Biff Spandex

Main papers and background

The purpose of this article is to introduce Vanguard Utilities Index Fund ETF Shares (Knee Search:VPU) as an investment option at current market prices.Description of this fund objective Track your performance It is a benchmark index measuring the investment return of stocks in the utility sector and is maintained by Vanguard.

As my followers know, VPU has been a staple in my portfolio for a long time. I use it for diversification, income, and overall stability, and it has certainly served me well for a long time. However, as with any fund, buying selectively can mean everything in this one, and just about a month ago I thought the timing was ripe. In retrospect, this was a great thing. phone As the entire utility industry attracted rapid interest in a short period of time,

fund performance (Seeking Alpha)

meanwhile Taking a victory lap is a feel-good exercise, but what’s more important today is thinking about how well the VPU will perform going forward. forwardWhile there is certainly momentum, I am concerned that such gains (double digits in one month) are not sustainable.

Do I think VPU is still worth holding in a portfolio? Yes, I do and will continue to do so. However, I am considering this in relation to new funds. I like the concept of utility, but that does not mean I will add it at any price. I would never promote a buying idea without considering costs, including utilities. For this reason, I believe some caution is warranted and support a downgrade to “Hold” for now. I will explain why in more detail below.

Why have my utility bills skyrocketed recently?

First, take a moment and why Here’s what’s behind why VPUs will be alpha generators in the near term. This is an important exercise because it helps determine if the momentum can continue. The simple fact is that the rise of VPUs (and broader utilities) isn’t due to one idea, but multiple ideas.

First, the broader market is rising. This includes large US companies (especially tech companies), developed markets, emerging markets, high yield bonds, etc. So utilities have been caught up in this bull market, which has certainly helped. The main catalyst behind this broad rally is US inflation trending lower. I am somewhat skeptical about how this will affect the Fed in the short term, but the market is against me for now and I see this dip as a buying opportunity.

Inflation Rate (US) (Bloomberg)

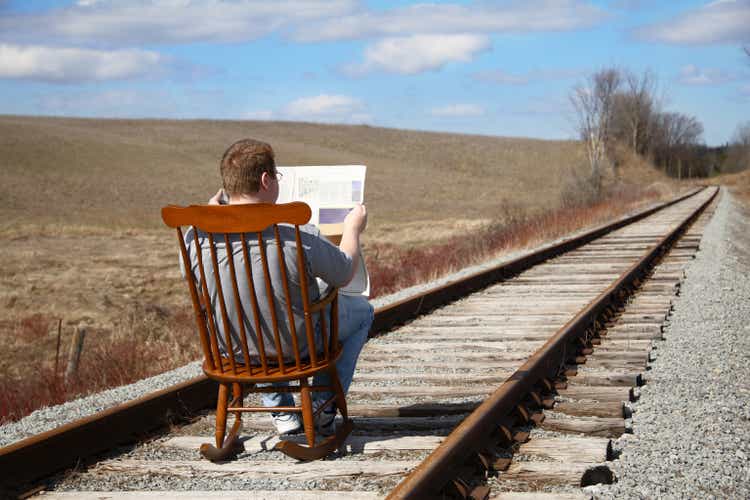

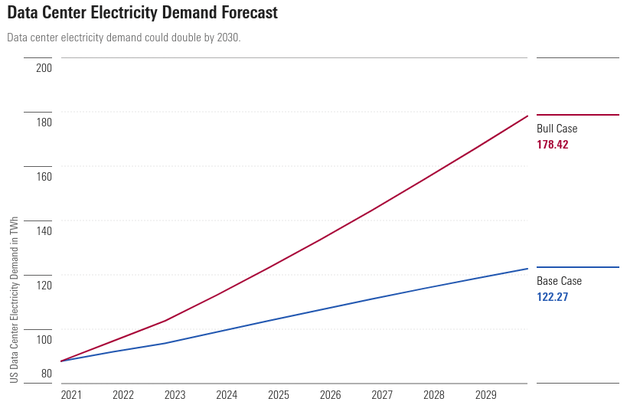

The second reason is that investors have rethought the entire industry. It has turned into an “AI” play without AI. That is, investors believe that utilities will benefit from the AI boom because electricity demand will skyrocket. Companies that leverage machine learning and those that use it will need more internal bandwidth to develop and produce this service. As a result, market participants have started to predict a surge in electricity demand over the next few years.

Electricity Demand – Forecast (bullish and bearish cases) (Lucifer)

This is certainly a good sign. That means utilities, often seen as a boring sector, are at the forefront as one of the biggest investments of 2024 so far. “AI mania” is driving tech stocks higher, and it’s good to see that utilities are also benefiting.

The third reason is that economic growth in the United States is slowing. This may seem counterintuitive, but it helps explain why defensive sectors such as utilities have performed well over the past few months. When economic concerns rise, investors are drawn to the stability offered by utility providers. That’s because their services are necessities, not “wants.” This slowing growth dynamic will probably continue into the second half of 2024 (my personal view). And that may be driving some of the recent purchases in this area of the market.

GDP Growth (US) (US Bank)

After all, utilities are rising for a good reason, and this is something to keep in mind. This reality is why I continue to hold this sector, including his VPU, and why I am not a “bear” in the broader sense. But that doesn’t mean I like the risk/reward proposition of the new buy point at this point. I have concerns and support a neutral view. More on that next.

Is this really an “AI” play?

My main concern has to do with one of the factors listed above. The AI frenzy is driving buying momentum for many big tech companies, but it’s also making its way into the utilities sector. I’m not going to ignore this story completely. After all, increased demand for electricity and other data centers is certainly good for providers of those services. Yes, this is a positive catalyst.

But my concern is with how optimistic the market has become. To be fair, I think AI demand is a bullish catalyst for the space. This is a very reasonable outlook, and this is certainly a multi-year trigger. However, will the increase in electricity demand really push up utility stocks in a straight line? I doubt it, so I’d like to live up to expectations here.

It’s unusual for the sector to see double-digit surges in a single month, and the AI hype will eventually fade even if the long-term story behind it is favorable. I don’t expect to see another double-digit surge in the coming months, which is why I am lowering my outlook. It would be unwise to jump in with new money and try to ride this wave when optimism seems to be taking hold at current levels.

Be mindful of your debt burden

Another factor to consider is that the utilities sector carries above-average debt. Therefore, the inflationary environment is a disproportionately large headwind for VPUs and other utility funds, as rising borrowing costs pose a challenge for the sector. Obviously, lower interest rates are better when debt levels are high. In my view, with inflation still above the Fed’s target, this means the Fed is unlikely to change interest rates anytime soon. For me, this supports choosing his VPU. We need to understand that rising borrowing costs continue to be a risk.

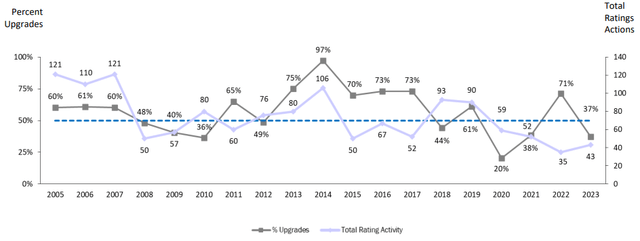

This is not something I am worried about alone. One only needs to look at the US credit rating agencies to understand that this is a macro concern for the sector. As investor optimism for rate cuts in 2023 has not materialized, these agencies have consistently downgraded, rather than upgraded, publicly owned utilities.

Downgrades outnumber upgrades (utilities) (US) (Edison Electric Institute)

The importance is clear. Unless something changes, these companies could face financial challenges in the coming years. Will things change? Probably. I don’t believe we’ll have the same inflationary environment we have today in two years. Likewise, I don’t believe interest rates will be at current levels in 2025 or 2026. So, I wouldn’t get alarmist here. But smart investors don’t ignore credit rating agencies, and in this case, they should. Keep this in mind when evaluating how large an allocation you want to make in this arena.

Reasons to own this sector Diversification

I want to balance this review by highlighting why I want to own Utilities (and by extension VPUs) for the long term. As my followers know, this is a fund (and sector) that I have supported for many years, and there are multiple reasons for that. So, while I am exercising some degree of caution here, I am not trying to raise any major red flags or be overly bearish. Quite the opposite. I will continue to own VPUs going forward and will see the merits of buying it. However, this review is not meant to cheer or hype the fund I own, but to provide readers with insight into what the near-term risks are and why they should be considered carefully.

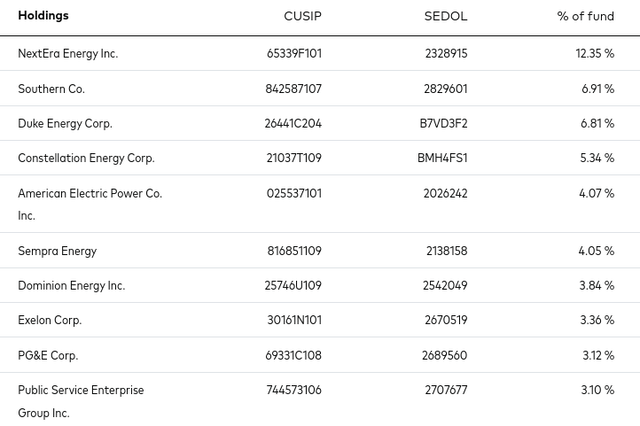

But one of the reasons I bought a VPU all those years ago still holds true today. That is decentralization. Although the fund owns many stocks in the S&P 500, it has a low weight in that index. VPU’s top 10 stocks are not noteworthy holdings for funds that track the S&P 500. As such, it in itself brings a certain balance to an investor’s portfolio.

VPU’s major holdings (Vanguard)

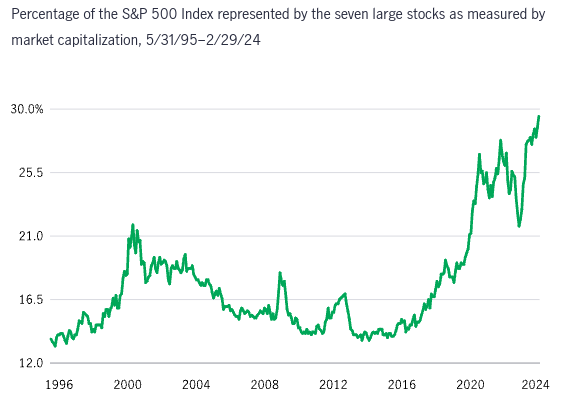

To expand on this point, I feel this ETF is more useful than ever. That’s because the S&P 500 continues to become increasingly concentrated in a small number of stocks. In fact, the top seven stocks in the index account for nearly 30% of his total. This is generally well above the historical norm for top-heavy indices, but not by much.

Mag 7 Ratio to S&P 500 (Factset)

Consolidation within the S&P 500 does not change the fact that entering sector ETFs in utilities, energy, industrials, real estate, and other areas remains a top priority for myself and many investors. Or in the case of the U.S. “large-cap” index, which essentially gives you a lot of exposure to a small number of stocks. As we’ve seen over the past two years, this can be a good thing when trades are going well. However, concentration risk can work in both directions, highlighting the need for diversification and balance. VPU helps provide this for the entire portfolio and that’s why I own his VPU.

conclusion

Utility stocks have been surging recently, which is a welcome development for me. VPU has generated significant profits since I expanded my position and I hope to see continued profits in a similar manner.

However, such an outlook does not bode well for the wise side of my brain. As the famous saying goes, “only fools rush in,” but I don’t want to be a fool. Looking at outsized returns in a sector that has not traditionally been prone to such big moves in a short period of time, I think it’s clear that being aggressive here is not the right move. As such, I am downgrading my outlook on VPU to “hold” and I think readers should be very cautious about approaching any new positions at this time.