PM image

investment thesis

First Trust Rising Dividend Achievers ETF (Nasdaq:RDVY) deserves a Buy rating due to its ability to combine growth with dividend income. Compared to peer dividend growth funds, RDVY has outperformed and shown strong performance. Potential for the future. Although the main drawback is a relatively high expense ratio, RDVY’s stock selection methodology captures a mix of companies with sustainable dividends and manageable debt. These qualities have led to strong performance over the past decade. In addition to solid dividend growth and price appreciation potential, this fund also offers an attractive valuation.

Fund overview and comparison ETF

RDVY is passive ETF that tracks the Nasdaq U.S. Dividend Achievement Index. By tracking this index, the fund aims to capture small-, mid- and large-cap stocks with dividend-growing characteristics. Since its establishment in 2014, The fund has 50 holdings and total assets under management of $10.69 billion. By market sector, the highest proportion of this fund is in financials (31.10%), followed by industrials (17.11%) and retail (14.18%).

For comparison purposes, the other funds we looked at were the Vanguard Dividend Appreciation ETF (V.I.G.), Schwab U.S. Dividend Stock ETF (SCHD), and iShares Core Dividend Growth ETF (DGRO). VIG aims to track the S&P 500 US Dividend Growth Index Therefore, it has a similar purpose to RDVY. However, he differs from RDVY in that the Vanguard Fund is a large blend fund that primarily lacks small- and mid-capitalization holdings. SCHD is also biased toward large-cap stocks and is more evenly distributed across market sectors than RDVY, with a higher weight in healthcare and consumer staples. SCHD Passively tracks quality-focused indexes, sustainability of dividends, and basic strength. Finally, DGRO Latest dividend fund comparison And the most diverse. Like RDVY, DGRO aims to provide investors with access to companies that deliver sustainable dividend growth.

Comparison of performance, expense ratio, and dividend yield

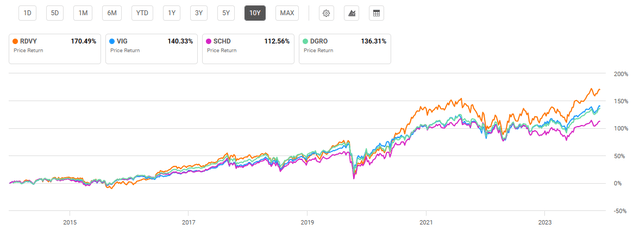

For RDVY Average annual return over 10 years is 12.15% The 10-year total price return is over 170%. This performance ranks the fund first among its peers over the past 10 years. By comparison, his 10-year average return for VIG and SCHD is 10.90%. Although DGRO is less than 10 years old, his average annual return since June 2014 is 11.60%. Although these dividend growth ETFs have underperformed the average annual return of the S&P 500, with a 10-year average return of approximately 12.4%, each fund’s dividend yield is higher than the S&P 500 index.

10-Year Total Price Return: RDVY vs. Dividend Growth Fund (In search of alpha)

RDVY’s main drawback is its expense ratio compared to others. RDVY’s expense ratio is 0.49%; The average expense ratio for all ETFs is 0.57%. However, RDVY’s fees are significantly higher than other comparable funds. While RDVY doesn’t currently have the highest dividend yield, it does have a strong history of dividend growth, as we’ll discuss later. This is due to key fundamental qualities that allow it to maintain dividend growth above its peers.

Comparison of expense ratios, assets under management, and dividend yields

|

RDVY |

V.I.G. |

SCHD |

DGRO |

|

|

expense ratio |

0.49% |

0.06% |

0.06% |

0.08% |

|

parrot |

$10.69 billion |

$89.7 billion |

$56.3 billion |

$27.69 billion |

|

Dividend yield TTM |

1.95% |

1.76% |

3.33% |

2.27% |

Source: Seeking Alpha, May 16, 24

RDVY Holdings and its competitive advantage

Each fund compared to RDVY has a different way of achieving dividend growth, so the top holdings vary widely. RDVY is Jackson Financial (JXN) and Garmin (GRMN). RDVY is the least diversified fund with just 50 holdings, but it is also the lightest among the top 10 holdings, with a total weight of 22.0%.

Top 10 Holdings of RDVY and Peer Dividend Growth ETFs

|

RDVY – 50 held |

VIG – 340 held |

SCHD – 103 holdings |

DGRO – 419 holdings |

|

JXN – 2.38% |

MSFT – 3.87% |

TXN – 4.60% |

AAPL – 3.15% |

|

GRMN – 2.26% |

AAPL – 3.81% |

AMGN – 4.41% |

XOM – 3.13% |

|

QCOM – 2.25% |

AVGO – 3.43% |

PEP – 4.12% |

CVX – 3.06% |

|

EQH – 2.22% |

JPM – 3.33% |

LMT – 4.11% |

MSFT – 3.04% |

|

MLI – 2.18% |

XOM – 2.84% |

CVX – 4.10% |

JPM – 2.97% |

|

WSM – 2.18% |

UNH – 2.69% |

PFE – 4.09% |

JNJ – 2.53% |

|

AXP – 2.14% |

V – 2.44% |

KO – 4.01% |

AVGO – 2.41% |

|

FITB – 2.14% |

PG – 2.31% |

CSCO – 3.96% |

ABBV – 2.29% |

|

KLAC – 2.14% |

MA – 2.24% |

VZ – 3.87% |

PG – 2.13% |

|

AAPL – 2.12% |

JNJ – 2.09% |

BLK – 3.86% |

MRK – 1.92% |

Source: Multiple, edited by author on May 16th

Looking ahead, RDVY has several unique attributes that will drive greater dividend growth than its peers. Apart from a history of dividend growth and capital growth, First Trust Fund has a low dividend payout ratio on its top holdings and a relatively low debt-to-equity ratio. These qualities demonstrate the fundamental strengths of his ETF and are discussed in more detail below.

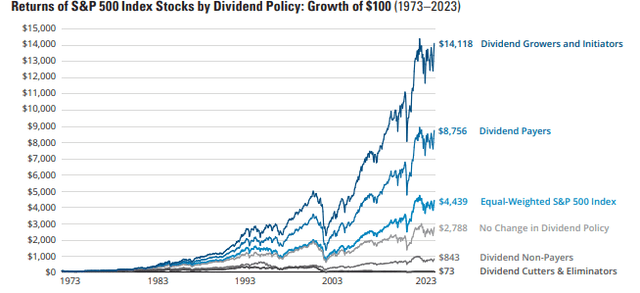

Advantage #1: High dividend growth rate

Before discussing RDVY’s unique properties, it’s important to understand why dividend growth is important. To illustrate the importance of this, we can take a quick look at its historical performance from 1973 to 2023.According to research by The Hartford Fund, the average annual return is The 50 year period for dividend growth companies was 10.19%, the dividend payer was 9.17% and the equal-weighted S&P 500 index was 7.72%. The compounding effect of dividend reinvestment in these dividend growth companies was significant over long periods of time. Therefore, we can conclude that dividend growth companies have led to better overall performance over the past few decades.

Comparing the performance of dividend growth companies with other indices, 1973-2023 (Ned Davis Research and The Hartford Foundation)

RDVY seeks to capture these “dividend growers” using specific, quantifiable criteria. First, to be eligible for the index tracked by RDVY, a company must have paid more dividends in the past 12 months than it paid in the previous 12 months three to five years ago. not. This key metric has given RDVY a higher 3-year and 5-year dividend growth CAGR than comparable funds.

Comparison of dividend yield growth

|

RDVY |

V.I.G. |

SCHD |

DGRO |

|

|

Dividend growth rate 3 year CAGR |

20.73% |

11.39% |

8.56% |

8.36% |

|

Dividend growth rate 5 year CAGR |

19.31% |

8.46% |

11.80% |

9.70% |

Source: Seeking Alpha, May 16, 24

Advantage #2: Dividend sustainability

Almost any company can start or increase its dividend, but a key factor to consider is dividend sustainability. To measure this quality, you can look at the dividend payout ratio. This shows how much of a company’s profits are used to pay dividends. To be included in the index, a company must have a prior 12-month period with a payout ratio of less than 65%.

Compared to VIG, RDVY’s average payout ratio for the top 10 stocks was significantly lower at only 25.63%. The table below simply shows the weighted average of each of the top 10 stocks for RDVY and VIG, but it gives you a sense of how RDVY is selected. The First Trust Fund’s criteria for including companies with lower payout ratios fosters more sustainable dividend growth.

Dividend payout ratio of RDVY and VIG Top 10 Holdings

|

RDVY Holding (% weight) |

Dividend payout ratio |

VIG Holding (% weight) |

Dividend payout ratio |

|

JXN (2.38%) |

18.42% |

MSFT (3.87%) |

25.37% |

|

GRMN (2.26%) |

48.67% |

AAPL (3.81%) |

14.93% |

|

QCOM (2.25%) |

35.24% |

AVGO (3.43%) |

45.91% |

|

EQH (2.22%) |

17.72% |

JPM (3.33%) |

25.66% |

|

MLI (2.18%) |

13.17% |

XOM (2.84%) |

42.51% |

|

WSM (2.18%) |

24.23% |

UNH (2.69%) |

29.18% |

|

AXP (2.14%) |

20.59% |

V (2.44%) |

21.36% |

|

FITB (2.14%) |

38.98% |

PG (2.31%) |

57.36% |

|

KLAC (2.14%) |

24.38% |

MA (2.24%) |

19.26% |

|

AAPL (2.12%) |

14.93% |

JNJ (2.09%) |

45.51% |

|

RDVY top 10 holdings average dividend payout ratio: |

25.63% |

VIG top 10 holdings average dividend payout ratio: |

32.71% |

Source: Created by author, Seeking Alpha data, May 24th 16th

Advantage 3: Debt-to-equity ratio

Another factor that can be investigated to assess a company’s dividend growth potential and sustainability is its debt. To be included in the index tracked by RDVY, a company must have a cash-to-debt ratio of greater than 50%. Therefore, in addition to the dividend payout ratio, a company’s debt-to-equity ratio is another important factor that can be considered. This tells you how much equity each holding has to cover its debt. Less than 1.0 is desirable, but more than 2.0 is dangerous as it means a large amount of debt. If we look at the sum of the debt-to-equity ratios for each of the top 10 stocks in RDVY and DGRO, we find that RDVY’s average is more attractive. Again, the table below simply shows the weighted average of each ETF’s top 10 holdings, but this comparison gives you an idea of the quality of RDVY’s holdings and selection criteria.

Total Debt to Equity RDVY and DGRO Top 10 Holdings

|

RDVY Holding (% weight) |

Total debt/equity |

DGRO (% weight) |

Total debt/equity |

|

JXN (2.38%) |

0.59 |

AAPL (3.15%) |

1.41 |

|

GRMN (2.26%) |

.036 |

XOM (3.13%) |

0.19 |

|

QCOM (2.25%) |

0.63 |

CVX (3.06%) |

0.14 |

|

EQH (2.22%) |

1.17 |

MSFT (3.04%) |

0.42 |

|

MLI (2.18%) |

0.01 |

JPM (2.97%) |

2.28 |

|

WSM (2.18%) |

0.65 |

JNJ (2.53%) |

0.48 |

|

AXP (2.14%) |

1.76 |

AVGO (2.41%) |

1.66 |

|

FITB (2.14%) |

0.98 |

ABBV (2.29%) |

9.24 |

|

KLAC (2.14%) |

2.20 |

PG (2.13%) |

0.64 |

|

AAPL (2.12%) |

1.41 |

MRK (1.92%) |

0.85 |

|

RDVY Top 10 average debt/equity holdings |

0.94 |

Average debt/total equity held by top 10 DGROs |

1.73 |

Source: Created by author, data from Yahoo Finance, May 16th, 24th.

Current valuation

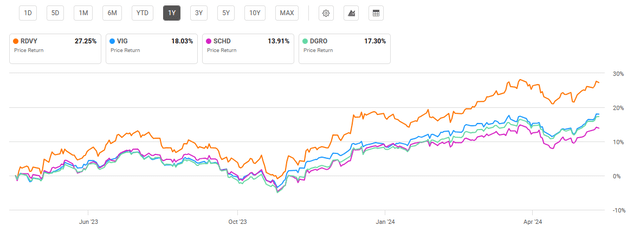

RDVY has a relatively attractive valuation in addition to strong dividend growth and sustainability metrics. Over the past year, RDVY significantly outperformed all peer dividend funds surveyed, with a price return of 27.25%. This performance is roughly equivalent to the S&P 500’s one-year return of 27.4%.

1-Year Performance: Comparing RDVY and Dividend Growth ETFs (In search of alpha)

Despite its recent strong performance, RDVY is valued more attractively than all other stocks and the S&P 500 index as a whole. Using price-to-earnings and price-to-book ratios, RDVY is the least valuable among its peers compared; S&P 500 P/E ratio is 27.53. Looking ahead, we view RDVY’s attractive valuation, dividend sustainability, and low debt ratio of its top 10 holdings as solid buy signals. I believe that the overall dividend yield of the fund will increase, contributing to an increase in capital value.

RDVY and competitor metrics

|

RDVY |

V.I.G. |

SCHD |

DGRO |

|

|

PER |

11.55 |

October 23rd |

15.92 |

20.66 |

|

P/B ratio |

2.19 |

4.40 |

3.07 |

3.44 |

Source: Compiled by author from multiple sources, 16 May 24

Risks to investors

Although many companies that pay dividends are usually stable and established, RDVY is not without risk. In fact, this fund’s volatility, as measured by standard deviation, was slightly higher than the overall market. At 20.22, RDVY’s implied volatility is greater than his 3-year. Standard deviation of S&P 500 at 18:00.

Although RDVY has a strong track record of acquiring dividend growth companies, its selection criteria methodology is not perfect. A company may be forced to cut its dividend if one or more of its major holdings are unable to maintain its dividend. Dividend cuts typically result in a drop in stock prices in addition to a reduction in dividends, resulting in a “double blow” to investors.

Summary of conclusions

RDVY has a strong track record of dividend growth and capital appreciation. Although it has a higher expense ratio than other similar funds, its performance outweighs this downside. After examining the dividend payout ratio and debt-to-equity ratio of RDVY’s top holdings, the fund was able to acquire stocks with high potential for dividend growth. Finally, RDVY has attractive P/E and P/B ratios compared to peer funds, further enhancing its quality.