Nikaita

Gladstone Investments (NASDAQ:Nasdaq:profit) has been one of my favorite BDCs since I did a more thorough investigation in late December of last year. evaluation We have analyzed the fundamentals and determined that the risk and return profile is sufficiently attractive. length.

The motivation for recommending the purchase of GAIN comes from the following aspects:

- One of the lowest leverage levels in the BDC sector.

- Notable exposure to preferred stocks not only generates stable cash flows, but also increases upside potential in a declining interest rate scenario.

- We focus on cash flow companies that are already established in relatively defensive industries.

- Stringent underwriting standards reduce the risk of portfolio exposures and reduce the likelihood of meaningful receivables being recognized.

The counterargument was that GAIN’s small portfolio inherently limits the overall options space. Participating in LBOs, M&A, and other transactions typically requires significant external financing. Similarly, the fact that GAIN is not leveraging its leverage potential could theoretically suggest that the upside potential in an uptrending market scenario is decreasing. there is.

However, given my investment strategy of prioritizing defense over attack and focusing primarily on fundamental dividend sustainability, the aforementioned advantages were more than enough to compensate for the potential disadvantages.

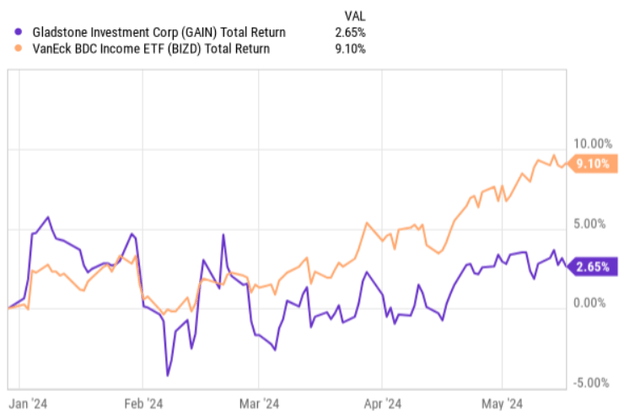

Since the publication of my bullish paper, GAIN has had a steady performance, but underperformed the BDC market. The BDC market has been experiencing tailwinds primarily due to strengthening ‘longer term’ interest rate scenarios. This is consistent with my assumption before recommending a purchase on GAIN. This means that a highly trending BDC market will likely lag the index due to lower leverage and a lower overall beta component.

GAIN announced Q4 2024. earnings reportThis reveals a new set of data points that are worth adding context to my current bullish theory. Let’s take a look at the earnings deck to determine if the bullish case remains intact.

Thesis examination

The fourth quarter sent mixed messages, but a deeper assessment shows that at the end of the day, the underlying business continues to have good momentum.

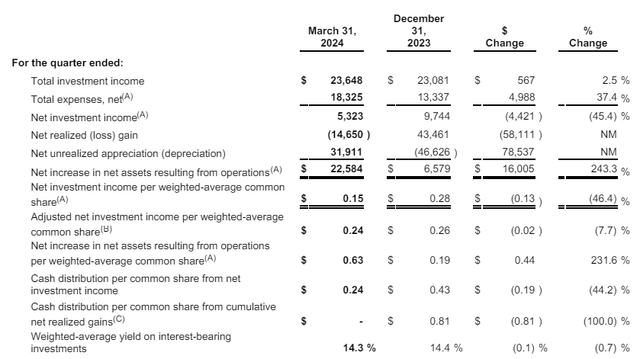

On the surface, the most jarring aspect of the fourth quarter’s results is that net investment income fell to $5.3 million from $9.7 million in the previous quarter. If you look at the top line, you’ll see that it actually improved by about $500,000, but the expanded cost base was what pushed down the bottom line number (i.e., net investment income). Net expenses for the fourth quarter were $18.3 million, an increase of approximately $5 million from the previous quarter. So if we stop here and contextualize this with the underlying dividend, it would be easy to conclude that the dividend is unsustainable and that GAIN will sooner or later adjust the dividend downward.

However, the main reason for the large increase in the net expense portion is the realization of equity investments that derive large capital gains from the embedded book value recorded when GAIN injected capital into the stock of companies in the relatively distant past. was associated with success in .

Therefore, although the increase in cost base was mainly caused by incentive fees based on accrued capital gains, this can be considered to some extent positive as it is a one-off and is attributable to a successful exit. Masu.

As the table below shows, the adjusted net investment, excluding these changes and focusing only on interest-bearing factors, was $0.24 per share. This was slightly lower than last quarter, when GAIN delivered his $0.26 per share performance.

This $0.02 per share decline was due to margin compression across the BDC segment and primarily GAIN’s success in exiting its equity position, thereby creating headwinds at top-line levels. This is also temporary, and even if he is unable to recoup his adjusted net investment income results, it would still be enough to cover the dividend.

Now, as a result of the exit, GAIN has been able to increase its NAV by $0.42 per share after making distributions. Therefore, this sale alone provided sufficient capital to cover the difference between adjusted net investment income and dividends, while also freeing up untapped liquidity that could be used to reduce debt or support additional investments. That means you have enough left.

But on a future basis, GAIN could boost its core net investment income by either reducing debt further or leveraging its fortress balance sheet to start taking on even more significant new investments. I guess it is. He has one of the lowest leverage profiles in the BDC space).

According to a recent commentary by President Dave Durham: financial statementWe also believe GAIN will continue to slowly but surely leverage its equity portfolio to unlock embedded value that should ultimately provide tailwinds to either the top line or balance sheet.

Our portfolio is mature and has been since 2005, and with our stock value where it is today, it is clear that we can continue to earn returns constructively for the benefit of our shareholders. As you all know, this model allows us to stay in some of these companies for a long time, and it’s really in the interests of our shareholders to not have to quickly exit companies that are no longer sustainable. . they. We continue to balance the timing of our exits while maintaining the income-producing asset levels necessary to maintain currently achievable monthly dividend levels, and hopefully continue to grow our dividends over time. I think so.

conclusion

At first glance, recent quarterly results may seem to indicate that the company’s deteriorating performance has led to unsustainable current dividend levels.

However, if you peel back the onion a bit, it is only a successful realization of previously made equity investments that introduced incentive fees based on accrued capital gains, resulting in lower net investment return results. That becomes clear.

However, the fact that GAIN was able to sell one of its shares improved its NAV base and strengthened its liquidity profile. This not only covered temporary gaps in dividend coverage, but also gave management more flexibility to reduce the dividend. Take on more debt or direct this capital to new interest-bearing investments. Either of these should ensure a higher net investment return result.

Given the aforementioned dynamics and the clear value potential of the Gladstone Investments stock portfolio, this stock is a buy.