Autumn sky photo

In the second quarter, Qualcomm IncorporatedNasdaq:QCOM) made a strong post. Quarterly ResultsAdjusted earnings per share were $2.44 (well above analyst estimates of $2.32 per share), and adjusted revenue was $9.39 billion (slightly above the consensus estimate of $9.34 billion for the same period).

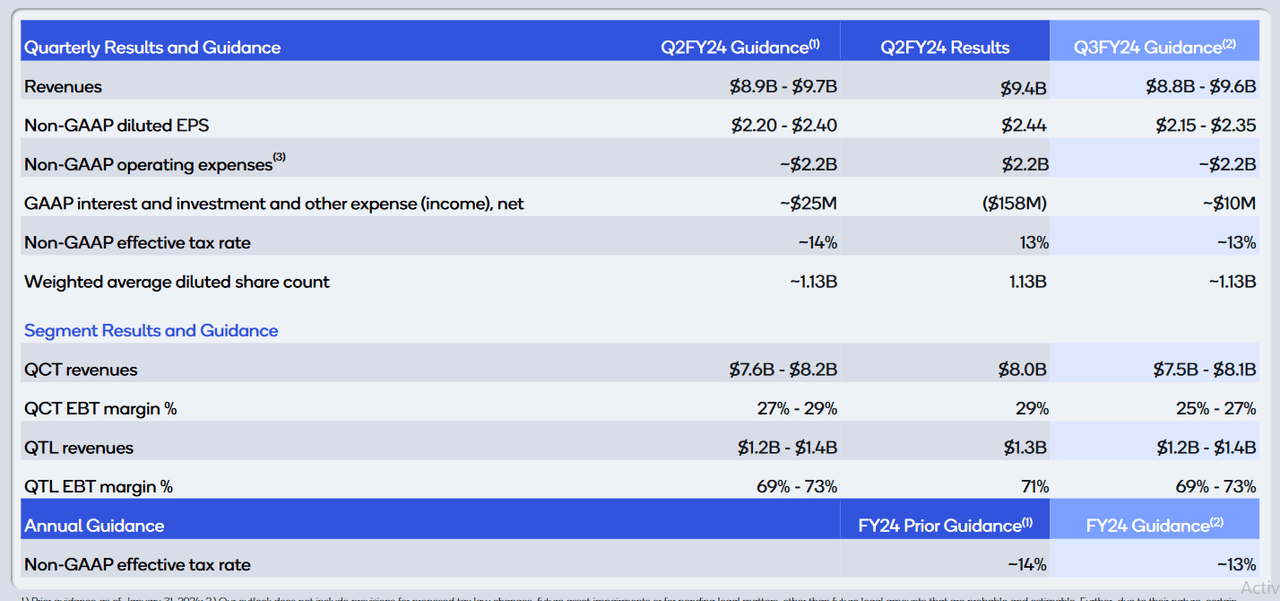

Quarterly Results and Guidance (Qualcomm, Inc.)

The smartphone hardware components maker also reported net income per share of $2.06 ($2.33 billion), compared with Qualcomm’s $1.52 per share ($1.7 billion) in the same period last year, representing an annualized increase of about 21.2%. For the current quarter, the company expects quarterly revenue in the range of $8.8 billion to $9.6 billion (versus the consensus estimate of $9.05 billion) and earnings per share in the range of $2.15 to $2.35 (versus the consensus estimate of $2.17).

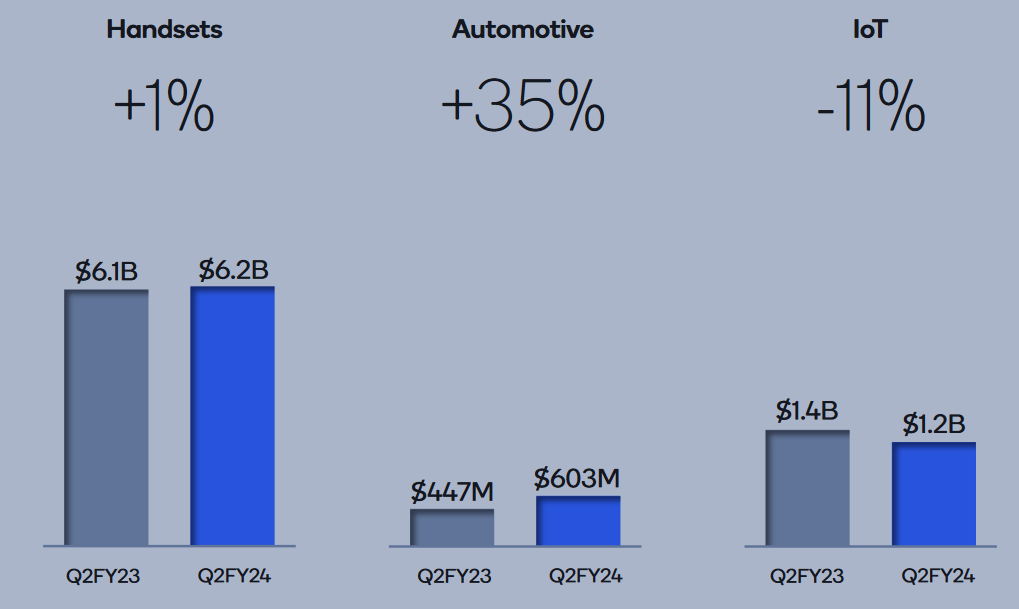

Quarterly Results (Qualcomm)

In Qualcomm’s case, most of the attention tends to be focused on the company’s mobile phone division. Mobile phone sales were $6.18 billion (up 1% annualized for the period), primarily suggesting that trends in this part of the market are stabilizing after various weaknesses in the post-pandemic period. Perhaps most surprising were Qualcomm’s sales tied to Chinese smartphone makers, which grew at an annualized rate of about 40% for the quarter. Similar growth was seen in Qualcomm’s automotive division, where sales of $603 million indicate growth of 35% for the period. On the negative side, the company’s IoT revenue fell 11% during the quarter (to $1.24 billion), signaling weak sales of cheaper processing components and processors used in virtual reality products.

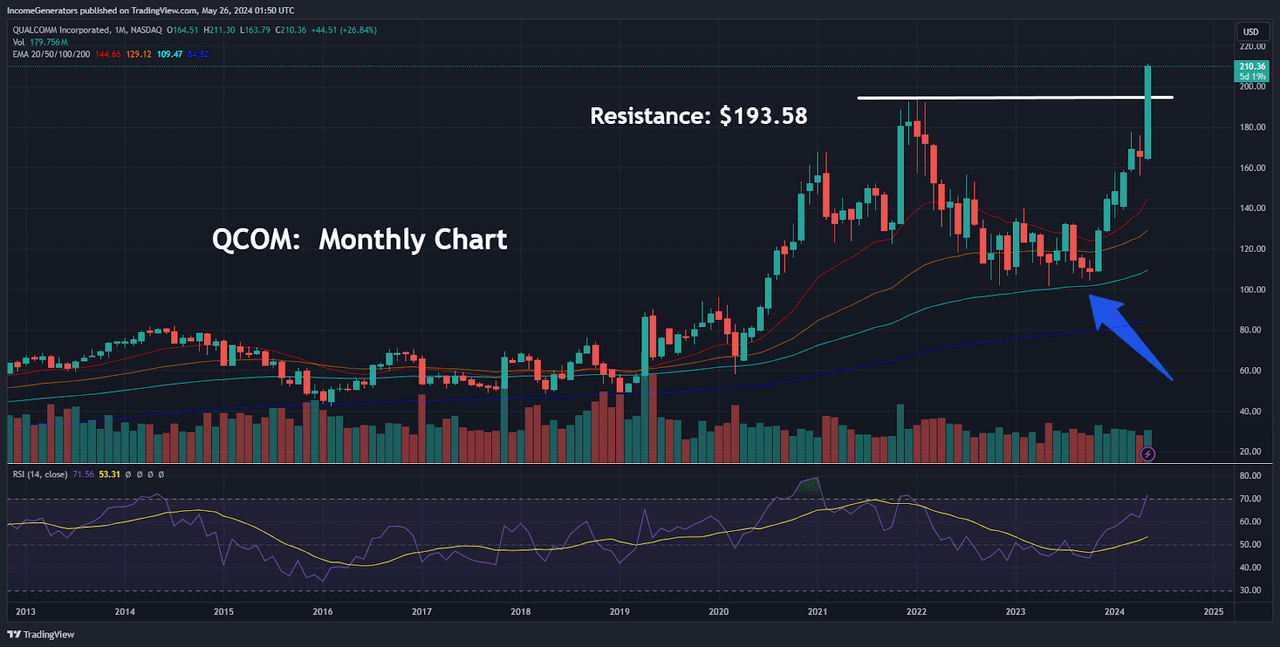

QCOM Monthly Chart: Previous Resistance Levels (Profit Generator via TradingView)

Overall, these quarterly figures are very encouraging and it is not at all surprising to see QCOM stock continue to rise. However, the strength of the stock’s current uptrend surge may come as a surprise to some investors, since it has already broken through a key long-term resistance level on the monthly chart. Specifically, we outlined the January 2022 high as the stock’s main long-term resistance level, but the chart above shows that the current uptrend has relatively little difficulty breaking through all-time highs this month. Given the strength of the May 2024 candle, we believe the stock’s surge momentum could continue. Further evidence of this positive direction can be found in the monthly indicator reading of the Relative Strength Index (RSI). The RSI has not yet reached serious overbought territory. Additionally, we believe the stock could find strong support near the 100-month exponential moving average, and this type of price action could limit the stock’s potential downside going forward.

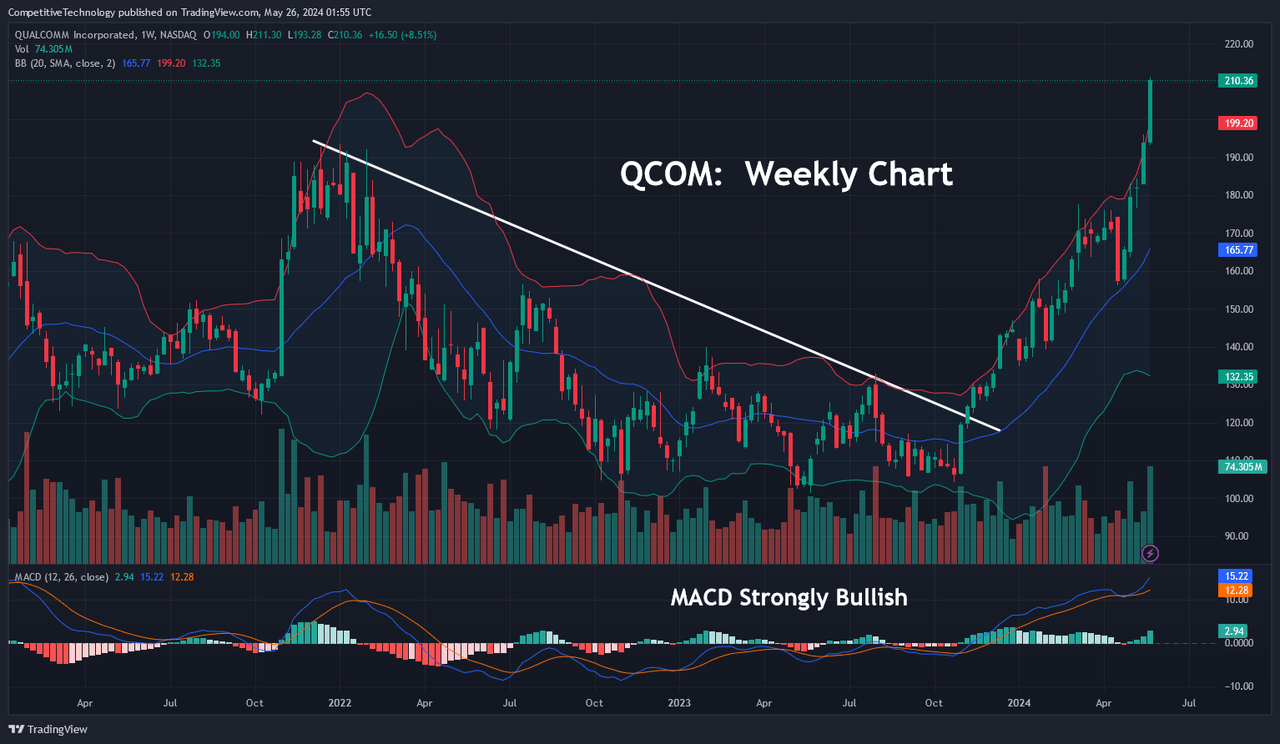

QCOM Weekly Chart: Breaking Downtrend (Income Generator via TradingView)

Finally, focusing on the technical price action events that have led to this point, we can see that the downtrend began to break down on the weekly chart near the end of 2023, just as the Moving Average Convergence Divergence (MACD) weekly indicator reading began to turn positive. Clearly, this confluence of bullish signals has helped this stock establish a solid foundation near the beginning of the year, and currently, when looking at the price history of this stock from a multiple timeframe perspective, we see very little evidence of weakness. The weekly MACD reading remains very bullish, which we believe is another reason to believe that the stock’s downward corrective move may be somewhat limited in the near term.

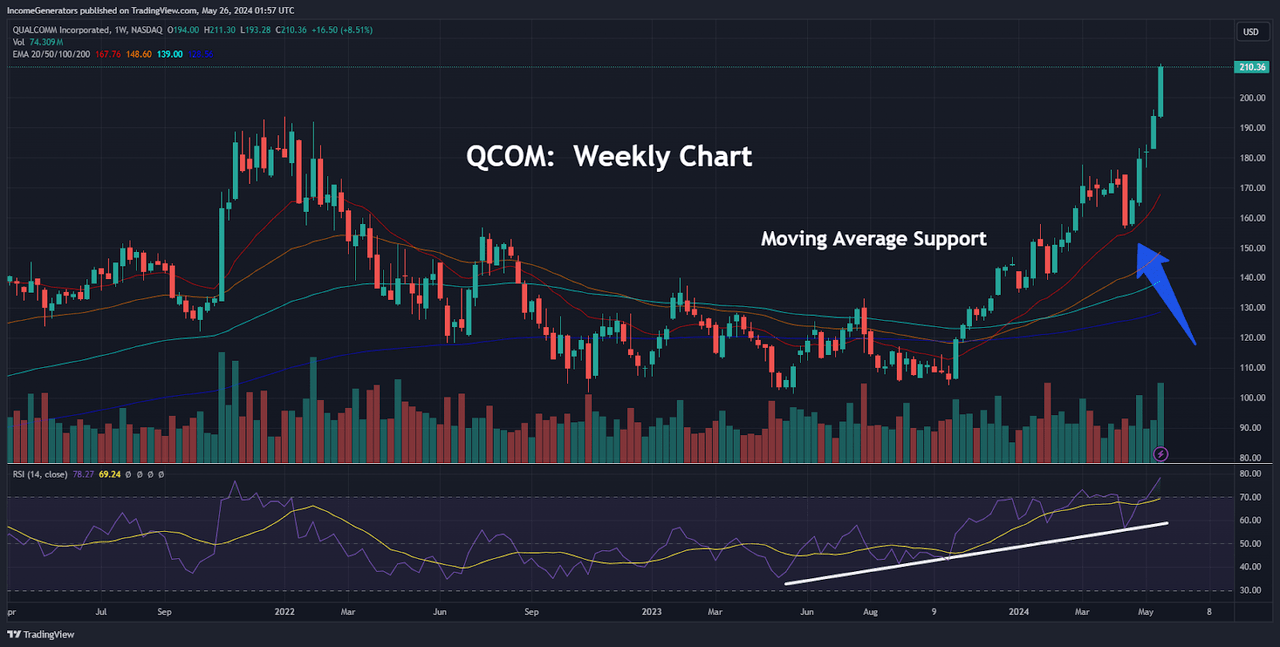

QCOM Weekly Chart: Moving Average Support (Profit Generator via TradingView)

Another factor to consider is how often QCOM stock has found support near its longer-term moving averages. In the first price chart, we saw this positive activity clearly around the 100-month exponential moving average. In the chart above, we can see an example of similar strong buying activity as the stock price drops towards the 20-week exponential moving average. We can also see in this chart that the stock’s exponential moving average cluster (consisting of the 20-week, 50-week, 100-week, and 200-week exponential moving averages) has also started to slope significantly upwards. Ultimately, this indicates that the stock will likely continue to find support at higher levels. The RSI reading is also very bullish on this time frame, but we should point out that the reading on this indicator has finally moved into the overbought area. This suggests that the stock price may need at least a period of sideways consolidation before it can continue to the next stage of upside.

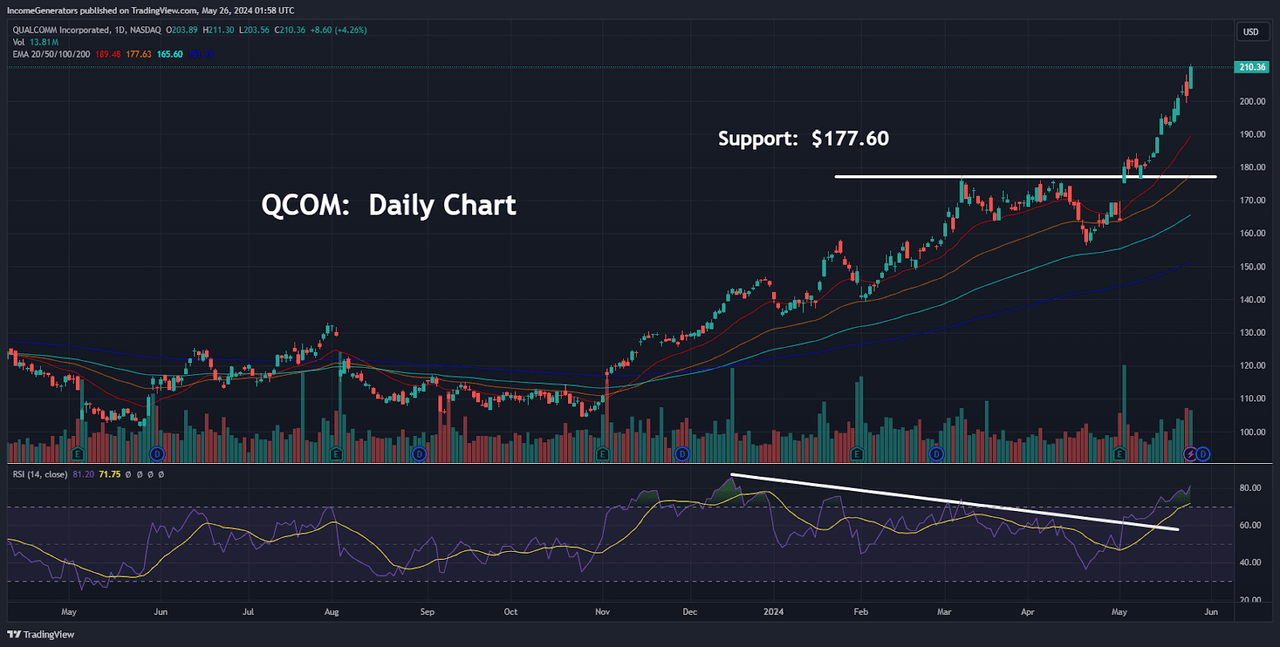

QCOM Daily Chart: Potential Downside Targets (Profit Generator via TradingView)

Finally, we move to the daily chart, which allows us to identify a level that could serve as support on the downside if our primary stance proves incorrect and the stock starts to reverse sharply from here. Specifically, we have outlined the March 2024 high near $177.60 as a bearish downside objective. As you can see, this price level is also aligned with the 50-day exponential moving average, strengthening the validity of this area as a potential downside objective if QCOM’s price falls below $200 per share. However, one factor that may make this bearish outcome less likely is the breakdown of the downtrend in the daily RSI readings. But at the same time, the readings of these indicators have moved significantly into overbought territory, which suggests that the recent rise in stock price may require a period of consolidation (or a downward retracement) before QCOM can continue resuming its broader uptrend. For these reasons, the daily timeframe looks the least constructive at the moment compared to the stock’s long-term outlook, but this is a scenario that lends itself very well to a buy-low strategy. Overall, Qualcomm’s stock performance this year has been nothing short of impressive. The soaring stock valuation easily overcame previous resistance levels, and pullbacks from the highs have been very limited. While the daily chart shows signs of potential trend exhaustion, it is clear that most of the price momentum is strongly concentrated in the bullish direction. Qualcomm’s latest quarterly earnings numbers continue to support this outlook, so we believe investors should look for instances of near-term pullbacks to build long positions at more favorable levels.