Ismagilov

Palantir Technologies (New York Stock Exchange:PLTR) recently reported First quarter results. Check out my analysis after Q4 2023 results are reported. here I believe the stock is overvalued and overhyped and assigned a “sell” rating. in the process. As I’ve highlighted in the past, the stock remains range-bound despite the company’s strong growth due to valuation concerns. As a result, the company’s valuation continues to rise, largely supported by bullish sentiment towards the AI sector in general. This article provides an updated outlook on the stock by reviewing its first quarter performance and valuation.

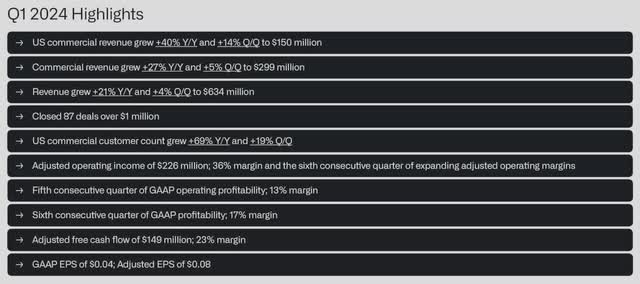

PLTR Stock Q1 Highlights

The best news this quarter was that the U.S. commercial business was growing rapidly, with revenue up 40% year over year.Furthermore, customer acquisition continues to be strong and we are developing initiatives. It’s like a bootcamp to increase your awareness of how you can meet the needs of your potential customers. As a result, U.S. commercial customer numbers increased 69% year-over-year in the first quarter. In addition to new customer acquisition, the company also noted that existing customers, including some of its largest customers, continue to increase their spending on Palantir’s software products and services.

Other highlights of the quarter included a big win on the Titan project, further supporting Palantir’s claim that it is the U.S. military’s first major defense software product. Additionally, the company saw some improvement in the growth of its US government business, with year-over-year growth of 21% during the quarter and continued overall revenue growth of more than 20%. The company also remains highly profitable, reporting five consecutive quarters of GAAP operating margins and repurchasing several shares from its large and growing cash pile during the quarter. I did. Overall, the business appears to be growing well on all counts, with strong profitability, strong growth, and an even stronger balance sheet.

PLTR Q1 Highlights (Investor Presentation)

Issues remaining with PLTR stock

That said, it hasn’t all been smooth sailing for the company, with its international business, particularly in Europe, continuing to struggle. This is particularly notable, with reported quarter-on-quarter declines. PLTR administrators usually rotate the numbers as positive as possible for the company, even the government recognizes financial statement The harsh economic environment in Europe is said to be a headwind for business.

First quarter international government revenue … down 9% sequentially to $79 million, as a result of the fourth quarter revenue catch-up noted last quarter and continued headwinds in Europe … Europe So there are certainly headwinds, 16% of our revenue business is in Europe. Europe’s GDP growth rate is slowly trending towards zero percent over the next few years. That’s a problem for us.

Additionally, questions regarding Palantir’s ability to generate growth in its international operations have been lingering for quite some time and are not likely to go away anytime soon.While strong growth in the US, particularly in commercial operations, is sufficient to continue to drive overall numbers solidly, our concern is that in the long term, the US will expand more meaningfully into international markets and Unless they can generate significant growth there, the total addressable market is likely not as large as they have. Cast members who have appeared in the pastIf this is the case, ultimately their growth trajectory and valuation will be severely limited.

Another big concern we have is simply the valuation itself. We certainly believe that the company’s products are of high quality and have a growing range of applicable industries and businesses as the artificial intelligence revolution continues to accelerate. The company’s products have proven to be consistently profitable on his GAAP basis, and the company’s balance sheet is impressive. As a result, we are not concerned with the quality or long-term prospects of the business itself, nor with the safety or stability of the business model or balance sheet. The only issue we have is that the economies of scale are not very strong given that the company’s revenue growth rate has only been around 20% and EBITDA margins have remained range-bound for the past few years. , profits are not growing that much. A faster clip than the top line. In fact, from 2021 to 2023, revenue grew at a CAGR of 20.1% and EBITDA grew at a CAGR of 16.8%.

On the other hand, the company’s EV/EBITDA ratio is still very high at 47.85x, and its price-to-earnings ratio is 64.23x. Moreover, the law of large numbers means that the more revenue increases, the harder it will be to accelerate its growth rate, especially if it is unable to break through international markets. With interest rates this high and the risk of recession looming in places like Europe, Japan and even the United States, it’s hard to buy stocks at such high valuations. As a result, we continue to rate the company a Sell and believe we would only be interested in buying if the stock price declines significantly from here or if it can meaningfully and sustainably accelerate growth overseas. Masu.

Key points for investors

We think Palantir has a bright future and will eventually grow to its current valuation, but for all we know, the AI bubble in the stock market will keep its stock price low for some time. will not fall significantly below the $20 per share level. -Until we can change the fundamentals of growth internationally, we simply cannot offer enough upside potential from here. As a result, the risk/reward profile is very unfavorable, and we rate the stock a Sell. Additionally, it won’t be considered a hold until it drops into the mid-teens, and it won’t be considered a buy until it drops below $12.00 per share.