Bilanol/iStock via Getty Images

Over a year ago, in September 2022, I analysis In Beacon Roofing Supplies (Nasdaq:BeckAs its name suggests, the company operates as a distributor of roofing materials. The company also offers other complementary building products. With a market capitalization of $5.94 billion as of this writing, this company may not seem like a big deal. But after 90 years in business, it has grown to 542 branches, spread across all 50 U.S. states and seven Canadian provinces. The company offers over 130,000 SKUs and serves approximately 100,000 residential and non-residential customers.

In that first article, I talked about how the company has been doing well in terms of growth over the past few years. Attractive pricing. Ultimately, this combination made me pretty bullish on the business, enough to rate it a “Buy.” Since then, things have been going incredibly well. Despite mixed financial performance, with some worsening earnings and cash flow numbers, the stock has surged 67.6%. That’s more than double the 32.5% increase recorded by the S&P 500 over the same period. At this point, you might think it can’t go any further. Sure, there’s easy money to be made. But I would argue that the stock is not yet fairly valued, and as a result, the stock deserves a soft “Buy” rating at this point.

There is still room to grow

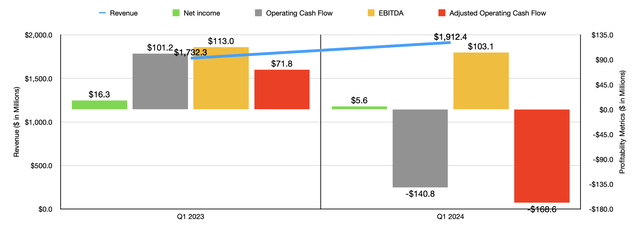

As I’ve said, Beacon Roofing Supply’s performance has been mixed lately. To understand what I mean, First Quarter Revenues for fiscal year 2024 are up significantly compared to the same period in 2023. The good news is that sales were strong during the period, at $1.91 billion. This is a 10.4% increase from $1.73 billion a year ago. This increase in sales is driven by multiple factors. For example, total organic revenues increased 7.2% from $1.73 billion to $1.86 billion. If we were to focus only on facilities that were in operation both years, revenues would have increased more modestly at 4.9%. Acquisitions also contributed approximately $54.9 million to the company’s sales. On an organic basis, management said sales volume increased 6% to 7% as demand for both residential and non-residential products remained strong. Average selling prices ranged from flat to up just 1%.

Looking at the specific categories of products the company sells, we see that management is reporting growth across the board. For example, residential roofing product revenues increased 9.1%, from $849.8 million to $927.4 million. Non-residential roofing product revenues were even more impressive, growing 17.6% year over year from $449.6 million to $528.6 million. And finally, complementary building product revenues increased a more modest 5.4%, from $432.9 million to $456.4 million.

While revenue growth was good, the bottom line worsened. Net income fell from $16.3 million to $5.6 million. This was due in part to the company’s gross margins dropping from 25.5% to 24.7%. When applied to revenue achieved in the first quarter alone, this represents a decline of approximately $15.3 million on a pre-tax basis. The decline was driven by two main factors. First, the increase in weighted average product costs was modest, between 0% and 1%. Second, the larger share of non-residential products sold. Non-residential products generally have lower margins than residential products. This is likely because non-residential buyers place larger orders and have more negotiating power with the company than residential buyers. Selling, general and administrative expenses also increased from 19.5% to 20% of sales. This was primarily due to higher salaries and employee costs as management had to increase headcount and address wage inflation. However, other cost increases also contributed to this, including higher warehouse operating costs due to an expanded physical footprint and higher sales costs.

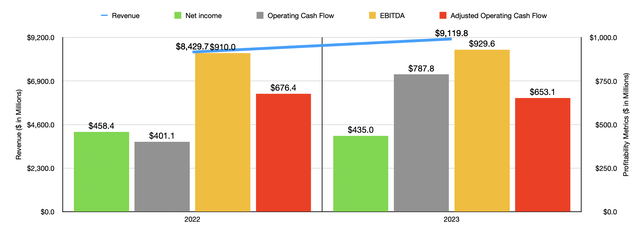

The company’s other profitability metrics also worsened. Operating cash flow fell to minus $140.8 million from $101.2 million. Adjusted for changes in working capital, it also plummeted to minus $168.6 million from $71.8 million. Meanwhile, the company’s EBITDA shrank to $103.1 million from $113 million. chart From the chart above, we can see that mixed financial performance is not unusual for the company. While revenue increased from 2022 to 2023, the company’s profit and adjusted operating cash flow deteriorated. Fortunately, the company’s other two profitability measures improved during this period.

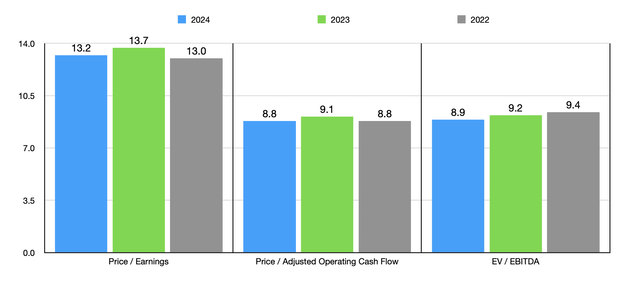

Mixed financial performance makes it hard to value a company. Fortunately, management has provided some guidance for fiscal 2024. They expect EBITDA to be between $930 million and $990 million. If we use the midpoint of $960 million and assume other profitability measures rise at the same percentage year over year, net income should be about $449.2 million and adjusted operating cash flow should be $674.5 million. From these results, we can see how the stock is priced using 2022 and 2023 data, as well as 2024 estimates, all of which are shown in the chart above. It’s always nice to see a company with a single-digit cash flow multiple. In the table below, we compared this company to five similar companies. On a price-to-earnings basis, Beacon Roofing Supply was the cheapest of the group. On a price-to-earnings basis, only one of the five companies was cheaper than Beacon Roofing Supply. And finally, when it comes to the EV vs EBITDA approach, two out of five are now cheaper.

| company | Price / Earnings | Price / Operating Cash Flow | EV/EBITDA |

| Beacon Roofing Supplies | 13.7 | 9.1 | 9.2 |

| Owens Corning (O.C.) | 14.3 | 8.3 | 8.0 |

| Builders First Source (Bulldler) | 14.3 | 10.6 | 8.9 |

| Gibraltar Industries (rock) | 20.0 | 9.8 | 11.7 |

| Applied Industrial Technology (Australian Institute of Information Technology) | 20.7 | 17.9 | 14.2 |

| MSC Industrial Direct (Mainstream Media) | 16.7 | 11.9 | 11.2 |

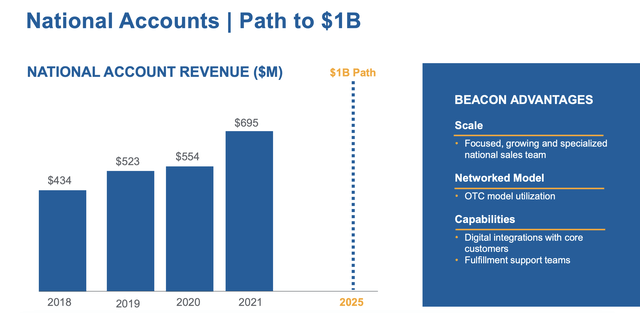

Beyond the valuation, there are a few other factors to look at. First, management has ambitious plans in the works between now and the end of next year. Part of this plan is to grow the company through so-called “greenfield” ventures, which are essentially newly constructed facilities. Earlier this year, management said Said The company is evaluating 65 greenfield locations, with 17 of them actively progressing. The company plans to open about 10 locations per year, but this year alone the company is targeting 25 new locations. And by 2025, it expects these locations to bring in about $200 million in combined annual revenue, with the ultimate goal of increasing that revenue to $450 million annually once these facilities are fully operational. The company is also looking to boost revenue related to national accounts up to $1 billion by the end of this period. That compares to national account revenue of $695 million in 2021.

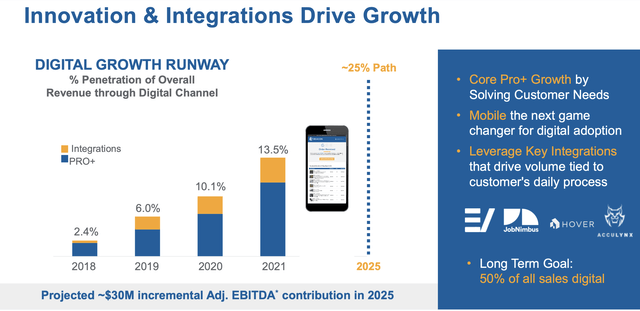

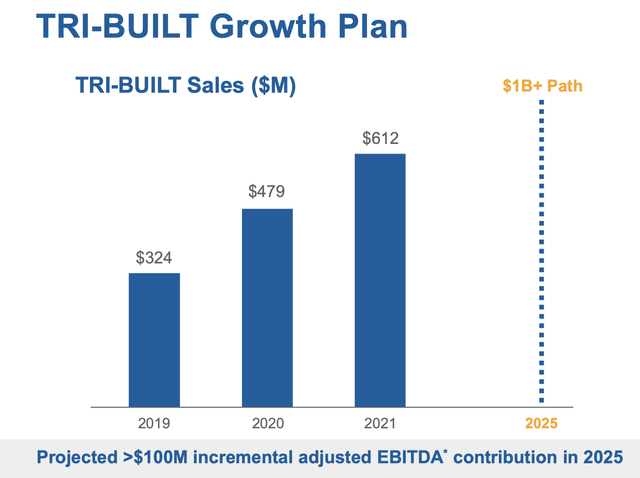

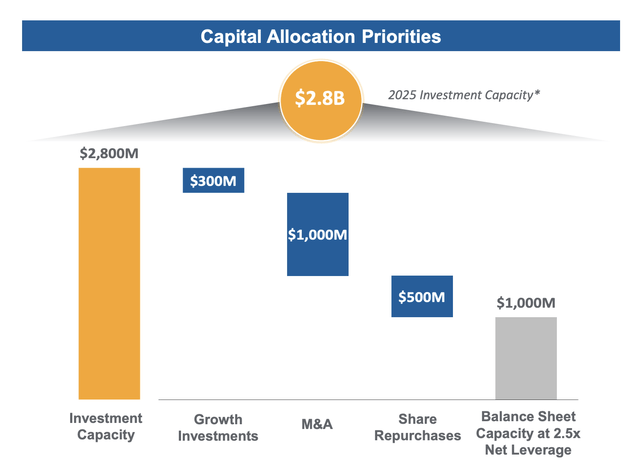

The company is also targeting $1 billion in annual revenues related to acquisition activities, which should generate more than $100 million in EBITDA each year. Management sees this as a $54 billion market opportunity, and to capture it, it is looking to acquire operators that generate $50 million to $250 million in annual revenues each. This is not to say that all opportunities have to be brick-and-mortar. For example, the company remains focused on investing in digital channels. The current goal is for about 25% of the revenue the company generates to come from digital activities by 2025. This is up from 13.5% in 2021. This should increase EBITDA by about $30 million on an annualized basis. In the long term, it would like to increase the share of revenues related to digital activities to 50%. But there is no timeline on when that will be. The company has seen a lot of third-party products, but it also sells some of its own private label products. Most notable is the TRI-BUILT brand, which generated $612 million in revenue in 2021. Management wants to boost this to at least $1 billion by 2025, which would add roughly $100 million to the company’s EBITDA on an annualized basis.

It seems to me that management has executed this strategy well so far. The end goal is to grow annualized EBITDA to $1 billion by 2025. As I mentioned at the beginning of this article, they expect $930 million to $990 million this year. So, from this point on, it doesn’t take much growth to achieve these goals. Management initially said that these efforts would require investments of about $1.3 billion, of which about $1 billion would be related to mergers and acquisitions, but that hasn’t stopped the company from buying back its own shares.

The original plan was to buy back about $500 million worth of shares during this period. The company spent $110.9 million to buy back 1.6 million shares in 2023 alone. This was to be followed by 6.8 million shares in 2022 for $387.8 million. And just on May 10, the company announced that it had entered into an accelerated share repurchase agreement to buy back $225 million worth of shares. As part of the agreement, Beacon Roofing Supply will pay Citibank $225 million up front and will initially receive a pro rata share of its shares. However, the number of shares it ultimately receives will be based on the stock’s daily volume-weighted average price during the term of the agreement. This is expected to be completed in the last quarter of fiscal 2024.

remove

All things considered, I’d say Beacon Roofing Supply is doing really well. While financial performance has been mixed recently, the company’s overall trajectory is good. The stock looks attractive and management is investing in various growth prospects as well as share buybacks. So far, these seem to be working. Given this, plus how cheap the stock is currently, I’d argue it still represents a “buy” at this point.