Matteo Colombo

Mid-cap stocks are an often forgotten group of stocks in the U.S. market. While all eyes are on the Magnificent Seven, which led the S&P 500 large-cap index to record highs over the past year, domestic small-cap stocks are also struggling. As we approach our peak in late 2021, mid-cap stocks are typically relegated to an area of focus for only the most nimble asset allocators. But I see encouraging signs in this area.

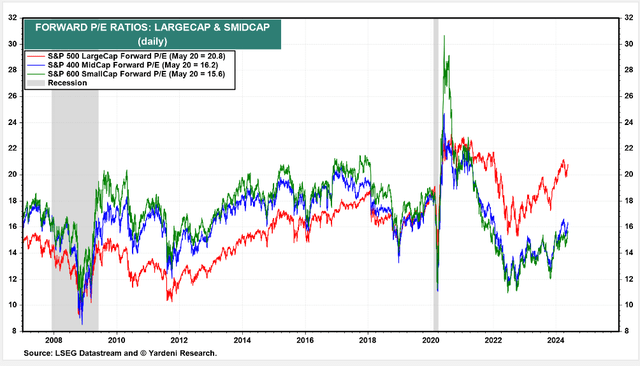

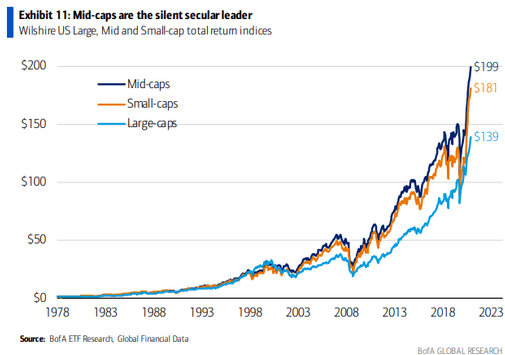

I Upgrading iShares Core S&P Midcap ETF (Knee search:IJHAt just 16x price-to-earnings, it’s more than 4x cheaper than SPX and only slightly higher than the S&P SmallCap 600, so I think IJH has the best of both worlds.For long-term investors, mid-cap stocks are actually Best long-term returns Among all three size profiles.

S&P MidCap 400 Forward P/E: Just 16x, significantly cheaper Comparison with 3 years ago

Yardeni

Medium caps have the best performance of the three size groups

BofA Global Research

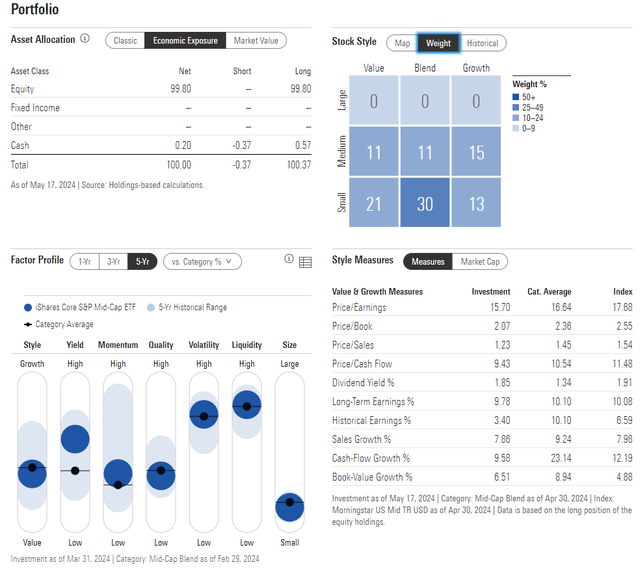

According to its issuer, IJH seeks to track the investment performance of an index composed of mid-cap U.S. stocks. The fund’s benchmark is the S&P MidCap 400 Index. As a low-cost, tax-efficient index ETF, it represents a solid option for long-term investors looking to diversify away from typical traditional portfolio holdings of large and small cap stocks.

IJH is a very large ETF, commonly held by investors looking for diversification in the U.S. stock market. Its assets under management are currently $85 billion, up from $63 billion when I last reviewed the ETF over a year ago. Very low annual expense ratio of 0.05% and The dividend yield is small at 1.3%.Funding Stock price momentum It has improved in recent months, rising from an ETF grade of B to A- by Seeking Alpha, and is testing all-time highs as we approach the second half of the year.

Despite significant cyclical exposures, Risk assessment is strong meanwhile Liquidity IJH’s stock price is very healthy. His average daily trading volume is over 6 million shares, but his 30-day median bid-ask spread is a tight 1 basis point.

Looking closer at the portfolio, the Morningstar Silver-rated 4-star ETF is spread across the bottom two rows of the style box, with no significant changes in either value or growth styles. As mentioned earlier, the low P/E ratio is solid considering the 10% long-term earnings growth. Look for earnings growth to improve for the Mag 7 stocks in 2024 as well. contribution Overall U.S. EPS growth is expected to slow.

IJH: Portfolio and factor profiles

Lucifer

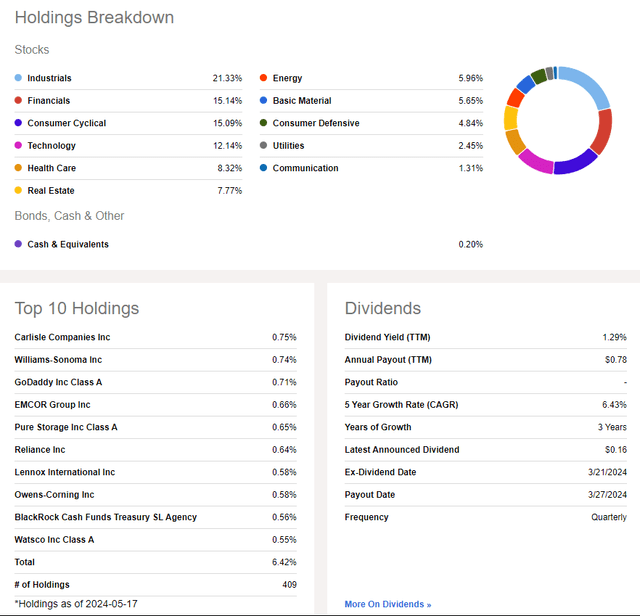

What makes IJH unstable is its relatively high exposure to the industrial sector. Interestingly, the Industrials Select Sector SDPR ETF (Article 41) has underperformed the S&P 500 since the beginning of the second quarter, and IJH has endured some negative alpha recently.

However, over the past six months, the strength of the finance sector has been a general boon. Of course, if the information technology sector continues to outperform, IJH could become even weaker in relative terms.

IJH: Stock holdings and dividend information

In search of alpha

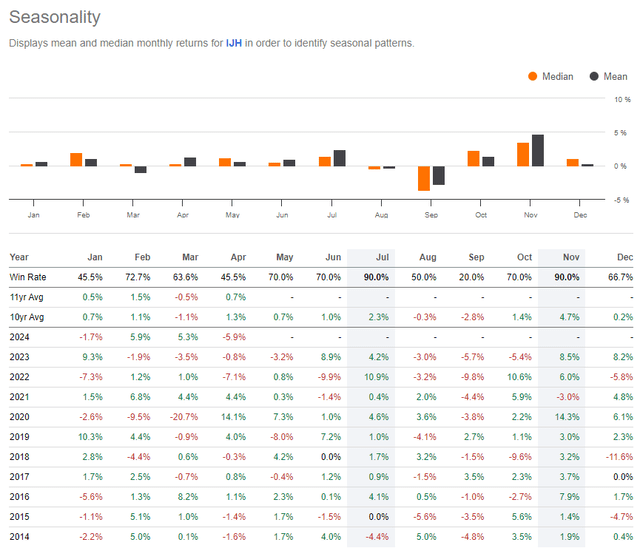

Turning to the calendar and analyzing trends over the past 10 years, IJH returns are currently strong through July. However, volatility is often closer to the end of the third quarter.

IJH: Historically strong returns from May to July

In search of alpha

Technical insight

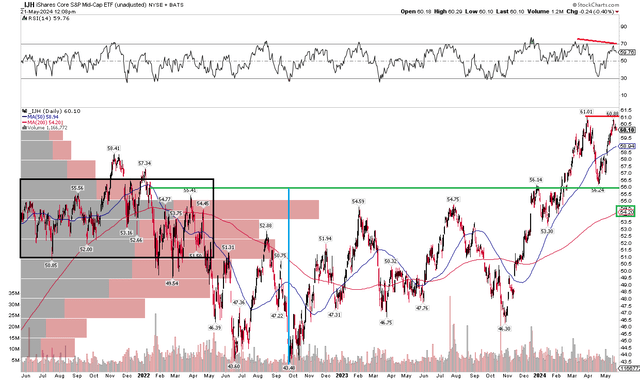

Last March, I was cautious about IJH from a technical perspective given the fluctuating levels of volatility. In fact, the fund hit a new low the following October, falling below its March 2023 level. But today, the technical picture looks brighter. Notice in the chart below that despite a modest double top feature at $61, the stock has risen above key support near the $56 mark. However, with the long-term 200-day moving average rising since early last year, the bulls appear to be in control of the main trend.

Also notice the volume profile by price on the left side of the graph. There are a lot of stocks trading in the mid-$50s to low-$40s. If we see a deeper pullback, this means the number of potential buyers will be much larger. However, the main risk at the moment is that the RSI momentum has weakened slightly today, so I would like to see a decisive push above the $61 resistance mark.

Overall, IJH looks much healthier than it did for much of last year, when it was experiencing a sideways trading pattern.

IJH: Above key $56 level, monitoring momentum trend

StockCharts.com

conclusion

I am a Buy recommendation on IJH. I like the low cost and good diversification it offers in non-large cap U.S. stocks. Valuation is roughly as strong as it was a year ago, and the technicals are more attractive despite it underperforming the S&P 500 over the past 12 months.