shark pick

We will return to comments about Zurich Insurance Group after the first quarter release (OTCQX:Zurvi). For new readers, the company is a one-stop shop for insurance solutions, including property and casualty insurance, life insurance, and annuity products. Zurich was founded in 1872 and operates in the following regions: With a presence in 210 countries, the Farmers division is heavily involved in the North American market.

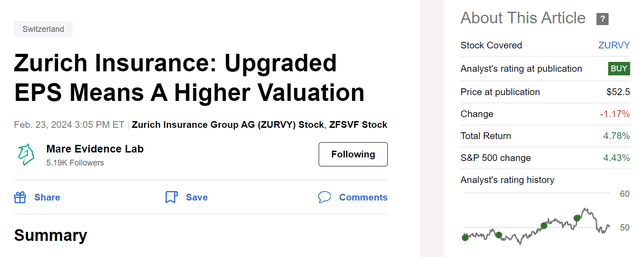

Continue our last update (Q4 and FY 2023 results), the company’s stock price is down 1.17%. However, including the dividends received, the total return increases by his 4.78%.

Our supportive purchase rating is confirmed by:

- a 10 years analysis Zurich Insurance’s key financial ratios.

- a Rebuilding the farmers’ sector;

- of Highest ROE and safest balance sheet Among EU insurance companies.

- Generous shareholder compensation with a total yield of over 7%.

Mare Evidence Lab evaluation updates

May 16, 2024 company report First quarter press release with impressive results. The CEO commented: ”Zurich Insurance Group achieved a strong performance in the first three months of 2024, continued to grow profitably and sales, and is looking forward to building on the record results achieved in 2023. The momentum was maintained.. ”

Before looking at the details, let me report the following:

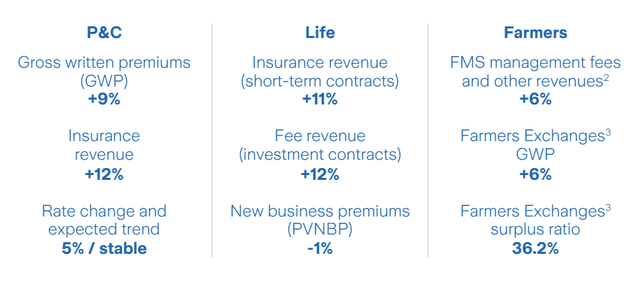

- The property and casualty insurance (P&C) revenue segment increased by 12%.

- The Life segment continues to grow in the areas of protection and unit links.

- Farm sales achieved a 6% increase in underlying fee income.

- On the balance sheet, Zurich confirmed its strong capital position with a Swiss solvency test ratio of 232%.

A brief explanation of Zurich Insurance’s first quarter financial situation

Why are we positive?

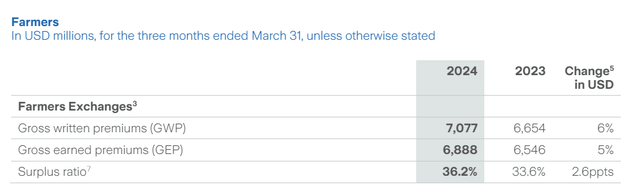

The company’s first quarter release showed solid sales momentum with solid Farmers Insurance premium growth. The sector is up 6.4% for the year, beating Wall Street’s average forecast. This sector should support future fee increases. Moving on to analyze the P&L department, we must report that Q1 2024 marked his 6th consecutive quarter of consecutive combined ratio improvement. The total ratio of farmers he reached 89.4%, improving by 5% over the years. Due to improvements in operating expense management, the division’s surplus rate was 36.2%. This is currently within the intermediate target range of between 34% and 36%.

After a 6% price increase in 2023, Zurich continues to benefit from continued commercial pricing activity. Specifically, the price MIX in the non-life insurance sector is favorable at 5%. The North American region was the main driver, with commercial vehicle rates increasing by 14% in the sub-segment sector.

In its fourth quarter update, the company announced a CHF 1.1 billion share buyback. This is expected to begin in the coming weeks and could support the evolution of Zurich’s share price.

Following the company’s capital markets day, there are also five key points to report.

- Thanks to capital management solutions and selected portfolio actions, Zurich may (again) surprise at the upside of its ROE evolution.

- The company has a proven track record. In detail, he has been aiming for his EPS growth of 5% while Zurich has always achieved results in excess of his 8%.

- After ten years of analysis, Zurich has always maintained a keen interest in the evolution of the composite ratio over this period.

- It is expected to increase shareholder remuneration to achieve a solvency ratio of 220% above the minimum capital requirement of 160%.

- During the Q&A analyst conference call, the new CFO emphasized an 85% cash generation target.

Earnings trends and evaluation

This result confirms a change in EPS CAGR of 10% from 2024 to 2025. This is an increase from the 8% EPS growth target the company set on its 2022 capital market date. Zurich confirmed the guidance. However, we think the Farmers segment is well on track to outperform his mid-single-digit growth outlook for the company. Looking at the details, our team projects that the Natcats’ combined ratio impact for the year will be within his 1.7% (he’s 1.8% in 2023). This is due to strong first quarter results. Regarding farmers’ main financial ratios, we currently expect the combined ratio to normalize to over 99%. Report on CEO’s words. ”Farmers Management Services has taken decisive steps to reduce expenses, improve underwriting discipline and increase distribution efficiency. All these efforts are bearing fruit, as evidenced by the exchange’s improved profitability and positive position.“The life and non-life sector continues to see commercial momentum. This is primarily driven by favorable market developments and strong sales. At a sector level, Zurich’s life and non-life sector continues to see commercial momentum. Operating profit of $2.3 billion and $4 billion, respectively. Meanwhile, with Farmers’ solid turnaround and taking into account the three brokerage companies acquired last year, pre-tax operating profit of $8 billion. will be confirmed.

Here at Rabo, we want to remain cautious and see net income of $6 billion and EPS of $41.8, even if we like Zurich, which beat Wall Street analysts’ expectations. Masu. Our valuation is confirmed at CHF 502, which is supported by his ROE of 24%. This is also supported by cumulative cash transfers of over $13.5 billion for the period 2023-2025.

Wall Street analysts are likely to support Zurich, expecting a positive change in consensus given Farmer’s profitability and the company’s ability to grow profits in the coming years.

risk

Downside risks to the target price include regulatory changes and corporate tax increases. Zurich Insurance is exposed to changes in public market valuations, including deterioration in its bond portfolio and sharp declines in stock market values. High default rates and volatile markets are harmful to businesses. Additionally, although Zurich Insurance reports in US dollars, it is listed in Swiss francs. The Company is also exposed to general economic conditions and disruptive bolt-on acquisitions, which could adversely affect its stockholders.

conclusion

Zurich showed great strength in the Farmers category, beating consensus expectations. This sector is performing faster than expected, which could force Zurich Insurance to reassess its stock rating. The company has always had a strong stock market, given its safe balance sheet, best-in-class ROE, supportive share buybacks, and safe haven Switzerland status. Here at the lab, we maintain buy recommendations.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.