praetorianphoto/E+ via Getty Images

Investment Thesis

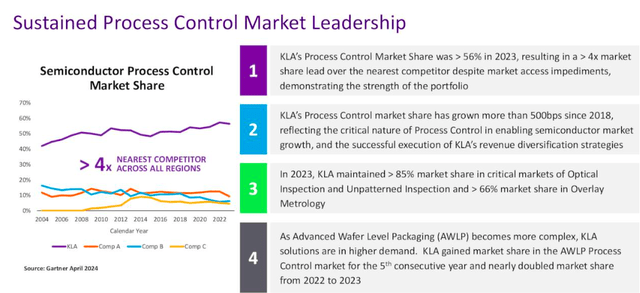

KLA Corporation (Nasdaq:crack) CFO Bren Higgins is JP Morgan (JPM) We are hosting our Global Technology, Media and Communications Conference earlier this week. At the meeting, He argued How is the company expected to benefit from several long-term growth trends, including rising capital intensity in chip manufacturing, increasing process complexity at advanced nodes, and growth in the advanced packaging market?

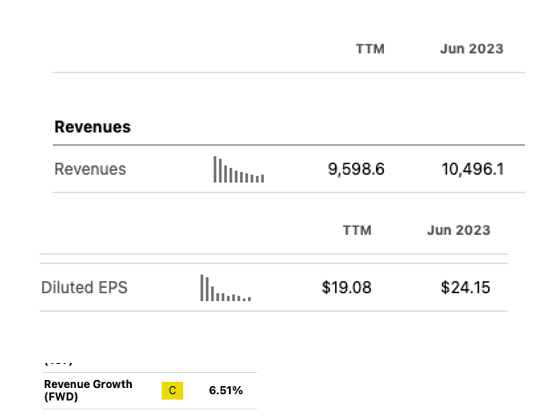

KLAC has a strong market share, its financial reports show a strong focus on research and development, and a resilient services business that puts it in a good position to capture this growth. The company’s latest guidanceAccording to Higgins, the 2026 financial targets of $14 billion in sales, 63% gross margins, and $38 EPS are achievable despite the recent industry slowdown. This represents a high growth rate from current figures. As shown below, sales would grow by approximately 40% and revenue would grow by 57%. In EPS.

Seeking Alpha

However, I believe there are some factors to consider: The recent industry slowdown and potential macroeconomic headwinds could impact revenue growth. KLAC acknowledges this and predicts growth will slow to 6.51% going forward. A higher growth rate is needed to reach its ambitious goal of $14 billion by 2026.

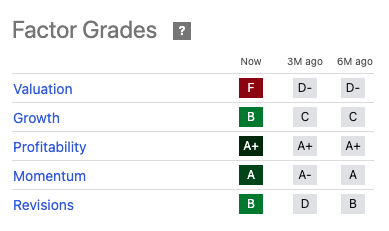

The company’s current valuation may not fully reflect its growth prospects, as its stock price seems to be constantly hitting new all-time highs thanks to momentum generated by accelerating demand in the semiconductor sector.

Seeking Alpha

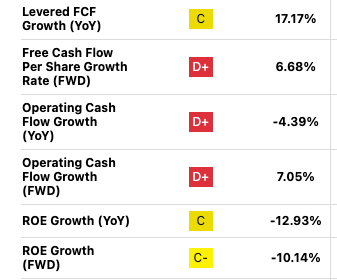

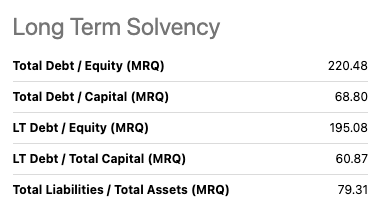

Another concern is KLA’s high debt levels, which are funded by R&D and capital expenditures. These investments appear to be paying off in the form of market share retention, and I believe the latest earnings report keeps debt under control, but a bad year could be an issue. The increase in debt is already impacting ROE growth, which is down -12.93% year over year and is expected to continue to decline. On the plus side, FCF is growing, which helps ease concerns about the high debt levels.

Given the momentum in the semiconductor industry, the market may have gotten ahead of itself and dragged KLAC’s price into overbought territory. PEG RatioThis is higher than the industry average (2.76 vs. 2.0) and Seeking Alpha’s Rating Grade on a forward-looking basis. For these reasons, I would be inclined to initiate coverage with a Hold until we see a price correction.

Seeking Alpha

Management Evaluation

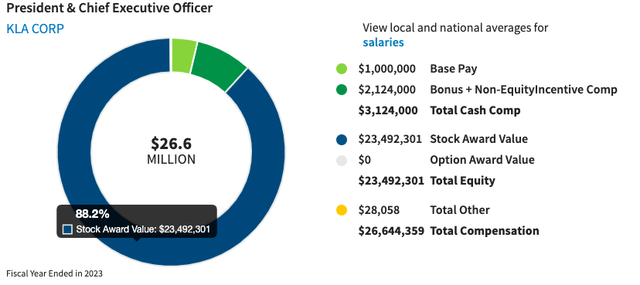

Rick Wallace Wallace is a veteran executive with over 30 years of experience with the company. He currently serves as CEO and President of KLA Corp and also serves on the company’s board of directors. Wallace began his career at KLA in 1988 as an applications engineer and steadily advanced through various leadership roles. He also serves on the board of directors of other companies in the company. Given his tenure with the company and the fact that 88% of his compensation is stock-based, I believe Wallace’s “alignment ratio” is very high.

CFO Bren Higginswho has over 25 years of experience at KLA in various senior finance roles, oversees the company’s financial position. The company has been increasing debt to fund investments, with the current D/E ratio exceeding 200%, impacting ROE. While this is a concern, it is also important to consider the company’s current strong momentum. While this high debt level may not pose an immediate threat, it requires close monitoring to ensure sustainable growth.

Seeking Alpha

Overall, KLA Corp’s management team appears committed to the long-term success of the company, as evidenced by Wallace’s leadership and the positive employee feedback on Glassdoor. However, there is room for improvement in the management of the company’s financial structure, particularly with regard to high debt levels and ROE. Considering all factors, I would give KLA’s management a “Meets Expectations” rating.

Glass Door

Corporate Strategy

KLA has a leading position in yield management, a critical stage in ensuring high-quality water production in chip manufacturing. This leadership is built on its leadership in process control. KLA’s tools and expertise enable chipmakers to monitor and optimize the manufacturing process in real time, minimizing defects and maximizing yield. This leadership has led to strong customer relationships and a reputation for innovation that has led to the development of Onto Innovation, a leading global semiconductor company.Ont) and Camtek (About CAMTA) is a semiconductor company with a more niche market. The company’s strategy is to leverage this advantage to expand into new areas such as advanced packaging and emerging technologies, and solidify its position as a leader in the evolving semiconductor industry. However, its reliance on mature markets and high debt levels remain challenges.

To compare their strategy with those of their leading competitors, we created the table below.

|

KLA Corporation |

LAM Research (LRCX) |

Applied Materials (Amato) |

ASML Holdings (ASML) |

Samsung Electro-Mechanics (OTCPK:SSNLF) |

|

|

Current Strategy |

Leverage our leadership in revenue management to expand into new areas such as advanced packaging and emerging technologies. |

Focus on customer collaboration and development of next-generation deposition and etch technologies for advanced nodes |

Diversified product portfolio for chip manufacturing. Investing in R&D for advanced materials and process control |

Maintaining our competitive edge in lithography systems and developing next-generation EUV technology |

Vertically integrate within Samsung’s chip ecosystem to expand into broader market segments |

|

advantage |

A Leading Player in Revenue Management. Strong Customer Relationships. Focused on Innovation. |

Expertise in deposition and etch processes. Strong R&D capabilities. Global presence. |

Broadest product portfolio in the industry. Leading positions in multiple segments. Strong brand recognition. |

Unmatched lithography expertise. High barriers to entry. Strong financial position. |

Cost advantages in Samsung’s supply chain; expanding presence in advanced packaging |

|

Demerit |

High dependency on mature markets. High debt levels. |

Vulnerable to fluctuations in the chip market. Lower market share than KLA. |

Lower profit margins compared to competitors. Complex organizational structure. |

Limited product portfolio Dependence on a few key customers |

Limited brand recognition outside the Samsung ecosystem; dependent on parent company success |

Sources: Company websites, presentations, SeekingAlpha

evaluation

KLA Corp. is currently trading at around $780, up about 20% since reporting earnings in late April.

We adopt a conservative discount rate (r) of 11%, which represents the hurdle rate that an investor would expect to receive, taking into account the time value of money and the inherent risks of that investment. To calculate this, we used a 5% rate for the time value of money and an average market premium of 6%.

I then used a simple 10-year two-stage DCF calculator and reversed the formula to arrive at an implied FCF growth rate of roughly 20%.

$780 = Total^10 FCF (1 + “X”) / 1+r) + TV FCF (1+g) / (1+r)

*Added book value to calculation

That said, the market is currently expecting KLAC’s FCF to grow 21.5% this year, but KLA Corp is projecting FCF growth of 6.68%, so valuation seems overvalued.

Seeking Alpha

Technical Analysis:

The stock has maintained positive momentum and appears to have hit an all-time high since the last earnings report due to favorable momentum in the semiconductor industry. However, the company’s projected growth rate, as noted above, does not currently reflect that. Because of this, while I believe the stock may continue to maintain positive momentum, I will hold off until signs of weakness appear. I believe in the long-term story, but not at this price. I view any signs of weakness as an opportunity to buy and believe it will start to look attractive around $700.

The company’s next earnings report is expected on July 26th.

remove

KLA Corp. is a long-term growth prospect in the semiconductor industry, but I do have concerns. Strong market share, R&D focus, and a resilient services business give the company an advantage. Its ambitious 2026 targets look achievable. However, the recent industry slowdown and heavy debt buildup should be monitored. The stock price may be overvalued due to industry momentum. Management seems enthusiastic, but FCF and ROE growth should be monitored. Given the overvaluation and potential headwinds, I would cover with a Hold initially and reconsider if the price becomes more attractive.