Morsa Images

summary

Continue My Report Floor & Decor Holdings Co., Ltd.New York Stock Exchange:FundingIn Oct ’23 I recommended a sell rating given my negative outlook for mortgage rates and the macro economy, and this post provides an update. My thoughts on the business and the stock. This recommendation worked well in the short term (mid-October to mid-November). However, the stock has since skyrocketed from the mid-$70s to its current level of around $112. I would like to reiterate my sell rating on FND as the valuation currently does not factor in a possible deterioration in macroeconomic conditions, which would put significant pressure on FND’s near-term growth.

Investment Thesis

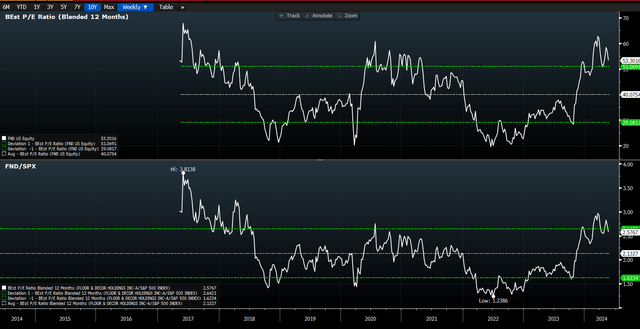

First, I want to give you my thoughts on why this stock performed so well against my sell rating. My mistake was underestimating how much the market wanted to sell. It is difficult to price in an economic recovery in such a macro environment. In my opinion, the market started pricing in the possibility of a rate cut in November 2015. End of 2023As a result, valuation (forward P/E) has increased significantly from approximately 29x to the current 53x. With the current valuation and an uncertain macro outlook, the risk/reward landscape is heavily skewed to the downside, so I still maintain my sell rating on FND.

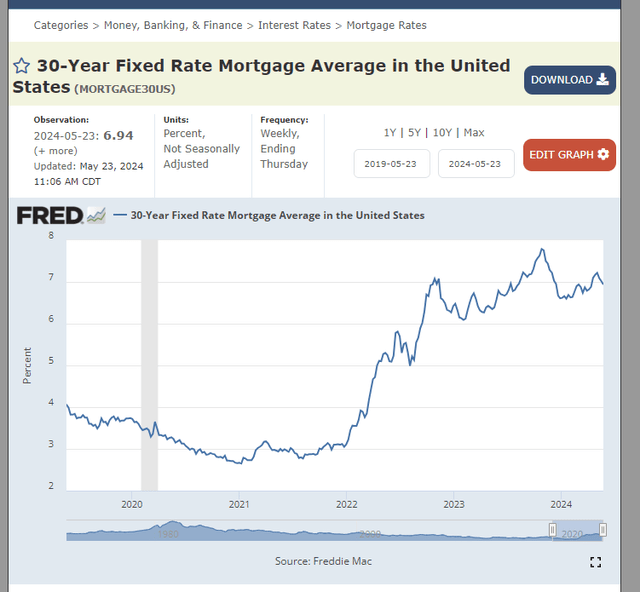

Essentially, FND is showing no signs of improvement whatsoever. Comparable sales continue to deteriorate from -9.4% in Q4 ’23 to -11.6% in Q1 ’24, and net sales growth is in negative territory (-2.2% in Q1 ’24 compared to flat in Q4 ’23). The outlook remains unclear, and with more uncertainty in the macro environment and the Fed mentioning the possibility of rate cuts, I believe there is potential for a further slowdown. Prices will riseThis is a major rebuttal to the notion that interest rates will be cut anytime soon for FY23. The immediate impact is that mortgage rates, already close to five-year highs, are likely to rise further in the future.

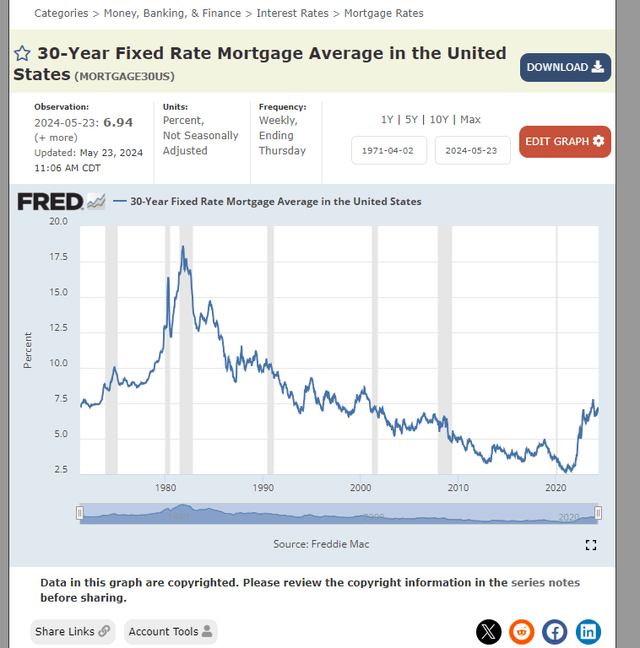

The bigger implication is that mortgage rates a lot If we look back over the past 30 years, interest rates have been even higher. Historically, US mortgage rates have risen to 17.5% at one point (when the Fed aggressively raised interest rates to fight inflation). With inflation still high and the labor market thriving, a similar situation is likely to occur (inflation was over 10% back then, so we may not see it rise to 17.5%).

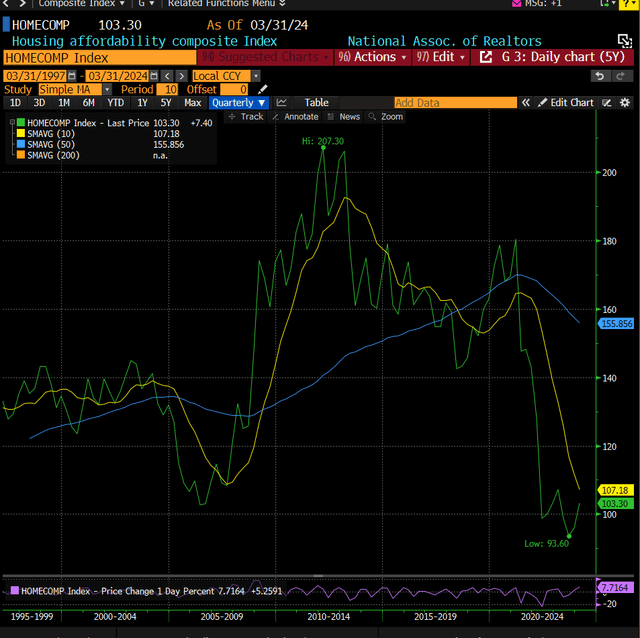

To put things into better perspective, the current home affordability index is at subprime levels. Mortgage rates are likely to rise further. This will undoubtedly drive home prices down considerably and fundamentally erode demand for FND products. This macro trend has already impacted home sales, which have fallen sharply. Slow down Recent history has shown that home sales will plummet. If my view is correct, management’s comments regarding sales trends in Q2 2024 align well with my view above in that Q2 2024 sales are not progressing as expected.

Cumulative second-quarter fiscal 2024 same-store sales decreased 9.3% compared to the same period last year. 2024 Q1 Earnings Announcement

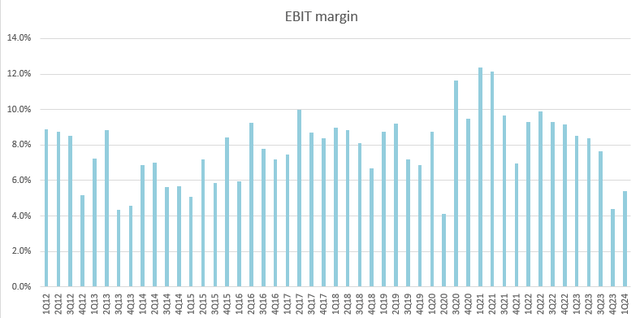

However, we applaud management’s ability to manage margins in this challenging environment. Gross margins have expanded over the past five quarters (103 basis points in 1Q24) despite continued significant declines in same-store sales, and operating margins improved sequentially compared to 4Q23 despite an 11.6% decline in same-store sales in the quarter. Looking at FND’s historical EBIT margins, the lowest quarterly margin on record is 4%, and given the flexibility of FND’s cost structure (55% fixed, 45% variable), there are many levers management has available to protect margins. Specifically, they can adjust labor costs and delay project timelines. Thus, to some extent, revenue growth will not experience the same degree of growth slowdown if the macro environment worsens. That said, if growth were to fall sharply, valuation would likely follow suit as the market prices in weaker sales going forward.

evaluation

Given FND’s premium multiple and macro uncertainty, I believe the stock will be range bound at best with significant downside potential. For reference, FND is currently trading at 53x, which is higher than the upper end of its trading range, and its premium to the S&P forward multiple is currently at 2.5x (+1 standard deviation). Whenever the latter ratio hits or approaches 2.5x, valuations drop in the coming months. I believe this pattern will occur again, which could easily be triggered by increased macro uncertainty. While it’s difficult to predict near-term revenue numbers (even management didn’t discuss new store growth plans for 2025), using consensus expectations as a benchmark (which has been historically accurate), FND is expected to generate $1.84 EPS in fiscal ’24, and assuming a forward P/E (historical average) of 40x, that equates to a stock price of about $74, which could be a significant downside from the current price of $112.

danger

The upside risk is that the economy will improve going forward. Inflation will fall, the labor market will ease, GDP will continue to grow, there will be no conflicts around the world, and the world will simply be a better place. The housing market should improve dramatically as mortgage rates fall, which will have a significant positive impact on demand for FND products.

Conclusion

In conclusion, we reiterate our sell rating on FND despite the recent share price rally. We believe that the current valuation of 53x forward P/E does not reflect a likely weakening macro environment. Mortgage rates, already at five-year highs, could rise further due to inflation and a hawkish Fed, further reducing home affordability and demand for FND products. While management has demonstrated good skill in maintaining margins during a downturn, the risk/reward picture is tilted to the downside due to the premium valuation.