Travel Photography Pro

Investors are investing in NVIDIA Corporation’sNVDA) First Quarter Earnings ReportOptimism was rife as the stock price neared all-time highs ahead of the company’s most anticipated first-quarter EPS report. According to data from Options Research & Technology Services (ORATS), the market is pricing in an 8.3% stock price movement on the earnings announcement day.

That’s exactly what happened, with the stock up just over 10% as of midday in the session following a super beat (announcement of earnings and revenue expectations, guidance increase, dividend increase, and a 10:1 stock split).

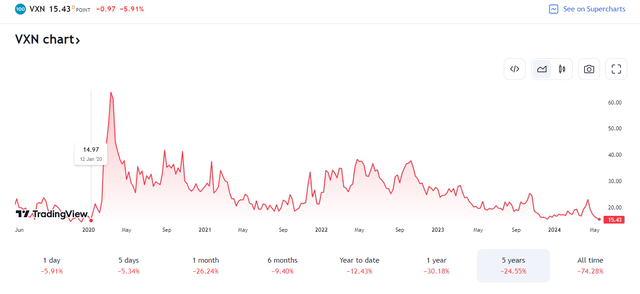

Still, everyone breathed a sigh of relief, as seen in the Nasdaq-100 Volatility Index (VXN), which hit its lowest weekly level since early 2020 ahead of the holiday weekend. This is important for investors in the JPMorgan Nasdaq Equity Premium. Income ETF (Nasdaq:Jep) Selling options is now much less attractive than it was just a month ago, when the index was up well over 20%.

I Downgrade JEPQ has been moved from buy to hold because selling Nasdaq 100 calls is not as profitable as it is today. Still, Invesco QQQ Trust ETF (Hehehehe) and the seasonal bullish trend, holding the tech-heavy index as is seems like a better investment.

Nasdaq 100 Volatility Index: 4-year low

by IssuerJEPQ seeks to generate income through a combination of selling options and investing in large US growth stocks, providing a monthly income stream from associated option premiums and stock dividends. The ETF seeks to deliver a significant portion of the returns associated with the Nasdaq 100 Index with lower volatility, and its construction involves the use of a long equity portfolio with a proprietary investment approach designed to drive portfolio allocation while maximizing risk-adjusted expected returns.

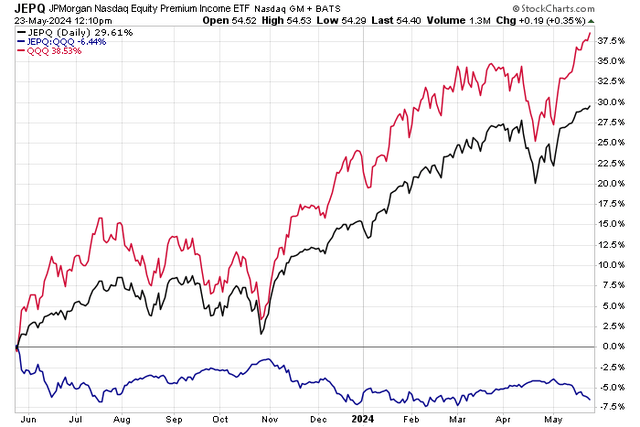

I was neutral on QQQ in February, but the selloff in late March and April saw JEPQ enjoy alpha on QQQ before the big tech companies reported their first quarter results. Today, JEPQ is holding steady. Stock price momentumHowever, it has lost relative strength to QQQ.

JEPQ’s relative strength weakens in May

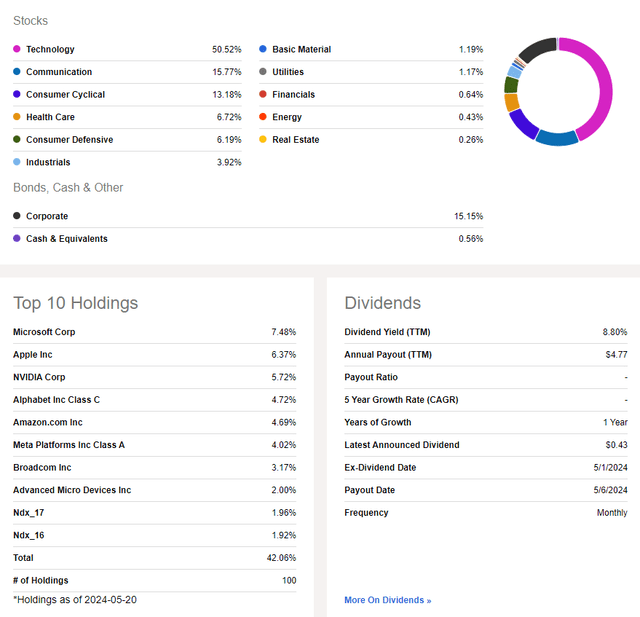

For background, JEPQ is a large covered call ETF with $13.5 billion in assets under management as of May 22, 2024. Moderate annual expense ratio of 0.35% This is a reasonable price for the fund’s activity. Instead of investors selling options, JEPQ does it for them. The dividend yield over the past 12 months is high at 8.8%.But almost all of that, more than 7 percentage points, came from options sales.

JEPQ is rather Low risk Given the strength of its B+ ETF grade by Seeking Alpha, this is a way to access exposure to tech stocks. Liquidity indicators are robust According to JPMorgan, the fund’s average daily trading volume is currently nearly 3 million shares, and its 30-day average bid-ask spread is just 2 basis points.

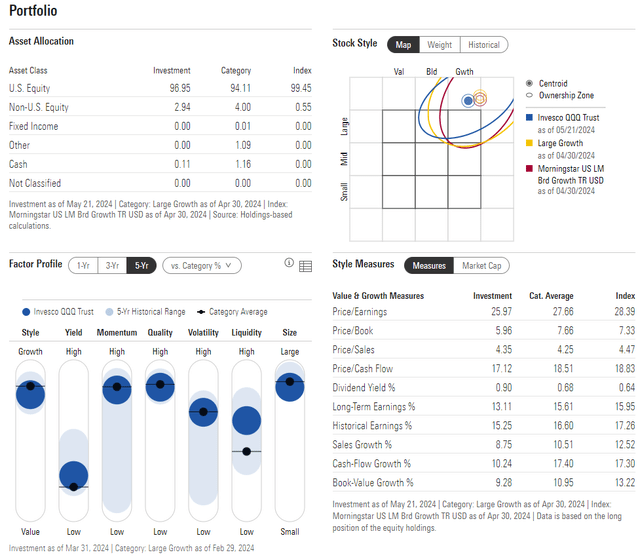

It’s important to understand the fundamentals of the Nasdaq 100 Index today. The growth-focused index trades at 26 times earnings, according to Morningstar, but its long-term EPS growth rate is a higher 13.1 times and its PEG ratio is not as impressive at just under 2 times.

QQQ Allocation: Large-cap growth stocks, 26x earnings

JEPQ’s equity allocation is, of course, somewhat concentrated in the information technology sector. While the S&P 500 holds less than 30% of its IT holdings, QQQ and JEPQ’s portfolios have more than half concentrated in that niche. Financials, energy, and utilities are notably underweight, which increases the likelihood that QQQ and JEPQ will underperform if the value trade picks up over the summer.

The best-case scenario for investing in JEPQ would be for the Nasdaq 100 price trend to be neutral to slightly upwards, meaning you would be able to capture much of the income from selling options without missing out on any big increases in the index.

JEPQ: Half IT, yields close to 9%

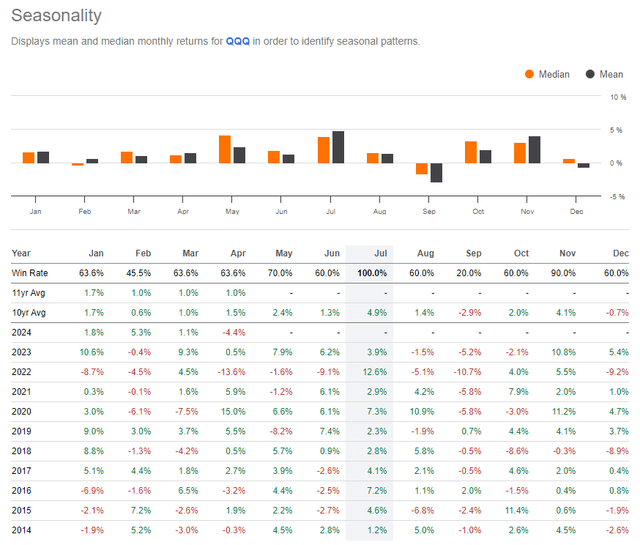

Another reason I prefer QQQ over JEPQ today is because we are about to enter one of the most bullish periods historically for QQQ. The period from late May to early August was extremely bullish over the past decade.

QQQ seasonality: bullish until early August

Technical insight

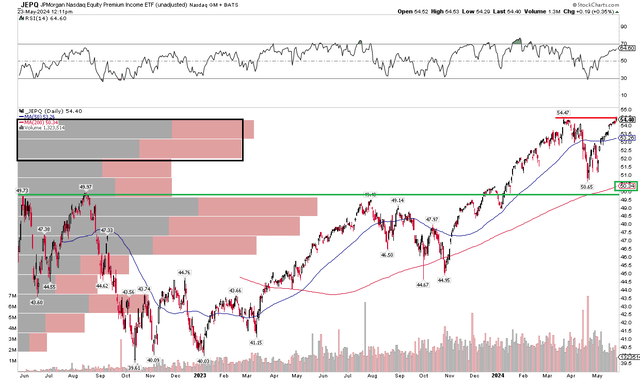

Looking at the chart situation for JEPQ, the trend is clearly up as evidenced by the rising long-term 200-day moving average. However, note in the chart below that resistance could occur near the $55 mark. It remains to be seen whether bulls can push the high-yield ETF to that level. If they can, an upside price target of around $59 would come into play based on the recent range highs since early February.

Also, look at the volume by price indicator on the left side of the chart. There is a significant amount of stock trading in the $51 to $54.50 zone. This suggests that the battle between bulls and bears may continue for the next few months. I believe that long-term support lies at the $50 level, which was a major area of resistance before it eventually turned to the upside. Earlier this year, I pointed out that a test of $50 could come during the QQQ pullback, and that is exactly what we saw.

For now, while QQQ is climbing to new all-time highs, new resistance lies in the mid-$50 range.

JEPQ: Potential resistance near $55, long-term support at $50

Conclusion

I am downgrading JEPQ to Hold from Buy based on the price action of both QQQ and JEPQ. While JEPQ remains a solid product for risk-conscious investors looking for exposure to the Nasdaq 100, I am favoring QQQ ahead of the summer months.