Tas Photo NL

Investment Thesis: I remain bullish on ABN AMRO.

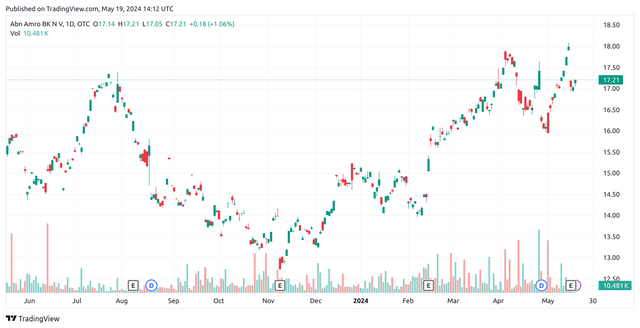

previous article In January I purchased ABN AMRO Bank NV (OTCPK:AAVMY) Possible rebound to $16-18 levels We expect mortgage demand and net interest margins to continue to increase.

This has since come true, with the stock price up nearly 20% since our last article to $17.21 at the time of writing.

The purpose of this article is to assess whether ABN AMRO has the ability to rise further from here.

performance

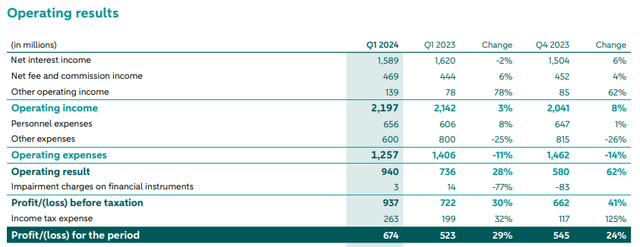

Looking at the revenue for the first quarter of 2024. result ABN AMRO’s results published on May 15, 2024 show a slight increase in operating profit of 3% year-on-year, which is lower than the net interest income announced on May 15, 2024. This was driven down by a 2% decline in sales. same period.

ABN AMRO Bank NV: Q1 2024 Quarterly Report

However, we also see that operating expenses decreased by 11% and overall profit increased by 29% during this period compared to the same period last year.

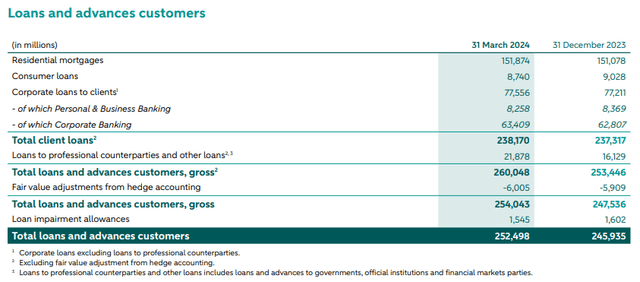

It shows that mortgage loans (which accounted for more than 63% of total customer loans in the latest quarter) increased by €796 million from the previous quarter.

ABN AMRO Bank NV: Q1 2024 Quarterly Report

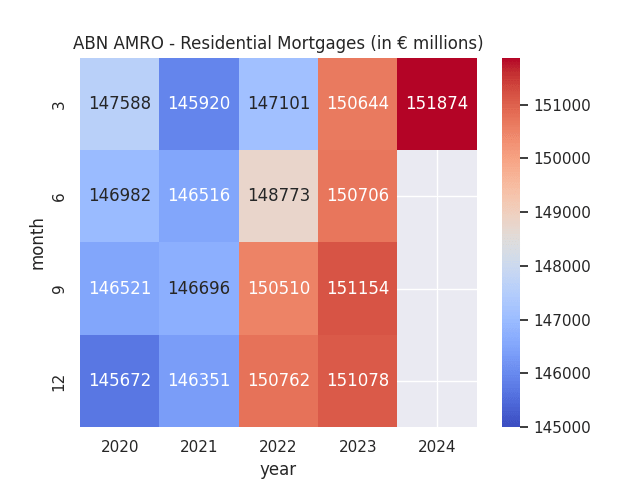

Looking back over the past five years from a longer-term perspective, we see that mortgage lending is currently at its highest level in this period, increasing by €1.23 billion year-on-year.

Figures sourced from ABN AMRO’s past quarterly reports (Q1 2020 to Q1 2024). Plots were generated by the authors using the seaborn visualization library in Python.

According to ABN AMRO, house prices in the Netherlands continued to rise in the first months of 2024, approaching the all-time high recorded in July 2022. In addition, house prices rose by 6.5% compared to the first quarter of 2023, and consumer confidence rose to 85. 72 in June 2023 to March 2024.

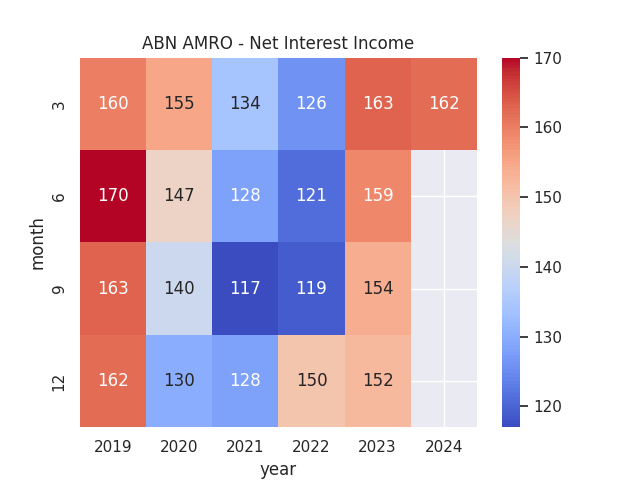

Looking at the trajectory of ABN AMRO’s net interest income, this metric has seen significant growth over the past two years due to rising interest rates, but is now starting to level off, with NII slightly lower than in the same period last year . .

Figures (basis points) are sourced from ABN AMRO’s past quarterly reports (Q1 2020 to Q1 2024). Plots were generated by the authors using the seaborn visualization library in Python.

with growth speculation We expect that the European Central Bank’s planned interest rate cuts in June may put further downward pressure on net interest income going forward. However, we are encouraged by the fact that customer loans continue to increase overall, and we expect continued housing demand to continue to drive loan growth.

Risks and future prospects

My take on these results is that it is encouraging that increased demand for mortgages has driven overall growth in total customer loans.

In my previous article, I stated that I would pay close attention to future developments in net interest income, as demand for deposits is expected to increase due to rising interest rates. This is expected to result in lower net interest margins based on the fact that banks earn less interest income from loans compared to deposits.

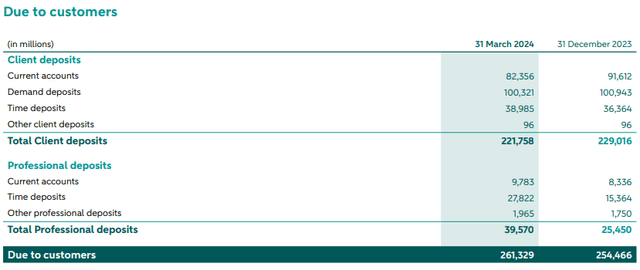

However, while total customer loans showed a slight increase of 0.36% compared to the previous quarter, total customer deposits actually decreased by -3.17% over the same period, with the decline mainly in the current account sector. This is a factor.

ABN AMRO Bank NV: Q1 2024 Quarterly Report

The decline in customer deposits was driven by a variety of factors, including seasonal tax payments and dividend distributions, as well as increased year-end operating expenses.

From this perspective, when interest rates remain flat, deposit growth also remains flat. With interest rates potentially falling and businesses using deposits for services, leaving your money on deposit is becoming a less attractive option. Expenses instead.

In this regard, I believe that net interest income may continue to increase.

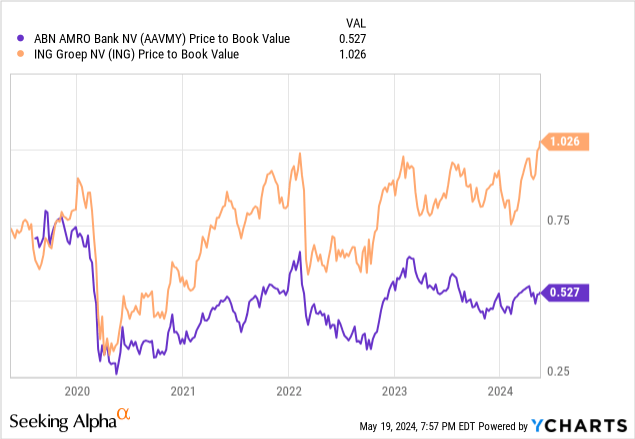

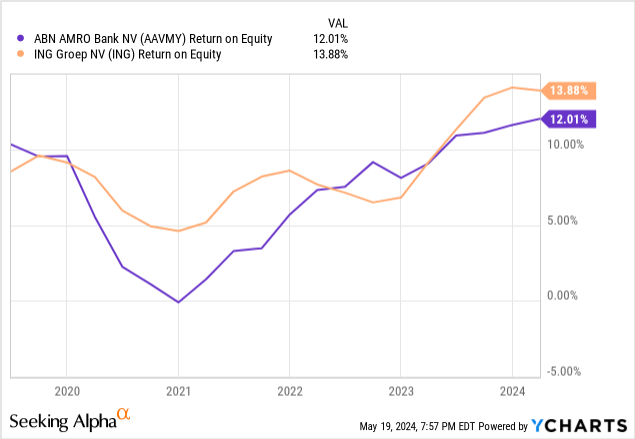

ABN AMRO’s price-to-book ratio and return on equity compared to its competitor ING Groep NV (ING), we see that the former is trading at a lower price-to-book ratio and has a similar return on equity.

Reserve Price

YCharts.com

Return on equity

YCharts.com

From this perspective, I think ABN AMRO is still an attractive value at this point, and the stock price could rise further from here.

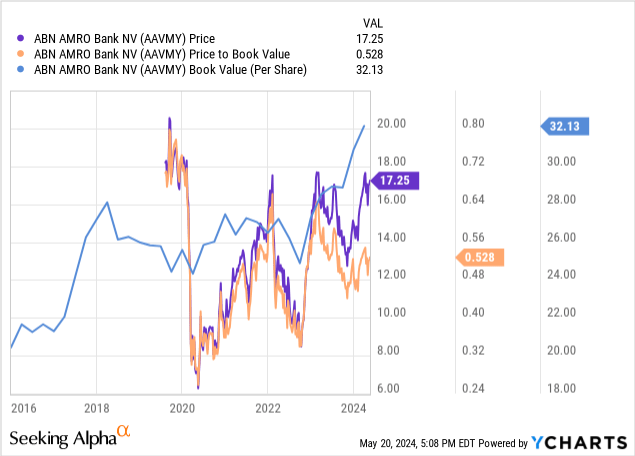

In particular, it’s interesting to note that the share price has diverged from its price-to-book multiple over the past year. We can see that at the beginning of 2023, when the price was hovering at a similar level, the price-to-book multiple was also trading at 0.64x compared to his current level of 0.528x.

YCharts.com

If the price-to-book return is 0.64x, I think the stock could break through the $20 mark given a book value of 32.13 per share (32.13 * 0.64 = 20.5632). If the current growth trajectory in terms of overall mortgage and loan growth continues, I expect investor confidence in the stock to increase, reflected in higher price-to-book multiples.

In my view, the main risk for ABN AMRO at the moment is the potential for a sharp decline in mortgage demand. House prices are rising again, showing that demand remains strong. However, if we see a situation where high prices start to raise affordability concerns among potential buyers, this could mean a decline in mortgage demand, leading to a decline in overall loan demand. It is expected that it will have a negative impact.

Conclusion

In conclusion, ABN AMRO continues to see growth in gross customer loans and mortgages, and net interest income remains at a similar level to last year.

I remain bullish on ABN AMRO.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.