Ipwadol/iStock via Getty Images

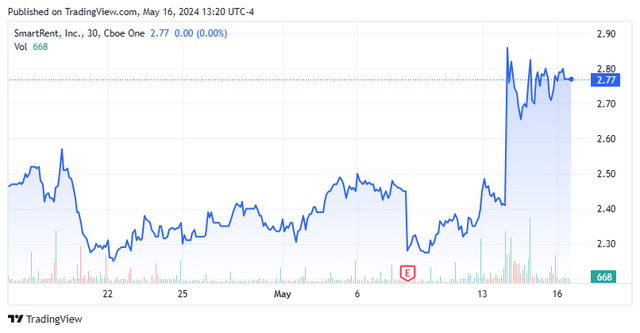

I’ll go back again today Smart Rent Co., Ltd. (New York Stock Exchange:SMRT) For the first time in more than half a year since the last time article About this small-cap concern and a busted IPO.Stock has increased a little This week, we reported that activists have emerged calling for the company to be sold. Will this be the catalyst that the company’s long-suffering shareholders have been waiting for, or will it just be a “”?Fool’s Gold” lastly? See our latest analysis for SmartRent below.

SmartRent, Inc. targets the multifamily housing space with services consisting of smart hardware and cloud-based SaaS solutions. The company is headquartered in my hometown of Scottsdale, Arizona. The company’s stock is currently trading at $2.75 per share, giving it a market capitalization of approximately $560 million.

Activist pressure emerges:

On Tuesday, Land & Building Investment Management owns over 3% of the company’s shares, called For the sale of the company. The company believes such an acquisition could represent a 150% premium to enterprise value (the stock closed Monday at $2.40 per share). Activist investors are pushing this solution:

”SmartRent continues to fail to meet its growth goals and we believe the company has no choice but to thoroughly explore strategic alternatives.. ”

Recent results:

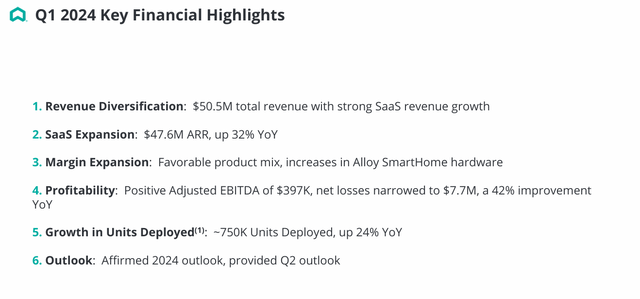

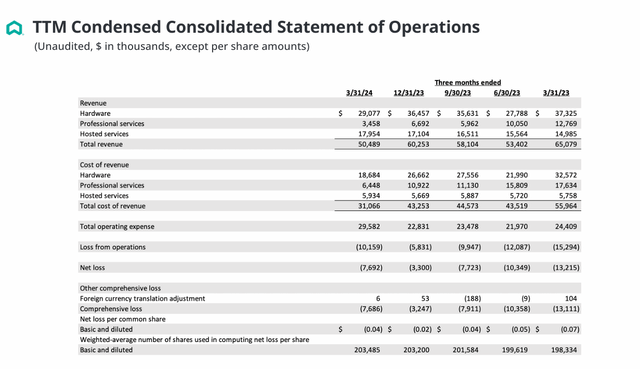

Given its recent performance, it’s no surprise that the company is under activist pressure. On May 8th, SmartRent First quarter numbers. Although things weren’t all that encouraging on the surface, there were some positives. The company’s GAAP loss was 4 cents per share, 3 penny less than expected. Net loss for the quarter was $7.7 million. It is worth noting that the company suffered a loss of $13.2 million in the first quarter of 2023.

May 2024 company briefing session

Sales fell more than 22% year over year to $50.5 million, slightly below expectations. One bright spot in earnings was SaaS revenue of $11.9 million, up 32% year-over-year. The overall revenue decline was expected, as management said it was more focused on “profitable growth.” Towards this goal, SmartRent generated $400,000 in adjusted EBITDA, an improvement of $9.3 million from the prior year period, despite the decline in revenue. Total units deployed increased 24% to 749,000. Leadership also noted that market demand for community WiFi continues to increase.

May 2024 company briefing session

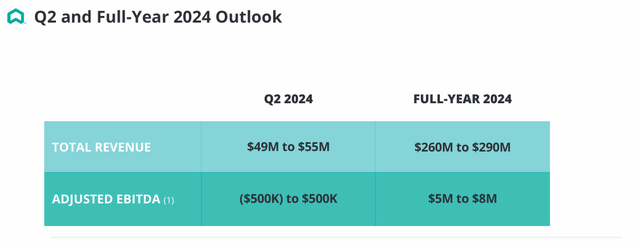

Management also reaffirmed its fiscal 2024 revenue guidance of $260 million to $290 million and expects adjusted EBITDA for the current fiscal year to be between $5 million and $8 million.

May 2024 company briefing session

Analyst views and balance sheet status:

Despite the disappointing quarterly results, DA Davidson, KBW ($3.50 price target), and Colliers Securities ($5.00 price target) all maintained buy ratings after announcing their first quarter results.

May 2024 company briefing session

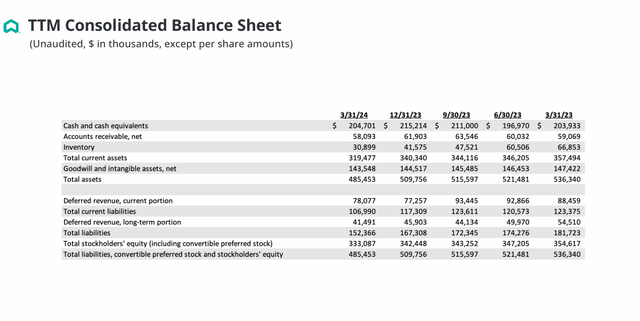

As of 2024, there is no insider activity on the stock. Company directors actually received nearly $250,000 in new shares in late November last year. The company ended the first quarter with approximately $205 million in cash and marketable securities. Balance sheet. SmartRent also has $75 million in undrawn credit facilities available to him and no long-term debt. The company repurchased 1.6 million shares during the quarter.

Conclusion:

SmartRent lost 17 cents per share in fiscal 2023 on revenue of just under $237 million.Current analyst company consensus Revenues for fiscal 2024 will be $273 million, and losses will reduce to 4 cents per share. Furthermore, in fiscal 2025, he expects 20% revenue growth to result in earnings of nickel per share.

I don’t see much merit in this week’s calls by activists to sell the company. They hold a small stake in the company and have little influence. They also haven’t identified potential buyers for SmartRent, or at least not in the announcement.

SmartRent, Inc. has made some progress in reducing losses and maintains a healthy balance sheet.of projected A decline in multifamily construction this year is a headwind to growth. This week’s rise in stocks is likely to be temporary, and I’m not going to chase stocks here. If the company can cut its losses further in the coming quarters, then it might be worth revisiting.