JoeDphoto/iStock Unreleased via Getty Images

Dear readers and followers,

Over a year ago, I bought a Smith & WessonNasdaq:SwitzerlandThe company is a market-leading firearms company with strong margins, low debt and impressive profitability. Unstable revenue trends.

At the time, the company’s results showed improved sales driven by a focus on the outdoor market and several new products that were well received in the market. I expected the company to continue to perform well, but I did not expect it to nearly double the S&P 500 in that time.

And yet it happened.

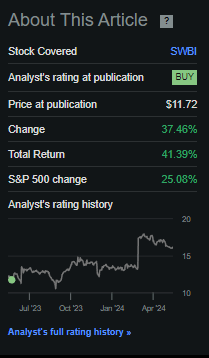

Since my article and bullish assessment, the company’s TSR has increased to over 41%, as shown below.

Seeking Alpha Smith & Wesson Article (Seeking Alpha Smith & Wesson article)

Therefore, we You may be in a very good position with this stock holding and considering rotating at the right price, and that is one of my main goals in this article – to tell you if now is the time and if not, state and tell you why.

For many investors, firearms remain a no-brainer. My own stance on firearms is not all that controversial. Smith & Wesson Brands was a very marginal “buy” in my portfolio, but companies that outperform the index are worth featuring here. Also, I am not picky about products or companies. In my opinion, it is not the investor’s job to distinguish between right and wrong, but the job of the respective law and policy makers.

Of course, there are funds and strategies that get around this, but I’m not one to do that. When the situation is right, I’ll invest in anything that’s legal and profitable.

Let’s see what we have here.

Smith & Wesson – The upside here is no longer as attractive

Some have stated and believe that Smith & Wesson still has a lot of upside potential. The company is a company with a market cap of less than $1 billion, no real credit rating, and a relatively small yield, especially compared to what’s readily available in today’s market.

But Smith & Wesson is still leading the market. And by leading the market, I mean exactly that: it’s at the top of its class in terms of profitability — in this case, in the 60th to 80th percentile compared to the aerospace and defense industry — with net debt/EBITDA of less than 0.8x, interest coverage of more than 30x, and That’s excellent ROIC minus WACC.

The downside for Smith & Wesson is that its earnings have been and can be quite volatile, and trends and history speak for themselves: in particular, in periods following crises such as the Global Financial Crisis and COVID-19, the company saw negative net income but quickly recovered afterwards.

The key here is understanding circularity and how it’s cyclical: The company is in the handgun and long gun business, a market estimated to be just under $5 billion in the U.S. alone, and has a number of highly desirable brands.

Smith & Wesson IR (Smith & Wesson IR)

In its most recent quarter, Q3 2024, the company grew again. Quarterly sales increased 6.5% to $137.5 million, but there was a decline in gross margins, a decline in GAAP net income, and a slight decline in EBITDAS.

What is the reason for this decline and decline?

Well, shipments are outpacing the overall firearms market, which means demand hasn’t been an issue. And demand is expected to continue into 2024 due to the election cycle and other ongoing concerns. The company also owns a relatively new and very modern Tennessee factory that will be able to produce quality products for decades to come. They have a very strong balance sheet that can handle these challenges.

Channel inventory is also declining, indicating very strong sales numbers and operating cash flow is actually increasing, not decreasing. The company also used a small portion of its authorization to buy back 71,000 shares in the open market, but not by a large amount ($916,000 out of $50 million). Dividends remain unchanged at $0.12 per share.

As with any company with circulating products, stock levels at distribution points and their rotation remain a critical factor.

that’s why, Negative These come from new operating costs at the company’s new facilities, inefficiencies from start-ups, and what the company calls “inflationary factors,” which I consider to include labor, materials/inputs, and possibly logistics. This is due to increased sales and The January 1st price increase the company managed to push through (paid TIKR.com link).

Will these sub-30% margins become the new norm for Smith & Wesson?

It’s possible. We’ll see clearer signs in the next few quarters. I’ll be keeping an eye on this. The company said TN is increase Cost savings at the margin level, but this is also due to geographic P&L as the company is out of Missouri. The company is also clear that efficiencies and synergies from the new Tennessee facility have not yet been fully realized, but it remains to be seen whether this will make up for the 300+ bps gross margin gap. We will begin to see improvements as some automation changes are initiated. Also, the company has not yet closed its Connecticut facility, so this should also have room to upside.

This is also evident in operating expenses, which increased by approximately $500,000 due to higher depreciation and litigation costs.

Overall, SWBI is currently a firearms manufacturing and leisure goods company with a market cap of less than $1 billion, yielding less than 3%, and a P/E ratio of Significantly Normal operating range exceeded.

The company’s significant cyclicality creates some forecasting and valuation issues, which we’ll discuss later. But aside from that, Smith & Wesson is a relatively safe stock financially, with a good customer base, strong demand, a track record that beats the market, and a market that wants to buy its products. It’s also the number one firearms brand in America.

From an evaluation perspective, the following cases need to be considered:

Smith & Wesson Valuation – High in the Short Term, Potential for Upside in the Long Term

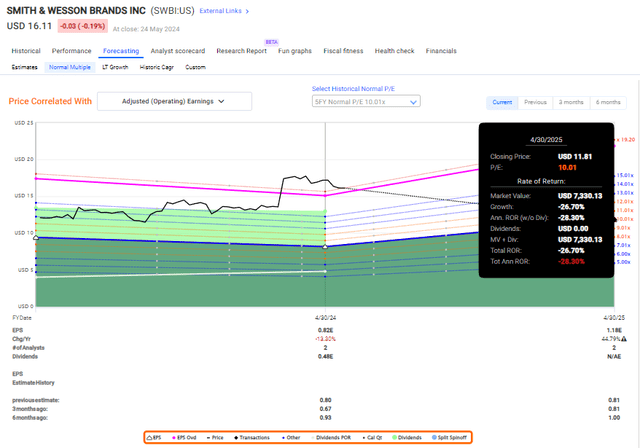

The paragraph title says it all. For example, if we look at companies from a 5-year average valuation perspective, Smith & Wesson is not trading at a P/E ratio of more than 10. Assuming that P/E ratio of 10 is where it is today, the company is definitely do not have It’s a “buy” here, because even with a strong 28% EPS growth through 2025, the company still has a 10x downside potential.

Smith & Wesson FAST Graph Upside (Smith & Wesson FAST Graph Upside)

But if we look at a longer-term view, say a 20-year average, the picture is very different, as the P/E ratio rises to about 20x. The one-year upside potential is about 58%, which is much higher than market expectations. Also, analysts are forecasting 44% growth this year, due in part to new facilities and election cycle trends, which should provide some cushion to valuations despite the recent “surge.”

There’s also the very simple fact that, historically, Smith & Wesson has frequently delivered above-average performance here — by more than 65% in a one-year period with a 10% margin of error, the business has significantly outperformed these projections, again lending some credence to the positive theory here.

The question is, where do we set our expectations? I say neither at the high end nor the low end. Smith & Wesson is worth considering for outperformance, but it’s already up 40%. It could go further, but the more it goes up, the more cautious I’d be.

I value the company’s shares at about 13.5-14 times average, which I believe is an average over roughly 15 years and includes the company’s potential annual earnings growth, but also factors in the possibility that the stock could actually decline.

For this reason, we Estimated EPS growth rate is 44.79% (paid FAST Graphs link)The company expects annual profit margins to be between 0% and less than 10%.

That, dear reader, is not enough to make me want to buy more.

Furthermore, looking back at my last article, the company’s stock price is now well above my conservative estimate of $13.5 per share, and with this strong performance and forecast in mind, I would raise my bar to around $15 per share to take this into account, making a P/E of 15-17x a reasonable estimate, but I wouldn’t go any further than that and won’t be making any predictions much higher.

The reason is simple: I say the company is now a no-no and I’ve changed my rating on Smith & Wesson from a “buy” to a “hold.”

I still use long-term sales and earnings/book value multiples as indicators of a company’s overall attractiveness, but with the current share price below my expected price targets, these don’t look as good as they did at the time of my last article.

My next article on Smith & Wesson is:

paper

- Like Ruger and other firearms manufacturers, SWBI is a volatile, cyclical company with ups and downs, but it is in a fundamentally attractive segment of the U.S. market. The company does not have a credit rating, but it also has very little debt and produces products that are highly unlikely to end up anywhere in the short, medium, or long term, at least in the U.S. market.

- I am giving the company a conservative PT of $15, down from a previous PT of $13.5, which implies a flat upside at today’s valuation. As I said in my last post, the upside is no longer huge, no longer over 15% per year. I don’t see the potential for significant outperformance here yet, which is why I think it’s time to move away from this stock.

- But you have to think of this company as cyclical and consider what other investments are out there at this point, because there are better investments out there.

- I say “hold” cautiously, but I have no plans to sell my shares in the company at this time.

Keep in mind, I am working on the following:

1. Buy undervalued companies (even if the undervaluation is only slight and not mind-bogglingly large) at a discount and allow them to normalize over time, earning capital gains and dividends in the meantime.

2. If the company becomes overvalued far beyond normal, I take my profits, switch my position to other undervalued stocks, and repeat #1.

3. If the company is not overvalued and remains within its fair value range or goes back to being undervalued, buy more as time allows.

4. Reinvest earnings from dividends, savings from work, or other cash inflows as specified in 1 above.

Here are my criteria and how the company meets them:Italics).

- This company is overall high quality.

- The company is fundamentally safe, conservative and well-managed.

- The company pays a well-covered dividend.

- This company is currently cheap.

- This company has realistic upside potential based on earnings growth or price multiple expansion/reversion.

The company’s weaknesses at the moment are its dividend and valuation. With low debt, I don’t see it falling below a qualitative level in terms of credit rating. It’s no longer cheap, so I view it as a “hold” here.