JHVEPhoto/iStock Editorial via Getty Images

I’ve been thinking about luxury brands and prestige brands, and the main argument is that luxury brands are great to own during economic downturns due to the persistence of their usually recoverable revenue streams. Companies can weather a downturn with smaller revenue losses and faster recoveries, which leads to better stock price performance after the downturn. They made this case for Louis Vuitton (OTCPK:LVMUY) and now L’Oreal (OTCPK:LRLCY).

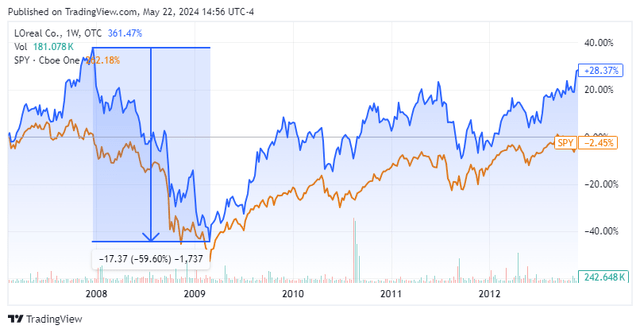

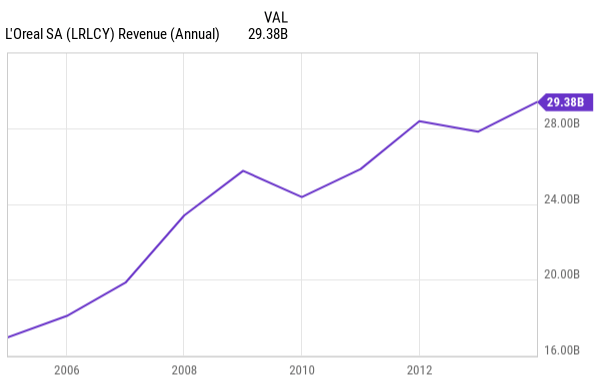

L’Oreal operates in the luxury self-care beauty segment through dermatology products, cosmetics, and fragrances. Most of the company’s segments target the luxury self-care segment, and some of the company’s brands are very well-known and popular among consumers. This is a good way to look at the company’s earnings during the period from the subprime crisis to the European debt crisis.

Y Chart

result It was very interesting. The company weathered two major financial crises with relative ease and was already posting record profits in 2013. In terms of stock market performance, the company’s share price fell by nearly 60% between the peak and trough of the subprime crisis. Not exactly a safe haven.

However, this result is not surprising to us. Those who remember the panic of 2008 and 2009 will recall that no company was immune to this liquidity flight. What is more important to me is how quickly the company was able to recover from the market-wide bottom in 2009.

Business Type

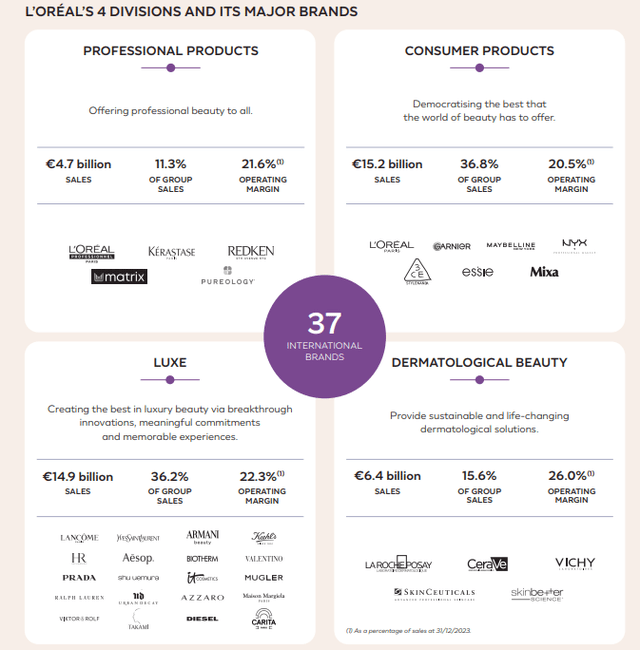

The company operates through four different divisions, each with brands that cater to diverse markets. Each brand shares L’Oréal’s research and development platform, its extensive retail store network, and its promotional and advertising expertise. This cross-linking seems to give it the flexibility to reallocate resources based on market traction, strengthening what’s effective.

A very important feature of the company’s business model is the acquisition of early stage brands that it believes have the potential to become global players. For example, They bought Kiehl’s The brand, which started with an annual sales of $40 million in 2000, crossed the $1 billion revenue line in 2016. This shows that when a brand is acquired, the work of brand building begins from there. After acquiring a brand, L’Oreal integrates it into the group’s distribution and awareness channels. While maintaining identity Brand’s.

The company also Online Channels Addressing a hyper-segment of the beauty market. Social media has lowered the barrier to entry for new brands, but the barriers to scale remain. Social media, when used well, has the power to leverage larger brands like L’Oreal even further.

Finance

Many companies are trying to implement a brand combination strategy. But most people failCompanies fail when they hold on to brands for long periods of time with no signs of growth, and then make acquisitions that fill their balance sheets with debt.

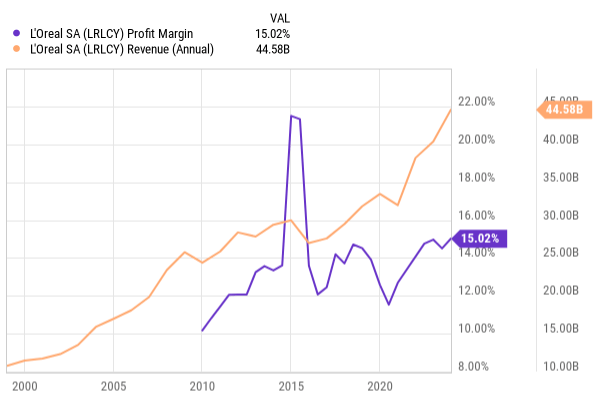

For L’Oreal, this strategy has worked, allowing the company to grow revenue and improve profit margins over the long term. This is primarily due to the company’s ability to centralize research and development for a variety of products and its role as a platform to launch new brands. These brands cater to different market segments, which helps them maintain exclusivity without abandoning competing consumer segments. Their financial performance reflects this.

Y Chart

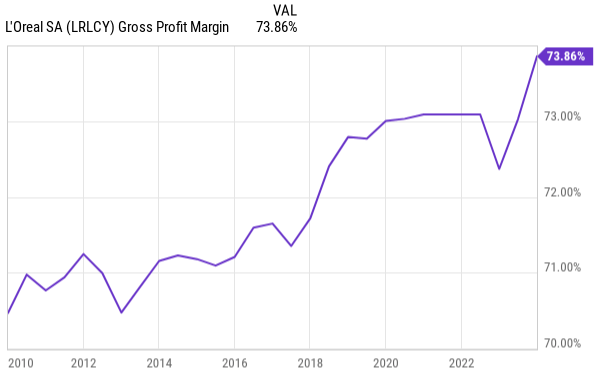

Pricing power is evident in gross margin trends over time.

Y Chart

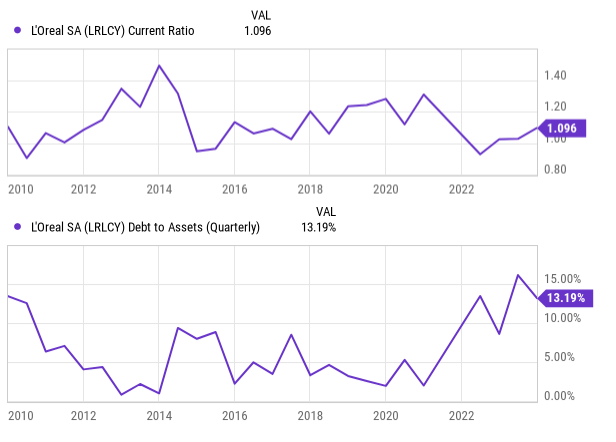

The balance sheet also reflects the success of this strategy. Although the company has acquired several brands over the past few decades, its debt-to-asset ratio remains very healthy, and its current ratios are in line with historical figures.

Y Chart

The final proof that this strategy worked for the company is that its goodwill and intangible assets grew at the same rate as its assets, and it didn’t make many mistakes with its acquisitions.

Evaluation and Risk

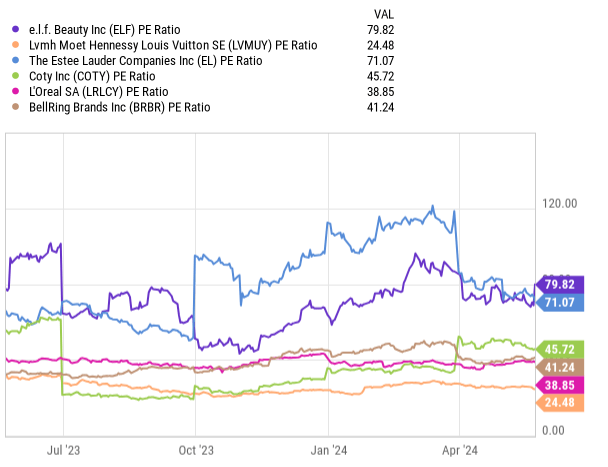

Now that we’ve looked at L’Oreal’s management and how it has performed over the past few decades, let’s look at how the company is valued relative to its peers. Its price-to-earnings multiple is on the lower side compared to its peers, but 38 times earnings is still not cheap.

Y Chart

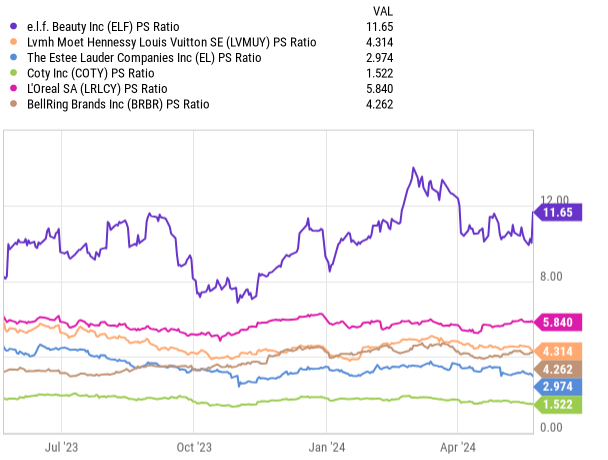

Sales ratio is Elf (fairy) significantly above its predecessor. These indicators show that the stock is not trading at an obvious discount. At best, it’s a story of buying a quality business at a fair price.

Y Chart

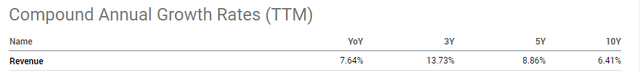

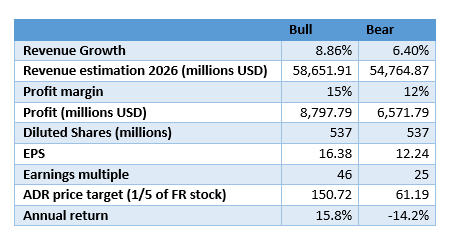

With these objectives in place, we can proceed to create bullish and bearish scenarios for the stock. The average annual growth rate of earnings over the past 10 years has been 6.41%, but has accelerated to 8.86% over the past five years.

In the bull scenario, we use a 5-year yield of 8.86% and in the bear scenario, we use a 10-year yield of 6.41%. Furthermore, in the bull scenario, we use a 15% return rate and in the bear scenario, we use 12%. Finally, in the bull scenario, we have a return rate of 46 (using Coty as a benchmark) and in the bear scenario, we have a return rate of 24 (using Louis Vuitton as a benchmark). Note that one LRLCY ADR is equivalent to one-fifth of a France-based stock.

Author’s calculations

These results suggest a slight positive asymmetry, but the difference is not large, meaning that current prices do not offer a margin of safety against the realization of risks to our hypotheses. Several big risks come to mind. The most troubling is a shift in consumer preferences that could negatively impact one or more of a company’s brands. In a more extreme scenario, we could see disruption to the luxury and prestige markets from new forms of digital retailing, driven by social media.

Another key risk is the inability to continually add brands to the portfolio, which could lead to a scenario where the company’s profitability declines and its balance sheet becomes bloated with debt.

At a more granular level, there is always the risk that one acquisition will fail and the company will suffer impairments and financial losses in the short term. It is important to keep in mind that there is a limit to the number of brands that management can effectively retain, and that successful management teams have a tendency to become ossified and lose control of the business.

So far, the company has performed flawlessly over the past few decades. Even today, there are no obvious signs that management is losing control of the business. On the contrary, the company’s earnings have accelerated over the past three years. Given that there is significant pricing power in the prestige market and the current macro environment seems inflationary, it may be wise to pay a fair price for this company and include it in your portfolio. Therefore, I rate it a “Buy”.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.