Carolina Rudah/iStock via Getty Images

Introduction

Perhaps you have all heard about Novo Nordisk (NVO, OTCPK:NONOF) in recent months or years. Either due to the spectacular performance, it has had in the stock market in recent years or due to the launch of the popular Ozempic and Wegovy. Novo Nordisk is a Danish pharmaceutical company that has just celebrated its 100 years of history, specializing in developing treatments for diabetes, obesity, and rare diseases.

I have always been very reluctant to invest directly in pharmaceutical companies. I believe it is a sector in which it is difficult to maintain lasting competitive advantages due to patents and the continuous need for innovation. Those who follow me know that I expose the healthcare sector through Danaher and Thermo Fisher, two companies completely unrelated to this inherent cyclicality of patents and in which value creation is simpler (I recommend taking a look at my Deep Dive on Thermo Fisher). However, upon delving deeper into Novo Nordisk, I have been pleasantly surprised by how special this company is and how well they have done things.

Obviously, they are not immune to the patent cycle or the need for continuous innovation. However, I believe that Novo Nordisk is special within the industry and has laid out its strategy for the very long term and its pipeline in a very intelligent way. In this article, I want to delve into the aspects that I believe make Novo Nordisk a very special company within this sector, its markets, and why this pharmaceutical company fits into my investment universe.

Brief medical class

Before delving into Novo Nordisk’s pipeline and the medications they have already approved, we must give a brief medical lesson. The most important concepts to understand are what diabetes is, what insulin is, and what GLP-1 is.

Diabetes is a chronic disease that occurs when the body cannot produce enough insulin or cannot effectively use the insulin it produces. Insulin is a hormone produced by the pancreas that regulates the level of glucose (sugar) in the blood. Its main function is to help glucose enter cells to be used as a source of energy. When there is a deficiency of insulin or resistance to its effect, blood glucose levels rise, which can lead to various long-term health problems.

There are mainly three types of diabetes: Type 1, Type 2, and gestational. Type 1 diabetes is an autoimmune condition where the body mistakenly attacks the beta cells of the pancreas that produce insulin, resulting in little or no insulin production. It is generally diagnosed in children and young adults. Type 2 diabetes is the most common form and occurs when the body develops resistance to insulin or when the pancreas does not produce enough insulin. It is strongly associated with overweight, obesity, and a sedentary lifestyle.

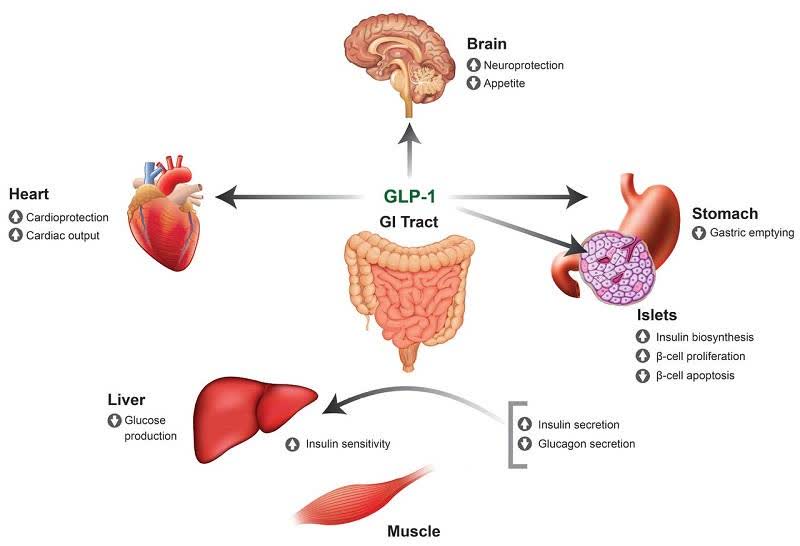

On the other hand, in contrast to insulin, the body produces another hormone called glucagon, which increases blood sugar levels. This is where GLP-1 comes into play. This hormone acts in such a way that it decreases glucagon levels in the blood and increases insulin levels, in addition to enhancing the feeling of fullness in our brain and other effects that you can see more clearly in the following diagram.

huatengsci.com

Novo Nordisk treatments

Diabetes treatments

The main source of income for Novo Nordisk is products directly related to diabetes. Patients with type 1 diabetes require insulin injections throughout their lives to properly maintain their blood glucose levels. Since its founding, Novo Nordisk has been at the forefront in the development and improvement of these treatments, constantly seeking to improve the quality of life for patients.

Novo Nordisk markets a wide range of insulin products, including fast-acting and long-acting options, designed to meet the specific needs of each patient. Additionally, the company has pioneered the development of more efficient and less invasive insulin delivery systems, such as insulin pens and continuous infusion devices.

For patients with type 2 diabetes, Novo Nordisk offers not only insulin but also innovative treatments such as GLP-1 receptor agonists. These medications, which mimic the action of the naturally produced hormone GLP-1 in the body, not only help control glucose levels but also contribute to weight loss and have beneficial effects on the cardiovascular system. The most popular today is undoubtedly semaglutide (Ozempic), which has proven effective in improving glycemic control and reducing the risk of cardiovascular events in high-risk patients.

Furthermore, Novo Nordisk is actively researching new therapies in its robust development pipeline, which includes improved versions of insulins and GLP-1 agonists, as well as entirely new treatments based on advanced research in the field of endocrinology.

It is currently estimated that 10% of the adult population suffers from diabetes and that by 2045, 1 in 8 adults will have this disease. The TAM this year is calculated at about 790 million people. Additionally, it is also estimated that only 30% of those currently suffering from diabetes are receiving treatment since in the early stages of the disease symptoms are very mild and often the disease is not detected.

The growth of this business segment seems clear that it will continue for many more decades; however, we must consider that governments and medical associations are pressing to reduce the price of these treatments since they are essential for people suffering from the disease, and in some countries like the USA, they have reached very high prices. Therefore, I do not expect significant growth in this segment in the coming years, since the growing number of patients with diabetes will probably be offset by downward pressures on the price of medications.

Obesity Treatments

The segment from which growth is expected to come and continue coming in the coming years is obesity treatments. It has been discovered that drugs based on GLP-1 agonists, besides being useful for fighting diabetes, are extremely effective for weight loss. These medications increase the production of hormones that cause a feeling of satiety in the brain, which reduces the desire to eat and increases the feeling of fullness after consuming less food.

At the same time, GLP-1 agonists slow down the rate at which the stomach releases digested food into the small intestine. This slower process helps maintain the feeling of fullness for longer after meals, reducing the need to consume more food and lowering total calorie intake. Additionally, by improving blood glucose control, these medications help reduce insulin spikes that can lead to increased hunger and fat storage in the body.

Ozempic, the drug we mentioned being used to fight diabetes, also started being used for weight loss, which even led to shortages for diabetic patients at times. In response to this situation, Novo Nordisk patented Wegovy and Saxenda, a medication based on the same active ingredient as Ozempic but prescribed exclusively to combat obesity and aid in weight loss.

Currently, there are 890 million people suffering from obesity worldwide and more than 2.5 billion who are overweight. Despite the alarming numbers, it is expected that this number will continue to grow in the coming decades, leaving a TAM (Total Addressable Market) of approximately 2/5 of the global population for Novo Nordisk. Initially, these medications are intended for people with obesity; however, there are many cases of people with a bit of overweight resorting to these medications to lose a few kilos, as it is a convenient, quick, effective, and safe way to lose weight. Therefore, there is no doubt that the TAM for this segment is enormous.

Other treatments

This is currently a residual line of business for Novo Nordisk since, as we will see later, it has practically no weight within the company’s revenue mix. Novo Nordisk has several medications to treat other types of diseases, such as hemophilia or growth-related disorders.

A pipeline to sustain long-term growth

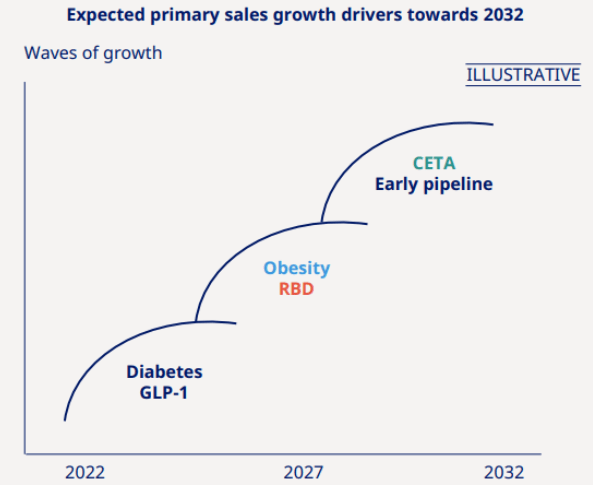

So far, we have reviewed the treatments that Novo Nordisk currently offers on the market. However, when analyzing a pharmaceutical company, the most important aspect is undoubtedly its future pipeline. In this regard, I believe that Novo Nordisk has done an excellent job planning its long-term growth. Their strategy reminds me of a lot of Tesla’s master plans.

The first phase began with the launch of the first GLP-1 based treatments, where they are currently capitalizing on the growth and benefits of these revolutionary treatments. These treatments have a TAM large enough to ensure many years of aggressive growth, as we are witnessing. However, Novo Nordisk is not settling and is already working on new GLP-1 based drugs for both diabetes and especially obesity, more potent and safer, which will likely be released over the next decade, like CangriSema, which is already in phase III.

Over the next decade, Novo Nordisk will capture all this growth thanks to GLP-1 based treatments. However, an admirable aspect of this company’s culture is that they are not just settling for this; they already have in mind where growth will come from in 10-15 years. Currently, besides GLP-1, their R&D is focusing on developing treatments for cardiovascular diseases, Alzheimer’s, Parkinson’s, and other markets they consider promising for the future.

Additionally, something that has been studied for a while and for which more studies are recently emerging is the use of GLP-1 to treat other conditions such as addictions, for example to drugs or alcohol. Since these investigations are still in very early stages, I do not consider them in my thesis on the company. However, they undoubtedly represent a very positive option, and if they come true, they could imply an even larger TAM for GLP-1 and a possibility of greater growth and leverage on their previous research. Therefore, it is a topic that I am certainly following very closely.

Novo Nordisk IR

Summarizing their ‘Master Plan’ for the next 20 years, it is based on:

-

Phase 1: GLP-1 against diabetes.

-

Phase 2: GLP-1 against obesity.

-

Phase 3: Cardiovascular diseases, rare diseases, and other emerging treatments.”

Novo Nordisk IR

As long-term investors, it is useless to us if Novo Nordisk makes a lot of money for a few years with a breakthrough like Ozempic, only for that growth to evaporate and return to previous sales levels in a few years. If you don’t believe me, look at the example of Pfizer. After the COVID vaccine, their profits and stock price soared, but when all that growth was behind them, the stock plummeted to levels even lower than pre-pandemic. As I said at the beginning, I am quite reluctant to invest in pharmaceutical companies precisely for this reason, but I believe that Novo Nordisk has the right long-term mindset and execution, which is one of the reasons why this is one of the few pharmaceutical companies in my investment universe.

Financials

I have focused this article on the more qualitative aspects of the company because I believe they are the most difficult to understand, but at the same time, the most important. However, now we are going to see how these fundamentals translate into numbers, so let’s proceed with a very brief review of Novo Nordisk’s financial performance.

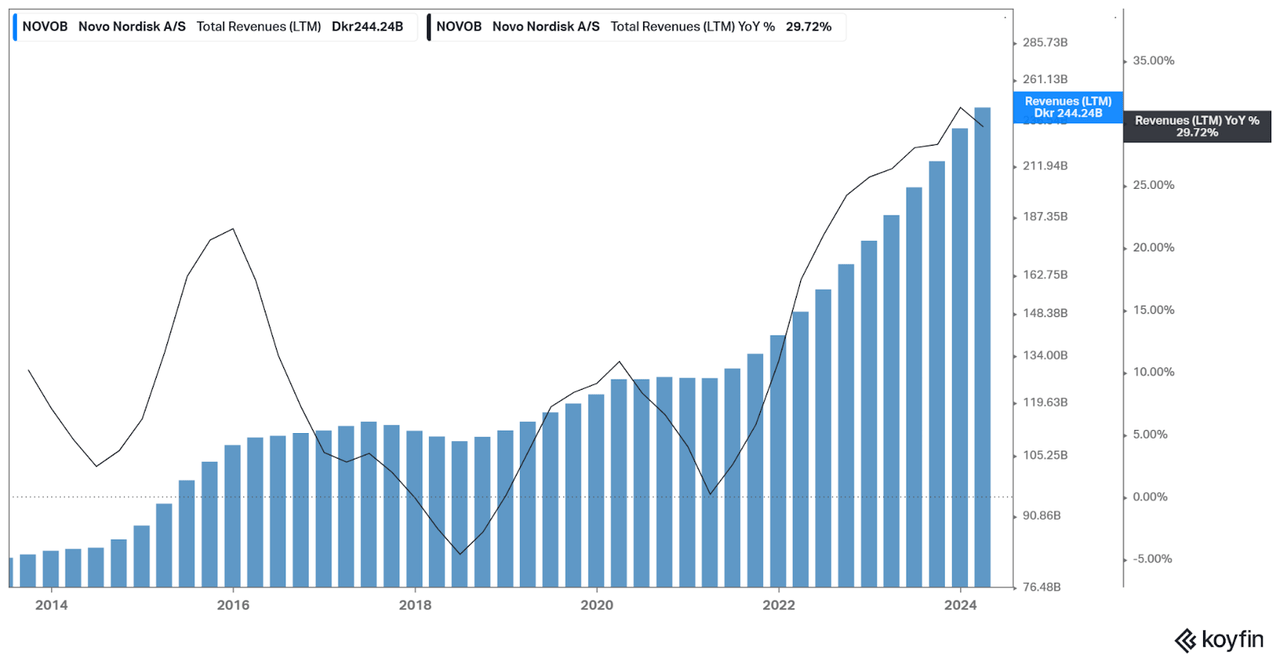

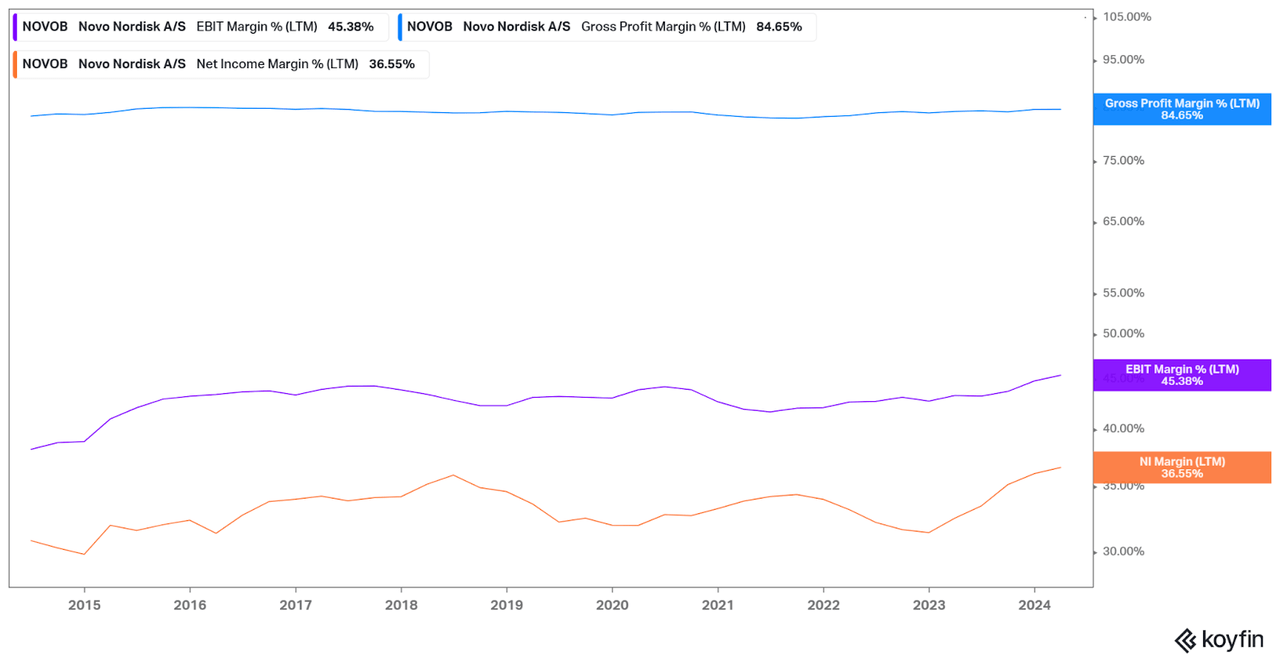

Sales have shown a clear inflection point with the launch of Ozempic and Wegovy, achieving 30% year-over-year growth in recent quarters. All of this has been accompanied by clear operating leverage, which we can see in all the company’s margins. Having a duopoly makes the pricing power in GLP-1 treatments very strong, and right now, Novo Nordisk is capitalizing on it.

My growth estimates

Novo Nordisk’s valuation has experienced a huge increase in recent years, aligning with the substantial growth expected from GLP-1 treatments. However, just because a company’s value has risen significantly does not necessarily mean it is overvalued. There are many instances where a company can be cheaper after a substantial rise because its expected growth has increased even more. Therefore, let’s analyze whether Novo Nordisk could still be an investment opportunity despite its significant rise.

To do this, I have made this future sales estimate, trying to be somewhat conservative. I have divided its sales into three different segments than they do, but I believe this makes more sense. On one hand, I have estimated that insulin sales will gradually decline until 2030. Although Novo Nordisk’s new insulin treatments are very promising, governmental and social pressures to lower treatment prices are very strong. So I have decided to be conservative in this regard and estimate annual declines in the mid-single digits.

On the other hand, I have grouped the GLP-1 related sales for both diabetes and obesity treatments. From 2024 to 2030, I estimate a CAGR of around 20%, with an acceleration of sales capitalizing on the global growth of GLP-1 and by leveraging their duopoly position in the industry alongside Eli Lilly. I have also assumed a re-acceleration around 2027-2028 due to the launch of new scheduled drugs.

This may seem like an excessively large growth, but considering that until 2031 this market will be practically a duopoly between Novo Nordisk and Eli Lilly, the huge TAM, and the effectiveness of these treatments, I believe this scenario is not at all a utopia. Some analysts estimate that this market will reach $125Bn by 2033 and these estimates have only grown in recent years.

Finally, I have decided to group treatments for rare diseases, cardiovascular diseases, and other treatments into the segment ‘Other.’ In the short term, I estimate that the growth of this segment will be very small, but as many of the treatments in the pipeline are approved and enter the market, I believe that growth will accelerate, becoming one of the main drivers of growth by the end of the decade.

Other estimates I have made include the FCF margin decreasing to 36%. I really believe it could be higher and expand throughout the decade thanks to operational leverage and the company’s strong vertical integration. However, I prefer to be conservative and consider this potential margin expansion as a safety margin. I estimate that shares outstanding will decrease by around 1% annually. In recent years, they have been decreasing by 2% and the historical average is 1.5%, but again I prefer to be more conservative in this regard. Considering that the stock is currently trading at higher multiples than its historical ones, I prefer to estimate a smaller reduction.

Author’s Calculations

Taking these estimates into account, we arrive at the conclusion that Novo Nordisk could be generating between 60 and 70 Danish kroner of Free Cash Flow per share by the year 2030.

Risks

Personally, there are some risks I have identified for Novo Nordisk that, although I don’t believe they will undermine the thesis, I do think we need to closely monitor them.

-

The first and most obvious is that no matter how much they have prepared for the long term, they remain a pharmaceutical company and are exposed to the typical risks of such companies. There is a risk that some drugs under research may not come to fruition or that some already in production may have to be withdrawn or that a better alternative may appear on the market. I believe Novo Nordisk’s culture protects it quite a bit from this, but obviously, it is not immune.

- There is also the ongoing regulatory risk over pharmaceuticals. A clear example of this are the pressures being made to reduce the price of insulin or this news questioning the patent of Ozempic. I don’t think we should spend too much time on this since it is something completely out of our control, but we should keep it in mind.

Conclusions and valuation

My intention throughout this article has been to convey that Novo Nordisk is not the typical pharmaceutical company we can find in the market. Obviously, they are affected by the cycles generated by patents within the sector; however, I believe that the company’s long-term plan and culture make it much less vulnerable to these. With the plan we have outlined, as long as it goes well, we can say that this company has guaranteed growth until 2040.

Regarding the valuation, I think the market has done a good job adjusting the stock price to the growth that the company will have in both the top and bottom line in the coming years. If we consider the FCF/Share we have calculated that it could be generating by 2030, the main factor that will determine its price then is whether they will continue to be able to grow at good rates. From my point of view, the seeds of that growth have been planted for some years with treatments for cardiovascular diseases and other emerging ones, in addition to the progress that GLP-1 will still have.

I mention this because in 2030, the multiple will be marked by the market’s estimates for future growth, so ensuring that this growth exists is key to determining a purchase price today. In the following table, the columns represent the final multiple in 2030 and the rows the FCF/Share that it could be generating. Each cell represents the value that Novo Nordisk’s stock could have in 2030 based on these two parameters.

Author’s Calculations

If everything goes perfectly, they are probably generating around 65-70 DKK per share and there will be very clear future growth, so the stock could be valued at 25-30x. However, despite all the good things I’ve said about the company, the inherent risk to pharmaceutical companies remains: regulations, the emergence of better alternative treatments, patents, etc. From my point of view, the most likely scenario is that they are generating 65 DKK FCF/Share and that the market values it at 20-25x, so a target price for me would be between 1300-1600 DKK per share, which implies a 7-11% return from current prices including dividends.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.