Ryanair aircraft at Bergamo, Italy MaxBaumann/iStock Unreleased via Getty Images

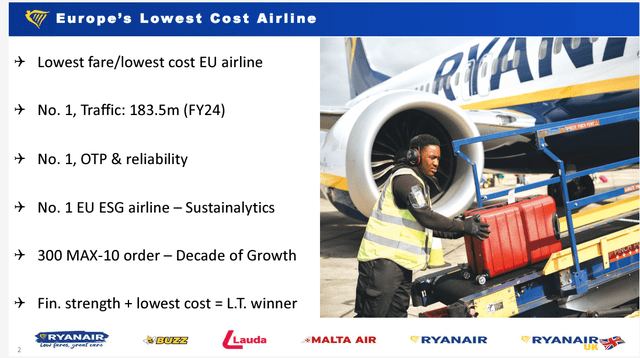

Ryanair (NASDAQ:RYAAY) is an ultra-low-cost carrier headquartered in Ireland but serving most countries of Europe plus parts of the Middle East and North Africa. A relatively young airline, RYAAY has aggressively built its network over less than four decades to become the largest airline in Europe operating a near-exclusive fleet of Boeing 737 jets.

Ryanair has thrived because of its aggressive focus on cost control, financial strength, and its ability to stimulate traffic with low fares. On a continent where the legacy carriers dominate major airports, Ryanair has built its presence around secondary airports and what some would call bare-bones service; it has won a loyal following indicated by its ability to fill its jets (near 100% load factors) and deliver reliable basic transportation that covers the European continent and beyond. Often accused of crossing the line of being “too cheap,” RYAAY has shaped European aviation in the same way that Southwest (LUV) has shaped U.S. aviation – by extending air transportation to the masses. Unlike Southwest which has given up its title of being the lowest-cost U.S. large airline, Ryanair has relentlessly focused on driving its costs always lower than its competitors – even if finding no use for some of the values that helped build Southwest.

RYAAY Europe low cost airline (investor.ryanair.com)

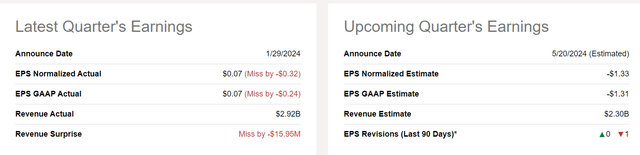

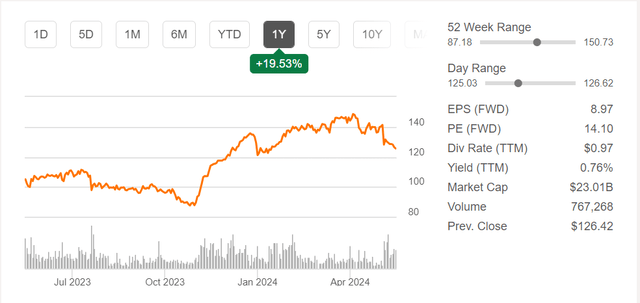

Ryanair is scheduled to report its first quarter of calendar 2024 or RYAAY’s fourth quarter fiscal year 2024 earnings before market open on Monday 20 May 2024. Analysts expect RYAAY to report a $1.31 GAAP loss per share, worse than its loss one year ago. As the airline with the second highest market cap in the world – behind Delta Air Lines (DAL) – RYAAY’s recent stock performance is concerning and an indication that some of the same problems afflicting low cost airlines in the United States are producing disparate results within the airline industry in Europe. Competitors such as International Consolidated Airlines Group (parent of British Airways and Iberia of Spain) are seeing improved results while continental European superpowers Air France/KLM (OTCPK:AFLYY) and Lufthansa Group (OTCQX:DLAKF) are seeing weak results. While Ryanair has traditionally generated above-average margins not just compared to other European airlines but in the global airline sector, expected deeper losses in the most recent quarter raise concerns.

RYAAY earnings summary May 2024 (Seeking Alpha)

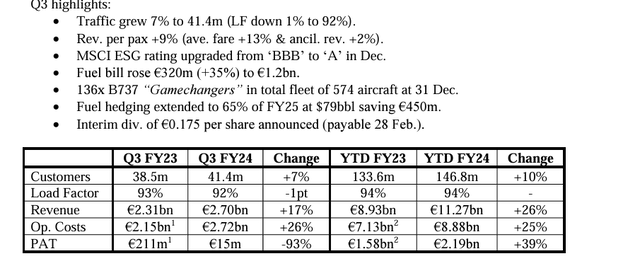

Reviewing RYAAY’s 3Q FY 2024 Performance and Guidance

In the December quarter of fiscal 2024, Ryanair reported revenue growth of 17% but an even larger increase in operating costs of 26% which led to a 93% reduction in after tax profit from the year earlier quarter which gave them a small profit of EUR 15 million also driven by a 35% increase in fuel costs. Their fiscal year to date metrics show that the first and second quarters were much more kind to RYAAY.

The market was not initially rattled by RYAAY’s reduced guidance that was released with its December quarter earnings in which the company guided to higher costs based on the need to increase operational reliability as well as an approximate 5% reduction in its annual profits.

RYAAY 3Q F2024 summary (investor.ryanair.com)

Growth Challenged Business Model

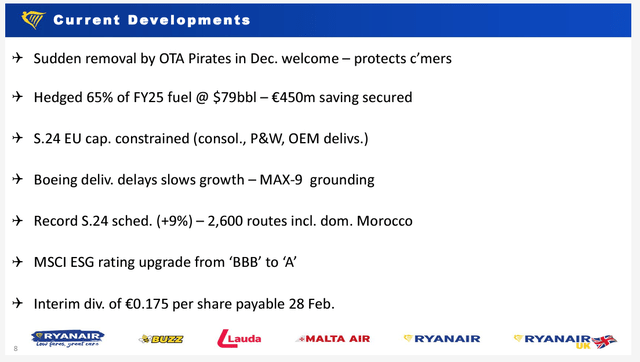

RYAAY stated that it faces revenue pressures due to a couple of significant factors. Many ultra low cost carriers were built around a model of bookings by consumers directly on the airline’s website which is the least expensive distribution channel for most businesses. Because RYAAY is so large and so popular, they have been the target of online travel agents (OTAs) that want to distribute their product. Because of Ryanair’s low fares, some OTAs have added unauthorized fees to RYAAY’s fare structure in order to increase their revenue which also complicates RYAAY’s ability to care for its passengers in the event of irregular operations such as delays or cancellations. In addition, no airline wants to lose control of its pricing structure which rogue OTAs can easily do. Other OTAs have been willing to pass Ryanair’s unadulterated fare and schedule information to consumers and RYAAY has embraced those intermediaries.

RYAAY has tried a number of technological and legal techniques in order to try to shake unwelcome OTAs but several large OTAs finally withdrew distribution of Ryanair’s fares and schedules in the third fiscal quarter which resulted in the need to discount their fares more aggressively and a slight reduction in the number of seats filled. The impact into the fourth fiscal quarter appears to have accelerated over the third quarter as further revenue weakness appears to have been in play. Although the company notes that having Easter fall in March helped traffic, there is not likely to be a large enough increase in revenue from the holiday shift to offset the loss of some online travel agent bookings. The company is likely to further address the OTA issue and the resulting revenue weakness in its earnings release but it is very possible if not likely that it will take RYAAY’s typical busy summer season until they are able to see enough organic demand growth to fully overcome the change in distribution.

RYAAY current developments (investor.ryanair.com)

In addition, the company notes that fuel and labor costs are up. Fuel remained elevated in the beginning of this year due to instability in the Middle East that only began to wane in the now-current quarter. While the security situation in the Middle East can change quickly, it is not expected that there will be significant spikes in fuel prices. RYAAY does expect that their net fuel costs will increase in the fourth fiscal quarter because of expiring carbon credits. Labor costs are expected to increase as the company increases pilot pay in several major markets. Although the pilot staffing model in Europe is different than in the U.S., rates for skilled labor continue to increase as demand recovers and grows beyond pre-covid demand faster than new labor can be trained and integrated into the workforce.

Another Big Boeing Customer Struggles

Ryanair, like Southwest, has been an incredibly loyal customer for the Boeing (BA) 737. Even though Airbus (OTCPK:EADSY) made early inroads with its A320 family of jets with European airlines, RYAAY has remained faithful to Boeing other than as part of acquisitions of airlines where the A320 family of aircraft was already in service.

As with many airlines around the world, RYAAY execs were stunned after the in-flight failure of a door plug on an Alaska (ALK) 737 MAX 9 jet in January which led to the two-week grounding of the MAX 9 fleet. Subsequent investigations uncovered significant production issues at both Boeing and Spirit AeroSystems (SPR) which manufactures the 737 fuselage for Boeing. The U.S. FAA moved quickly to slow Boeing’s production and work with Boeing to improve its quality control while also halting Boeing’s intended plan to increase production. The impact to airline strategies as a result of delayed Boeing deliveries is and will be one of the most significant events in aviation history. Airlines like Southwest, United, and Ryanair which are large and major Boeing customers are watching their growth and fleet replacement strategies be shredded as they can no longer plan with certainty when they will receive new aircraft.

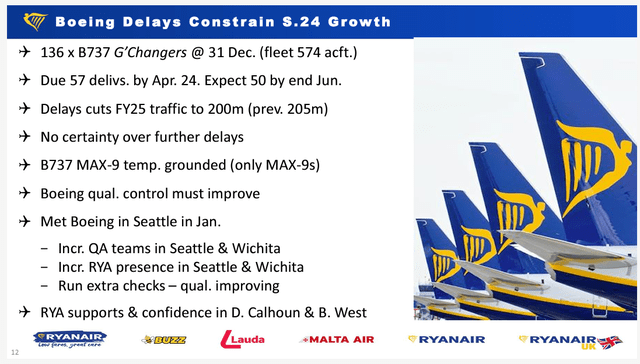

RYAAY Boeing delays (investor.ryanair.com)

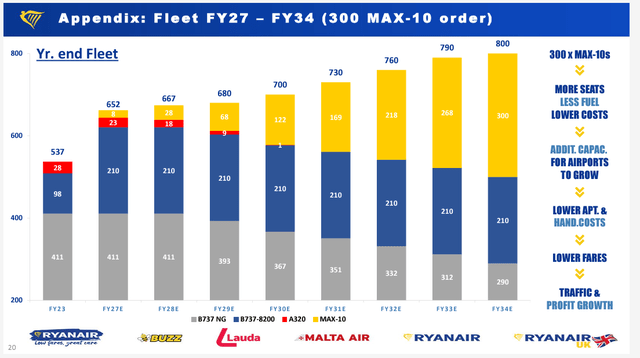

Ryanair is a loyal Boeing customer and has been instrumental in bringing new models of the MAX such as the 737 8200, a high-density version of the 737-8 that activates additional emergency exits due to higher passenger levels and which RYAAY calls its “gamechanger.” Part of RYAAY’s growth risk is due to delivery delays on new Boeing aircraft; like United, Ryanair is a major customer for the MAX 10 which has yet to be certified and, like the smaller MAX 7, is delayed beyond original plans although RYAAY is later in the delivery timeline for MAX 10s than other customers. The carrier was supposed to receive 57 Boeing Max 8200 planes by the end of April, but due to the deepening crisis at Boeing, the delivery will be reduced even further to 40 jets by the end of June. As with many other airlines, lower aircraft deliveries will not only reduce revenues but will also increase unit costs as fewer passengers can be carried and costs are spread over fewer seat miles/kilometers.

It is far from clear when Boeing will be able to return to its previously projected production levels; catching up from the delayed deliveries is certain to take years. The company cannot afford to cancel orders but it is not known how much slack it has between its order book and delivery commitments in order to rebalance its delivery commitments with its production capacity. RYAAY’s future, just as with other major Boeing customers, is heavily tied to Boeing’s ability to turn around the MAX program and to obtain certification for its current uncertified MAX 7 and MAX 10, the latter of which RYAAY wants to buy in the hundreds later this decade.

RYAAY fleet plan (investor.ryanair.com)

Growth and Opportunity Remain

While RYAAY’s unique revenue challenges related to its online travel agency situation and the larger issue of aviation manufacturer issues cloud the horizon, RYAAY should experience upset in several ways. First, Boeing’s production problems with the 737 MAX are also being accompanied by manufacturing problems with the Pratt and Whitney (RTX) Geared Turbofan engine which powers some A220 and A320NEO family aircraft. Pratt and Whitney discovered that some of the metal coatings used in its most fuel-efficient engine suffers degradation much earlier and worse than previously known due to the high temperatures and harsh operating conditions of modern jet engines. RTX is having to remove hundreds of engines worldwide from service for inspection with replacement of parts in a process that can take nine months or more due to limited shop capacity and replacement parts. RTX expects that the situation with out of service engines and aircraft should improve in 2025 and into 2026 which might be about the time that Boeing begins to return to higher levels of production for the MAX and might also see certification of the MAX 7 and MAX 10. Like many large Boeing customers, Ryanair is pushing Boeing to fix its problems and restore the reliability of its products and timeliness in delivering its products.

RYAAY 1 yr chart 17May2024 (Seeking Alpha)

The reduced capacity from both Boeing and Pratt and Whitney’s problems is dramatically reducing airline capacity growth around the world which should put upward pressure on fares and ultimately revenues. Unfortunately, the unpredictable nature of these production delays makes planning difficult for airlines. Some airlines are having to keep older aircraft in service longer, resulting in higher maintenance costs while others are moving to a less optimistic outlook for expansion and will use an unexpected increase in new deliveries, if they occur, to retire older aircraft; the lead time for capacity planning and the associated investments in labor and facilities makes it too risky to continue to bet on aggressive growth that will not materialize. RYAAY and other airlines can see higher unit revenues and optimizing of their networks for lower amounts of capacity by planning for less capacity than earlier hoped and using it more judiciously should it arrive.

RYAAY ratings summary 17May2024 (Seeking Alpha )

Ryanair also wants to continue to grow its presence in major markets. It has now become the largest carrier in many markets including in Italy where it faced weak local carriers for years. The restructuring of former Italian carrier Alitalia into ITA has provided opportunity not only for RYAAY to grow but also for large global carriers to restructure partnerships in order to better access the Italian market. Lufthansa Group (OTCQX:DLAKF) which is strong in Central Europe via its family of airlines in multiple countries agreed to invest in the restructured ITA. The European Union’s competition authority has, so far, expressed concern about the transaction that would have resulted in significant concentration of services. Lufthansa’s proposed remedies do not appear to be sufficient to meet the EU’s requirements. One of those remedies involved ITA/Lufthansa releasing slots at some Italian airports including Milan’s close-in and coveted Linate airport where Ryanair would like to expand. While it is not clear if a settlement can be reached between the EU and Lufthansa, RYAAY supports the transaction because it expects it will be able to receive remedy slots. RYAAY’s position as a low-cost carrier helps its case in arguing that it can help check the growth of larger legacy carriers.

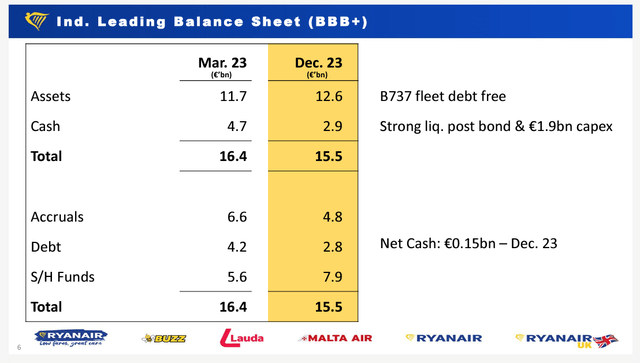

An Enviable Balance Sheet

While the near-term for Ryanair might be more cloudy than some expected even as early as six months ago, the company does possess one of the best balance sheets in the industry with little debt – actually no net debt, large numbers of unencumbered aircraft, and more than adequate cash on hand. Like Southwest, Ryanair can endure years of reduced earnings before its balance sheet is reduced to the level of some of its larger global competitors. Nonetheless, RYAAY appears to be managing the compromised environment well and is expected to announce initiatives necessary to improve its operating finances until its growth rate can return to planned higher levels.

RYAAY balance sheet (investor.ryanair.com)

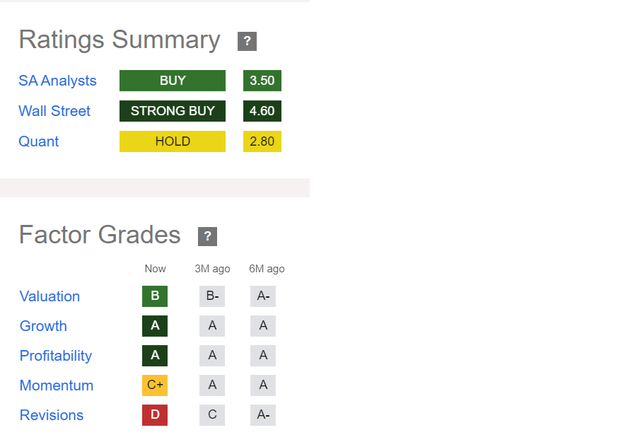

While I rated RYAAY as one of the global airline industry’s top five stocks just five years ago, I must reduce my rating to a HOLD based on uncertainty regarding the airline’s revenue generation and growth strategies.