Nastco/iStock via Getty Images

One of the most fascinating companies on the market at this point in time has got to be Medical Properties Trust (NYSE:MPW). If you are reading this article, odds are that you know what the company does. But for those who don’t, it’s worth mentioning that it is a REIT that owns and leases out hundreds of buildings that are used by the medical industry. Usually, REITs are viewed as bastions of safety that generate strong returns for investors. But this is not always the case. From time to time, some players in the REIT space face difficulties. And Medical Properties Trust has been one such example.

High amounts of debt, combined with issues with tenants, has resulted in tremendous downside from where shares traded not long ago. As an example, the 52 week high mark for the stock was $10.74. As of this writing, shares are down more than half at $5.04. And at one point in the past year, they have been down as far as $2.92. I originally started acquiring the stock back in May of 2022. The highest price I paid for it was $18.55 per share. So as you can tell, it has been a rough go for many investors. Fortunately, I didn’t go all in at once. I built up my steak and, as of this writing, I’m not far from breakeven if weeks exclude distributions. My weighted average cost today stands at $5.66. And that is because I piled in after shares plummeted.

As of this writing, Medical Properties Trust is the largest holding in my portfolio, accounting for 22.6% of my assets. To be perfectly honest, this is a larger share of my portfolio than I am usually comfortable with. And at some point, I will unload some of my units. Having said that, as I stated in my last article on the company, published just last month, shares look to be significantly undervalued and management is making moves in order to shore up the company’s issues.

Since I last wrote about the company last month, a lot has transpired. In addition to management reporting financial results covering the first quarter of the company’s 2024 fiscal year, the firm also had to deal with the fallout of news that its largest tenant, Steward Health Care, finally filed Chapter 11 bankruptcy in order to restructure operations. And most recently, management announced a refinancing of some of its debt that will allow the firm to push the repayment of $800 million worth of debt substantially into the future. Given all of these developments, I figured it would be a good idea to revisit the firm and see whether or not my original thesis still makes sense.

A solid move by Medical Properties Trust

The most recent development announced by the management team at Medical Properties Trust involves the company’s decision to refinance some of its debt. According to a press release issued on May 24th, the firm was able to enter into a new non-recourse, non-amortizing secured financing that is backed by some of its properties in the UK. With this $800 million raise, the company has successfully tapped into a total of $2.4 billion of liquidity so far this year. This debt is backed by 27 of the 36 facilities that the firm currently leases to Circle Health in the UK. The maturity of the debt is 10 years into the future and it carries a fixed cash pay interest rate of 6.9%.

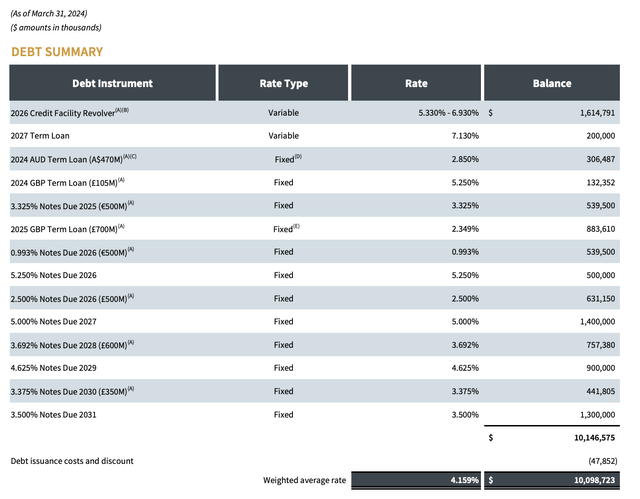

Medical Properties Trust

It’s unclear exactly how management intends to use the $800 million. They did say that they are going to be paying off the secured term loan that the business has coming due in December of this year. At current exchange rates, this comes out to roughly $132.4 million. With a 5.25% interest rate, this does imply that the firm is going to have to pay a little extra in the form of interest. The firm also said that it intends to pay some unspecified amount toward its revolving credit facility and to pay down a portion of its GBP term loan that matures early next year. The credit facility in question has an outstanding balance of $1.61 billion. And the term loan is worth $883.6 million. Or at least that is what the balances were as of the end of the first quarter. It is important to note that, subsequent to the quarter, in April of this year, Medical Properties Trust successfully sold off five of its Utah based properties to a joint venture that it would own a minority interest in.

Gross proceeds for that came out to $886 million. The company also got an extra distribution from that joint venture of $190 million. Management made clear that at least some of those proceeds would go toward the revolving credit facility. So until we have more data from the company, we actually have no idea what the end result will be. To keep things simple, if we assume that the company uses $100 million to pay down the GBP term loan and uses the remaining $567.6 million toward paying down the revolving credit facility, this particular transaction will result in annual interest expense growing by about $6.6 million. But that is a small price to pay when you consider that this takes $800 million of debt that would be coming due between this year and the end of 2026, and pushing that out 10 years to 2034. That means that the total amount of debt coming due between this year and the end of 2026 will drop from $5.15 billion to $4.35 billion without factoring in the pay down from the other asset sales.

Another interesting piece of information is that the loan to value ratio implied from this debt issuance was in the low 40% range. Since management did not give an exact number, we don’t know exactly what this values those 27 properties at. If we take a loan to value ratio of 40%, this implies a valuation for those properties of $2 billion. And if we use a loan devalue ratio of 45%, then we are looking at $1.78 billion. Regardless of what the number is, management claims that this values those assets 20% higher than what the company paid for them roughly four years ago. This is the newest testament of many to the idea that the real estate assets on its books are worth at least book value, if not more.

Steward

In my opinion, the good associated with the debt issuance most certainly outweighs the bad. It would have been nice if the company could have kept interest expense from rising. But that seems improbable. But other than that, I don’t really have a complaint. But this is not to say that everything is going great for the company. Earlier this month, news broke that Steward Health Care was entering into Chapter 11 bankruptcy protection. In response to this, on May 6th, management issued a press release talking about the bankruptcy process and what it means for shareholders as far as the company can tell at this point in time.

First and foremost, management announced that they were providing $75 million in DIP (debtor-in-possession) financing so that Steward can continue to operate while it is undergoing its restructuring activities. Even though the company has been burned when it comes to lending money to Steward, DIP financing is some of the best and most secure financing imaginable. It basically gives Medical Properties Trust first claim on assets up to the amount of the financing. In addition to this, the interest rate that must be paid on this debt is often quite high. I have seen rates well above 10% per annum on DIP financing in the past. So this would be a bit of easy money for the company for the foreseeable future.

On May 10th, following its first quarter earnings release, the company provided more details on material impairments that it is incurring as a result of the bankruptcy. Previously, Medical Properties Trust The company had working capital and other secured loans to its tenant in the amount of $346 million. This is on top of $362 million worth of loans to affiliates of the tenant. The REIT also had a 9.9% equity interest in the tenant. Because of the bankruptcy, some of these assets are now likely worthless. Or at least that is what management asserts. During the final quarter of last year, management announced that they were recognizing impairment charges on certain real estate assets, as well as on the 9.9% equity interest in Steward, totaling $700 million. Then, in the first quarter of this year, the company recognized another $470 million worth of impairment charges on assets, wiping out not only what remained of the equity interest in its tenant, but also getting rid of $362 million worth of loans from affiliates of said tenant. This included an accrual for property taxes and other expenses not paid by Steward to Medical Properties Trust that were supposed to be paid. The only good news on this front is that the $346 million of non-real estate loans to the tenant, loans that are secured by collateral, are expected to be fully recovered.

Medical Properties Trust

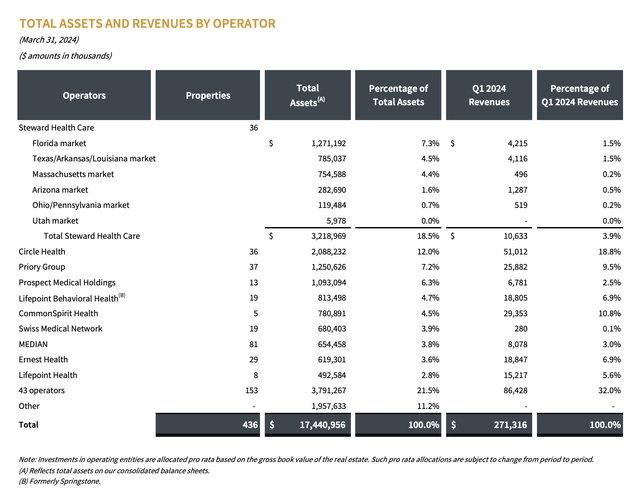

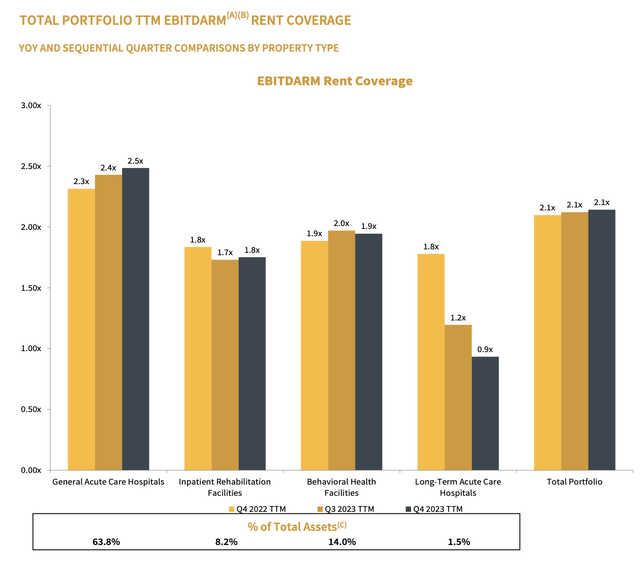

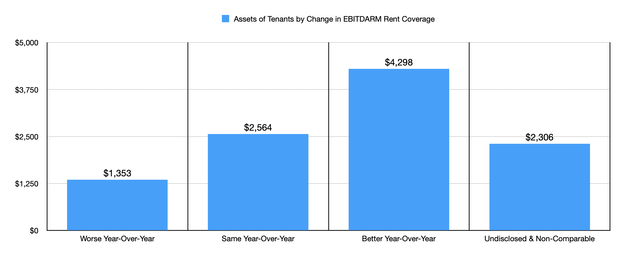

This is not an insignificant issue for the company. As of the end of the first quarter of this year, a whopping 18.5% of Medical Properties Trust’s assets were leased to Steward. And because of the bankruptcy process, Medical Properties Trust is now looking for new tenants to take over those hospitals. Those who are bearish about the company may argue that risks remain regarding other tenants potentially facing difficulties. I can’t deny that this is a possibility. If I did, I would be lying to you. However, when I looked from the first quarter of 2023 through the first quarter of this year, I found that tenants representing $3.69 billion worth of leased real estate assets saw an improvement and their trailing 12 month EBITDARM rent coverage ratios. Tenants representing another $2.56 billion worth of these types of assets saw their EBITDARM rent coverage ratios remain the same year over year. And tenants representing only $1.35 billion worth of these types of assets reported a worsening in their ratios.

Medical Properties Trust

Earlier this month, in response to concerns over what the bankruptcy would mean for shareholders, the management team at Medical Properties Trust issued a six-page statement that helps to explain why Steward ultimately failed. Management pointed out, rightfully so, that rent is almost never the primary cause of financial distress for hospitals that fail. The company cites not only some of the transactions that it made in recent years, including the joint venture sale of Utah properties that I mentioned earlier, a sale that affirmed the value of those assets, it also provided some insight into what little data is available regarding Steward. It blamed the issues of the tenant on multiple contributors. A bloated cost structure associated with the firm’s growth strategy was one such issue pointed out. However, management also talked about the role that the COVID-19 pandemic played in the picture.

Author – SEC EDGAR Data

During the pandemic, the number of elective procedures plummeted. Some estimates put the cancelation rate during the peak of the pandemic comfortably above 70%. According to one report published in early 2021, the decline in elective surgical procedures from March of 2020 through May of 2020 cost hospitals in the US approximately $22.3 billion in missed revenue. Another source estimated that the worst days of the pandemic cost the US hospital system between $16.3 billion and $17.7 billion each month in the form of reduced reimbursements and between $4 billion and $5.4 billion each month in the form of net income. This echoes what Medical Properties Trust stated in its own press release in response to the Steward bankruptcy filing. The good news is that we are starting to see a recovery in elective procedures. By late October of last year, Google searches for 20 different elective medical procedures were at 114% of what they were prior to the COVID-19 pandemic. This suggests that the medical industry is truly starting to recover and that should bode well for the firm’s other tenants.

MPW stock offers significant upside

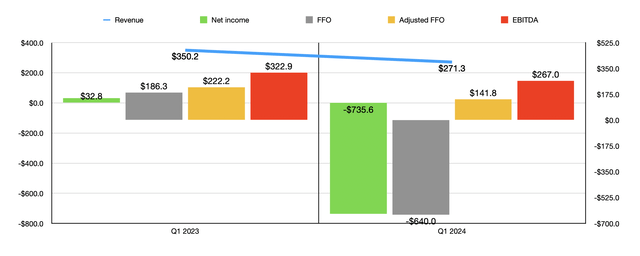

Author – SEC EDGAR Data

Because of asset sales, as well as other issues, financial performance achieved by Medical Properties Trust has been under pressure. In the chart above, you can see financial results covering the first quarter of the 2024 fiscal year compared to the first quarter of 2023. Revenue, profits, as well as various cash flow metrics, were all down year over year. Unfortunately, we don’t have my favorite metric, which is operating cash flow. But that is because the company has delayed the filing of its 10-Q because of the issues with Steward.

Author – SEC EDGAR Data

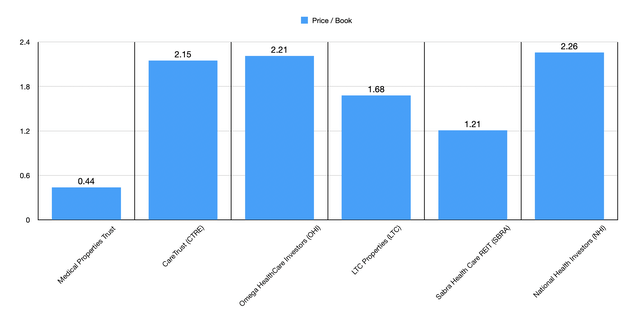

Even with these problems, we are looking at a business that generates annualized EBITDA of $1.07 billion. For the purpose of this analysis, I believe that using this annualized figure makes sense more than a trailing 12-month figure. That is because asset sales would mean that, using the historical figure, would give an overly inflated reading for EBITDA. While the company has faced troubles, namely a decline in its net asset value because of these asset impairments, it still boasts shareholders’ equity of $6.84 billion. This translates to a price to book multiple of only 0.44. In the chart above, you can see how this stacks up against five similar firms.

Author – SEC EDGAR Data

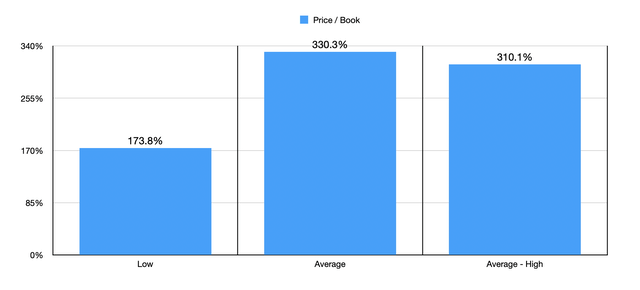

Using this data, I then was able to create the chart above. In it, you can see a few different scenarios that point to potential upside for the company. The most conservative of these scenarios assumes that Medical Properties Trust should trade at the price to book multiple of the cheapest of the five companies that I compared it to. This would result in upside of 173.8%. The most aggressive scenario averages out the price to book multiple for the five firms and applies that to our prospect. And the final scenario strips out the most expensive of the five companies from the average to calculate upside. At the end of the day, we are looking at upside of between 173.8% and 330.3%.

Author – SEC EDGAR Data

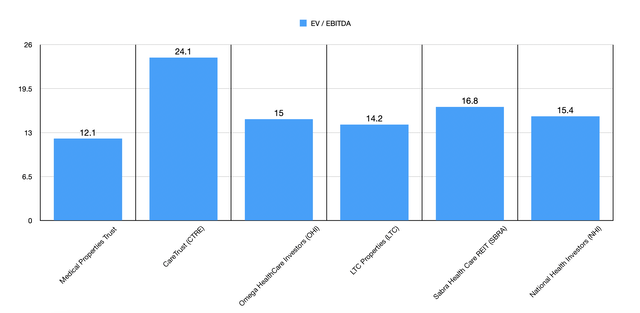

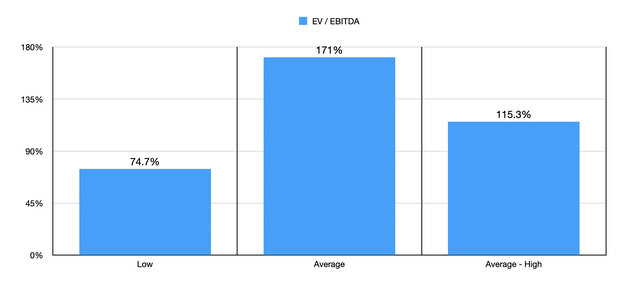

Another way to value the company that gives us a more conservative outcome would be through the lens of the EV to EBITDA multiple. Using the annualized EBITDA for the company compared to the most recent annual EBITDA readings for its competitors, we can see that Medical Properties Trust is trading at a steep discount to its peer group. In the chart below, I then calculated upside just like I did with the price to book approach. This results in upside of between 74.7% and 171%.

Author – SEC EDGAR Data

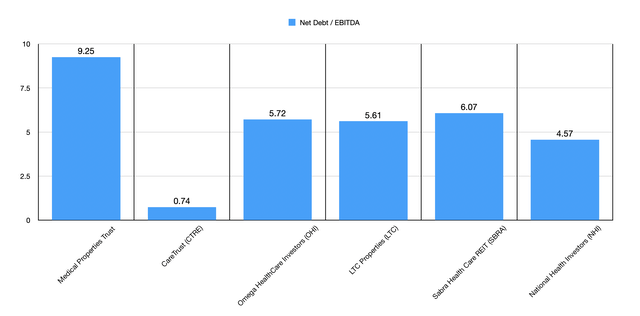

To be perfectly clear, I would argue that Medical Properties Trust deserves to trade at a discount to its rival group. And this is because the company does have a net leverage ratio that is higher than those companies. In the chart below, you can see what I mean. Clearly, CareTrust REIT is an extreme outlier with a net leverage ratio of only 0.74. However, the others all fit within a pretty narrow range of between 4.57 and 6.07. By comparison, Medical Properties Trust has a net leverage ratio of 9.25. That number is almost certainly going to be lower when the company reports financial results for the second quarter of 2024. And that is because of the aforementioned asset sale. But this does go to show that the company needs to consider additional asset monetization in order to lower overall leverage. In all honesty, even breaking the company up entirely and selling off the pieces could be highly profitable from this point.

Author – SEC EDGAR Data

Takeaway

At this point in time, it’s clear that the market does not like Medical Properties Trust all that much. Having said that, I believe that the company offers tremendous upside potential from here. In an article that I published about the firm in January of this year, I even looked at what I called a ‘nightmare scenario’ where almost all of its assets, other than its core real estate assets, are completely wiped out. But even in that case, with $5.11 billion of net asset value eradicated, shares were still worth $5.30 apiece. Obviously, I don’t think that kind of scenario is likely. But it does go to show just how much carnage could be inflicted on the company while still offering some upside for investors. Given this, I believe that maintaining my ‘strong buy’ rating makes sense at this time.