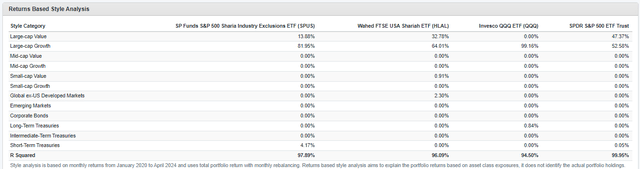

Whether you consider these results impressive or not depends on how you classify SPUS. According to a return-based style analysis report created by Portfolio Visualizer, SPUS returns mimic a portfolio comprised of 81.95% large-cap growth stocks, compared to 99.16% and 52.58% for QQQ and SPY, respectively. I did. So while it’s not as aggressive as QQQ, it’s pretty close, and that will become more apparent later as we consider its composition and fundamentals.

SPUS analysis

Sector exposure and top 10 holdings

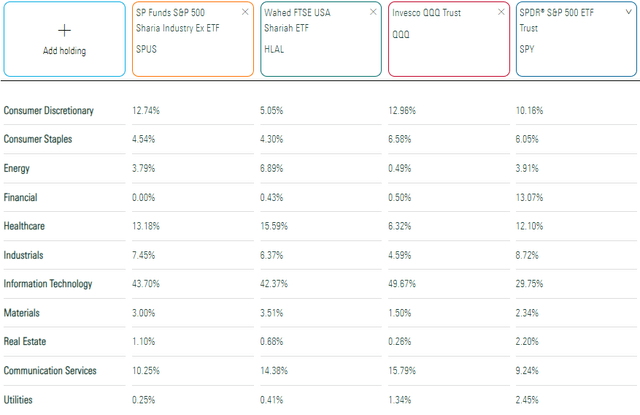

The following table shows the sector exposure differences between SPUS, HLAL, QQQ, and SPY. SPUS is a 43.70% Technology and supports the Large Cap Growth classification. SPUS also allocates 12.74% to consumer discretionary business and 10.25% to communication services business, of which 10.24% is allocated to Alphabet (Google) and metaplatform (meta).

HLAL is also expensivey Concentrated in technology, with slightly higher exposure to energy and healthcare, which have relatively low valuation ratios. This helps explain the higher “Large Cap Value” assignment in previous return-based style analysis and why SPY is probably the most appropriate benchmark for his HLAL.

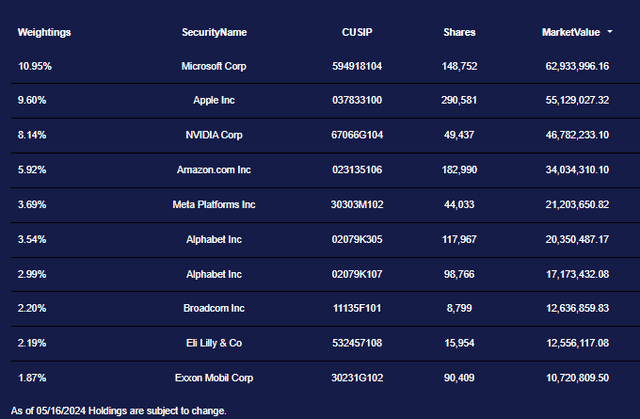

As of May 16, 2024, Microsoft (MSFT), apple (AAPL), and Nvidia (NVDA) are SPUS’s top three holdings, accounting for a total of 28.69% of the portfolio. SPUS is certainly a very concentrated play, as the Magnificent Seven’s total exposure rate is 46.61% and QQQ’s 40.96%.

Fundamental analysis of SPUS

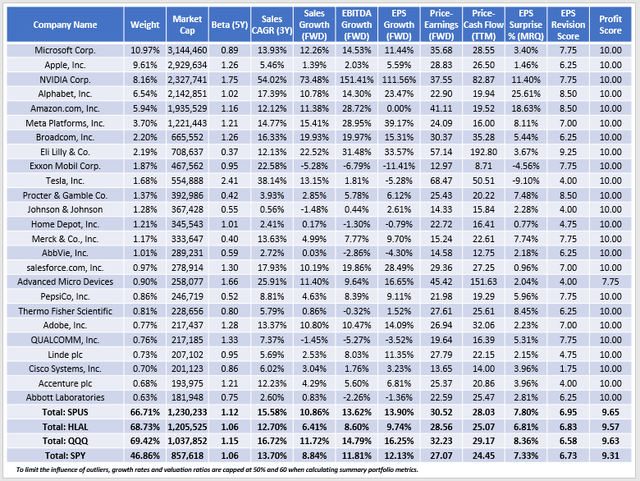

The following table summarizes the fundamental metrics of the top 25 stocks in SPUS, which together account for 66.71% of the portfolio. This concentration level is slightly better than QQQ, indicating a relatively small exposure to stocks 11-25. The bottom line is that SPUS shareholders should feel comfortable with their supercap growth stock. Because that exposure is only enhanced by religion and debt screening.

Here are three more takeaways:

1. SPUS constituents delivered a weighted average surprise return of 7.80% in the last quarter, outperforming Nvidia, Alphabet, and Amazon by 11.40%, 25.61%, and 18.63% (AMZN). This is above the S&P 500’s long-term average of 5% to 7%, suggesting that large-cap growth stocks remain in the lead. We are encouraged by the relatively high Seeking Alpha EPS revision grades for most of the top stocks. This has been normalized to a 10-point scale in the table above. However, there is also concern about how unbalanced the grades are from top to bottom. The average score of the top 10 stocks is 7.66/10, while the average score of the remaining 158 stocks is 6.45/10. In other words, there’s tremendous pressure on just a handful of stocks to perform well, and if that stops, SPUS and many other large-cap growth ETFs could be hit hard.

2. As the previous return-based style analysis report showed, SPUS has a growth profile between SPY and QQQ. Specifically, the company’s estimated one-year sales and earnings per share growth rates are 13.62% and 13.90%, which are lower than QQQ but higher than SPY. Similarly, SPUS is trading at 30.52x forward earnings (simple weighted average), 1.71 points lower than QQQ, but 3.45 points higher than SPY. While this pattern holds true, investors looking for growth at a fair price might consider using these numbers to calculate the PEG ratio. If we divide the earnings growth rate by the future P/E ratio, we get:

- Spas: 2.20

- HLAL: 2.93

- QQQ: 1.98

- Spy: 2.23

Since lower PEG ratios are more favorable, we can conclude that QQQ offers the best combination of growth and value, SPUS and SPY are similar, and HLAL is the least attractive. Although HLAL’s results are surprising, the fund allocates his 27.60% to Microsoft and Apple, and as shown above, the estimated revenue growth rates for both companies are relatively low.

3. Despite these concerns, I reiterate my confidence from previous reviews that SPUS will be successful in the long term. This is a high-quality fund, with a return score of 9.65/10 that ranks it 18/57 in the large-cap growth category and 33/850 among all US stock ETFs I track. Masu. Excluding Advanced Micro Devices (AMD), all 25 of our top holdings have a perfect 10/10 Profit Score, equivalent to an “A+” Seeking Alpha Profitability Grade.

Investment recommendations

We are satisfied that the SPUS methodology provides high-quality selection, which is its main feature. However, we caution investors that despite its name, SPUS should not be compared to S&P 500 index ETFs like SPY. My analysis reveals how SPUS is most similar to large-cap growth ETFs like QQQ, and by excluding hundreds of S&P 500 stocks that are generally less risky and have lower valuations, SPUS is a select mega-cap growth ETF. It became clear that there was a strong dependence on the group of stocks. Unfortunately, there are few options available and HLAL has a poor combination of value and growth potential, making it unattractive at the moment.

For non-religious readers, we can offer lower-cost alternatives such as: Spyg, VUG, MGKand Aiwai, both have higher PEG ratios and earnings scores than SPUS. Otherwise, SPUS is a big fish in a small pond at the moment, and assuming you have a high risk tolerance, it’s your best option. Therefore, I will leave his rating on SPUS “Hold” and look forward to answering your questions in the comments section below. thank you for reading.