Funtap/iStock (via Getty Images)

introduction

After several attempts over the past year or so, I decided now was the time to go long the US REIT market, which is set to recover in 2024. I build my REIT portfolio as part of an income bucket (based on 6% of distributions) and a total value income bucket (which includes battered sectors).

One of my favorite choices among REIT holdings is the Cohen & Steers REIT and Preferred Income Fund (New York Stock Exchange:RNPCohen & Steers is known for managing some of the best CEFs in the space, and RNP is one of the highest quality REIT-focused CEF funds. Combined with its high-yield bond holdings, it pays a monthly dividend of 7.89%, which is attractive and competitive in the current income market.The ETF’s counterpart The most popular REIT ETF VNQ pays out only about half of its yield in dividends. RNP uses high leverage, with an effective leverage of 31.53%. With modest interest rate cuts expected by the Fed in the near future, RNP’s high leverage may begin to have positive consequences for the fund’s returns, as the fund was designed to do. He wants to be prepared for a significant recovery in REITs after 2024, and recommends RNP to those seeking high yields.

RNP Fund Premier

RNP is a closed-end fund established in June 2003 and managed by Cohen & Steers, one of the industry’s premier asset managers. The Fund’s primary objective is to provide high-yield income, with capital appreciation being a secondary objective. The strategy that RNP deploys to achieve its objectives is to invest in REIT stocks, preferred stocks, and other debt securities such as corporate bonds.

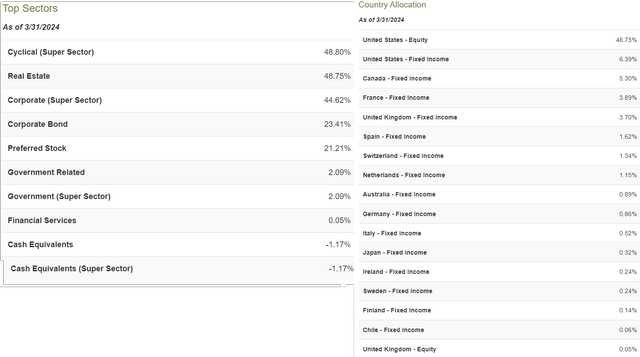

The fund is global in nature and invests in many countries around the world. It accounts for more than 48% of investments in the US stock market, with Canada and France close behind in second and third place. Other invested countries are the UK, Spain, Switzerland, the Netherlands, and other countries with very small weights.

Below are the top sectors of the fund’s portfolio. Real estate accounts for 48.80% of the total. As we’ll discuss later, those are primarily large-cap and top-quality his REIT companies.

RNP top sectors and country allocation from CEFConnect

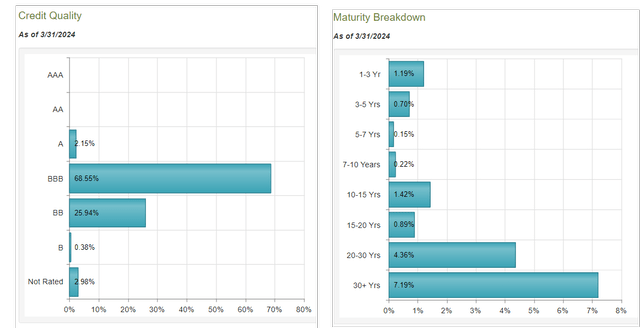

Note that RNP has the majority of its investments in fixed income assets, including corporate bonds and preferred stocks. This credit is of low quality and primarily intended to generate high yields, most of which are rated BBB (68%) and BB (26%) and have long durations.

RNP bond information from CEFConnect

This allows the fund to maintain high yields and maintain some stability. As a result, CEF’s volatility level is comparable to his non-leveraged ETF VNQ. RNP’s effective leverage is 31.49%, which is about the average level for his CEF of this kind.

Actively managed funds are rational in the REIT market

I’ve spent a lot of time over the past 12 months analyzing individual REIT stocks. Given that each REIT may have hundreds of properties in which to invest, the amount of time and effort spent can be significant. Ultimately, I believe this type of careful due diligence can also be left to industry experts such as Cohen & Steers and other top firms in the field. Adding CEFs and actively managed ETFs to your portfolio makes sense not only for proper diversification but also to form a solid foundation for your REIT portfolio.

A top-notch management team makes the difference. Cohen & Steers is recognized as one of the foremost experts in understanding and managing real estate assets. Motivated by the fund’s performance, management tends to pick leaders in growth areas such as cell towers, data centers, and industrials. Below are the top 10 REIT holdings (32% of the total). These REITs of his are large-cap blue chip stocks in their industries. Many of these are the same stocks I selected based on my homework.

CEFConnect’s RNP Top REIT Holdings

It’s important to note that CEF management knows which REITs to avoid. This is actually an advantage of CEFs over index ETFs, which have not been able to avoid lower quality REITs in their portfolios for indexing purposes. This benefit is often overlooked, but in my opinion, it is the key to a fund outperforming its benchmark ETF. Typically, the top holdings will be very similar for both CEFs and ETFs.

RNP is considered one of the best CEFs and has a 5-star rating from Morningstar, as shown below.

RNP 5-star rating by Morningstar

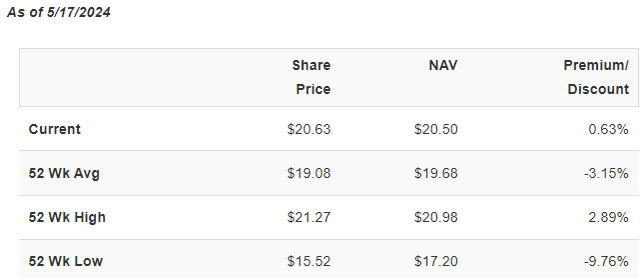

RNP is currently trading at a small premium (0.63%) to NAV. Some investors may want a small discount to avoid paying more than the current value.

RNP NAV information from CEFConnect

I view this as a fair premium for a fund with 5-star status and very well managed, but any additions that could facilitate the fund’s upside potential, especially in the long run. Some people may be hoping for a catalyst.

REITs are still in the doghouse, with prices at five-year-old levels and NAVs at deep discounts.

REITs are one sector where prices are still holding at levels from five years ago. It is currently the worst performing sector in the market. I think now is the time to invest in REITs. Stocks are cheap today after falling significantly over the past few years due to COVID-19 and rapid interest rate hikes by the Fed. According to S&P Global market intelligence data, The REIT sector is at a median discount of 19.1% to consensus as of April 30th. The valuation is approximately 25% lower than historical standards, making it attractive on a historical basis.

From a market perspective, I believe the REIT market has already priced in a “higher for the long” interest rate regime. As time passes, it is becoming increasingly clear that the REIT market will inevitably recover. It makes little sense to me that market sentiment is still skewed bearish towards his REIT sector as the overall market continues to hit new all-time highs.

Indeed, even after the overall market has risen significantly and the S&P 500 and S&P 500 indexes have reached all-time highs, macro uncertainties such as interest rate cuts, the economy, and inflation still cast a big cloud over the real estate market. REIT investments are on hold. However, if the Fed begins to lower interest rates, it will not only reduce the interest expense burden on RNP, especially due to its high leverage, but it will also increase the value of the underlying REIT assets in the portfolio.

What is actually shown is Recent SA reports“With the possibility of rate hikes ruled out, real estate stocks have already begun to outperform major market averages, and earnings continue to grow.” The REIT market is likely to continue to perform well. think.

I am actively building a REIT portfolio as part of an income bucket (based on a 6% distribution threshold) and a total value income bucket (including distressed sectors). The second part is based on my expectations for a strong REIT recovery in 2024. RNP plays a good role in my current REIT portfolio.

Risks and precautions

In the short term, rising interest rates are the main risk for REITs. Although the Fed has recently ruled out raising interest rates, inflation is not trending down well into 2024. It is still possible that rising inflation statistics will force the Fed to change its interest rate policy. As interest rates rise, the leverage burden could also reduce the performance of some of his REITs within the ETF portfolio. As discussed earlier, the Fund’s premium may prevent the Fund from increasing further in price.

On the other hand, more than half of high-yield stocks are not REIT stocks, so if a full-fledged REIT recovery gets on track, they may have an impact on price increases. Once that happens, we might look for alternatives with higher REIT holdings.

conclusion

REIT-specific CEF RNP is considered one of the best CEFs. It offers a very high dividend yield and looks attractive in the REIT sector. A gradual rate cut by the FED will ensure very favorable conditions for RNP to outperform his REIT ETFs. RNP’s high leverage could start to work in its favor in the current interest rate cycle, where interest rates are peaking out. Furthermore, there is a good chance that the REIT market will make a significant recovery. REIT investors may find this a very attractive opportunity to buy the stock now for strong total returns in 2024.