Gearst

PANW Investment Thesis Looks Expensive as Revenue Growth Slows

Palo Alto Networks (NASDAQ:Nasdaq:Pan W) is a global cybersecurity provider that leverages artificial intelligence and automation to deliver comprehensive Zero Trust solutions for the enterprise user, network, cloud and endpoint markets.

The company operates using a typical SaaS approach, with subscription/support revenue accounting for 77.1% of fiscal year 2023 revenue (up 1.9 percentage points year-over-year).

Needless to say, the SaaS business model is also highly profitable, with the subscription/support division posting a high gross profit margin of 71.9% (up 2.5 percentage points year-over-year).

“$200 Billion Growth Opportunity Cloud security alone“With remote work remaining popular and enhanced cloud investment driven by the generative AI boom, it’s not surprising that PANW beat expectations by 2x in its Q3 2024 earnings report.

this is Total revenue: $1.98 billion (+0.5% compared to the previous quarter/ YoY increase of 15.1%), operating margin was 8.9% (+6.2 points quarter-over-quarter/+4.3 points year-over-year), and adjusted EPS was $1.32 (-9.5% quarter-over-quarter/+26.9% year-over-year).

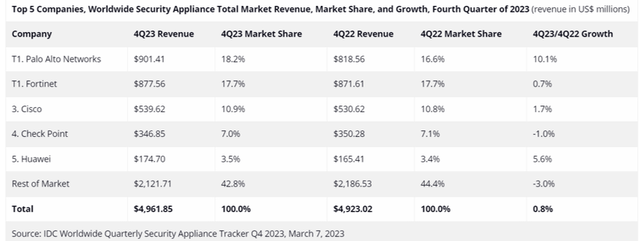

Total Worldwide Security Appliance Market Revenue

IDC

PANW’s offerings appear to remain stable, as evidenced by growing annual subscription revenue of $4.16 billion (up 1.9% quarter-over-quarter and up 25.3% year-over-year) on increasing multi-year remaining performance obligations (RPOs) to $11.3 billion (up 4.6% quarter-over-quarter and up 22.8% year-over-year).

And the long-term outlook for ultimate revenue recognition is why PANW is likely to continue reporting strong market share going forward. Global Security Appliance Market International Data Corporation’s reported market share for Q4 2023 was 18.2% (up 1.6 percentage points year-on-year) and is expected to grow further in 2024.

The development also shows why PANW is benefiting from the sustained cloud migration since the COVID-19 pandemic, with a larger platform and diversified services that will inevitably attract bigger deals and more customers.

This allows management to work on specific sales strategies to increase adoption of its three vertically integrated platforms – Strata (network security), Prisma (cloud security) and Cortex (security operations) – while also increasing customer lifetime value and reducing churn.

Key risks from PANW’s platform approach – growth appears to be slowing

However, readers should note that PANW previouslyPlatformization“Also known as”A multi-platform win“In its second quarter 2024 earnings call, management is looking to accelerate growth opportunities in the near term,” it said.

this is,”Free support in case of infringement,” meanwhile “Approach customers well before their individual product contracts expire and offer a free extended rollout period before their traditional vendor/payment obligations end.“

As a result of the monetization/revenue recognition delays, it’s not surprising to see PANW point to near-term revenue headwinds in its Q2 2024 earnings report, with a worst-case scenario of a 28.4% decline in market cap, or the equivalent of $30.89 billion.

Still, we’re impressed with SaaS companies continuing to report strong profitability in Q3 2024, demonstrating improving business scale despite short-term impacts.According to payment terms More and more customers prefer annual billing plans.“

At the same time, PANW’s platform strategy seems to be working very well,65 incremental platform sales“It has already been completed in the third quarter of ’24, and management hasWe will show the way to achieving platform sales of approximately 2,500 or more from the current 900.“

This represents a further expansion of the company’s economic advantage in an increasingly competitive cybersecurity market, where “enterprises’ spending is typically fixed and switching from incumbent vendors involves significant risk and disruption.”

With its efforts to become a platform and its expanding customer base to date, it is easy to understand why PANW has been able to gradually increase its share price. FY2024 Guidance Again Total sales were $10.15 billion (YoY increase of 10.4%), revenue of $8 billion (up 16.1% year over year), and adjusted EPS of $5.57 (up 25.4% year over year).

this is Previously lowered numbers The second quarter 2024 financial results are expected to be $10.15 billion (up 10.4% year-on-year), $7.97 billion (up 15.7% year-on-year), and $550 million (up 23.8% year-on-year). Original Guidance The fourth quarter 2023 earnings forecasts were $10.95 billion (+19.1% y/y), $8.175 billion (+18.6% y/y), and $5.33 billion (+20% y/y).

However, PANW’s significant fluctuations in its fiscal 2024 guidance are worrying, and management’s free trial platform approach is already shaking shareholders’ confidence in its future execution.CRWD) and Zscaler (ZS).

In context, CRWD is excellent Total revenue of $3.06 billion in 2024 (up 36.6% year-on-year) and a mid-point forecast for fiscal 2025 of $3.95 billion (up 29% year-on-year), indicating a period of consistently high growth.

A similar high growth trend is seen in ZS, Raises revenue outlook for fiscal 2024 $2.12 billion (YoY increase of 31.6%), adjusted EPS of $2.75, up 53.6% year over year, suggesting robust demand for cybersecurity products as the world enters the next supercycle of cloud computing.

And perhaps this is why PANW has had to embark on this aggressive platforming/sales approach to avoid losing out in the race, with management’s low double-digit growth guidance naturally pales in comparison to that of its peers.

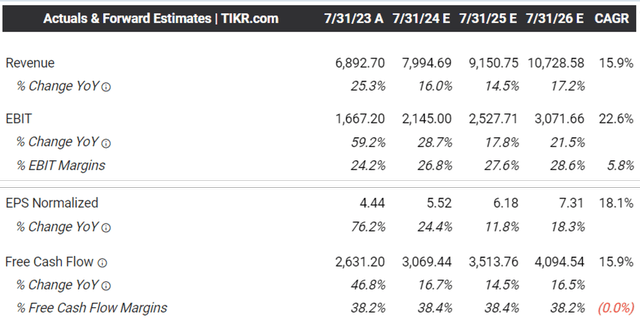

Consensus Forecast

Tickle Terminal

With PANW’s growth prospects slowing, it’s not surprising that the consensus is already softening its future expectations, with PANW expected to report disappointing sales/profit growth at CAGR +15.9%/ +18.1% through FY2026.

This compares with previous forecasts of +22.3%/ +24.9% from FY2016 to FY2023 and historical growth rates of +25.9%/ +34.5% indicating the end of a high growth trend.

Currently, with cash/short-term investments of $2.88 billion (-14.2% QoQ/-27% YoY) and convertible senior notes of $1.16 billion (-36.2% QoQ/-68.4% YoY), PANW appears well capitalized to weather near-term uncertainty.

This was heavily driven by a $3.01 billion increase in free cash flow over the trailing 12 months (up 9.8% sequentially), and the consensus also forecasts strong cash flow, suggesting the SaaS company’s ability to maintain its platform/sales approach going forward.

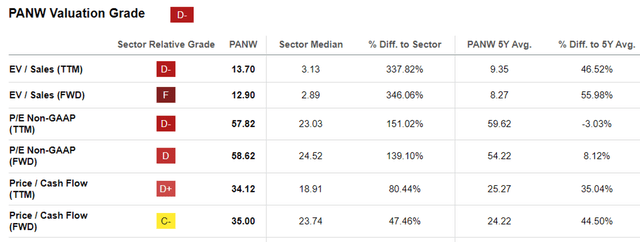

PANW Evaluation

Find Alpha

However, with growth set to slow going forward, this is why we believe PANW’s FWD P/E valuation is expensive at 58.62x compared to its one-year average of 50.54x and its three-year pre-pandemic average of 42.24x.

Compared to its cybersecurity SaaS peers, such as CRWD (FWD P/E valuation 89.06x), Fortinet (FTNT) at 35.19x, ZS at 65.39x, and Okta (Octa) at 45.41x, it’s clear that PANW is not cheap here.

This is especially true when comparing PANW’s consensus forecasts through FY2026 with CRWD’s +27.4%/ +27.8%, FTNT’s +12.2%/ +12.5%, Z’s +26.9%/ +31.1% and OKTA’s +13.1%/ +28.5%, with the former’s overvalued share valuation offering a minimal margin of safety for interested investors despite recent pullbacks.

PANW is no longer a high growth stock, and we believe the premium built into the company’s stock valuation is currently unjustified.

Readers may want to monitor the company’s performance in the medium term until its billing growth approaches that of better-performing peers and its robust RPOs are monetized into revenue.

Is PANW stock a buy?sell or hold?

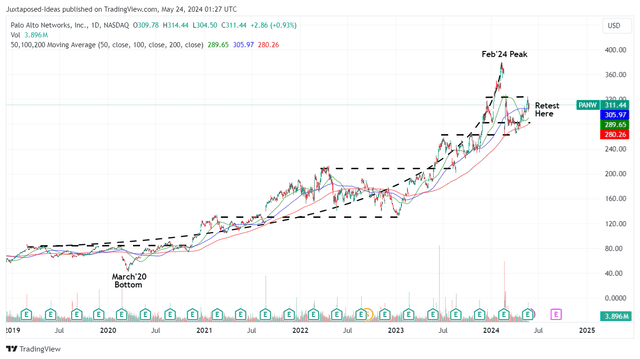

PANW 4Y Stock Price

Trading View

As of now, PANW is already down -3.8% since its most recent earnings release, but is down -14.9% since its Q3 2024 earnings release, when management forced the stock to take a big hit. Lowers outlook for fiscal 2024.

Nonetheless, based on trailing-12-month adjusted EPS of $5.60 and a pre-pandemic three-year average P/E ratio of 42.24 (close to lower-growth peers due to PANW’s slower monetization trends), it’s clear that the company’s shares are trading at a significant 28.4% premium to our fair value estimate of $236.50.

With fiscal 2026 adjusted EPS forecast of $7.31, our long-term target price of $308.70 also appears to have a minimum margin of safety.

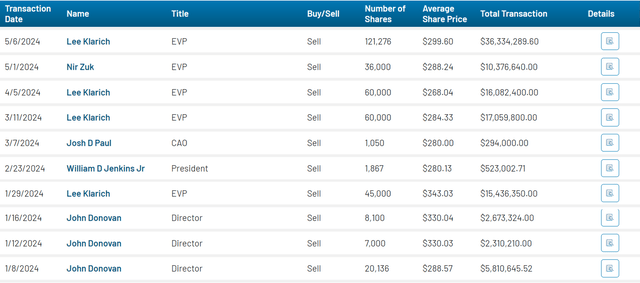

PANW Insider Sales

Market Beat

At the same time, readers should also note that PANW insiders have been gradually cashing out at these peak levels, making their investment thesis for shareholders worse. Continues to be diluted Stock-based compensation for the trailing 12 months was $1.06 billion (up 2.9% sequentially), and the number of shares rose to 354.6 million (up 9.9 million sequentially and 71.1 million since fiscal 2019).

Given the uncertainty around the risk/reward ratio, we have initiated a Hold (Neutral) rating on the stock and it is likely to continue trading sideways until it reaches a premium valuation.

On the other hand, traders might consider engaging in momentum trading and re-entering after a major pullback.