Mateo Colombo

ETF overview

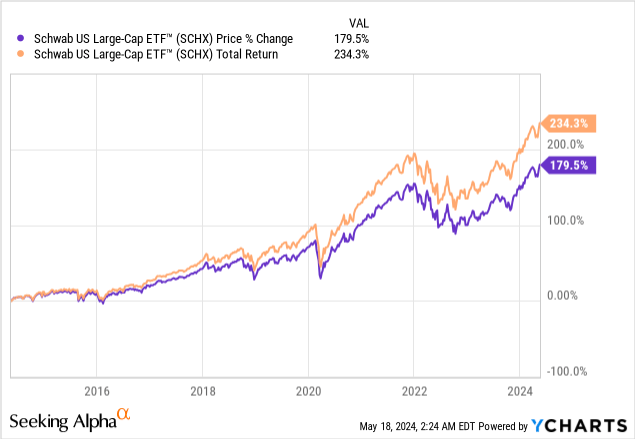

Schwab U.S. Large Cap ETF (Knee search:Shucus) has a portfolio of the 750 largest US stocks by market capitalization. This fund has historically achieved slightly lower total returns than the S&P 500 index, but has very similar returns. The composition of the portfolio is identical, even the top 10 holdings. Most of these top 10 stocks are technology stocks with high growth potential. These have been the primary drivers of SCHX and S&P 500 index performance to date, and are expected to continue to outperform for the foreseeable future. The proportion of the top 10 stocks in SCHX’s portfolio is slightly lower than the S&P 500 index because the S&P 500 index consists of only his 500 stocks, as opposed to his 750 stocks in SCHX. Therefore, SCHX is expected to continue to slightly underperform the S&P 500 index. Therefore, we believe there is no need for investors to own SCHX.

Y chart

Fund analysis

SCHX has been performing very well since the second half of 2022

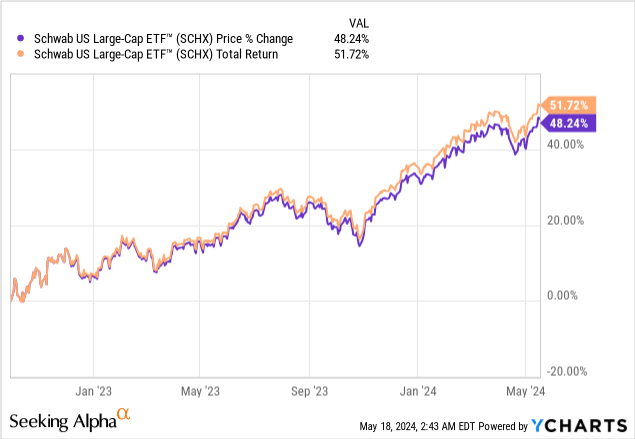

Similar to the broader market, SCHX has performed extremely well since reaching its cyclical low in October 2022. As you can see from the chart below, the fund delivered an impressive price return and total return of 48.2% and 51.7%, respectively. While this result is very good, it still falls short of the S&P 500 index’s total return of 51.1%.

Y chart

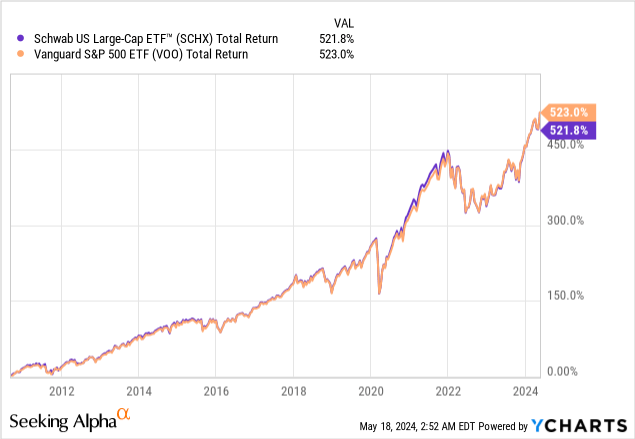

Since its inception in November 2009, SCHX has achieved an impressive total return of 521.8%. Despite this high return, it still falls short of the Vanguard S&P 500 ETF’s total return of 523.0% (VOO), tracks the S&P 500 index.

Y chart

SCHX has a very similar portfolio to the S&P 500 index

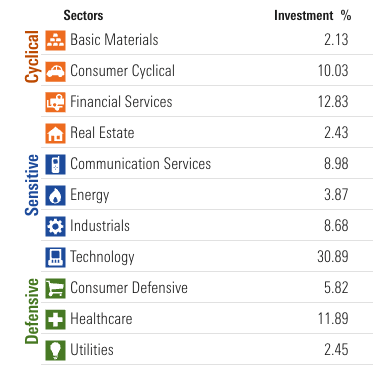

Based on the discussion so far, it appears that SCHX has consistently underperformed the S&P 500 index in the past. How do we explain this? Both SCHX and VOO have the same expense ratio of 0.03%, so this cannot be an expense ratio. Can it be a representative of the sector? As you can see from the chart below, SCHX’s three largest sectors are Technology (30.9%), Financial Services (12.8%), and Healthcare (11.9%).

Lucifer

Representative sectors in SCHX’s portfolio

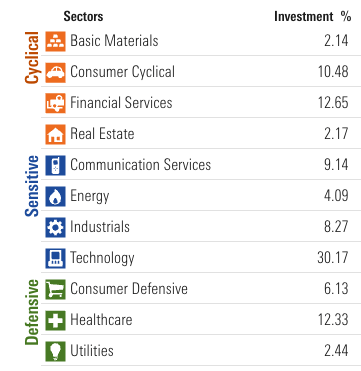

Meanwhile, the technology sector makes up 30.2% of the S&P 500 index, as the chart below shows. The second and third largest sectors in the index are financial services and healthcare, accounting for 12.7% and 12.3% of the index, respectively. In reality, the difference between SCHX and the S&P 500 index is small. The technology sector also has a higher representation in SCHX’s portfolio than the S&P 500 index, accounting for 30.9% of SCHX’s portfolio. This is 72 basis points higher than the S&P 500 index. This still doesn’t explain why SCHX performs slightly worse than the S&P 500 index, as SCHX has a higher proportion of high-growth technology stocks in its portfolio.

Lucifer

Representative examples of sectors in the S&P 500 index

The reason SCHX’s total return is slightly less than the S&P 500 index is likely due to the total number of stocks in the portfolio. As you know, the S&P 500 index includes approximately 500 large-cap stocks. In contrast, SCHX’s portfolio includes approximately 750 large-cap stocks. Considering that both make up the portfolio by market capitalization, SCHX’s top 10 stocks only represent about 31.1% of the total portfolio. In contrast, the top 10 stocks in the S&P 500 index (same as the top 10 stocks in SCHX) account for approximately 32.5% of the total portfolio. The difference is not that big. However, these 10 stocks like Apple (AAPL), Microsoft (MSFT), NVIDIA (NVDA),Amazon(AMZN), Metaplatform (meta), alphabet (Google) have been the main drivers of SCHX and S&P 500 index total returns in the past, and it’s not hard to see why the S&P 500 index has slightly outperformed SCHX since its inception in 2009. Because these technology stocks have a much higher percentage. The S&P 500 index is better than the SCHX portfolio.

Is SCHX expensive?

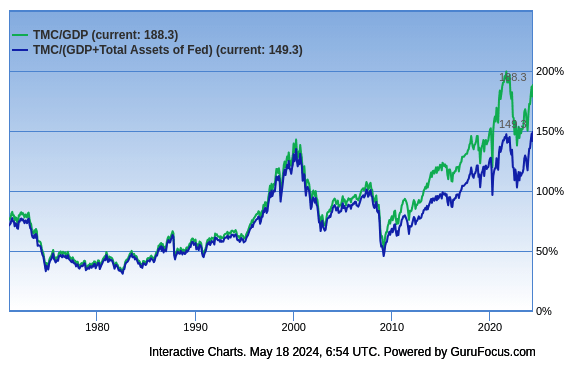

Because SCHX’s U.S. stock portfolio represents approximately 90% of the U.S. stock market, we believe one way to assess broader market valuations is to use the Buffett Index. This indicator basically uses the ratio of market capitalization to GDP to assess whether a country’s stock market is overvalued or undervalued. If the market capitalization to GDP ratio is in the range of 75% to 90%, the valuation is fair. If this ratio exceeds 90%, the country’s stock market is overvalued.

As you can see from the chart below, the Buffett indicator is currently at 188.3%. This is well above the 75% to 90% fair valuation range and near the high end of historical valuations. Even after taking into account the Fed’s assets, the ratio remains at 149.3%. This is still far above the fair valuation range.

GuruFocus.com

Can we simply conclude that the US stock market is overvalued? The answer is no. We believe investors should also note that many of the large companies in SCHX’s portfolio have significant revenues and profits derived from international markets. For example, Apple, Microsoft, Nvidia, Google, and Amazon all derive a significant portion of their revenue from international markets. Therefore, using US GDP as the denominator is not accurate. The US stock market is not cheap, but I don’t think it is extremely expensive either.

Key points for investors

SCHB’s performance has been slightly worse than the S&P 500 index in the past. It is also likely to slightly underperform the S&P 500 index for the foreseeable future, given its slightly lower exposure to top U.S. stocks by market capitalization than the S&P 500 index. Therefore, there is little reason to own SCHX unless you want to diversify your portfolio.

Additional disclosures: This is not financial advice and all financial investments involve risk. Investors are expected to seek professional financial advice before making any investment.