rear chic

One of my key themes this year remains the risk of credit mispricing and how high-quality duration increases the likelihood of future performance. Obviously, I haven’t gotten either one right so far.and maybe I won’t succeed End of the year. If I’m wrong that disruption is brewing and the period is still fragile, then the SPDR® Portfolio Short-Term Corporate Bond ETF (Knee search:SPSB) may be one of the funds you want to allocate to. This ETF is available to investors seeking stable but low-return exposure to short-term corporate bonds.

SPSB seeks to provide investment results that closely match, before expenses, the price and yield performance of the Bloomberg U.S. 1-3 Year Corporate Bond Index. SPSB was established on December 16, 2009 and invests primarily in short-term corporate debt securities issued in the United States. Provides investors with liquid access to the performance of short-term US dollar-denominated investment grade corporate bonds with maturities of 1 to 3 years. They typically have lower levels of volatility compared to corporate bonds with longer maturities. SPSB’s assets exceed his $7.69 billion, indicating his overall popularity in the ETF space.

Holdings overview

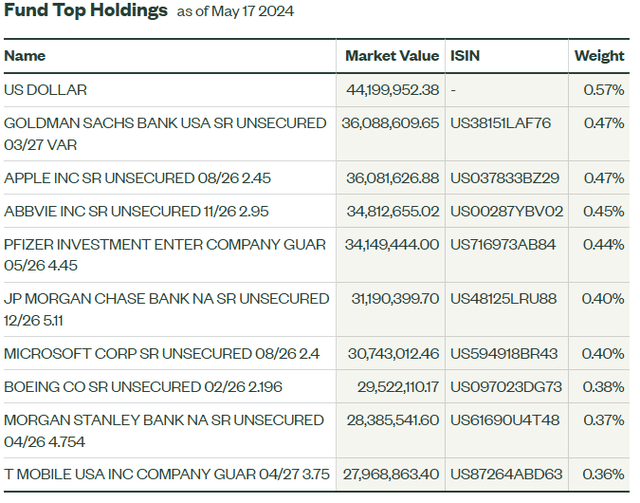

SPSB’s portfolio includes bonds from a variety of issuers. With no position exceeding 0.57% of the fund, it is very diversified, which in my opinion is a big plus.

S.S.G.A.

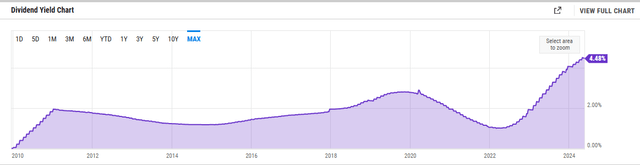

Looking at the fund’s yield history, its yield is at an all-time high, which is not surprising considering this cycle of rising interest rates. 4.48% is nothing to sneeze at.

Y chart

Sector composition and weighting

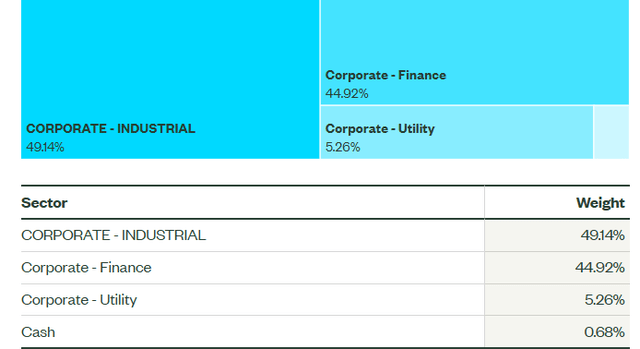

Just under half of SPSB, 49.14%, is allocated to the industrial sector. The financial sector accounts for 44.92%, while utilities account for the remaining 5.26% allocation. This is a fairly typical allocation given the amount of debt these two sectors have put on the market. Personally, I would like to see more exposure for utilities, but overall it’s not surprising.

S.S.G.A.

peer comparison

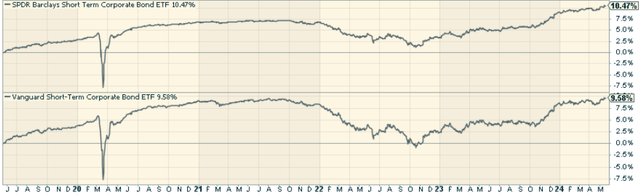

One similar fund is the Vanguard Short-Term Corporate Bond Index Fund ETF (VCSH). The sector composition is somewhat similar, with industrials accounting for 49% of the fund and financials accounting for 43%. Looking at performance, SPSB is slightly better, but overall the two perform about the same.

StockCharts.com

Pros and cons of investing in SPSB

There are many reasons why investing in SPSB is a good idea. First, SPSB is not a high volatility investment. Because bonds have short maturities, they are not affected by changes in interest rates that often disrupt investors’ portfolios. The rate of return for bond purchases is much more predictable. This allows SPSB to protect capital and deliver strong and stable returns. Another factor worth considering is the fund’s low expense ratio of just 0.04%. Finally, SPSB is a well-diversified investment, spread across hundreds of different securities, which provides greater stability compared to most other investment vehicles.

But there are also potential pitfalls. The lower risk associated with short-term bonds typically results in lower returns than those obtained from long-term bonds, limiting the potential for higher investment returns. Additionally, a fund’s performance is closely related to the credit quality of its holdings. If the issuer’s creditworthiness deteriorates, its performance and the value of the Fund may be affected. Although SPSB is well diversified through its sector allocation, it may become too concentrated in the industrial and financial sectors if they are hit by a recession.

Conclusion

I view SPSB as a money market alternative that offers higher returns and diversified investor exposure. The fund’s focus on short-term, investment-grade corporate bonds means that the potential risk of capital loss is low, and the low expense ratio further contributes to cost savings for investors. Given its diverse portfolio of nominal bonds and various fixed income indices, SPSB is very attractive to retail investors who want to diversify their portfolio and minimize risk. I think duration makes more sense at this point in the cycle. However, this is more of a personal view, and even if I’m wrong, it makes more sense to allocate here in the short to medium term.

Predict crashes, corrections, and bear markets

Predict crashes, corrections, and bear markets

Tired of being a passive investor and ready to take control of your financial future? Check out the Leadlag Report, an award-winning research tool designed to give you a competitive edge. This is an introduction.

The Lead-Lag Report is your daily source for identifying risk triggers, uncovering high-yield ideas, and capturing valuable macro observations. Stay ahead of the game with key insights about leaders, laggards, and everything in between.

Move from risk-on to risk-off easily and confidently. Subscribe to the Lead Lag Report now.

Click here to access and try the Lead Lag Report for free for 14 days.