Just_Super

since me I have written About microvision (Nasdaq:MVIS) As of March 2023, the company continues to focus on the consumer automotive ADAS space. At the time, I gave MicroVision a sell rating because I was skeptical about buying a bankrupt German company. Ibeo. My rationale was simple and clear. Ibeo was abandoned by all its investors and went bankrupt. Therefore, the product was of high quality and not worth recalling.

We were surprised that MicroVision, which specializes in MEMS technology, chose to go with frequency-based flash LiDAR, but as mentioned earlier, this wasn’t enough to sustain the original investors. .

Because MicroVision was focused on consumer automotive ADAS, IbeoNext was not of interest to OEMs looking for a future-proof, long-range sensor with a 120-degree horizontal FoV and 30-degree vertical FoV.

MicroVision touted this as an opportunity for a broader product offering.i guessed This was a rescue mission to maintain presence while their flagship homegrown product, MAVIN, failed to gain much traction. Still, the buzz helped his MicroVision regain its status as a meme stock. As a result, stock prices soared and ATM sales increased significantly. Initially, management tried to issue shares in a standardized offering, but faced a sharp decline in value and was forced to withdraw the idea from the market.

In Q3 2023, the company hinted while participating in an RFQ that it was on the verge of winning a nomination for its MAVIN sensor, with Ibeo’s Next sensor (now renamed MOVIA) also in the running. However, the year ended without a win. During the fourth quarter conference call in March 2024, CEO Sumit Sharma reported that he was participating in nine RFQs and assured that they could be announced by the end of the first quarter. did.

He eloquently explained that to win the nomination, Microvision must have the resources to develop to production, with cash being one of the most important requirements. In response, the company announced its new $150 million ATM and immediately began selling it. The first quarter records showed $20.7 million was cashed out, leaving $128 million. In 2023, ATM sales by Microvision brought him $73 million.

The lack of wins in the first quarter disappointed everyone in the consumer automotive ADAS industry. Cepton (CPTN) announced the acquisition of a global truck OEM through its partner, majority shareholder, and potential acquirer Koito (OTCPK:Kotme). MicroVision admitted that he was shortlisted with only 7 of his RFQs and lost in 2 of them, including his one for MOVIA in the Trucks category.

I suspect Cepton, with Koito’s backing, outbid Microvision in the Daimler Trucks bid, with Microvision reporting as a buyer for $500,000 worth of sensors in Q10. Was.

What surprised me the most was read The CEO speaks frankly about the background of the RFQ negotiations. The CEO described OEMs as inconsistent and hesitant even after making initial commitments.

“Furthermore, we often see OEMs that have appointed other LiDAR companies in the past few years actively working to evaluate us as an alternative, even though their other projects have not been commercialized. I’ll see you.”

He hinted that OEMs are looking for cheaper products with top-of-the-line functionality from companies willing to invest resources at the expense of shareholders.

“Each RFQ requires OEMs to make significant customizations of hardware, firmware, and recognition software. Customization and qualification timelines are long, requiring hundreds of engineers over several years. Commercially, , they want the OEM to pay for this customization, but they expect these large costs to be amortized over 5 to 7 years over the large number of units shipped and passed on to the investors. I look forward to that.”

Requires flexibility and adaptability to adapt to any situation:

“All OEMs want different levels of awareness. Some run inside the LiDAR, some run in the ECU, some say they don’t need awareness, but they need the source code. Some OEMs want to include LiDAR in their lines, while others want it integrated into the headlamp or headlamp.Others are looking at just behind-the-windshield integration. While we would like our core LiDAR to be flexible enough to fit in all locations, we recognize the trade-offs at each location, but may require updates to the core hardware. Become.”

MicroVision’s CEO hinted that companies like Innoviz are (INVZ) and Luminar (laser) Going through this process to win would have secured nominations from BMW and Volvo, and he was highly critical of their actual value.

“Whatever they announced regarding BMW, yeah, I’ll let them stick to it. What was the first order they received and the last order they received.”

and:

“So I think it’s great to release numbers, but wouldn’t it be great to see how much revenue is actually coming in from BMW? We look forward to hearing from you in the next few months.” Doing.”

CFO Anubhav Verma summarized the following three criteria for the nomination.

“Any LiDAR company that announces a significant serial production award with a large-scale commitment is under greater pressure for three reasons. First, the increased revenue from such wins will initially secondly, even if production has started, production volumes are far from the announced targets; and thirdly, the cash costs of industrialized products are high; There is an unanticipated financial loss to individual cash consumption as projects with lower volumes have to bear higher costs.”

Additionally, the CFO said of Luminar, which has $600 million in convertible debt:

“We employ a long-standing business model with low cash burn and low capital usage to stay ahead of the curve compared to all other LiDAR players. Our products are mature and Unlike our competitors, we don’t have to invest in the next generation of MAVIN or MOVIA. This is a very clear differentiation for MicroVision because our capital needs are not as intensive as others. We are able to raise capital very opportunistically and we are not in a hurry to put pressure on the stock price like other industry players.”

I think it’s hard to distinguish MicroVision from other companies in its efforts to secure consumer automotive ADAS candidates. Their transparency about the challenges they faced in securing deals and their assessment of how bad other companies’ deals were makes me wonder. If Luminar and Innoviz adopt something, will any of his OEMs consider her MicroVision as an RFQ candidate?

I also don’t see any difference between MicroVision’s $150 million ATM and Luminar’s ATM. Although Luminar has higher cash requirements, MicroVision will continue to spend $70 million annually on operating activities, and with minimal gross margins he expects to generate an estimated $9 million in revenue in 2024. The company hasn’t won a deal yet, but if it does, expenses will likely increase. The only difference is the current state and duration of funding needs, which are likely to change depending on the appointment. MicroVision, like Luminar and Innoviz, also reduced its headcount by 18% to reduce cash burn.

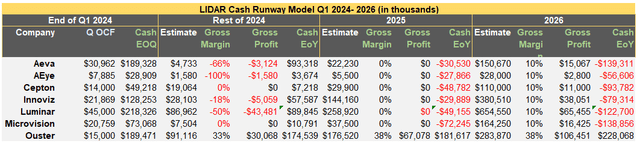

MicroVision cannot hypothesize or maintain its daily operations without ATMs. In this state, MicroVision is similar to its direct competitors. The table below shows the cash position of all Western LiDAR companies, with MicroVision having the least cash remaining in 2024 among companies with large market capitalizations.

ATMs in 2023 brought in $72 million, about the same as first quarter cash levels. During the first quarter, the company sold $20 million of its new $150 million ATM to cover quarterly net cash used in operating activities. This trend, similar to Innoviz’s cash usage, creates a cycle of issuing new ATMs every two years. The difference is in the timing. Innoviz needs funding beyond 2025, MicroVision needs funding in 2024 and 2025.

LIDAR Cash Runway Q1 2024 (author, financial statements)

I think it would be hard for MicroVision to win the nomination for other reasons. There is no indication that their product is better today than it was a year or two ago when other companies were winning OEMs. It’s not just about the terms of the deal, and I agree that that doesn’t underpin financial success, but many new prototypes on the market offer smaller, better form factors at much lower costs.

When the CFO said there was no need to develop mature products such as MAVIN, which is in the prototype stage, or MOVIA, which Ibeo manufactured in 2018, to me these products are candidates for the RFQ for SOP nomination in 2028. It becomes difficult to think. Why are OEMs committing to multi-year development cycles with first-generation products? Unlike MEMS technology, polygon mirrors and rods appear to be taking over designs in the next phase of competition.

In my view, OEMs are looking for exactly what MicroVision is missing: next-generation products. MOVIA may bring in some revenue, but I don’t think it will significantly advance the company’s cash position. Additionally, we are not certain that MicroVision’s software offers sustainable revenue potential.

On the positive side, while ATM is currently the only source of support for day-to-day operations and is essential to securing a nomination, winning could result in additional non-recurring engineering (NRE) income . Such revenue could effectively reduce the frequency of ATM usage and slow or perhaps stop dilution. What MicroVision needs is a win that generates interest in the stock, especially among retail investors, gives them a reason to stay invested, and creates room for the stock price to rise. Under these conditions, dilution is not a major problem.

The current situation will certainly change, even if only temporarily. I believe that consumer automotive ADAS remains a financially draining endeavor that permanently dilutes and erodes shareholder value on an annual or semi-annual basis for all companies focused on this space. . I recommend avoiding it until you have a positive gross profit.

Barring a win, we believe MicroVision’s stock price will continue to decline, possibly below $1, necessitating a reverse split. I continue to rate MicroVision as a sell.