Justin Padgett/DigitalVision via Getty Images

Holmen (OTCPK:HLMMF) (OTCPK:HLMNY) (OTCPK:HLHLY) continues to benefit from the tone shortage as major exporters Belarus and Russia continue to be shut out of the market (Discussed in a previous report). forest The business is therefore benefiting. Elsewhere, capacity expansion is planned to scale up the power generation business. Operational improvements are proving to be effective in Wood Products, but construction will require a turnaround. The shutdowns in Paperboard & Paper are over and are now translating into increased earnings, but overall end market demand remains weak. EV/EBITDA is over 10x, meaning expectations are still fairly high in this environment and the industrial turnaround and capacity expansion are probably already priced in.

Revenue Breakdown

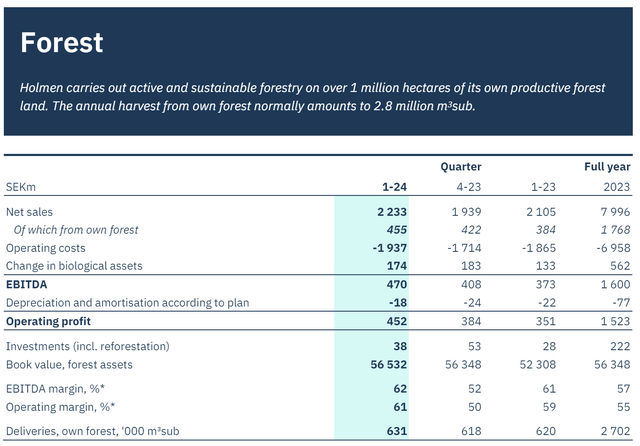

Belarusian and Russian instruments are not allowed to be imported. There are huge shortages in the Baltic and Nordic markets in the EU. price Tone Continues to riseThere is plenty of forest that could be harvested sustainably, but the problem is operational: no one is prepared to meet the demand shortfall. EBITDA in this segment increased year-on-year.

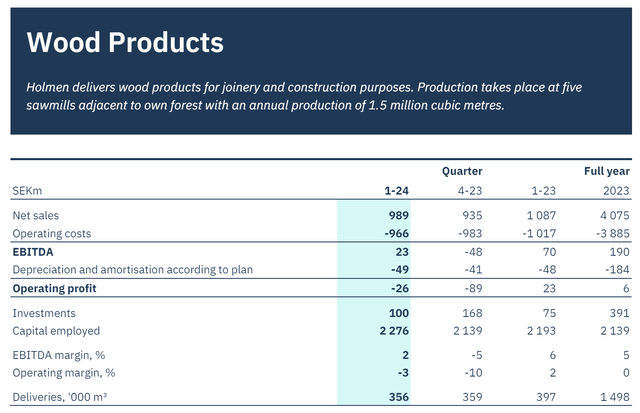

The wood products business is very closely linked to the local real estate market and construction activity. Until recently, house prices were under severe pressure. SwedenInflation Still quite highHowever, the overall weakness of the Swedish economy Implementing interest rate cutsInflation has fallen significantly month-on-month. The rate cut reflects weakness in the real estate market, which is impacting household wealth, rather than a catalyst for reversing the trend. The Swedish real estate market is peaking even before the Ukraine war. In general, this move, which gives European markets more room to cut interest rates than the US, reflects ongoing pressures on European economies, which have been hit harder and benefit less from supply chain restructuring.

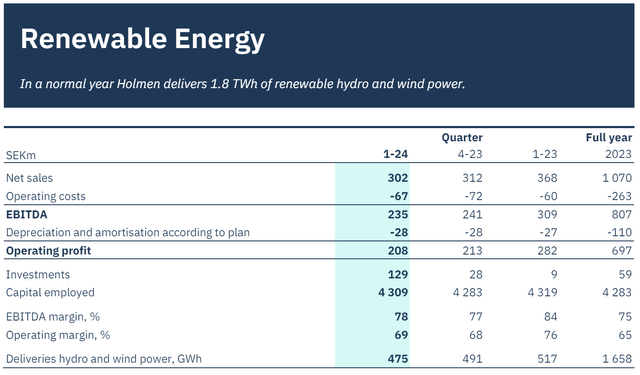

Holmen is also involved in renewable energy generation, including hydroelectric and wind power, and also owns nuclear power. The Bristerlieden wind farm is undergoing a major expansion, which is expected to increase overall electricity production by about 20%. Of course, electricity prices have fallen since the chaos caused by the war in Ukraine last year. But the increase in electricity production will be a big blow to the economy, especially in the region. electric bill It seems to have bottomed out in some areas, But not in all markets.

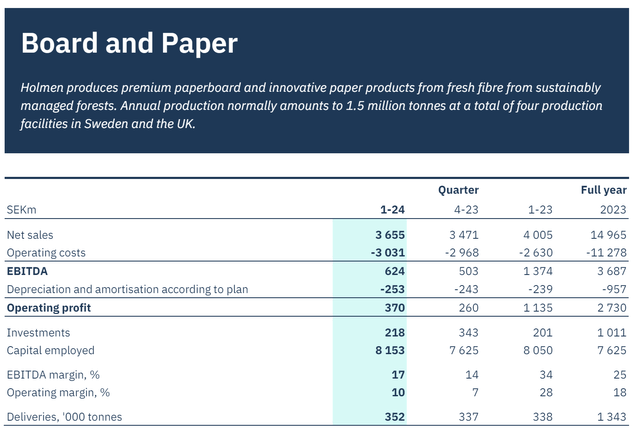

Pulp and paper is benefiting from restarts of production after planned shutdowns and maintenance, and from general restarts, with some paper grades, particularly office paper, seeing a recovery. Paper production is gradually declining, but at least paperboard destocking has ended and prices are recovering. Demand remains weak, but is beginning to stall out. Prices are falling Energy inputs are falling, but profit margins are still falling. Capacity reduction A recession is starting and paper prices will hit a bottom. However, things are not particularly good for European producers. They are far from their long-term levels and margins may fall further. Long-term levels were significantly lowered by the long-term slump in energy prices. Energy prices are now rising so current price levels are probably close to the bottom. The problem is demand, which may continue to fall if recessionary pressures intensify further.

Conclusion

The appropriate competition is SCA (OTCPK: Scabies). We are conservative and think we can annualize the current numbers. We don’t have high expectations for the economy and expect limited incremental improvements in most businesses. We would like to add the impact of a 20% increase in renewable energy production, but that will not come until 2026. In relative terms, if we annualize Holmen’s numbers, it would be roughly the same as SCA’s forward multiple, so there is no relative value case at around 14x EV/EBITDA. The problem is that we don’t like anything above 10x EV/EBITDA, especially when there are no clear upsides. Forestry is fine, but other segments are still under a lot of pressure. Pass.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.