Andreus K/iStock via Getty Images

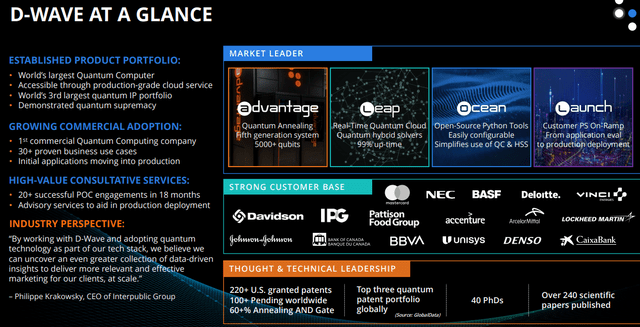

D-Wave Quantum Inc. (New York Stock Exchange:QBTS) offers a specialized approach to solving real-world optimization problems and has emerged as a leader in quantum computing. These systems are considered more effective for certain applications compared to GPU-accelerated computing.

The company’s latest quarterly results highlighted impressive growth and solid profit margins. On the other hand, the challenge here is that this business is still small, with less than his $10 million in revenue over the past year. D-Wave is currently unprofitable, and it could take years for key metrics to turn around.

We believe there are great opportunities for our company in the long term, but there is too much uncertainty at the moment and there is a lot of work to do. With the stock trading at more than 21 times sales, QBTS’s volatility is expected to remain high.

QBTS Q1 Earnings Summary

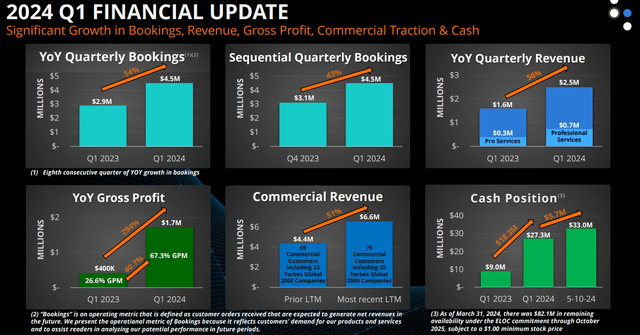

QBTS Q1 EPS -$0.11 Net loss was -$17.3 million. Revenue for him was $2.47 million, up 56% year-over-year, but not close to the consensus estimate of $3 million for him.

On a positive note, bookings reached $4.5 million, up 43% from the fourth quarter, illustrating the continued growth tailwind.

D-Wave Quantum now has 128 customers, compared to 113 in the previous quarter. Of these, 75 were commercial customers, up from 69 in the fourth quarter. This is important because commercial accounts are considered high-value transactions compared to academic and government customers.

of Gross profit margin 67.3% As a result of efforts to control expenses, adjusted EBITDA of -$12.9 million decreased from -$16.9 million in the same period last year.

We see several key themes driving business. D-Wave is the latest generation technologyAdvantage 2This move gives D-Wave the “world’s largest quantum computer” that customers can access via cloud services.

master Card (Ma), Johnson & Johnson (JNJ), Lockheed Martin (LMT) are identified as customers. The idea here is that the rapid turnaround in AI applications over the past year has brought increased attention to how quantum computing can perform more effectively at certain tasks compared to GPU-accelerated computers. That’s it.

This was pointed out by CEO Alan Baratz during the earnings call. Conference call:

D-Wave is the first company in the world to demonstrate quantum supremacy on a real-world problem. This groundbreaking research was achieved using our latest generation Advantage2 quantum computer and demonstrated that our quantum processes can solve classically unsolvable problems. Again, due to continued misinformation in the marketplace, we believe we have achieved a demonstration of quantum supremacy, not quantum advantage or quantum utility as is commonly understood in the community. Our results go beyond classical computation.

The company also Quantum Computing Pilot Program Short-term applications. Quantum technology is becoming a growing priority at the Department of Defense and could boost D-Wave’s growth prospects.

In terms of financial guidance, management’s only stated goal is for the 2024 adjusted EBITDA loss to be “less than the 2023 adjusted EBITDA loss of $54.3 million.”

What’s next for D-Wave Quantum?

Beyond all the buzzwords, we feel that while growth over the past year has been strong, the market wants more. The reality here is that building a quantum computer costs a lot of money, so the company will need to continue to spend and invest heavily to drive its commercialization strategy and continue advancing the technology.

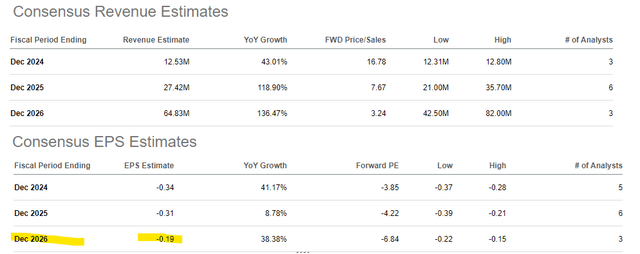

So while there’s a good chance that QBTS will generate significant growth over the next few quarters, the question is whether that path will be enough to start approaching sustainable profitability.

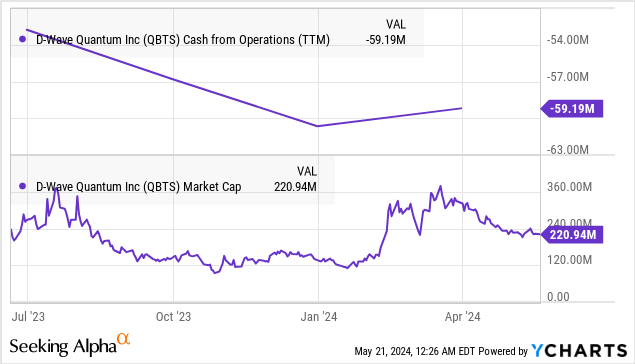

Consensus projections call for sales to grow from $9.8 million last year to $27.4 million in 2025 and $65 million by 2026. Still, EPS is negative for the period, so recurring cash burn is likely going to be an issue weighing on the stock price over the long term.

D-Wave reported a cash position on its balance sheet of $33 million as of May 10. This includes: $175 million on shelf This effectively gives the company the option to raise that amount at any time through a stock sale, effectively diluting current shareholders.

There is also an active equity credit facility, which allows D-Wave to borrow up to $83 million if needed, in addition to its $72 million total debt. Overall, short-term liquidity is not an issue, but it is clear that balance sheet and cash flow are fundamental weaknesses and important risks to consider.

This takes into account the company’s current market capitalization of $221 million, compared to a loss of $59 million in cash from operations last year. After all, the stock faces enough headwinds to justify even a 16x forward price-to-sales multiple.

final thoughts

D-Wave is an interesting stock with a lot of promise, but it’s still too early in its growth process to be considered an investment. On the upside, we would like to see growth accelerate again, with evidence of orders and sales gaining momentum above an already strong expected baseline.

The main risk to consider is increased cash burn due to increased spending and investment. A weaker-than-expected result could force the market to reassess its outlook, potentially pushing stock prices down significantly. The important point to monitor here is the movement in the number of outstanding shares.

Editor’s Note: This article discusses one or more microcap stocks. Please be aware of the risks associated with these stocks.