James Darrell/DigitalVision via Getty Images

Hanesbrands (New York Stock Exchange:H.B.I.) is an apparel manufacturer that owns brands such as Hanes and Champion.

Ahead of time April 2024In 2018, I published an initiation press article on Hanesbrands with a Hold rating. The company’s valuation takes into account various recovery scenarios and two potential valuations for the Champion brand, which the company is considering selling.

Looking back at the company’s first quarter of 2024 result and Earnings Report The article noted that ongoing profitability improvements on the cost side are offset by weak revenue growth across all of the company’s segments. Management has not provided an update on a potential sale of Champion, and rumors continue to circulate regarding the deal price.

The company’s stock price has not changed much, but I have updated my rating with a more detailed review of Champion’s profitability. Overall, the stock remains a Hold, It is not an opportunity based on evaluation.

Profit recovery and revenue challenges in Q1 2024

Sales Headwinds: All HanesBrands segments posted negative sales in Q1 24. Champion revenue was particularly negative, down 25% year over year (down 20% after adjusting for the kids’ business’ licenses).

The champion has faced problems since then. 2021. Fiscal Year 2011 Revenue from the activewear division, which accounts for the majority of Champion’s revenue, fell 25% compared to its peak in FY21.

The innerwear division, which sells the Hanes brand in the United States, saw an 8% decline due to struggles in the wholesale channel. This is likely due to the overall market trend, but Gildan (Gill) showed similar results. Recent Calls.

The international division, which combines activewear (primarily Champion) and international innerwear sales, was down 9% due to a variety of reasons stemming from issues at Champion and weakness in the innerwear market.

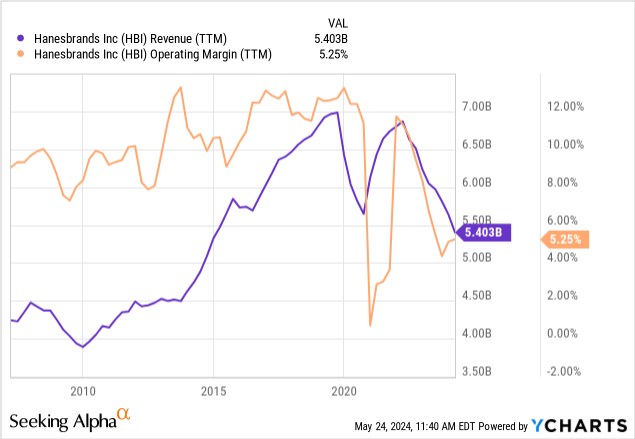

Profitability is recovering rapidly: The company’s margins have improved significantly from a year ago. In total, HBI’s gross margins were 770 basis points higher than a year ago, despite the decline in revenue. Much of the recovery was due to cost savings, particularly in cotton and freight. Again, the situation is similar to Gildan.

If we adjust for two factors, restructuring and increased marketing investments, the results are even better than reported. HBI’s unadjusted operating margin is about 4.5%, not too different from the first quarter of 2023 levels. However, this result includes $32 million in restructuring charges ($17 million from the search for a buyer for Champion). Adding in these non-recurring costs, the business’s operating margin for the quarter is closer to 7.2%.

Additionally, the company increased its advertising spending by 1.8% of revenue year over year. Marketing is considered a type of discretionary investment that is expensed now but will be enjoyed in future quarters. Adjusting for this change, operating margins would be closer to 9%.

Review of FY24 GuidanceThe company also expressed confidence in achieving its guidance of fiscal 2024 sales of approximately $5.4 billion (down 4% from fiscal 2023) and operating profit of approximately $430 million (profit margin of approximately 8%).

There are no comments for Champion SaleThe company made no mention of a possible sale of Champion. When an analyst asked for clarification during the conference call, management reaffirmed that there is outside interest in the brand, but that it is still evaluating whether to sell it. rumor Authentic Brands signed an exclusive deal, reportedly asking $1 billion for the deal, but HBI executives believe that was too low, and the company has not confirmed this.

Increase Champion sales

HBI’s share price has not changed much since our last article, the company is operating according to guidance, and in April the company was already considering a possible sale of Champion to Authentic Brands for a price of $1 billion to $1.5 billion, so the main conclusions of our valuation in our last article still stand.

However, in this article, we wanted to explore the potential impact of the sale of Champion on its international revenues. Hanesbrands does not separately release Champion revenues, which are mixed into its activewear and international revenues.

I believe the majority of the activewear category’s sales come from Champion because the company doesn’t own any other significant brands in the category. 10-KThe international segment is even more challenging as HanesBrands also sells Hanes underwear overseas and also owns a large underwear company in Australia called Bonds.

If we were to count only activewear sales as a loss from the sale of Champion, we would be overstating the company’s post-sale profit potential.

The only reference I could find for Champion’s worldwide sales is the company’s Investor Day 2021At the time, management said Champion would grow 50% between 2022 and 2024, reaching $3 billion in global sales, meaning the brand would make roughly $2 billion in sales in FY21.

But FY21 was also the company’s revenue peak — activewear sales have fallen 25% since then — so Champion’s current global revenue is probably closer to $1.5 billion.

Review of evaluation

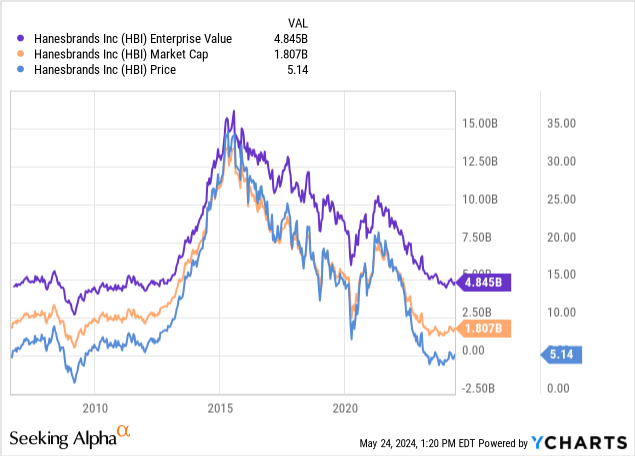

Now let’s revisit valuation using the adjusted Champion numbers: Hanesbrands has a market cap of $1.8 billion and an EV of $4.85 billion.

First, consider HanesBrands without the sale of Champions. Management’s guidance is a good starting point for evaluating a neutral scenario. This implies revenue of $5.4 billion, adjusted operating income of $430 million, or a margin of 8%. This margin is consistent with the adjusted margin for Q1 2024.

Applying a 25% income tax rate to this operating income results in a NOPAT of $322 million. Given an EV of $4.85 billion, the EV/NOPAT multiple is 15x. I believe this multiple is too high for a leveraged, distressed company operating in a cyclical industry like apparel. In my opinion, a more reasonable multiple would be 10x or lower. This is not based on the company’s historical multiples or the multiples applied to its peers, but on what I consider to be a sufficient investment return. Given that the long-term average market return is around 8% (a 12x multiple), a lower multiple is needed to justify the risk of owning a leveraged, distressed company in a highly competitive industry.

When moving down the income statement, you need to exclude interest. HBI’s TTM interest expense is $266M, but if you adjust for the $300M debt repayment announced in FY24, interest expense is probably closer to $230M. This would give pre-tax earnings of $200M and net income of $150M. Compared to a market cap of $1.8B, that’s a P/E of 12x. More reasonable, but still not opportunistic.

Next, we consider the sale of Champion. The offer from Authentic Brands is rumored to be $1 billion, but Hanesbrands seems to want more than that. Whatever the agreement, some of it will be funded by investment banks and taxes. So we can work from the assumption of a net proceeds of $1 billion. I think this is optimistic, but it should be enough.

From an EV perspective, EV decreased $1.0 billion to $3.85 billion. Under our previous assumptions, revenue would decrease $1.5 billion. If we apply the same 8% margin to Champion sales, operating income would decrease $120 million. We believe this assumption is safe as the innerwear division has historically demonstrated higher margins than Champion.

That would imply an EV of $3.85 billion, operating income of $310 million, and NOPAT of $232 million. The resulting EV/NOPAT multiple would be 16.5x, which, as explained above, is excessive in my opinion.

The P&L downward revision would see $1 billion going to pay down the company’s highest yielding 9% debt (which was the implicit course of action mentioned by management during the Q1’24 conference call). This would reduce interest expense by $90 million, on top of the already guided $30 million reduction from debt repayments. This would bring the final interest bill to $140 million.

Operating income of $310 million minus interest of $140 million and 25% tax would leave net income at approximately $130 million. And compared to the current market cap of $1.8 billion, the P/E ratio is 13.8x, even higher than if Champion were not sold.

I believe these multiples are too high for Hanesbrands. Again, the company has challenges, does not manage its brands well, is leveraged (and will continue to be leveraged after the sale of Champion), and operates in a cyclical industry like apparel. A more reasonable multiple, in my opinion, is 10x or less. This is based not on the company’s historical multiples or multiples applied to its peers, but on what I consider to be a sufficient investment return.

Therefore, I still believe Hanesbrands is a hold stock.

Upside risks

I see three potential upside risks to my thesis.

The first is that Hanesbrands could sell Champion for a higher price, which would reduce debt or EV to a greater extent than expected and allow for further upside, although this seems unlikely given the rumored takeover bid.

The second risk is that Champion’s sales and profits could be lower than expected, resulting in higher-than-expected profits for Hanesbrands after the sale. This could happen because the company doesn’t release brand-specific figures.

Finally, Hanesbrands can turn around the championship, improve guide numbers and make the brand more valuable to a potential acquirer. Previous restructuring measures, such as SKU reductions and licensing adjacent businesses, plus recent marketing enhancements, are moves in the right direction toward turning the brand around.