MicroStockHub

Nvidia (NVDA)’s profit weighting is 3.2% of the S&P 500, while its market cap weighting was 5.8% as of the closing price on Thursday night, May 23, 2024.

This revenue weight is likely to be lifted quickly over the next 12 to 18 months.

this This week, the S&P 500 closed at 5,304.72, compared to last week’s closing price of 5,303.27.

S&P 500 Data:

- The S&P 500’s forecast for the next four quarters fell slightly to $252.61 this week from $252.93 last week, but is still up nicely from $243.98 at the start of January.

- The P/E ratio this week is 21x, up from 21x last week and 21x in early January 2024. (This means that very little of the stock market rally this year has been driven by P/E expansion – it’s all been driven by earnings growth).

- The S&P 500 earnings yield is at 4.76% this week, down from 4.77% last week and 5.19% in early January. (I still hope so.) More than 5%.

- This week’s bottom-up S&P 500 EPS estimate for the first quarter of 2024 is $56.62, below the $54.92 forecast and up 3% from the last weekend in March.

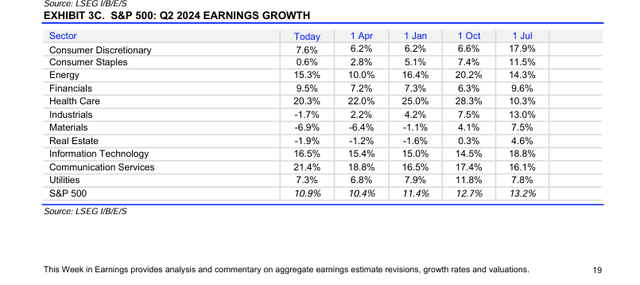

What will the sector growth rate be in Q2 2024?

Consumer discretionary goods (Amazon (Amazon), Tesla (TSLA)), communication services (meta (Meta) and alphabet (Google) (Google)) and Technology (Microsoft (MSFT), apple (AAPL), NVIDIA and others are leading the S&P 500, which isn’t exactly surprising.

When looking at a table like the one above, pay attention to sectors with positively revised growth forecasts. The typical pattern is that as the quarter approaches, growth forecasts are revised negatively or decline.

Frankly, Q2 2024 is looking pretty solid six weeks into the quarter.

Summary/Conclusion: The S&P 500 Q1 2024 earnings season is over, but the S&P 500 earnings are completely fine, and have been for some time, despite voices to the contrary.

Projected EPS growth for Q1 2024 bottomed out at +2.7% on April 12th and is expected to close at +8% as of today. Last quarter, S&P 500 EPS increased 10% year over year.

Companies to watch for next week’s earnings report are Foot LockerFlorida) on Thursday morning, May 30th at Costco (Fee) will be held on Thursday night. Foot Locker’s comments were shared by Nike (NKE), and Costco is a phenomenal business that was sold too quickly.

They are not advice or recommendations. Past performance is no guarantee of future results. Investments involve the risk of losing capital, even in the short term.

thank you for reading.

Editor’s note: The summary bullet points for this article were selected by Seeking Alpha editors.