PM image

Real estate investment trusts (REITs) have struggled in recent years as rising interest rates have posed headwinds for the industry and concerns remain over commercial real estate defaults. There are times when they behave like a risk-on sector (benefiting from low equity volatility) and times when they behave like a risk-off sector (benefiting from high equity volatility). But whether they are risk-on or risk-off doesn’t matter in the long run for this group, because given how weak these stocks have been for so long, they’re likely to continue to outperform for a long time to come. If you agree, you should consider the Invesco S&P 500® Equal Weight Real Estate ETF (NYSEARCA:RSPR) might make sense.

RSPS is an exchange-traded fund designed to track investments. S&P 500® Equal Weighted Real Estate Index Results. The index is composed of companies in the real estate sector that are included in the S&P 500, and each index constituent is equally weighted in the portfolio. This equal weighting approach is designed to reduce concentration risk by underweighting larger, more expensive companies, while ensuring that small or mid-sized companies are not undervalued relative to their market capitalization.

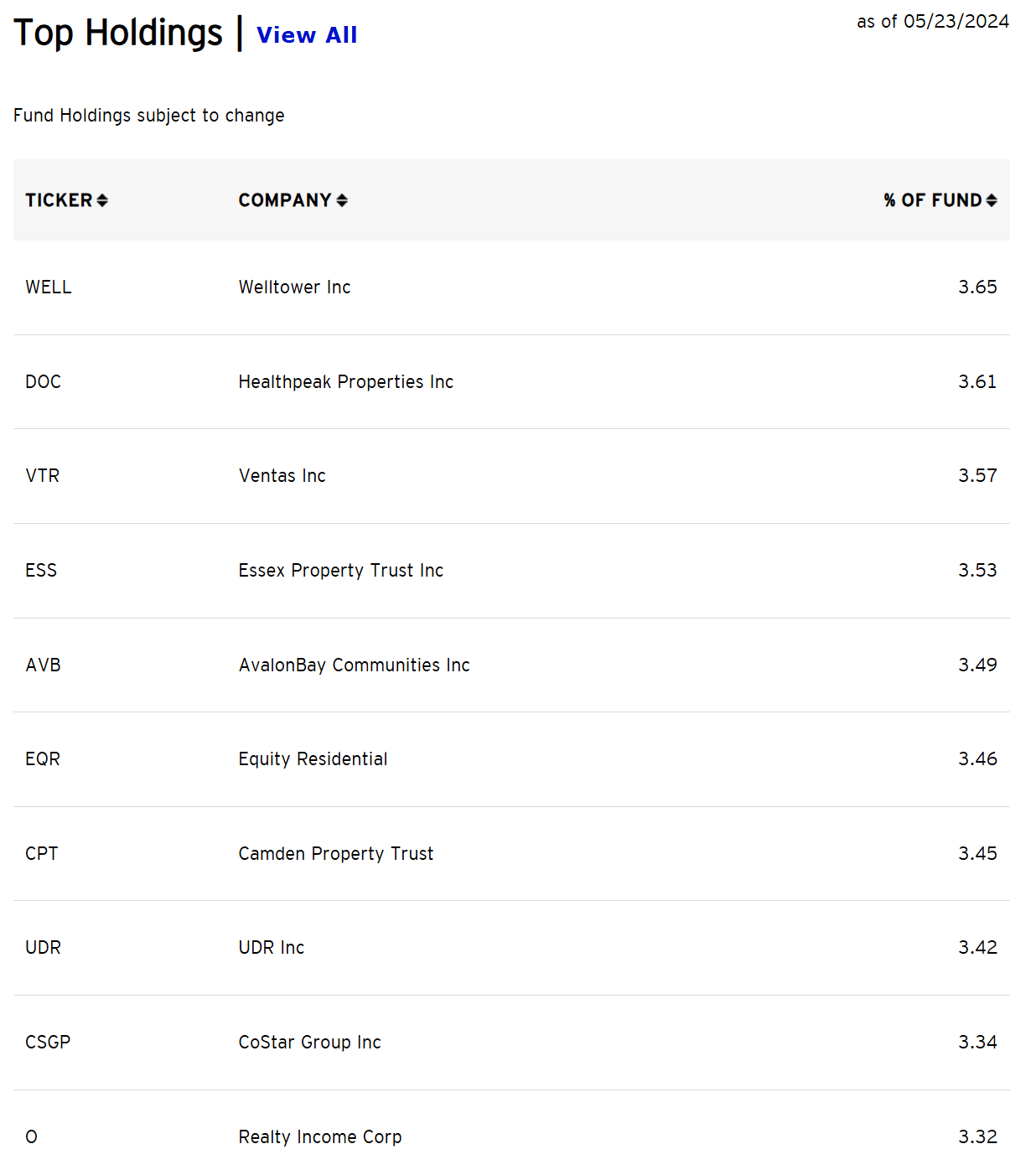

ETF Holdings

RSPR holds 32 stocks, and when rebalanced, each stock is evenly distributed at roughly 3% of the total. The equal-weighted approach here means that the top 10 stocks have naturally outperformed, and therefore have a higher relative weighting.

Invesco

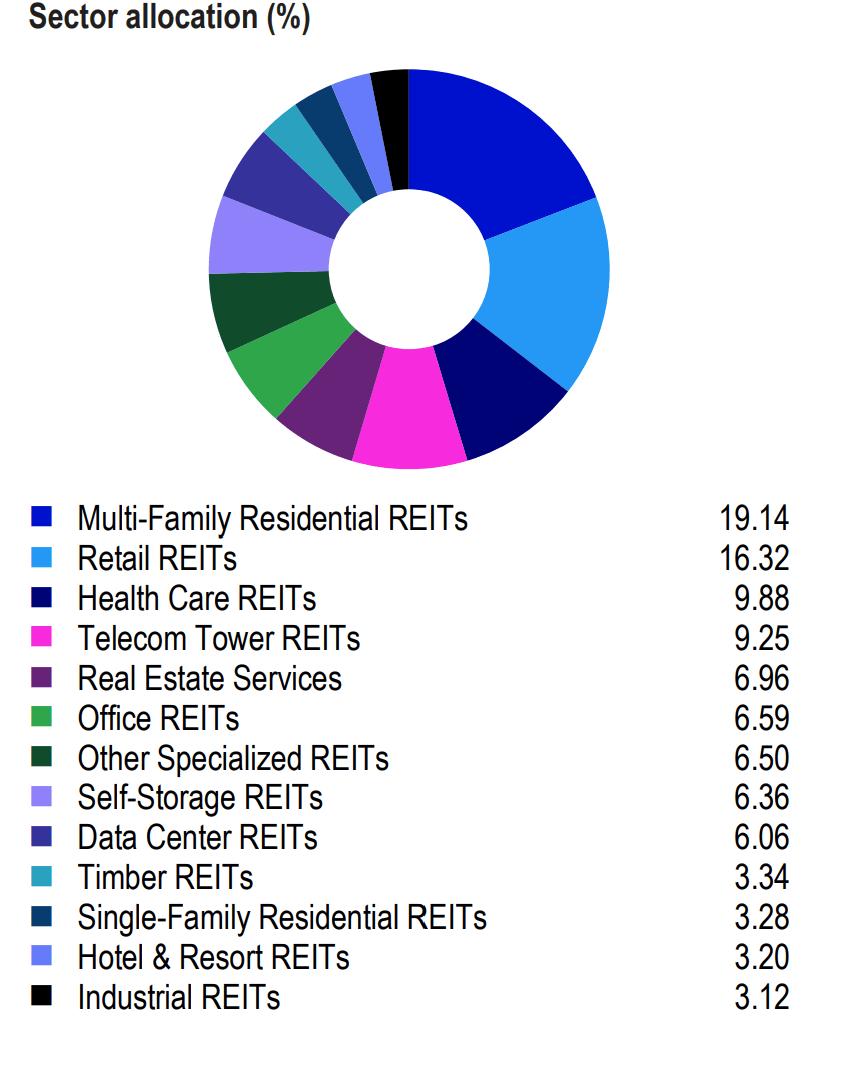

Sector Composition and Weightings

The RSPR ETF’s sector distribution reflects the broad composition of REITs. Multifamily REITs have the largest weighting at 19.14%, followed by Retail REITs at 16.32% and Healthcare REITs at 9.88%. The next sectors are Communication Tower REITs at 9.25% and Real Estate Services at 6.96%. Office REITs have weightings of 6.59%, Hotels at 4.35% and Data Centers at 3.92%. The remainder of the sector analysis is made up of a number of subsectors, including Self Storage, Timberland REITs, Diversified REITs and Mortgage REITs. A good mix overall. It’s good to see the relatively low overall weighting of Office REITs, which have been a concern.

Inveso

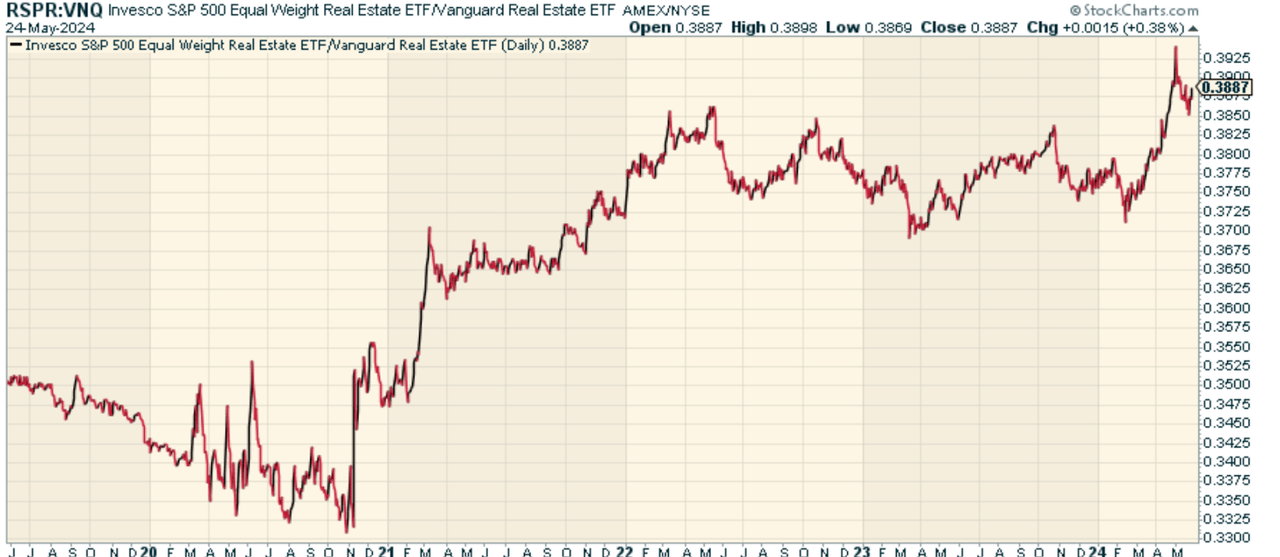

Peer Comparison

While RSPR approaches the sector with an equal-weighting approach, we need to look at its performance relative to other ETFs that offer exposure to the real estate sector. To do so, consider that Vanguard has a market-cap-weighted real estate ETF that tracks the MSCI US Investable Market Real Estate 25/50 Index. Its ticker is VNQ. Looking at the price ratio of the two, we can see that RSPR’s equal-weighting approach is indeed less risky and has outperformed VNQ.

Stock Chart

Pros and Cons

On the plus side, equal weighting potentially reduces exposure and provides overall diversification, plus, because all of the companies in the index are part of the S&P 500, you can be (at least to some extent) certain about the quality and liquidity of the underlying holdings.

The problem is that the REIT sector as a whole is sensitive to interest rates. Higher funding costs will reduce REIT cash flows, which could hurt fund returns as higher interest rates squeeze margins. It’s also possible that market-cap-weighted REITs will outperform their equally weighted counterparts over the next few years, as larger companies may be better able to handle refinancing risk. And of course, the larger issue remains that some real estate subsectors are sensitive to consumer behavior and economic conditions. For example, the shift to remote work and the rise of e-commerce could change demand for office and retail space, redirecting it to other uses and suppressing the performance of the associated REITs.

Verdict: To invest or not to invest?

I like REITs and I like this fund. I believe the fund is well diversified and reflects the sector better than market-cap weighted proxies. Keep in mind that REITs can help diversify returns, but they also tend to offer solid yields. The current 30-day SEC yield of 3.6% is attractive relative to capital appreciation for many of these stocks. For those looking for a differentiated approach to real estate investing, this fund offers a great opportunity as the economic cycle may finally be favoring these companies after a long period of weakness.

Predicting crashes, corrections and bear markets

Predicting crashes, corrections and bear markets

Are you tired of being a passive investor and ready to take control of your financial future? Introducing Lead-Lag Reporting, an award-winning research tool designed to give you a competitive advantage.

The Lead-Lag Report is your daily source for identifying risk triggers, discovering high-yield ideas, and gaining valuable macro observations. Stay one step ahead with key insights into leaders, laggards, and everything in between.

Move from risk-on to risk-off with ease and confidence. Subscribe to the Lead-Lag Report now.

Click here to access and try the Lead-Lag report free for 14 days.