Tony Anderson

I have always found the homebuilding industry to be an attractive sector. Persistent supply shortages and assets that have historically almost always appreciated in value make it an attractive prospect if priced right. This is because homebuilders It’s well-run and worth looking into, which is the attitude I approach every analysis with. Taylor Morrison Home Corporation (New York Stock Exchange:TMHC) I first wrote about it in January 2022 and have been doing it ever since.

Latest article My article on the company was published last August, in which I acknowledged that the stock price had risen significantly despite mixed financial performance, but my view that the industry was showing signs of growth and that the stock price was undervalued meant that I had to maintain my rating for the company at “Buy.” Stocks should outperform the broader market in the near future. And that’s exactly what’s happened since then. Homebuilder stocks are up 26.3%, far outpacing the 17.8% gain for the S&P 500 over the same period. And since I first saw this news: The company was evaluated The stock has risen 101.6% since it was rated a “buy” in January 2022. This is far outpacing the broader market’s 21.2% gain.

Concerns that the economy may finally be slowing, coupled with the stock’s rally, might lead you to believe that I would finally downgrade the company. However, that is not the case. In fact, the stock remains attractive both in absolute terms and relative to peers. Add to this some positive indicators that far outweigh the recent weakness shown by management, and I can’t do anything but maintain my Buy rating for now.

Stock prices are likely to continue to rise

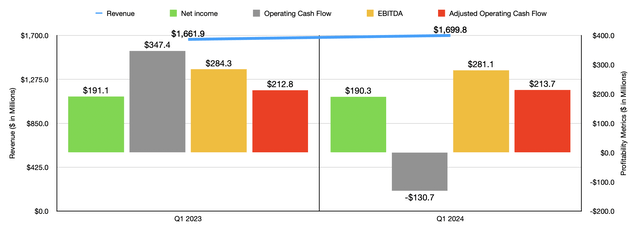

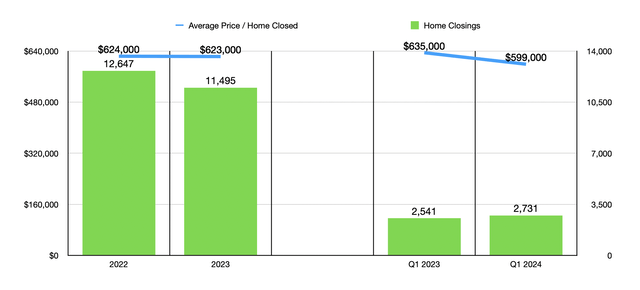

Basically, Taylor Morrison has been in a bit of a mixed bag lately. Let’s start with the earnings. A few more quarters of data have been released since I last wrote about the company. The most recent data was: 1st Quarter 2024At the time, sales were just under $1.7 billion, up 2.3% from $1.66 billion in the same period last year. 2023The increase was driven by an increase in home purchase contracts, from 2,541 to 2,731. However, this figure was somewhat offset by a decrease in the average closing price, from $635,000 to $599,000 per home.

While revenue grew modestly, profitability declined slightly. For example, net income fell from $191.1 million to $190.3 million. There were several changes that impacted this to some degree. For example, sales, commission and other marketing expenses increased from 5.58% of revenue to 6.04%. This may not seem like a big difference, but when applied to revenue in the first quarter of this year, it represents a reduction in profits of $7.8 million on a pre-tax basis. Other profitability measures broadly followed suit. For example, operating cash flow fell from $347.4 million to negative $130.7 million. However, when adjusted for changes in working capital, this measure rises from $212.8 million to $213.7 million. Finally, EBITDA of the business fell from $284.3 million to $281.1 million.

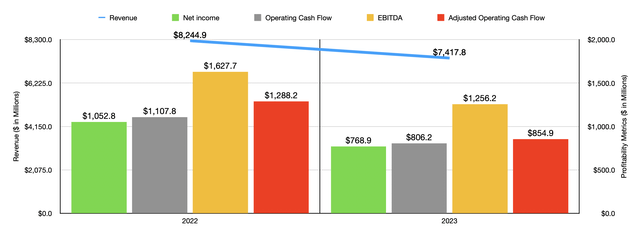

As you can see from the chart above, this is not the first time the company has faced some pressure. In 2023, revenue, profits, and cash flow all declined year over year. This was due to a significant decline in the number of home closings from 12,647 to 11,495. At the same time, the company suffered a decline in the average closing price from $624,000 to $623,000. However, this decline affected the entire industry. After all, inflationary pressures combined with high interest rates aimed at fighting inflation had a serious negative impact on consumers’ ability and willingness to purchase homes. In late 2022 and early 2023, it felt like the weakness would continue at least into the 2023 calendar year. However, by mid-year, we began to see some positive indicators suggesting that the housing shortage was more than offsetting the pressure on homebuyers.

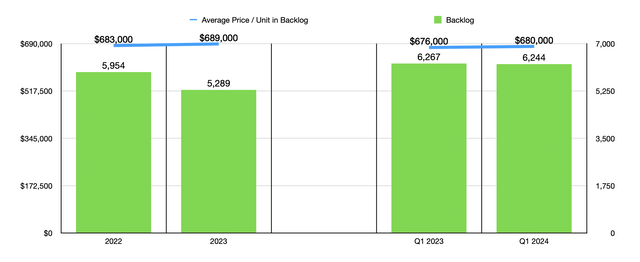

That’s not to say that all is well for Taylor Morrison at the moment. There are some issues to address. Most notably, the number of homes in the backlog is still low compared to last year. By the end of the first quarter of 2024, the company had 6,244 homes in its backlog. This is down from 6,267 a year ago. The good news on this, however, is that this was offset by a year-over-year increase in the average home price in its backlog, which rose from $676,000 to $680,000.

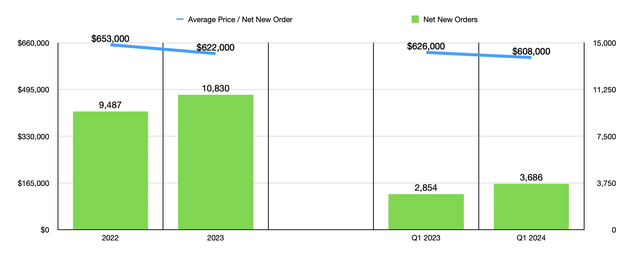

Looking at numbers like these, you might think I would be more pessimistic on the company. However, there are some really positive signs investors should be happy about at this time. The most important, in my opinion, are net new residential orders. In the first quarter of this year alone, the company recorded a total of 3,686 net new orders. While the average order price of $608,000 is below the $626,000 reported in Q1 2021, net new orders are up significantly, up approximately 29.2% from the 2,854 net new orders reported in Q1 2023.

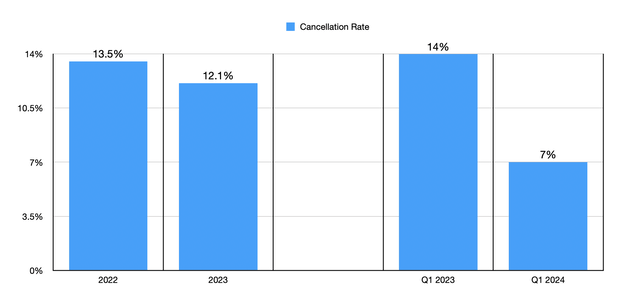

Another positive is that the company saw a significant drop in home cancellation rates. From 2022 to 2023, the company saw its cancellation rate improve from 13.5% to 12.1%. In the first quarter of 2023, the cancellation rate was quite high at 14%. But by the first quarter of this year, that number had plummeted to just 7%. What all of this means is that while backlogs remain low year-over-year and pricing may not be ideal, consumers are looking to buy homes again and are fulfilling far more purchase contracts than they did a year ago. This is undoubtedly a positive for the company and its investors.

Management expects this strength to benefit shareholders in the current fiscal year. For the entire year 2024, they expect approximately 12,500 homes to trade hands. This would be up from 11,495 homes in 2023. Unfortunately, they expect the average price of home transactions to be lower at $600,000 to $610,000. This compares negatively to the $623,000 reported in fiscal year 2023. However, if demand for real estate remains high, it is only a matter of time before the average price per home sold increases.

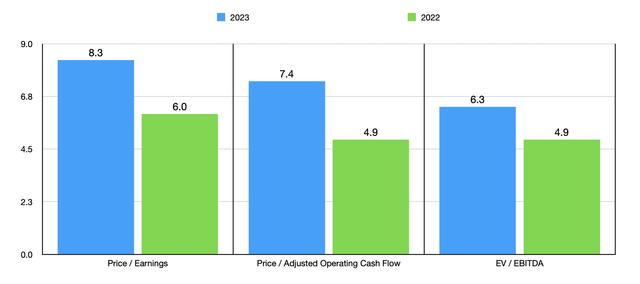

Given that management has not provided any actual guidance on bottom line earnings, it may be best to value the company using both 2022 and 2023 results. In the chart above, we have done just that. It is always nice to see a company trading in the mid to high single digit range, as is the case here. In addition to the stock being cheap in absolute terms, the stock also looks cheap relative to similar companies. In the table below, we compared the company to five similar companies. In terms of both the price-to-earnings approach and the price-to-operating cash flow approach, only one of the five was cheaper than the company. And in terms of the EV/EBITDA approach, Taylor Morrison ended up being the cheapest of the group.

| company | Price / Earnings | Price / Operating Cash Flow | EV/EBITDA |

| Taylor Morrison Home Corporation (TMHC) | 8.3 | 7.4 | 6.3 |

| Legacy Housing Corporation (Legs) | 11.4 | 44.3 | 8.4 |

| Meritage Homes (MTH) | 8.5 | 21.6 | 6.5 |

| Century Community (CCS) | 9.8 | 74.7 | 9.3 |

| Beazer Homes USA (BZH) | 5.7 | 25.8 | 10.1 |

| KB Home (KBH) | 10.0 | 5.9 | 8.4 |

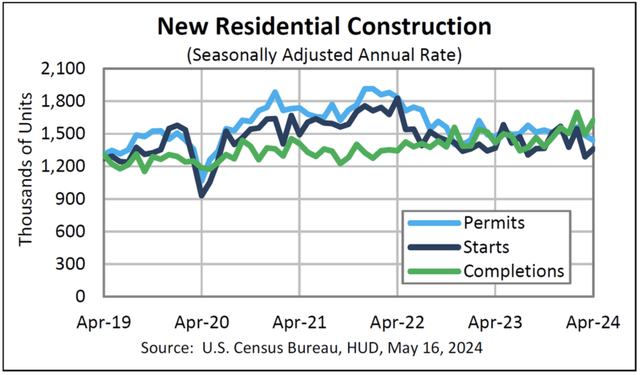

Beyond the fundamental data, there’s some other interesting data that investors should be aware of. First, it’s actually a bit surprising that management is making claims about the number of deals expected this year. data For example, available data from the U.S. Census Bureau estimates that building permits in April totaled 1.44 million, 2% lower than the 1.47 million reported for April 2023. For example, housing starts totaled 1.36 million, only 0.6% lower than the 1.37 million reported for the same period a year ago.

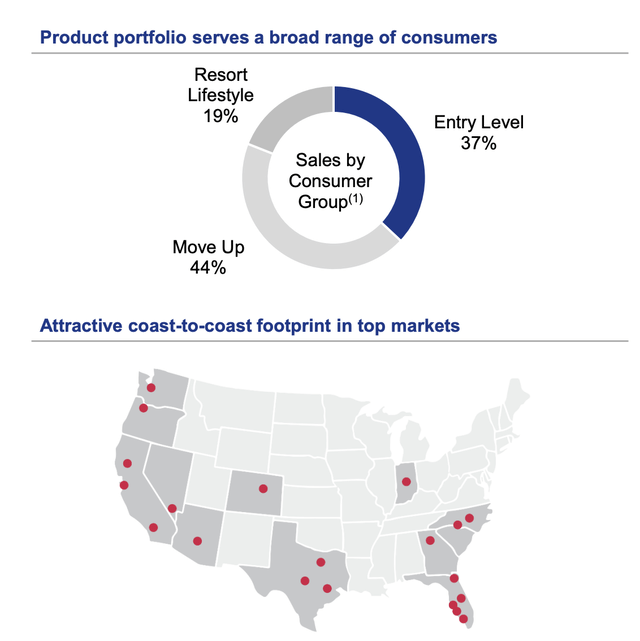

Perhaps the strength that management is forecasting from the data this year is due to the overall business model that Taylor Morrison is pursuing. First, the company is a fairly large, nationally influential company. Run The company operates in large states such as California, Texas, and Florida. It also has a presence in several other Sunbelt states such as Georgia and the Carolinas. These are all fairly attractive markets compared to other regions such as the Midwest and Northeast. In addition to this, the company operates by focusing on diverse customer types. Most notably, 37% of revenue comes from entry-level buyers and another 44% from buyers in the “upgrade” category. These are the most price-sensitive type of customers, but they are also the ones with high demand for homes. The company also benefits from high-end customers, as measured by 19% of revenue from what management calls the “resort lifestyle” group. This should help boost performance during challenging times.

Taylor Morrison Home Corporation

remove

While Taylor Morrison’s financial performance may not be perfect, the company is on solid ground and the stock looks cheap. Leading indicators are very bullish for investors right now, not just on an absolute basis, but also relative to peer companies. All things considered, this company looks very attractive, and I maintain my Buy rating on the company.