Dilok Khuraisataporn

Chub Limited (New York Stock Exchange:C.B.) has shown impressive financial performance since my last analysis, with higher profit growth and solid revenue growth than expected in my previous analysis. As recently as Q1, Warren Buffett called this stock a good buy. Berkshire Hathaway’s (BRK.A) (BRK.B) We have newly purchased Chubb stock.

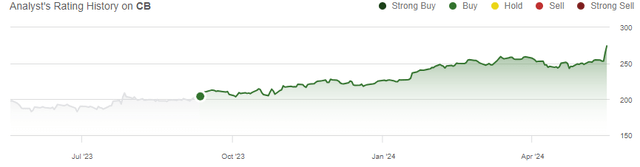

I wrote it before article Chubb with the title “”Chub: A relatively inexpensive savior, rated the stock a buy as it appears to be undervalued given Chubb’s stable earnings. This article was published on September 11, 2023. Since then, the stock has returned a total of 34%, compared to an 18% gain for the S&P 500 index. Despite the company’s continued strong financial reporting and share price appreciation, the stock remains undervalued.

My evaluation history at CB (in search of alpha)

Chubb’s financial performance is impressive.

Chub had an incredibly good experience financial performance According to the previous analysis, significant growth was recorded from Q3 2023 to Q1 2024.very recently in the first quarter, Chubb consistently performed well across segments, with a 14.2% year-over-year increase in net premiums written. Most notable in the quarter was his 26.3% increase in life insurance premiums written.

In addition to healthy revenue growth, Chubb is also increasing its profit margins. Chubb’s first-quarter core operating profit increased 20.3% year-over-year, and his margin on written premiums rose to 18.1% from 17.2% in his 2023 first quarter. Mr. Chubb continues to see the positive impact of higher pricing, which contributes to both higher dollar-based premiums written and improved margins.

First quarter financials continue the strong performance in the second half of 2023, with Chubb also managing to increase written premiums and operating margins beyond the expectations of the DCF model in our previous analysis. While we are unable to further estimate price increases, we expect them to sustainably raise expectations for Chubb’s operating margin levels. As Chubb’s revenue has grown steadily, the company recently raised the dividend Quarterly payments come out to $0.91, and the current dividend yield is relatively low at 1.33%.

Warren Buffett’s Berkshire Hathaway buys Chubb stock

Recent 13F filing Announced on May 15, Warren Buffett’s investment company Berkshire Hathaway disclosed 25.9 million Chubb shares worth about $7.1 billion at the time of writing. Berkshire Hathaway held a significant position in Chubb, accounting for approximately 6% of the company’s total stock, and the stock rose 5% on May 16 following the 13F disclosure.

berkshire hathaway was building Position within the company during the past quarter based on confidential declarations. Now that Berkshire Hathaway no longer requires confidentiality regarding stock purchases, the position appears to be building without any major additions. Berkshire Hathaway already holds a significant position in the insurance industry, so we expect a deal to be unlikely due to regulatory issues – despite a vote of confidence, Warren Buffett’s position in the company Although Chubb’s position is unlikely to have any concrete impact on Chubb’s investment projects, the investment tycoon’s comments strengthen confidence in investment.

competitive industry

There are many competitors in the property and casualty insurance industry. For example, publicly traded Progressive Corporation (P.G.R.), Travelers Companies (TRV), and Allstate Corporation (all) has a total market capitalization of $218 billion. Overall, the insurance industry is a difficult industry to differentiate from competitors because services are highly standardized and pricing is the clearest form of differentiation.

Still, compared to its larger publicly traded competitors, Chubb has been able to grow its earnings more consistently. While competitors also appear to have benefited from price hikes in recent quarters and boosted margins, Chubb’s growth in the industry has been more stable overall.Chub boast With clearly superior underwriting ratios compared to multiple competitors, the company is highly competitive in the industry.

Overall, the property and casualty insurance industry is expected to have a strong year in 2024.Swiss Re Institute Estimate Premiums are expected to grow 7.0% for the year, driven by personal insurance. With easing inflation and higher investment returns, industry profitability is expected to increase ROE to 9.5% in 2024 and 10.0% in 2025, which is already pushing Chubbs’ and its competitors’ profit margins higher. It’s showing.

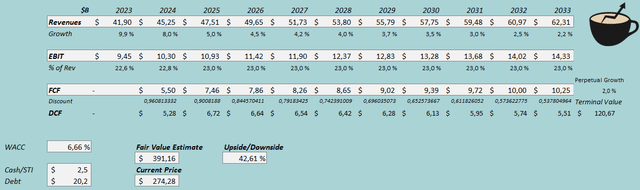

Valuations continue to have significant upside potential

Chubb’s excellent financials over the past few quarters suggest that my DCF model assumptions are open to change. Currently, he estimates returns based on net premiums written in non-life insurance, and from 2023 to 2032 he has a CAGR of 3.7%, whereas his previous DCF model had a CAGR of 3.7% from 2022 to 2032. We estimate a CAGR of 4.0% until 2033. The permanent growth rate remains unchanged at 2%. Due to Chubb’s reported higher margins, I currently estimate the company’s operating income at a significantly higher level. For example, we estimate EBIT in 2024 to be $10.3 billion instead of $8.2 billion in the previous DCF model. The margin in 2024 corresponds to 22.8%. 23.0% after 2025. Cash flow conversion has been revised downward.

Based on the aforementioned estimates, the DCF model estimates Chubb’s fair value to be $391.16, which is approximately 43% above the stock price at the time of writing. The stock still appears to be undervalued, as the recent earnings trajectory has significantly increased my cash flow forecast.

DCF model (author’s calculation)

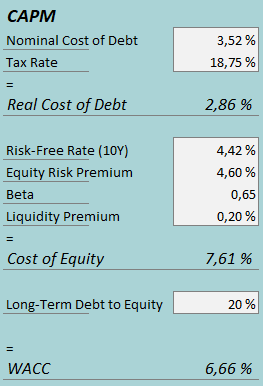

The DCF model uses a weighted average cost of capital of 6.66%. The WACC used is derived from the capital asset pricing model.

CAPM (author’s calculation)

In the first quarter, Chubb’s interest expense was $178 million. Considering the company’s current amount of interest-bearing debt, Chubb’s annual interest rate is 3.52%. I maintain the long-term debt-to-equity ratio estimate at the same 20%. For the risk-free rate on the equity cost side, we use the US 10-year bond. Yield 4.42%. The equity risk premium of 4.60% is based on Prof. Aswath Damodaran’s Latest quote Updated for the United States on January 5th. We use the same beta estimate of 0.65 as his previous CAPM. Finally, add a small liquidity premium of 0.2%, creating a cost of capital of 7.61% and his WACC of 6.66%. The WACC decreased from the previous estimate of 7.38% due to the lower estimate of the equity risk premium.

risk

Although chubs are relatively resilient to macroeconomic disruptions, they are not completely immune to macroeconomic factors. Mr. Chubb has a large amount of debt on the company’s balance sheet, and his interest rates have an impact on the company, although the effect is very modest.

Chubb’s recent high profit margins may be only temporary, and the potential decline in profit margins could significantly worsen the investment situation. If a major catastrophe were to occur, Chubb could incur significant losses and deteriorate its earnings. lost The collapse of the Baltimore Bridge caused a significant amount of money. However, Chubb has a global and diversified insurance portfolio, with only 19% of its premiums coming from large commercial P&C lines, making it unlikely that a very large lump sum payment would cause a significant disruption to its bottom line. It is low.

remove

Chubb’s financial performance since my last analysis was excellent, characterized by good growth and high profit margins due to the company’s price increases. Warren Buffett’s Berkshire Hathaway has also taken notice of Chubb’s financial position, with Chubb buying $7.1 billion worth of stock, according to a recent 13F filing. Although Berkshire Hathaway’s stake does not change the specifics of the investment, the company’s stake in Chubb solidifies its confidence in the investment. This valuation continues to provide a good price for investors, so I maintain my Buy rating on Chubb.